iQIYI, in Urgent Need of a Hit

![]() 11/25 2024

11/25 2024

![]() 520

520

On November 21, iQIYI released its financial report for the third quarter of 2024.

The good news is that in the third quarter of this year, iQIYI's Non-GAAP operating profit was 370 million yuan, achieving positive operating cash flow for ten consecutive quarters. This indicates that iQIYI's lifeline remains healthy.

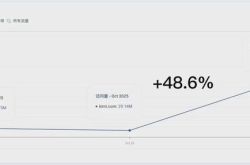

The bad news is that iQIYI's revenue declined. During the reporting period, its revenue was 7.2 billion yuan, a year-on-year decrease of 10%. Among this, membership service revenue, which accounts for a significant portion of total revenue, was 4.4 billion yuan, down 13% year-on-year. Online advertising service revenue was 1.3 billion yuan, down 20% year-on-year. Moreover, the net profit attributable to iQIYI in the third quarter was 229 million yuan, also down 51.8% year-on-year.

On the surface, memberships and advertising are the two major sources of income for long-video platforms and the foundation of their business models. In reality, the key to driving these two revenue streams is the principle of "experience is king," encompassing both content and service experiences.

High-quality content attracts users, driving both membership fees and creating traffic that attracts advertisers.

Excellent service experiences enhance user loyalty, further boosting both membership renewal intentions and advertiser interest.

In simple terms, earning user preference is the greatest competitive advantage for long-video platforms. However, iQIYI's content and service experiences were not outstanding in the third quarter of this year.

01

Lack of Continuous Hits, Service Experience Needs Improvement

Regarding the year-on-year decline in membership and advertising revenue in the third quarter, iQIYI attributed it to lighter content and a reduction in brand advertising business.

In terms of content, iQIYI actually released some significant hits in the third quarter.

According to the Yunhe Data report, in the third quarter's top-ranked programs, iQIYI's exclusive "Comedy Monologue Season" ranked second with a market share of 4.7%; for dramas, "The Mysterious Tales of Tang Dynasty: Journey to the West" topped both the continuous drama ranking and the membership content ranking.

The key point is that compared to other long-video platforms, iQIYI has too few consecutive hits.

In Yunhe Data's third-quarter online variety show ranking, Mango TV took three of the top five spots, with iQIYI and Tencent Video each occupying one spot; among the top ten, Tencent Video's exclusive variety shows occupied four spots, and iQIYI occupied two. Additionally, according to Yunhe Data's 2024 summer drama report, Tencent Video occupied six spots in the top ten, while iQIYI occupied three.

Despite having hits, the number of iQIYI's hit content is falling behind its competitors.

In fact, from last year to the present, iQIYI has consistently lacked consecutive hits.

In 2023, iQIYI only had one "nationwide hit" with "The Speed of Time" at the beginning of the year. Subsequent dramas such as "The Way Home," "The Longest Promise," and "The Mystic Nine" did not achieve the same popularity as "The Speed of Time." From the first to fourth quarters of 2023, iQIYI's average daily subscriber count was 128.9 million, 111 million, 107.5 million, and 100.3 million, respectively, showing a continuous decline. In other words, the traffic brought by "The Speed of Time" to iQIYI was not effectively retained.

In contrast, Tencent Video's exclusive dramas "Love Like the Galaxy Season 2," "River of Time," "The Rose," and "Celebration of Life Season 2" all ranked among the top continuous drama membership content in the third quarter. Continuously producing hits naturally strengthens membership intentions. Tencent's third-quarter financial report shows that thanks to popular anime and drama content, paid long-video memberships increased by 6% year-on-year to 116 million.

Furthermore, consecutive hits can also boost brand advertiser interest. According to Jirang Data, Tencent Video accounted for 50% of the top ten self-recruited dramas on platforms in H1 2024, with "The Rose" ranking first in recruitment across all platforms after its premiere.

Besides the lack of hits, the issue of content homogeneity on iQIYI is also severe. Apart from "The Mysterious Tales of Tang Dynasty: Journey to the West," dramas such as "The Song of the Ordinary," "The Lonely War," and "The Lonely Boat" were simulcast on other video platforms, failing to form an exclusive advantage.

This means that with the same content, users can choose video platforms with better service experiences. Regrettably, iQIYI is also failing in this regard.

For example, on November 12, iQIYI adjusted its policy for Gold Member VIPs. Simply put, previously, the same VIP account for both new and existing iQIYI members allowed logins on up to five devices, supporting simultaneous playback on two devices at a time.

After the new regulations, members can still log in on five devices but are limited to simultaneous playback on only one device. This has caused dissatisfaction among netizens and users.

Nonetheless, iQIYI has maintained positive cash flow in terms of commercialization. The financial report shows that in the third quarter of this year, iQIYI's Non-GAAP operating profit was 370 million yuan, achieving positive operating cash flow for ten consecutive quarters. This indicates that iQIYI's lifeline remains healthy.

02

The 'Collective Anxiety' of Long-Video Platforms

Profitability was once a collective anxiety for long-video platforms.

In 2022, iQIYI achieved its first profitable quarter after 12 years of operation. Although it began to turn a profit, this was achieved through cost reduction and efficiency enhancement measures such as layoffs, business line cuts, and reduced investments in mid-tier dramas.

