ZTO Express in the Third Quarter: Achieving Both Market Share and Profit

![]() 11/25 2024

11/25 2024

![]() 467

467

As the Double 11 shopping festival drew to a close, the Double 12 sales event swiftly kicked off. Amidst the hustle and bustle, not only merchants and consumers but also express delivery companies have reaped significant benefits.

Image source: ZTO Express official account

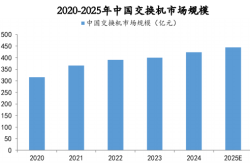

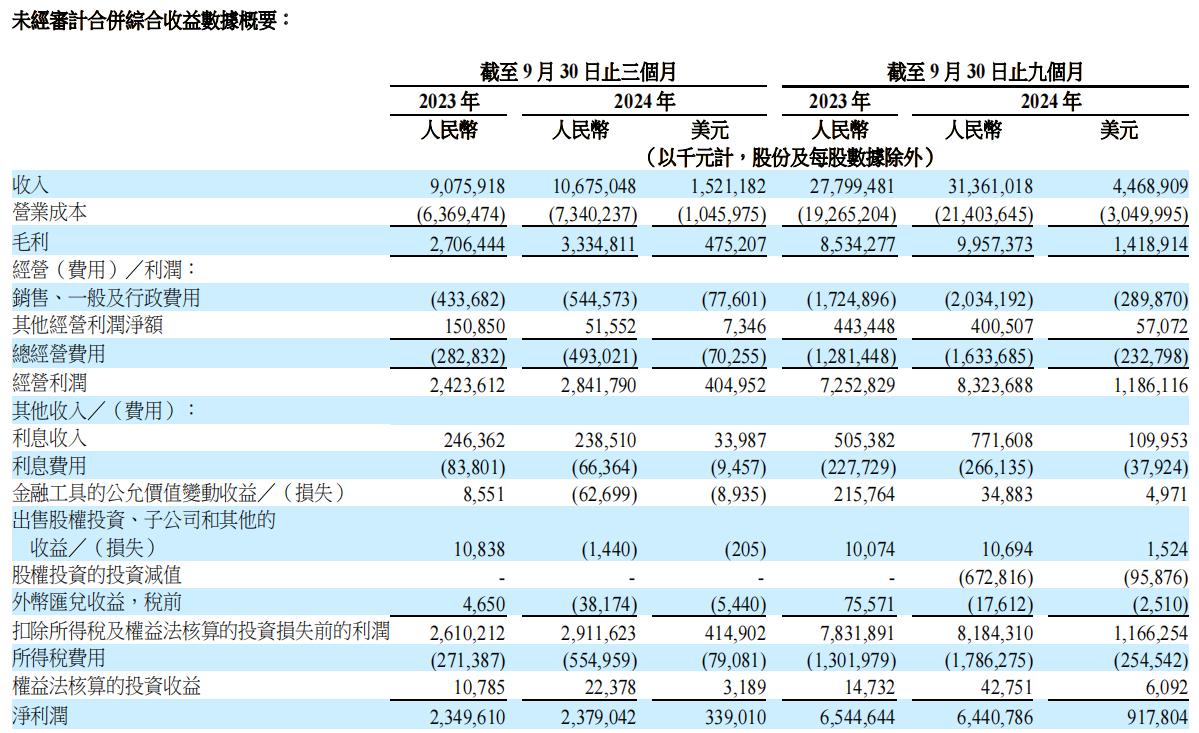

Recently, ZTO Express, known as the "Profit King," released its surprising third-quarter financial report. The report revealed that ZTO Express generated revenue of 31.36 billion yuan in the first three quarters of 2024, marking a year-on-year increase of 12.8%. Additionally, the company achieved a net profit of 6.44 billion yuan, demonstrating overall robust performance.

In balancing market share and profit, ZTO Express strives to achieve both goals simultaneously.

With 8.72 billion parcels in the third quarter, is ZTO Express "far ahead"?

Lai Meisong, founder, chairman, and CEO of ZTO Express, stated, "Since ZTO became the industry leader nearly a decade ago, maintaining a leading business volume has always been one of our primary strategic focuses. Meanwhile, we are actively initiating plans to regain market share, expand our lead in business volume, and achieve reasonable profitability while maintaining high-quality service and customer satisfaction."

"Words matched with deeds" accurately describes ZTO Express's third-quarter performance. The financial report revealed that ZTO Express generated revenue of 10.675 billion yuan in the third quarter, representing a year-on-year increase of 17.6% compared to the same period in 2023.

