BOSS Zhipin's Gross Margin Rivals Moutai, but Can the Bosses Still Afford It?

![]() 12/19 2024

12/19 2024

![]() 557

557

BOSS Zhipin's performance has soared, but can the bosses still afford it?

Recently, China's largest job recruitment website, BOSS Zhipin, released its third-quarter report for 2024. The report reveals that in the third quarter, BOSS Zhipin's revenue was 1.912 billion yuan, up 18.98% year-on-year, with net profit attributable to shareholders reaching 468.4 million yuan, a 10.02% year-on-year increase. For the first three quarters, revenue stood at 5.532 billion yuan, up 26.54% year-on-year, while net profit attributable to shareholders amounted to 1.135 billion yuan, a 47.8% increase.

As of the end of the third quarter, the number of newly posted jobs on BOSS Zhipin had increased by 18% year-on-year. The average monthly active user (MAU) count on the app hit 58 million, a 30% year-on-year increase. The number of paying enterprise customers during the reporting period reached 6 million, up 22.4% year-on-year.

According to a report by CNR, Zhao Peng, founder, chairman, and CEO of BOSS Zhipin, stated, "The essence of business growth lies in a company's products and services winning over more users or achieving a higher level of user recognition. To achieve growth, it is necessary to continuously build the company's core competencies. As long as the original intention of 'serving users' remains unchanged, enterprises can survive and evolve at any time."

Despite BOSS Zhipin's impressive performance, it has failed to gain recognition in the capital market. After releasing its financial report, on December 12, BOSS Zhipin's share price in the U.S. stock market rose by 2% but then fell for two consecutive trading days, by 1.35% and 5.28%, respectively. The day before the financial report was released, the share price dropped by as much as 8.02% in a single day.

Numerous complaints about BOSS Zhipin can be found on platforms such as HeiMao Complaints and Xiaofei Bao, with enterprise users questioning the excessive price hikes, making it challenging for them to afford. Among them, there are 4,253 complaints on HeiMao Complaints, with 2,831 completed, resulting in a completion rate of less than 70%, which is relatively low.

Why has BOSS Zhipin's performance soared, yet the bosses claim they can no longer afford it?

1. Gross Margin Comparable to Moutai?

BOSS Zhipin's 47.8% increase in net profit is significantly higher than its 26.54% revenue growth, partially due to improvements in its gross margin and net profit margin.

The financial report indicates that during the reporting period, BOSS Zhipin's gross profit margin was 83.26%, up 1.22 percentage points from the same period last year (82.04%). The net profit margin for the reporting period was 20.30%, compared to 17.57% in the same period last year, an increase of 2.73 percentage points.

In 2023, BOSS Zhipin's revenue was 5.952 billion yuan, up 31.94% year-on-year. The company's net profit attributable to shareholders was 1.099 billion yuan, up 924.97% year-on-year. This was also due to a significant increase in the net profit margin. In 2023, BOSS Zhipin's gross profit margin of 82.19% was actually 1.08 percentage points lower than the previous year's 83.27%, but the net profit margin surged from 2.38% in 2022 to 18.47%, an increase of 16.09 percentage points.

