European Auto Market | France July 2025: Lowest Sales in Three Years

![]() 08/11 2025

08/11 2025

![]() 442

442

In July 2025, the French new car market plummeted to its lowest level for the same period in three years, with registrations declining by 7.7% year-on-year.

Sales of gasoline and diesel vehicles continued to slide, and the plug-in hybrid market stagnated, while hybrid and pure electric vehicles exhibited robust growth, fueled by policy incentives and fleet purchases. This market downturn is not merely cyclical but a result of various factors, including powertrain types, consumption patterns, and brand perceptions.

Local mainstream brands saw their market shares erode, while Chinese brands like MG and BYD made significant strides at the nexus of the new energy transition. They gained a foothold through competitive pricing and established sustainable advantages in range, smart features, and channel strategies.

Sales dynamics are driving a market reshuffle. As the French auto market shifts from "structural stability" to "structural imbalance," the rapid ascendancy of Chinese brands will reshape the brand hierarchy, transitioning from a dominance of technological paths to a rebalancing of supply systems and cost structures.

01 Sales Overview: Mainstream Brands in Decline, New Energy in the Spotlight

In July 2025, new car registrations in France totaled 116,400, down 7.7% year-on-year. This structural decline, reappearing after the post-pandemic market recovery, indicates that consumers remain cautious about policy adjustments and purchasing decisions.

Year-to-date sales for the first seven months amounted to 958,600, a 7.9% decrease from the previous year. Private car purchases fell by 10.1%, and fleet purchases declined by 10% year-on-year. Conversely, tactical sales, such as short-term rentals and self-purchase registrations, surged by over 50%, partially cushioning the overall market decline.

From a powertrain perspective, the decline in traditional gasoline and diesel vehicles was particularly acute:

◎ Gasoline car sales stood at 24,900, a 33.4% year-on-year drop, with market share slipping to 21.4%.

◎ Diesel car sales plummeted to 6,816, a 28.3% decrease, further shrinking market share to 5.9%.

◎ Hybrid models bucked the trend, growing 9.8% year-on-year to 53,200 units, accounting for 45.7% of the market.

◎ The plug-in hybrid market remained flat, with sales of 8,415, a 8.2% decline, keeping market share largely unchanged.

◎ Pure electric vehicles shone brightly, registering 19,600 units, a 14.9% increase, and lifting market share to 16.8%.

Notably, the surge in pure electric vehicle sales was primarily driven by fleet purchases, which surged 70% year-on-year, while private user purchases declined by 15%.

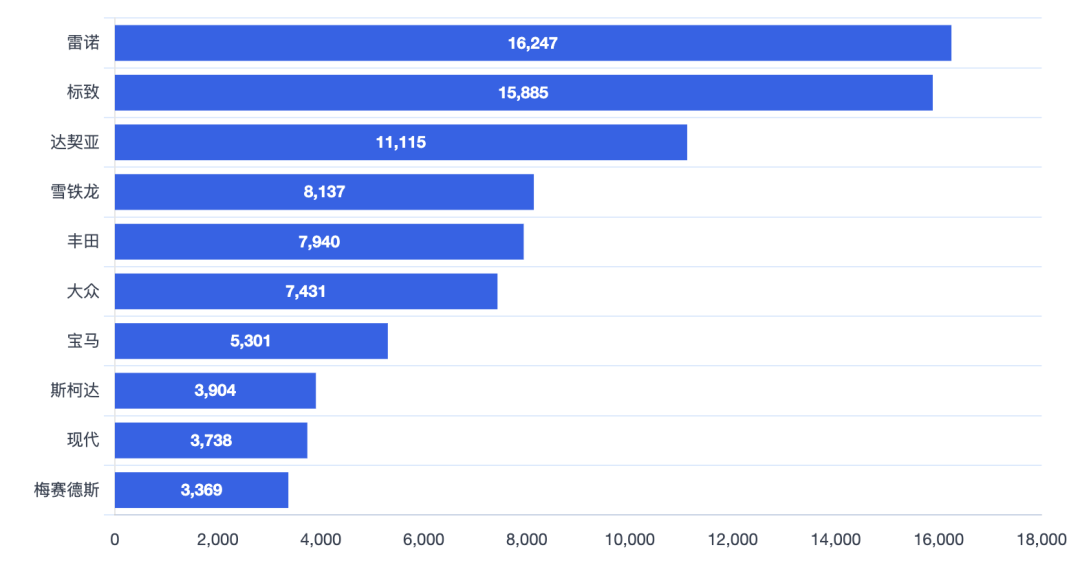

At the brand level:

◎ French stalwarts Renault and Peugeot retained the top two spots but witnessed significant market share reductions, with Renault selling 16,200 units (down 6.6%) and Peugeot 15,900 units (down 5.8%).

◎ Dacia fell 10.4% year-on-year but maintained a 9.6% share.

◎ Citroen rebounded slightly to fourth place, overtaking Toyota, which suffered a steep decline due to the base effect (down 27.1% year-on-year).

◎ BMW and Skoda were among the few mainstream brands to record year-on-year growth, with BMW increasing by 7.4% and Skoda by 25.2%, setting a new ranking record in the French market.

