Domestic Brands Drive Joint Ventures into a Corner

![]() 08/08 2025

08/08 2025

![]() 562

562

Introduction

It may seem like a cliché, but the automotive landscape is indeed in a constant state of flux.

"It's already 2025, why are we still hyping up domestic cars?"

Some readers might ask this after seeing the article's title. Before publication, I had numerous conversations with people who echoed this sentiment. In their view, domestic cars have already surpassed foreign counterparts in the new energy sector, so any talk of "going crazy" now is merely a tired cliché, indicative of outdated information.

However, I argue that the market is ever-changing and fiercely competitive. Perhaps in the blink of an eye, a new landscape has emerged. In this transitional period from old to new, we cannot help but witness another transformation of domestic brands.

Taking the first half of the year as an example, passenger vehicle retail sales reached 10.901 million units, an increase of 10.8% year-on-year. Among them, the performance of domestic brands was particularly impressive, accounting for 64% of the retail market share, a 7.5 percentage point jump from the same period last year. From 50% to 64%, it took just three years for domestic brands to go from occupying half the market to sounding the horn for a full-scale counterattack.

It's crucial to understand that over these three years, domestic brands' journey has been far from merely improving numbers on a spreadsheet. Behind the scenes, they have made significant progress in technological breakthroughs, market reshaping, global layout, and brand premiumization, transforming from followers to rule-makers and rewriting the global automotive industry's competitive landscape.

01 From Catching Up to Leading

Certainly, if we had to highlight the most eye-catching aspect, the data would be the most intuitive. For instance, in the top 10 list of retail sales in the first half of the year, domestic brands reshaped the automotive landscape with an unprecedented presence.

Among them, domestic brands occupied six seats, squeezing joint venture brands into just four positions (FAW-Volkswagen, SAIC Volkswagen, FAW Toyota, GAC Toyota). Notably, BYD, Geely, Changan, and Chery, these four domestic giants, not only firmly occupy the top 10 positions but also form the first tier with sales of over 600,000 units each. BYD (1.61 million units) and Geely (1.226 million units) have both surpassed the million mark, becoming crucial driving forces for the growth of domestic brands' share.

It's evident that in this list, domestic brands are no longer the supporting roles of yesteryear.

Accompanying the brilliance of domestic brands is the fading of joint venture brands. The once firmly held "golden lineup" by joint venture giants has now evolved into a stage where domestic brands take center stage.

From a data perspective, the retail market share of domestic brands in the first half of the year reached 64%, a year-on-year jump of 7.5 percentage points. This 7.5 percentage point increase means that out of the 10.9 million units, domestic brands have forcibly taken away more than 800,000 units of market share from the joint venture camp.

This is not a gentle erosion but a devastating takeover. Amidst these attacks and defenses, increases and decreases, there is as much joy for domestic brands as there is disappointment for joint venture brands.

However, this did not happen overnight.

Looking back a few years ago, the combination of SAIC Volkswagen, FAW Volkswagen, and SAIC GM, known as the "North-South Volkswagen + GM," long held the top three spots in the sales rankings, undisputed market leaders. Others such as Dongfeng Nissan, GAC Honda, Dongfeng Honda, FAW Toyota, GAC Toyota, and other Japanese joint ventures, as well as Beijing Hyundai and other Korean joint ventures, also occupied important positions in the rankings.

Relying on the strong brand influence of their international parent companies, mature and reliable product technology in the traditional fuel vehicle sector, a comprehensive global R&D system, and relatively advanced management experience, these joint venture brands, with product lines covering various mainstream segments from economical family sedans to mid-to-high-end sedans and SUVs, have successfully won the trust of Chinese consumers.

At the same time, in the TOP 10 list, the presence of domestic brands was indeed scarce and unstable. Geely, Changan, Great Wall, and other better-performing domestic brands usually barely squeaked into the top 10, struggling to shake the positions of joint venture giants. Even so, the overall market share of domestic brands was indeed below 40% for a long time, even around 30% or lower.

At that time, the core challenges faced by domestic brands included insufficient brand power, shortcomings in core technology, weak product quality and premium ability, etc. It reflected the gap in branding, technology, and system capabilities of the Chinese automotive industry at that time. But it was precisely that difficult period that inspired the determination for change and innovation in domestic brands.

In just a few years, with the help of the new energy revolution and the advantages of the Chinese market, domestic brands have achieved an epic turnaround. From the fringes of the rankings to dominance, from a share of only 30% to breaking through 60%, this is not just a change in numbers but a sign of a fundamental transformation in the strength, innovation ability, and market position of the Chinese auto industry.

Once-revered joint venture giants are now facing tremendous competitive pressure from Chinese domestic brands. More and more domestic brands are entering the top 10 automakers, outlining an upward trajectory for domestic brands from catching up to leading.