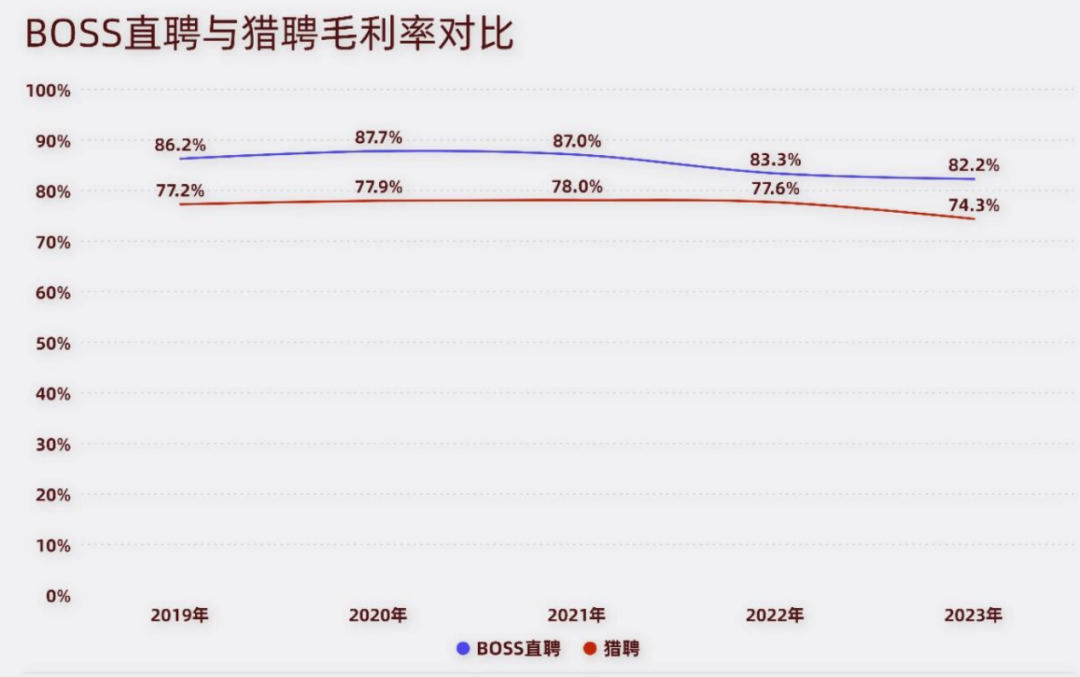

BOSS Zhipin's gross margin has remained above 82% since 2019. During the same period, Liepin.com's highest gross margin was only 78%, and the difference in gross margins between the two companies was close to 10 percentage points at its peak. In 2023, BOSS Zhipin's gross margin was 7.9 percentage points higher than that of Liepin.com.

BOSS Zhipin's remarkable performance growth may be closely tied to the current employment environment. SMEs are facing increased operational pressures, a significant number of private enterprises are struggling to survive, and unemployment rates are surging. Among them, the unemployment rate among young and middle-aged people is also on the rise. According to data from the National Bureau of Statistics, although China's urban surveyed unemployment rate has remained stable at around 5% since 2018, the unemployment rate for the 16-24 age group has reached a maximum of 16.8%, indicating that the unemployment rate among graduates is much higher than the overall urban surveyed unemployment rate.

BOSS Zhipin, with its slogan of "talk directly with the boss to find a job," has swiftly become the leading player in China's recruitment market, leading to its favorable financial performance. Its ultra-high gross margin has been crucial in turning losses into profits for BOSS Zhipin. Previously, software companies and Moutai were known for their high gross margins, but now BOSS Zhipin has joined their ranks.

Moutai's gross margin for the first three quarters of this year slightly decreased from 91.71% in the same period last year to 91.53%. Although the decline is not significant, there have been minor declines in recent years, with a gross margin of 91.96% in 2023. The net profit margin also fell from 53.09% in the same period last year to 52.19%, a decrease of nearly 1 percentage point. In contrast, BOSS Zhipin's net profit margin for the first three quarters hit a record high.

2. Over 90% of Revenue Comes from Enterprise Payments

For job seekers already unemployed, spending money to find a job may seem unacceptable. BOSS Zhipin seems to understand this, so its main paying customers are enterprises. As long as there are enough paying enterprises, it is sufficient to support BOSS Zhipin's high growth.

Since its inception, BOSS Zhipin's core business model has been "job seekers leveraging enterprises," which simply means relying on a large user base to generate revenue from enterprises. Enterprises have limited options to choose from as the once vibrant recruitment market has dwindled significantly after years of competition. Zhaopin.com has declined after multiple changes in ownership, Lagou.com has become inconspicuous, 58.com is no longer in its glory days, and now the top players in the market are BOSS Zhipin, 51job, Zhaopin, and Liepin. With the delisting of 51job and Zhaopin, the recruitment market may become dominated by BOSS Zhipin.

