Alipay's "Effective Self-Rescue" Starts with a "Tap"?

![]() 11/19 2024

11/19 2024

![]() 599

599

Alipay aims to prove its uniqueness

Image source: Xinshi Research Institute

Have you developed the habit of using Alipay's "Tap to Pay" feature?

On July 8, Alipay announced an upgrade to barcode payments with the introduction of "Alipay Tap to Pay." Users can now complete payments in as few as one step by tapping their phones against the merchant's payment device, eliminating the need to display a payment code.

In the four months following its launch, this "new" payment method has quickly gained popularity, spreading to over 50 cities including Shanghai, Chengdu, Wuhan, Changsha, Hangzhou, and Qingdao. While it may not be available in every store, it is certainly present in convenience stores like Meiyijia, 7-Eleven, and Lawson, which have a near-ubiquitous presence in these cities.

So, what incentives has Alipay offered to enable "Tap to Pay" to spread so rapidly across the country? Given that QR codes are already highly convenient, why is Alipay promoting "Tap to Pay"? What challenges does it face, and what ingenious solutions has it devised?

1. Alipay Spends Big to Promote Tap to Pay: Up to RMB 260 per Device Plus a 0.07% Commission

As the latest generation of payment method, Alipay has spared no effort in promoting Tap to Pay.

One of the key strategies is offering substantial immediate and long-term incentives to ground promotion staff responsible for installing the devices.

A Tap to Pay service provider told Xinshi Research Institute that successful installation of Tap to Pay devices for merchants entitles ground staff to three types of immediate benefits or long-term commissions, including boot-up rewards and sales incentives.

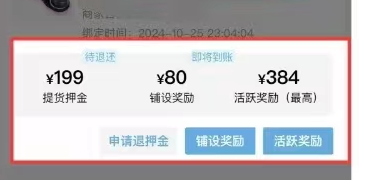

The most direct benefit is the boot-up reward. Ground staff can choose to either charge the merchant or pay RMB 199 themselves for the device and install it for free. They receive a RMB 40 installation reward the day after the first successful transaction, and an additional RMB 40 (totaling RMB 80) if the merchant uses Tap to Pay regularly within a month.

Beyond these "one-time" rewards, merchants also contribute a portion of their transaction volume and consumer payments to the original ground staff.

Alipay has set three thresholds for sales incentives: 120 transactions, 300 transactions, and 600 transactions, with corresponding rewards of RMB 40, RMB 60, and RMB 80, respectively.

Image source: Provided by a Tap to Pay agent

While sales incentives are tiered, the fixed number of transactions and fixed rewards make them similar to one-time income sources like installation rewards. Therefore, the service provider only briefly mentioned the reward amounts before discussing the third type of income generated by transaction volume.

According to the provider, Alipay Tap to Pay supports credit cards, Huabei, and other forms of "advanced spending." The platform charges a fee, and ground staff who install the devices earn a 0.07% commission on all transactions processed through them.

In addition to these generous rewards and commissions, Alipay also employs a competitive mechanism to motivate ground staff.

According to City Image News, there is a "competition mechanism" among service providers who pay a minimum of RMB 50,000 and bear a cost of RMB 150 per device. Alipay evaluates service providers monthly, categorizing them from one to five stars, with the highest level being Diamond Service Provider. Each star level comes with different levels of resource support and benefits.

As of September, there were 15 three-star and 13 two-star regional Tap to Pay service providers. The conditions for upgrading to three-star status include registering a cumulative total of 5,000 devices, with the requirement to add 1,000 new devices each month to maintain status, indicating a stringent evaluation process.

Some service providers have even posted "battle reports" celebrating their promotion efforts, claiming to be the national leader in this field.

Image source: Official account of a national service provider

This is still the deployment stage in first- and second-tier cities. In the future, as Alipay expands into lower-tier cities, competition among service providers is bound to intensify.

So, why did Alipay introduce "Tap to Pay"? And what do merchants who have installed these devices say about it?

2. "Tap to Pay": Alipay's Another Attempt to Catch Up with WeChat Pay?

"Tap to Pay" may seem like just another convenient payment method, but behind it lies Alipay's efforts to "rescue" itself.