Image source: ZTO Express financial report

Specifically, due to the optimization of the customer mix, ZTO Express's revenue per parcel and business volume continued to grow in the third quarter. In terms of pricing, the revenue per parcel was 1.20 yuan, up 1.8% year-on-year, with the increase in direct customer revenue offsetting the negative impact of incremental subsidies and lighter parcel weights.

Regarding business volume, ZTO Express handled 8.72 billion parcels in the third quarter of 2024, up 15.9% year-on-year. Its market share declined by 0.7% year-on-year to 20% but increased by 0.4% quarter-on-quarter, with scattered parcels achieving a year-on-year growth rate of over 40%.

Furthermore, profitability increased year-on-year due to a decrease in the cost per parcel for transportation and transit.

The financial report indicated that ZTO Express's cost per parcel was 0.82 yuan in the third quarter, unchanged year-on-year. Thanks to improvements in economies of scale, optimized trunk route planning, standardized operation processes, and increased automation equipment, the transportation cost per parcel decreased by 0.04 yuan to 0.39 yuan, and the transit cost per parcel decreased by 0.02 yuan to 0.25 yuan.

Considering these factors, ZTO Express achieved a gross profit of 3.3348 billion yuan in the third quarter, up 23.2% year-on-year; its net profit reached 2.39 billion yuan, up 1.3% year-on-year; and its gross margin was 31.2%, up 1.4% year-on-year, demonstrating solid profitability.

Moreover, ZTO Express's selling, general, and administrative expenses totaled 540 million yuan in the third quarter, up 25.6% year-on-year, with an income tax of 560 million yuan and an income tax rate of 19%, compared to 10% in the same period last year. Affected by these factors, its net profit margin decreased by 3.6% year-on-year to 22.3%.

Regarding the annual parcel volume forecast, ZTO Express management revised downward its projection for the company's full-year parcel volume growth rate in 2024 to between 11.6% and 12.3%, corresponding to 33.7 billion to 33.9 billion parcels.

In response, Ms. Yan Huiping, CFO of ZTO Express, stated, "Based on our forecast for the coming months, we have revised downward our annual business volume target. The increasing proportion of low-value e-commerce parcels poses challenges to our overall strategy of achieving simultaneous growth in service quality, business volume, and profit."

Overall, in the third quarter, ZTO Express maintained its market share while promoting simultaneous growth in business volume and profit. In particular, the significant increase in parcel volume and the continuous decline in cost per parcel solidify its reputation as the "Profit King."

Breaking Away from the "Tongda" Turmoil and Exploring New Markets

While ZTO Express has surpassed itself, the challenges and competition from external environments and formidable rivals in today's competitive era cannot be underestimated.

As early as the end of October this year, SF Holding, YTO Express, Yunda Express, and STO Express successively released their third-quarter earnings reports. Comprehensively examining their third-quarter performances, all five major express delivery companies reported revenue and net profit increases.

Compared horizontally, in the third quarter, ZTO Express handled 8.72 billion parcels, up 15.9% year-on-year; generated revenue of 10.675 billion yuan, up 17.6% year-on-year; and achieved a net profit of 2.379 billion yuan, up 1.3% year-on-year.

The other three companies in the "Tongda" network were not far behind. YTO Express handled 6.71 billion parcels in the third quarter, up 28.1% year-on-year; generated revenue of 16.8 billion yuan, up 22.1% year-on-year; and achieved a net profit attributable to shareholders of 943 million yuan, up 18.06% year-on-year.

STO Express handled 5.883 billion parcels in the third quarter, up 27.9% year-on-year; generated revenue of 11.92 billion yuan, up 16.3% year-on-year; and achieved a net profit attributable to shareholders of 215 million yuan, up 7761% year-on-year.

Yunda Express handled 6.019 billion parcels in the third quarter, generated revenue of 12.257 billion yuan, up 8.84% year-on-year, and achieved a net profit of 367 million yuan, up 24.25% year-on-year.

SF Express maintained its leading position, showing a significant gap in revenue and profit. It handled 3.229 billion parcels in the third quarter, up 14.37% year-on-year; generated revenue of 72.451 billion yuan, up 12.07% year-on-year; and achieved a net profit attributable to shareholders of listed companies of 2.81 billion yuan, up 34.59% year-on-year.

In comparison, apart from SF Express, ZTO Express's revenue level is comparable to the other three companies, but its parcel volume holds a significant lead, and its net profit level is on par with SF Express.

Specifically, ZTO Express's "far ahead" position in parcel volume is closely related to its dedication to the challenging rural market. Ten years have passed since the official launch of the "Express to the Countryside" initiative in 2014, and ZTO Express has increasingly stepped up its efforts to support agriculture.

