Jia Yueting's "Shell Game"?

![]() 08/14 2025

08/14 2025

![]() 492

492

When it comes to spinning tales for capital, Jia Yueting stands unrivaled.

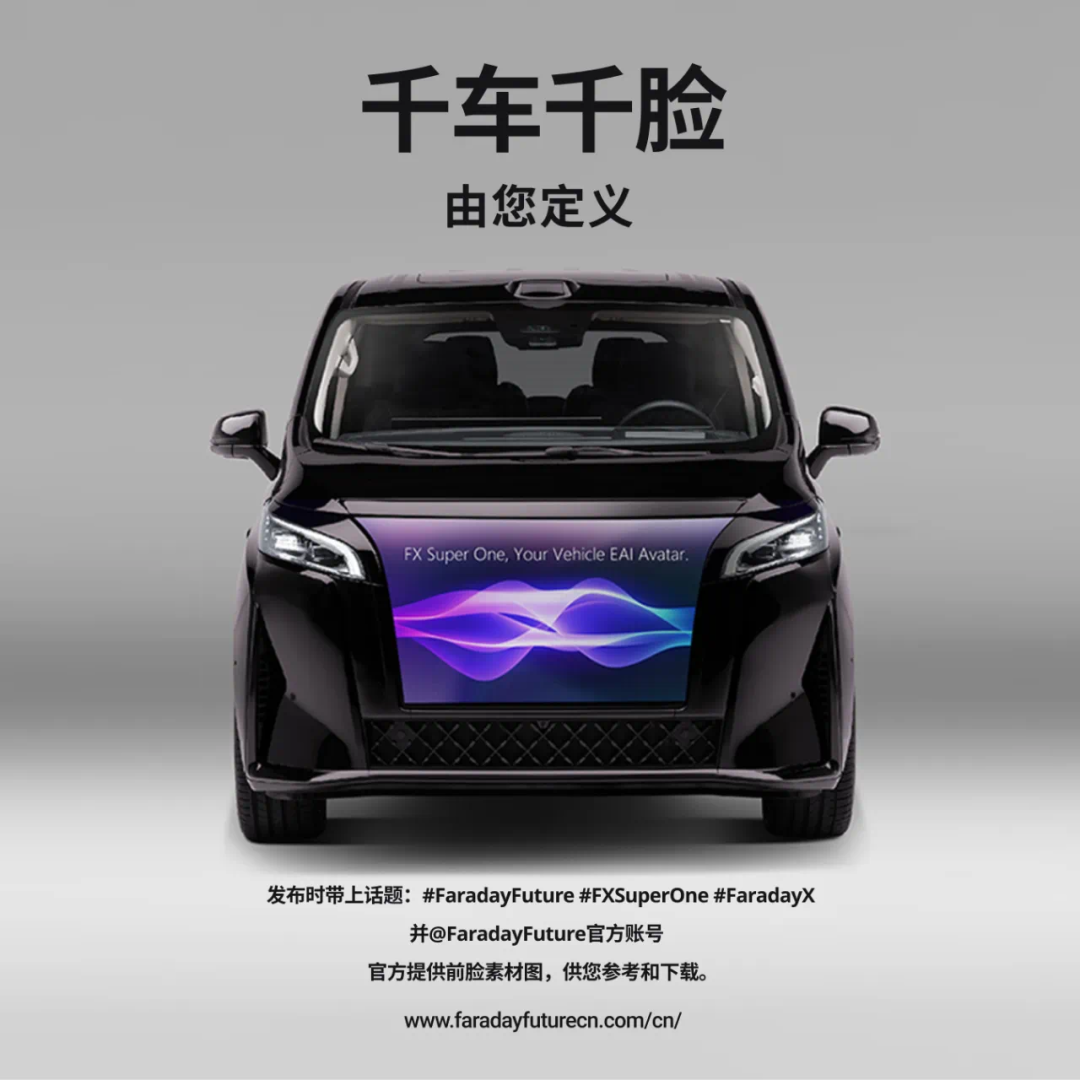

Shortly after securing $105 million (approximately 750 million yuan) in funding, Faraday Future (FF) unveiled its second vehicle. On July 18, FF introduced the FX Super One, the first MPV model of its second brand Faraday X (abbreviated as FX), and opened pre-orders, with an anticipated price under $80,000 (approximately 580,000 yuan).

Image source: Faraday Future

However, astute Chinese netizens quickly noticed that, aside from the massive front LED screen, the FX Super One's body lines, taillight design, and even interior button layout were strikingly similar to those of the Great Wall WEY Mountain Peak MPV. Even the model's official website description included a note about "Intelligent Electric 4WD Standard for All Models of Mountain Peak 9".