02 Behind the Multi-Dimensional Rise

"The overall performance of domestic brands in the first half of the year was good, but the industry differentiation was also particularly significant," said an industry insider. Behind the overall upward trend, the domestic camp is also undergoing a brutal reshuffle and upgrade with technology as its weapon.

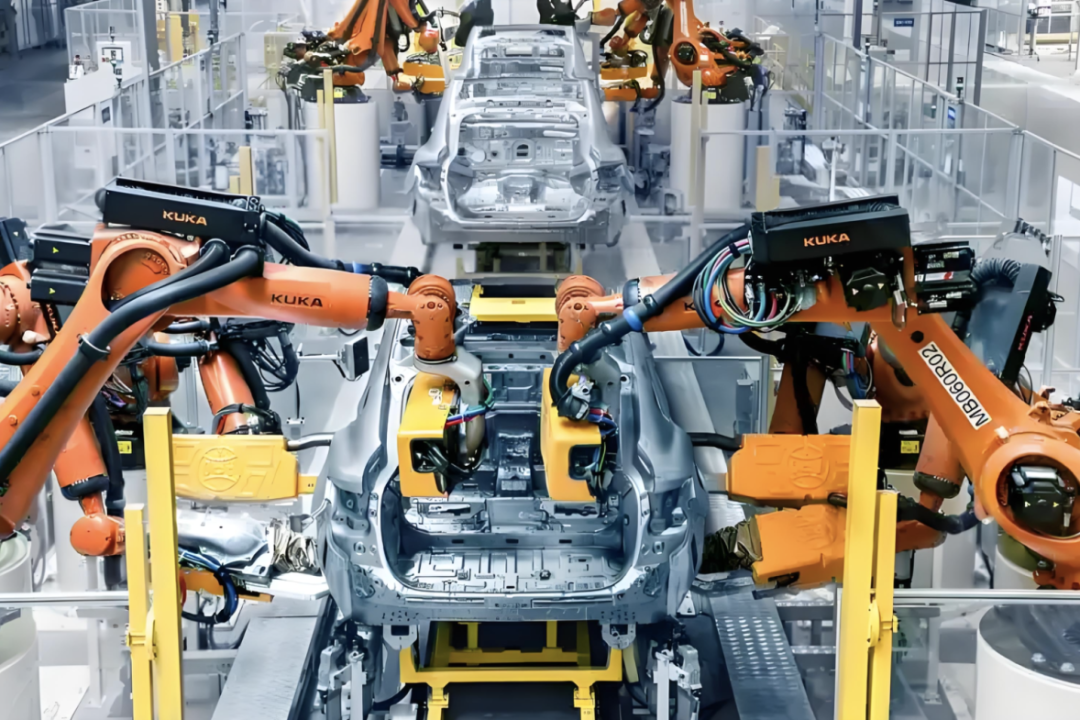

Indeed, traditional giants such as BYD, Geely, and Changan, with their deep accumulation and decisive turn towards the new energy sector, have not only defended their basic positions but also made breakthrough progress in premiumization (such as BYD's Yangwang and Yinhe series) and overseas markets, showing strong growth momentum.

On the other hand, the new force camp is staging an evolutionary drama of "survival of the fittest." For example, Lixiang continues to lead with precise positioning and robust operations; Xiaopeng and Leopard Run rely on the iteration of pure electric platform technology and intelligent upgrades to carve out a path in niche markets, becoming the second tier with impressive growth rates; and the cross-border entry of technological forces such as AITO empowered by Huawei and Xiaomi Automobile has become the "third wave of growth momentum" stirring up the landscape.

As they reap success, the presence of domestic brands has long surpassed mere sales figures, comprehensively reshaping the image of Chinese automobiles with unprecedented technological confidence, global vision, and brand height.