Previously, ZTO Express released data on its agricultural support efforts from January to August this year, revealing that as of August, it had transported over 9.3 billion parcels in rural areas, with a year-on-year growth rate of 43.77% for rural outbound parcels.

Image source: ZTO Express official account

Supporting the increase in rural business parcel volume is ZTO Express's continuous investment in rural network construction. As of August this year, ZTO Express had established express delivery services in over 277,000 rural villages. In terms of rural service points, the number of ZTO's self-branded village stations and cooperative stations exceeded 33,000.

Moreover, a notable change for ZTO Express this year has been its intensified efforts to compete for the scattered parcel market share. Since express delivery outlets have two pricing systems for individual scattered parcels and merchant-scale e-commerce parcels, ZTO Express's shift to the scattered parcel market has not only effectively alleviated the pressure from price competition but also ensured profit levels to a certain extent.

In response, Lai Meisong, founder, chairman, and CEO of ZTO Express, stated that increasing the ratio of scattered parcel pickup and delivery can provide franchisees and delivery staff with opportunities to increase income and ultimately provide price advantages at the front end.

Currently, ZTO Express handles an average of over 5 million scattered parcels daily, compared to an average of only 3.9 million last year. The significant increase in the number of scattered parcels has provided considerable support for the sustained and stable profits of ZTO Express.

In retrospect, grasping niche markets and core advantages while concentrating efforts on transformation are profound insights gained by ZTO Express after experiencing extreme price wars. These efforts have indeed yielded noticeable results.

The King of E-commerce Parcels: ZTO Express's Self-Cultivation

Whether competing for scattered parcel market share or deeply exploring the huge potential of the rural market, the vast e-commerce sector is an indispensable part of achieving sustained performance growth for major express delivery companies, with ZTO Express attaching particular importance to this area.

Since 2013, the proportion of e-commerce parcels in the express delivery market has continued to rise. As major express delivery brands have established deep cooperation with mainstream e-commerce platforms, the e-commerce express delivery business has also witnessed rapid growth.

Since this year, ZTO Express has actively expanded its scattered parcel business, fully integrated with e-commerce platforms, and deeply participated in reverse logistics cooperation, thereby winning a continuous increase in high-quality customers. Financial report data revealed a year-on-year increase of 2.6% in unit price, primarily due to the increase in the proportion of high-unit-price parcels, especially the significant revenue growth of direct customer business.

As social platforms such as Douyin, Kuaishou, and Xiaohongshu continue to drive the rise of social e-commerce, according to forecasts by the ECDI, e-commerce penetration will increase from 40.35% in 2023 to 41% in 2024.

Meanwhile, the extreme cost-effectiveness competition initiated by e-commerce platforms such as Douyin, Kuaishou, and Pinduoduo has led to a decrease in the average customer order value, an increase in the split order rate, and an increase in the return rate in the e-commerce market. These changes have ultimately resulted in a situation where the growth rate of express delivery is higher than that of e-commerce, and the growth rate of e-commerce is higher than that of social retail sales.

In the current express delivery market, companies such as ZTO Express, YTO Express, Yunda Express, STO Express, and Cainiao are closely connected to the Alibaba ecosystem, while JD Logistics relies on JD.com, and J&T Express closely cooperates with Pinduoduo through its extreme cost-effectiveness strategy.

As the interoperability between the Alibaba ecosystem and JD.com deepens, all express delivery platforms are on an equal footing. Therefore, competition among express delivery platforms once again focuses on core elements such as infrastructure investment and express delivery timeliness.

SF Express, which is comparable to ZTO Express in profitability, particularly emphasizes detailed construction at various nodes. In the first half of 2024 alone, SF invested over 6 billion yuan in purchasing aircraft, vehicles, and constructing sorting centers.

ZTO Express is also striving to improve service quality, not only expanding its coverage to time-sensitive and high-end parcel markets but also further refining time-sensitive parcel services and stratifying time-sensitive products. To strive for excellence, the financial report shows that ZTO currently has over 6,000 direct network partners and over 10,000 self-owned trunk vehicles and will continue to expand.

Furthermore, to break the inherent brand image of ZTO in consumers' minds, the company has initiated the "One Body and Eight Wings" full-chain development plan, committed to enhancing service quality and transforming towards a more comprehensive and high-end business model.

It is foreseeable that future competition among express delivery enterprises will not be solely based on express delivery services but will involve full-chain and ecosystem competitions. Comprehensive logistics service providers and ecological advantages are currently the goals pursued by express delivery companies.

This applies to JD Logistics, Cainiao Logistics, SF Express, and ZTO Express alike. From a fundamental perspective, becoming a truly top-tier "comprehensive logistics service provider" is the ultimate goal for all major express delivery companies.

Source: Hong Kong Stock Research Institute