Immediately, questions arose about FF's "shell game" with Great Wall Motors. What surprised the industry was that behind this apparent "copying" might lie a "secret" collaboration. On July 24, media reported that the FX Super One was a model authorized by WEY Mountain Peak, utilizing Great Wall Motors' "bridge strategy" to enter the U.S. market through FF. Great Wall Motors aimed to indirectly enter the U.S. market through this partnership. For Jia Yueting, this presented a ready-made "heavyweight new car" to showcase to capital investors. It is reported that by the end of the conference, the paid pre-orders for the FX Super One exceeded 10,000 units.

A week has passed since the incident, but Great Wall Motors has yet to respond. In contrast, FF's response seemed to indirectly acknowledge the earlier rumors. On August 3, FF Global CEO Wang Jiawei released a video stating that the car was developed in cooperation with Chinese industry partners and that no copying was involved.

"White Label Magic"

According to media reports, Great Wall Motors was one of the four Chinese automakers Jia Yueting proposed for the "China-U.S. Automotive Industry Bridge Strategy," and it was the first to implement this strategy. Facing the highly fortified U.S. market, Wei Jianjun chose to partner with Jia Yueting, aiming to use FF to indirectly promote Great Wall Motors' entry into the U.S. market.

From the vehicle's appearance, the overall silhouette and even the taillight details of the FX Super One are highly similar to those of the Great Wall WEY Mountain Peak 9, with the only addition being a front screen resembling a "big TV." This design has been mocked by netizens as a "LeTV TV frontend".

Wang Jiawei emphasized that the car was developed in collaboration with Chinese industry partners, leveraging each other's strengths to bring quality Chinese products to the U.S. market, achieving mutual success and empowerment.

This also seems to confirm that previous media reports were not unfounded, and that Great Wall's "impossible" move of "borrowing" FF was indeed the real answer.

Simultaneously, Jia Yueting had a new story to tell capital investors. Leveraging China's mature MPV platform, coupled with its own AI system and external screens, FF packaged an "intelligent travel terminal" for the U.S. market, bypassing manufacturing pain points and securing valuation and financing with a software shell.

Jia Yueting has perfected the art of using new stories to attract financing and using that financing to fill old holes. Industry insiders estimate that the cost of this "rebranding + software adaptation" transformation model is significantly lower than that of forward R&D investment. However, the selling price of this model is almost double that in China.

Nevertheless, some media reports suggest that this path may not be sustainable. Once the equation of "Great Wall technology = FF white label" becomes fixed in consumers' perceptions, it could not only limit Great Wall's own brands' high-end trajectory but also allow FF to fully "encroach" on Great Wall's technology patents in the U.S. Moreover, relying on the Chinese supply chain, FF could halt production at any time due to policy changes, posing a significant business risk.

Wei Jianjun once stated, "Chinese automobiles lack brand premium in the global market, and the inability to produce locally is the biggest pain point."

Capital Games

Essentially, Great Wall Motors, focusing on solid car manufacturing, and FF, excelling at "capital games," are almost two enterprises on parallel tracks. Wei Jianjun and Jia Yueting are also leaders who tread different paths by conventional wisdom.

Whether this controversy is a meticulously designed "crash marketing" strategy or a "strategic alliance" remains unclear, but it is certain that Jia Yueting's calculations are at play once again. Jia Yueting's automotive manufacturing dreams have repeatedly been on the brink of collapse due to production delays. The FF91 saga has run its course without substantial sales, and Jia Yueting desperately needs a mature vehicle to restore investor confidence.

Moreover, after losing ground in the To C market, Jia Yueting has also set his sights on To B. Reports indicate that behind the 10,000 pre-orders for the FX Super One, the primary buyers are car rental companies. With new cars, orders, and buzz, this conference appears to be an attempt to prove to capital investors that FF is once again "revitalized".

However, Jia Yueting's "credibility" remains a significant concern. Whether it's "returning to China next week" or repeatedly missed production deadlines, the industry remains wary of Jia's "dreamer" label. Should Jia Yueting miss another deadline, what reputational backlash will it bring to Great Wall Motors?

More notably, the U.S. Securities and Exchange Commission (SEC) issued a "Wells Notice" to Jia Yueting and CEO Wang Jiawei on July 16, formally warning them that they may face civil penalties, disgorgement of illicit gains, and market bans for alleged "false and misleading statements" during the company's SPAC (Special Purpose Acquisition Company) merger and listing process in 2021.

Industry insiders warn that if the charges are proven, Jia Yueting may face hundreds of millions of dollars in fines and a lifetime ban from the U.S. stock market, and FF may be forced to delist.

Great Wall Motors' anxiety to break the deadlock is evident, but Jia Yueting's ship is not a reliable choice for "borrowing a ship to sail abroad." Although Jia Yueting has been operating in the U.S. market for years, he remains an unstable factor. Avoiding tariffs and connecting the China-U.S. automotive supply chain seem more like another "big pie" Jia Yueting is painting for Chinese automakers. Once on board, everyone is on their own.

This article is originally written by China News Service Auto. Welcome to share with your friends. If media outlets wish to reprint this article, please indicate the author and source before the text. Any media or self-media outlet that uses any content of this article to produce video or audio scripts will be held legally responsible.