The cost for enterprises to recruit on BOSS Zhipin is evident. BOSS Zhipin's value-added services include various fee-based options such as direct beans, competitive job postings, VIP accounts, background checks, and resume refreshes, and the pricing has raised questions among business owners.

These paying enterprise customers who "cannot do without" BOSS Zhipin constitute the main source of revenue for the company. According to its prospectus, in 2021, 99% of BOSS Zhipin's total revenue came from online recruitment services for enterprise customers, while revenue from paid value-added services for job seekers (C-end users) accounted for only about 1% of total revenue. In 2023, revenue from other services (primarily paid value-added services provided to job seekers) was 60 million yuan, still accounting for only 1% of total revenue.

According to a report by Securities Times on July 10, 2021, titled "Strong Regulation on 'Data Cross-border Flow'! Four Platforms Including BOSS Zhipin Have Been Investigated," BOSS Zhipin faced an investigation during which new users were unable to register. However, the company's performance remained unaffected that year, with revenue reaching 4.259 billion yuan, a surge of 119.05% year-on-year, even exceeding the 94.69% increase in 2020. The reasons for this remain unclear.

3. Profitability Through 'Savings'?

In 2019, BOSS Zhipin invested heavily in the Russia World Cup, with marketing expenses totaling 916.8 million yuan for the year, accounting for 92% of its total revenue of 998.7 million yuan. As a result, the company incurred a net loss of 502.1 million yuan that year. R&D expenses for BOSS Zhipin in 2019 were 325.6 million yuan, accounting for 32.6% of total revenue.

In 2023, BOSS Zhipin's marketing expenses were 1.991 billion yuan, accounting for 33.8% of its total revenue of 5.889 billion yuan. During the same period, R&D expenses were 1.544 billion yuan, accounting for 26.2% of total revenue. It is evident that BOSS Zhipin has moved away from the era of heavy marketing. In the first three quarters of 2024, marketing expenses were 1.647 billion yuan, accounting for 30.1% of total revenue of 5.466 billion yuan, while R&D expenses of 1.375 billion yuan accounted for 25.2% of total revenue, both showing a downward trend.

It is noteworthy that BOSS Zhipin's R&D expenses have increased significantly year-on-year. From 2020 to 2023, R&D expenses were 513.4 million yuan, 822 million yuan, 1.183 billion yuan, and 1.544 billion yuan, respectively, representing year-on-year increases of 57.68%, 60.12%, 43.89%, and 30.51%. During the same period, marketing expense growth rates were 46.98%, 44.17%, 3%, and -0.48%, respectively.

Upon closer examination, it becomes apparent that BOSS Zhipin's turnaround to profitability in 2022 may be partly attributed to "cost reduction and efficiency enhancement." The financial report reveals that the company's general and administrative expenses decreased from 1.991 billion yuan in 2021 to 719.7 million yuan in 2022, a reduction of 1.271 billion yuan. Considering that BOSS Zhipin incurred a loss of 1.071 billion yuan in 2021 and achieved a profit of 107.2 million yuan in 2022, the total difference is approximately 1.178 billion yuan. The cost savings made by BOSS Zhipin more than cover this amount, with nearly 100 million yuan left over. Signs of cost reduction are also evident in the financial report. In 2023, BOSS Zhipin had a total of 5,346 employees, a decrease of 256 from the previous year. Reductions were seen across various job categories, including operations, administration, and R&D, with operations experiencing the largest decrease of 226 employees.

After BOSS Zhipin became profitable in 2022, the capital market's response was muted. Its share price has declined by approximately 70% since reaching a high of $44.78 in June 2021. As of the close of U.S. trading on December 16, BOSS Zhipin's market capitalization was $6.216 billion, a decrease of $13.9 billion from its peak of $20.16 billion.