Until now, iQIYI continues to promote cost reduction and efficiency enhancement. The third-quarter financial report shows that iQIYI's total costs for the quarter were 5.6 billion yuan, down 3% year-on-year. Among these, content costs were 4 billion yuan, while sales and administrative expenses and research and development expenses were 910 million yuan and 450 million yuan, respectively.

In comparison, iQIYI's content costs were 4.1 billion yuan in the second quarter of this year and 4.2 billion yuan in the third quarter of last year, showing declines both year-on-year and quarter-on-quarter. With reduced investments, the quality of dramas is naturally affected, theoretically reducing the probability of producing hits. Additionally, declining sales and administrative expenses will also impact the service experience to some extent.

Amid cost reduction and efficiency enhancement, Gong Yu, CEO of iQIYI, stated that iQIYI's primary strategy is to "increase top-tier content, reduce flops, and not deliberately produce mid-tier content." However, hits are sometimes a matter of probability, and producing top-tier content does not necessarily guarantee success; sometimes, mid-tier content becomes popular instead.

Apart from iQIYI, other video platforms have also shown declining performance trends. Mango TV's third-quarter revenue was 3.318 billion yuan, down 7.14% year-on-year, with net profit attributable to shareholders of listed companies totaling 380 million yuan, down 27.41% year-on-year.

Youku has not released separate financial data, but according to Alibaba's disclosure, the situation is similarly unoptimistic. Youku's parent company, Alibaba Digital Media and Entertainment Group, reported third-quarter revenue of 5.694 billion yuan in 2024, down 1% year-on-year, with an adjusted EBITDA loss of 178 million yuan.

It is difficult for long-video platforms to earn revenue, primarily due to two reasons. First, let's talk about advertising revenue. QuestMobile data shows that the share of online video advertising has declined annually for the past five years, with an estimated share of 2.9% next year, less than 3%. Advertising is a business reliant on external factors, and it is not the best cash cow for long-video platforms; long-term reliance on it would lead to unstable revenue.

The other aspect is membership fees. To stimulate membership renewal intentions, the key lies in producing high-quality dramas. This year, Pony Ma stated that the key to supporting long-video memberships lies in "a few major dramas." "Those minor dramas in the past couldn't hold up; at most, they could serve as advertisement billboards, with little value."

However, high-quality dramas mean higher costs. Balancing costs and benefits is a test of a platform's operational capabilities. After all, many long-video platforms cannot afford to be as financially generous as Tencent Video. This year, when discussing the long-video business, Pony Ma stated that being expensive is worth it and represents reputation. Rather than producing so-called "mid-tier dramas," resources should be concentrated on creating high-quality, reputable content.

To compete with financially generous Tencent Video, iQIYI must introduce new strategies. Currently, this new strategy may be micro-short dramas.

03

Will Micro-Short Dramas Be the Remedy for Anxiety?

During the third-quarter earnings call, iQIYI mentioned enhancing content appeal by optimizing long-videos and incorporating micro-short dramas.

Many consider micro-short dramas as the "most profitable content track in 2024" due to their low cost, short cycle, and high return.

Many micro-short dramas have short episode durations and low content quality requirements, resulting in relatively low production costs. Some micro-short dramas have episodes as short as one minute, with production costs of just a few thousand yuan but considerable returns. Previously, the 17-minute, three-episode micro-short drama "Escape from the British Museum" became a hit, garnering over 400 million views on Douyin. Another micro-short drama, "Unmatched," earned over 100 million yuan in advertising revenue within just eight days of its premiere.

Therefore, it is understandable that iQIYI views micro-short dramas as a new business opportunity. In September this year, iQIYI launched the "Short Theater" and "Micro Theater." The former features episodes of 5-20 minutes, primarily horizontal-screen dramas released weekly, while the latter features episodes of 1-5 minutes, primarily vertical-screen dramas released twice weekly.

Long-video platforms like iQIYI, Tencent Video, and Youku have advantages in layout short dramas as they excel in producing high-quality content, capable of outcompeting smaller short drama production companies.

After increasing investment in micro-short dramas, a practical question arises: how will iQIYI make money?

Gong Yu stated that iQIYI's current micro-short drama business models primarily include free viewing with ads and pay-per-view. iQIYI has now added a membership model, meaning iQIYI members will soon be able to watch micro-short dramas for free. Gong Yu believes this has significant value in retaining and attracting new members.

However, while increasing investment in micro-short dramas brings opportunities to iQIYI, it also brings pressures.

Firstly, despite their popularity, micro-short dramas do not have a high probability of becoming hits.

Jiuzhou Culture once stated that the company releases 50 to 60 short dramas each month, each costing 200,000 to 300,000 yuan. Among these, 70% break even, 10% to 15% become hits, 30% flop, and 10% incur pure losses. This means that iQIYI must bear certain risks in investing in short dramas, essentially requiring sound budget management.

So, where will iQIYI get the money to invest in short dramas?

Gong Yu stated that from a budget perspective, there are two sources for the increased budget for iQIYI's micro-short dramas: one is that iQIYI will reduce investments in less efficient long-video content, and the other is to moderately, rationally, and reasonably increase investments in micro-short dramas.

This means that in the long-video sector, iQIYI must compete with "Youku, Tencent Video, and Mango TV" on one hand and divert some resources originally invested in long-videos to micro-short dramas on the other. This dual-track development may enable iQIYI to achieve comprehensive development and gain more revenue, or it may lead to mediocrity and increased pressure.