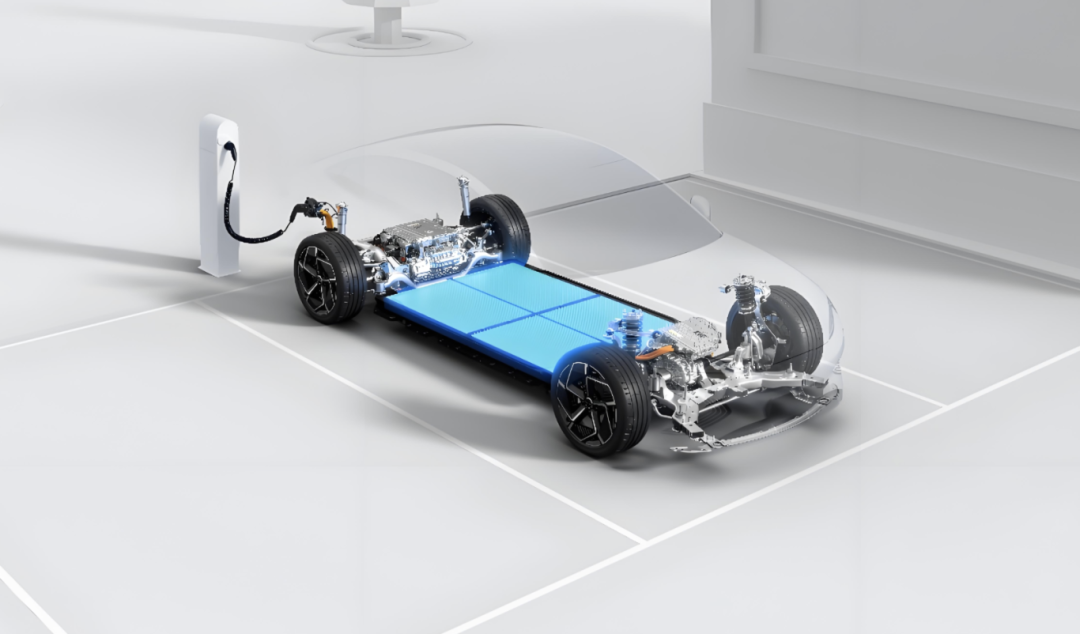

Currently, core technologies such as Blade Batteries, CTB body integration technology, Super Hybrid DM-i, Leishen Hybrid, high-level intelligent driving, and HarmonyOS cabin, which were first mass-produced and led by domestic brands, have become the new benchmarks defining the market. Chinese automobiles are forgetting the lack of confidence brought about by the soft underbelly of "three major parts" technology.

Moreover, in pursuit of additional growth and influence, leading domestic brands such as BYD, Chery, Geely, and Great Wall are exploring overseas markets with unprecedented strength and speed. From Europe to Southeast Asia, from the Middle East to Latin America, Chinese brand automobile exports have repeatedly hit new highs, overseas factory layouts are accelerating, and they are beginning to truly possess global competitiveness and influence.

Technological empowerment has also continuously elevated the value of Chinese brands with the arrival of more and more high-end models. Hardcore off-road vehicles like BYD's Yangwang U8, performance labels like Zeekr 001 FR, executive flagship positioning like NIO's ET9, technological luxury like AITO's M9... These products, with price ranges approaching or even surpassing traditional luxury brands, have won the recognition of high-end consumers with their technology and experience.

Thanks to their efforts, the ceiling for domestic brands to break into the high-end market is being pierced through by wave after wave of upward attacks.

On the other hand, when domestic brands are sweeping the market with a prairie fire trend, once-glorious joint venture brands are generally caught in a situation of "shrinking while seeking stability." Apart from "North-South Volkswagen" and "Japanese Two Toyotas" that can still stabilize their positions with strong system capabilities and timely product adjustments, more joint venture brands are facing the severe challenge of declining market share or even exiting China.

Because in the wave of electrification, some joint venture brands have clearly lagged behind; in terms of intelligent experience, they often fail to meet the demands of "spoiled" Chinese consumers. But strictly speaking, joint venture brands are not that weak. It's just that domestic brands' overtaking in the new energy sector has amplified the disadvantages of joint venture brands in this sector, forcing the latter to maintain themselves through strategies such as significant terminal discounts, accelerated introduction or local R&D of new energy vehicles, and strengthened supply chain cost control, trying to find a new balance point amid contraction.

At the same time, the brand image, reputation, and consumer trust accumulated by the joint venture camp over decades, especially in terms of reliability, durability, and resale value, are difficult to replace in the short term. Moreover, in the traditional fuel vehicle sector and hybrid technology, many joint venture brands still possess deep technical accumulation and advantages, with mature and stable products.

This makes many joint venture cars still dominate in more niche markets. For example, Passat, Camry, and Accord for mainstream mid-sized sedans, and CR-V and RAV4 for mainstream SUVs, with their balanced product power and reputation, they remain evergreen sales trees and benchmarks in their respective niche markets. Not to mention in the luxury car market, BBA, as well as second-tier luxury brands such as Lexus and Cadillac, still dominate. Although domestic premium brands are catching up, there is still a gap in scale and brand influence.

Therefore, beneath the appearance of domestic cars "going crazy," it is not only a systemic qualitative change for the Chinese auto industry after decades of accumulation but also a period for joint venture brands to seek counterattack opportunities while lying low. Currently, many mainstream joint venture brands have begun to accelerate their transformation, and future market competition remains full of uncertainties.

Editor-in-Charge: Li Sijia | Editor: He Zengrong

THE END