Pinduoduo's performance slows down, senior management warns of a protracted battle, share price plunges over 10%

![]() 11/22 2024

11/22 2024

![]() 478

478

Revenue growth has slowed down quarter-on-quarter, partly due to the increasingly fierce competition in the e-commerce industry and partly due to the impact of platform measures such as the "Billion Subsidy Plan".

E-commerce giant Pinduoduo's third-quarter revenue surged year-on-year, but its share price plummeted by over 10%!

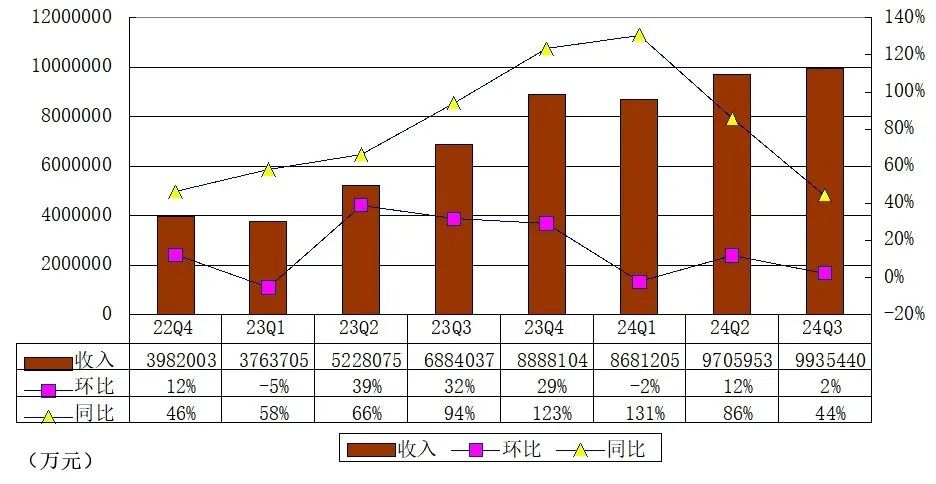

On November 21, Pinduoduo released its third-quarter 2024 financial report, showing that the company's revenue for the quarter was 99.35 billion yuan, an increase of 44% year-on-year; net profit was 24.98 billion yuan, and non-GAAP net profit was 27.46 billion yuan, both increasing by 61% year-on-year. Adjusted earnings per American Depositary Share (ADS) in the third quarter were 18.59 yuan, lower than the market estimate of 20.19 yuan.

Despite still impressive overall performance, Pinduoduo's revenue growth rates in the previous four quarters were 94%, 123%, 131%, and 86%, respectively. Compared to the rapid growth over the past year, Pinduoduo's performance in the third quarter slowed down, falling short of the market estimate of 102.83 billion yuan. Meanwhile, Pinduoduo's profit in the third quarter decreased by 22% quarter-on-quarter.

Affected by the company's third-quarter revenue falling short of expectations, Pinduoduo's share price plummeted by over 16% in pre-market trading after the financial report was released. After the U.S. market opened, the decline in Pinduoduo's share price narrowed compared to pre-market trading. As of the close of trading on November 21, EST, Pinduoduo's share price had fallen by over 10%.

In the post-earnings conference call, senior management of Pinduoduo admitted that the company's disadvantages relative to its e-commerce peers would be significant for some time, and the resulting financial impact might further expand. "We are prepared for a protracted battle," they said.

In the view of industry insiders, the slowdown in Pinduoduo's revenue growth quarter-on-quarter is not caused by a single factor. On the one hand, competition in the e-commerce industry is increasingly fierce, with major platforms seeking breakthroughs through technological and model innovations, intensifying market competition. On the other hand, measures such as the platform's "Billion Subsidy Plan" have also affected short-term financial report performance to a certain extent.

Analyzing Pinduoduo's financial report by revenue composition, revenue from online marketing services and other services was 49.35 billion yuan in this quarter, a year-on-year increase of 24%; revenue from transaction services was 50 billion yuan, a year-on-year increase of 72%.

The year-on-year growth rates of these two core revenue streams have declined for two consecutive quarters. Since the third quarter of 2023, the year-on-year growth rate of transaction service revenue has been above 300% for three consecutive quarters, dropping to 234% in the second quarter of 2024 and further to 72% in the third quarter.

It is worth mentioning that Bloomberg consensus estimates for transactional revenue were approximately 53 billion yuan, but the actual transactional revenue for this quarter was 50 billion yuan, 3 billion yuan less than expected.

Transactional service revenue refers to commission income, where Pinduoduo charges a percentage of the transaction amount as a commission for each completed order by merchants. In the past quarter, Pinduoduo has been actively courting merchants, announcing a "Billion Subsidy Plan" for merchants at the second-quarter earnings announcement.

Multiple service fee refund benefits have been introduced successively, including reducing the technical service fee for pay-after-use orders from 1% to 0.6% and lowering the basic deposit for merchant stores from 1,000 yuan to 500 yuan. The initial deposit for newly registered individual and corporate stores will also be reduced to 500 yuan.

In addition, Pinduoduo has also promoted the "E-commerce Go West" plan, eliminating logistics transit fees for orders from remote areas, which will be borne entirely by the platform. Following the "Billion Subsidy Plan," Pinduoduo has also comprehensively launched the "New Quality Merchant Support Plan."

Pinduoduo CEO Chen Lei said that beyond financial data, the company places greater emphasis on the long-term value brought by ecological investments. "In the coming quarters, Pinduoduo will continue to invest in strategies such as 'new quality supply' to bring more long-term returns to users, merchants, and the industry." Amidst intensifying competition and persistent external challenges, Pinduoduo's revenue growth will further slow down.

Founded in 2015, when China's e-commerce landscape was dominated by Taobao and JD.com, Pinduoduo's development over the past decade has undoubtedly been a success from a business perspective. Since its rise to fame, Pinduoduo has been at the center of public opinion and has recently become a focal point of discussion due to comments from China's richest man.

Nongfu Spring founder Zhong Shanshan criticized Pinduoduo during an event, arguing that internet platforms, particularly those with pricing structures like Pinduoduo's, have lowered price systems, which is detrimental to Chinese brands and industries. This is not just a case of bad money driving out good but also a misguided industrial trend.

In the nearly saturated e-commerce field, Pinduoduo introduced the "Billion Subsidy Plan" to carve out a niche through low pricing. Currently, multiple e-commerce platforms have also adopted low pricing as a weapon in the fierce market competition, making the "Billion Subsidy Plan" a standard feature among e-commerce platforms.

However, the consequences of low pricing seem to be borne more by the industry. In recent years, intra-industry competition and vicious competition have hindered the transformation and upgrading of manufacturing enterprises, with platforms' unprincipled low-pricing strategies undoubtedly being one of the contributing factors.

From Zhong Shanshan's remarks, it is evident that he is criticizing the low-pricing strategies of internet e-commerce platforms, with Pinduoduo being a prime example. In January this year, popular economist Ren Zeping directly targeted Pinduoduo, accusing it of "either condoning theft or being a thief itself." Ren Zeping claimed that the prevalence of fake goods on Pinduoduo could lead to a decline in society's moral standards and economic development if others followed suit.

It is undeniable that low pricing is a normal commercial competitive strategy. However, to achieve sustainable growth in the long term, Pinduoduo should focus on product quality, user experience, and other aspects, aiming to shed the label of "rampant fakes" as soon as possible.