◎ MG surged 98.2%, emerging as one of the year's standout brands.

◎ BYD continued its high-growth trajectory, rising 294.5% year-on-year to rank among the top 25.

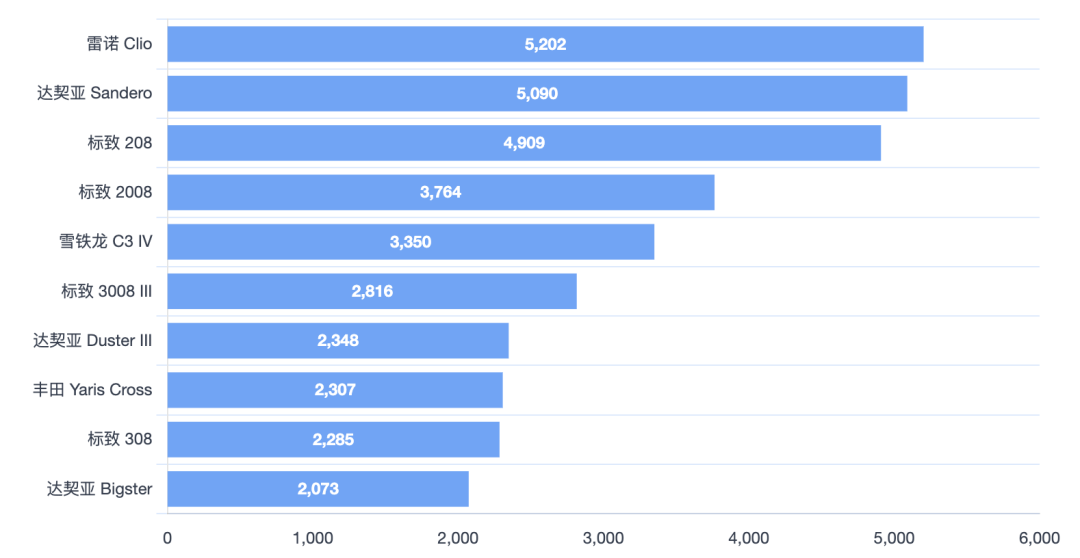

In the model rankings:

◎ Renault Clio reclaimed the top spot with monthly sales of 5,202 units.

◎ Dacia Sandero followed closely, despite a 23% year-on-year decline.

◎ Peugeot 208 held onto third place.

◎ Peugeot 2008 performed robustly, growing 19.6% year-on-year.

◎ The fourth-generation Citroen C3 skyrocketed by 2400%, breaking into the top five.

◎ Among new models, Dacia Bigster debuted in the top ten, making a strong impression.

◎ Renault 5 continued its ascent to twelfth place, signaling a new phase for the French electric vehicle market.

◎ In the electric vehicle segment, BMW iX1 ranked second with sales of 1,083 units.

◎ MG ZS placed 27th in the overall market with 1,069 units, a staggering 1624.2% year-on-year increase, cementing its position as one of the strongest Chinese brand representatives in France.

02 Chinese Brand Performance: Flourishing Across Sectors, Rapid Electrification Penetration

◎ In July 2025, MG ranked 15th among French brands with monthly sales of 2,370 units, nearly doubling year-on-year, steadily expanding its European footprint.

Its flagship model, the ZS, sold 1,069 units in July, ranking 27th overall. This achievement underscores its comprehensive competitiveness in product design, electrification technology, and pricing, demonstrating that Chinese brands have shed the "cheap" stigma and entered the mainstream European market with a focus on "both practicality and intelligence".

◎ BYD also achieved remarkable growth, selling 1,085 units in July, nearly tripling year-on-year, with market share nearing 1%. Still in its introductory phase, its electric vehicle lineup, including models like the Seal, Dolphin, and Yuan PLUS, is rapidly closing the gap with European brands due to its advantages in range, energy efficiency, and overall vehicle quality. With more new models launching in the second half of the year, BYD is poised to climb further up the rankings.

The structural transformation of the French new energy vehicle market is increasingly evident. Amidst the decline of traditional powertrains, the market share of hybrid and pure electric vehicles continues to rise. Especially for electric vehicles, they are accelerating into a growth trajectory, bolstered by policy support, increased fleet purchases, and heightened brand recognition.

For Chinese brands, this phase represents a critical window to build brand influence and channel foundations. Through pricing strategies, local partnerships, after-sales networks, and other means, leading brands such as MG and BYD have established a solid reputation. As brands like Zero Run, Jeekoo, NIO, and Voyah gradually introduce customized electric products to Europe,

Summary

The French market stands at a pivotal juncture in its transition from traditional powertrains to new energy vehicles. Short-term sales fluctuations cannot obscure the profound restructuring underway at the supply level: local brands face pressure from aging models and profit erosion, while newcomers, particularly Chinese brands, are seizing structural opportunities amidst the technological certainties of the new energy transition.

The key to this transformation lies not just in products but also in supply chain efficiency, brands' understanding of the local market, and their ability to swiftly establish economies of scale within subsidy and policy windows. MG and BYD have already become viable options for French consumers.