According to AllTech, on September 4, Taobao officially announced the addition of WeChat Pay capabilities, covering all Taobao and Tmall merchants. Just over three weeks later, consumers could use WeChat Pay for their purchases on Taobao. By October 8, WeChat also supported using Taobao to complete purchases without any adjustments.

In just over a month, Taobao achieved interconnectivity with WeChat. This collaboration between Taobao and WeChat, two of China's most popular apps, marks a milestone in the development of the mobile internet.

For WeChat Pay, as the owner of significant user traffic, every additional payment scenario translates into more revenue. This is especially true for a national-level shopping app like Taobao. For Taobao, this is a significant step in implementing its "user-first" strategy and a necessary choice in search of incremental markets.

Facts have shown that Taobao's integration with WeChat Pay precisely targets WeChat users who have not yet used Taobao. With the approach of Singles' Day, a massive influx of new users has begun to enter Taobao. According to a research report by J.P. Morgan, the interconnection is expected to bring Taobao a 20-30% increase in users, totaling 200-300 million, reaffirming Alibaba's (BABA) overweight rating and raising the target price to USD 125.

This seemingly win-win collaboration may have disappointed Alipay.

By integrating WeChat Pay, Taobao has gained more users but at the cost of introducing a formidable competitor on par with Alipay. Alipay, which once held a significant share of Taobao's payment processing, may feel a chill this Singles' Day.

In the past, users relied on Alipay for two main reasons: shopping on Taobao and using Huabei for advanced consumption.

However, which e-commerce platform or payment method today does not offer advanced consumption options? Pinduoduo has its "Pay After Use," JD.com has "JD.com White Consumer Credit," and even travel platform Ctrip has launched "Ctrip Credit Pay." Even WeChat has introduced "WeChat Pay Later," providing users with more payment options. The early advantage that Alipay's Huabei once enjoyed has vanished as competitors gradually catch up.

Image source: Ctrip Credit Pay, WeChat Pay Later

Imagine how many middle-aged and elderly people will lose their last reason to install Alipay on their phones after Taobao integrates WeChat Pay?

Alipay has not stopped its "self-rescue" efforts. Whether it's Alipay+AI's "ZhiXiaoBao" or innovative payment methods, they are all attempts by Alipay to prove its uniqueness.

According to official announcements, ZhiXiaoBao is a mini-program embedded in Alipay (or available as a standalone app). Users can use voice or text input to ask ZhiXiaoBao to fulfill needs such as ordering food, hailing a taxi, booking tickets, paying phone bills, and viewing travel guides.

According to Li Jun, General Manager of Alipay's APP Business Group, users only use Alipay about 10% of the time, with the remaining 90% forgotten. "Although it offers many essential services, users may not be able to find them. They often have to search on Xiaohongshu and follow guides step-by-step."

In other words, ZhiXiaoBao is simply giving users a reason to use Alipay.

However, due to technical limitations, ZhiXiaoBao failed to make a significant impact. According to DianDian Data, on the day of its launch, ZhiXiaoBao ranked fifth on the App Store's Lifestyle chart and 76th on the overall free chart. But a month later, it had completely disappeared from the charts.

Alipay's "Tap to Pay" shares similar responsibilities with ZhiXiaoBao.

On a more optimistic note, as an offline device, "Tap to Pay" has gained some recognition, unlike ZhiXiaoBao, which went relatively unnoticed.

Xinshi Research Institute surveyed several busy street vendors. One owner, Li Chao, said, "The introduction of Tap to Pay has indeed increased the frequency of Alipay payments. As more devices are installed and used regularly, people will get used to it and it can divert some traffic away from WeChat Pay."

However, this increase in usage may also be attributed to Alipay's random discounts or even free transactions through Tap to Pay. After all, WeChat has already launched palm payment devices, which are arguably more convenient in terms of ease of use.

Therefore, it remains to be seen how much "Tap to Pay" can boost Alipay's usage rates until ground promotion and incentive programs are fully implemented. For Alipay, relying solely on "Tap to Pay" is unrealistic. Its quest to discover its own "value" has only just begun.

References:

"This Singles' Day, Taobao Unleashes a Hidden Masterstroke," AllTech

"Alipay Seems a Bit Anxious," Xinshangye Pai

"Alipay 'Taps' into WeChat," City Image News

Editor: Ding Li