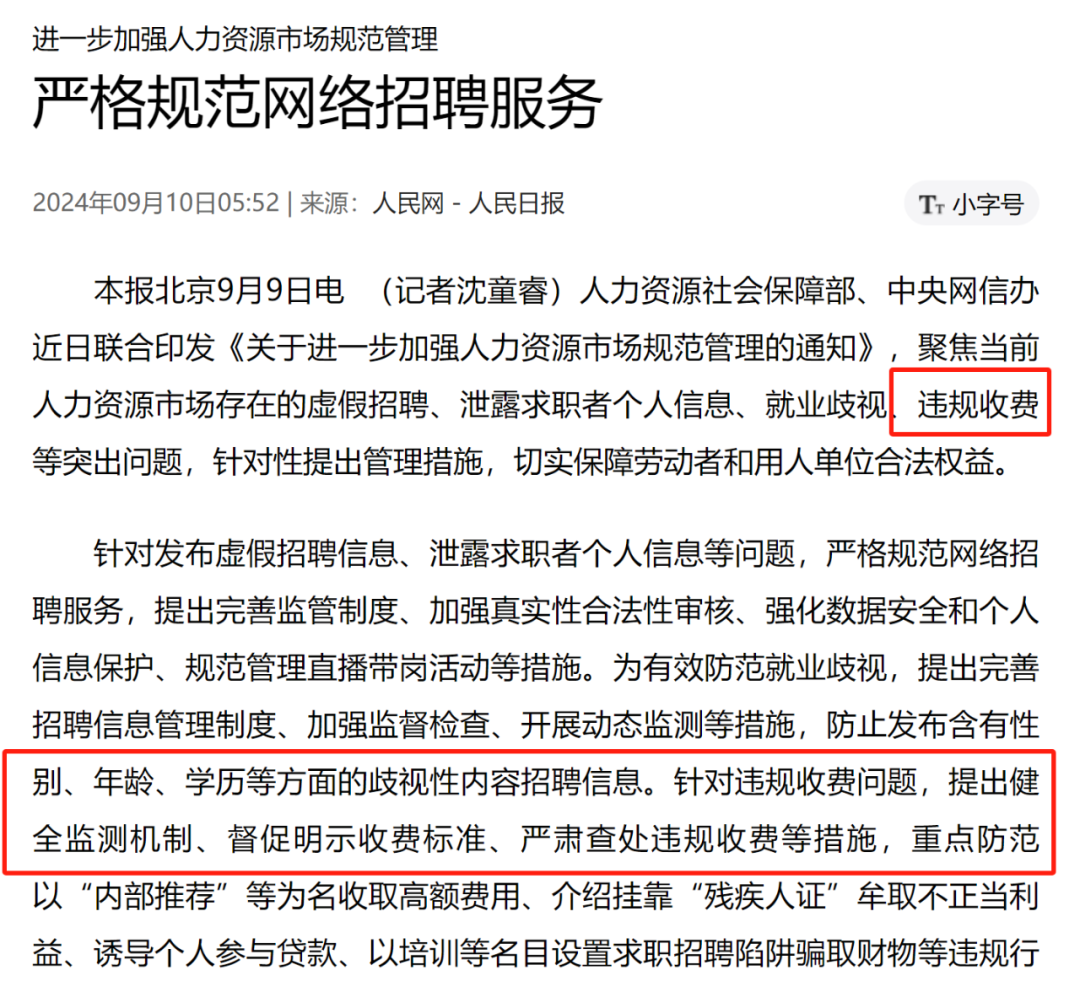

In response to questions from enterprises about its fees, BOSS Zhipin has not provided a direct response. However, in September of this year, People's Daily published an article about a joint notice issued by the Ministry of Human Resources and Social Security and the Central Cyberspace Affairs Commission titled "Notice on Further Strengthening the Standardized Management of the Human Resources Market," which focuses on addressing irregularities in the current human resources market and proposes targeted management measures to effectively protect the legitimate rights and interests of workers and employers.

Currently, there have been no reports of irregular or excessive fees charged by BOSS Zhipin, but the aforementioned notice also clearly urges recruitment platforms to "clearly indicate fee standards."

Since its inception, paying enterprises have been the main source of revenue for BOSS Zhipin. Returning to the initial question, as enterprises face increasing difficulties, who will support the company's growth when the bosses can no longer afford it?