Are Traditional Luxury Cars Losing Their Appeal?

![]() 08/14 2025

08/14 2025

![]() 622

622

Introduction

There are no enduring moats in China's automotive landscape; only an acute awareness of trends and a swift response matter.

On July 1, HarmonyOS Intelligence eagerly unveiled its June sales figures – 52,700 units sold. Among these, AITO, its best-seller, contributed 44,600 units. Beneath the HarmonyOS Intelligence sales poster, two lines of text stood out: "Achieving a cumulative delivery of 800,000 units within 39 months, setting a new speed record."

On August 7, the China Passenger Car Association (CPCA) released its import data for the first half of the year. In the first six months, 220,000 imported cars were sold, with 43,000 units sold in June alone. The concluding sentence of an article by Cui Dongshu, Secretary-General of the CPCA, was equally noteworthy: "This is a rare decline in imports from January to June recently."

Based on the information provided in the above paragraphs, it is evident: In June, the total sales of imported cars in China did not surpass those of the AITO brand alone.

The challenges faced by traditional luxury carmakers extend beyond the decline in imported car sales and the rise of independent luxury brands.

In the first half of 2025, Jaguar and Cadillac prices dipped to 150,000 yuan, while Maserati prices contracted to 400,000 yuan. Furthermore, none of the net profits of traditional luxury brands such as Porsche and BBA (BMW, Benz, Audi) increased...

Under this pressure, the transformation of traditional luxury carmakers is imminent.

01 Successive "Huge Declines"

"From January to May 2025, 180,000 imported cars were sold, a year-on-year decrease of 33%, marking a rare huge decline in imports from January to May recently."

"From January to June 2025, 220,000 imported cars were sold, a year-on-year decrease of 32%, which is a rare huge decline in imports from January to June recently."

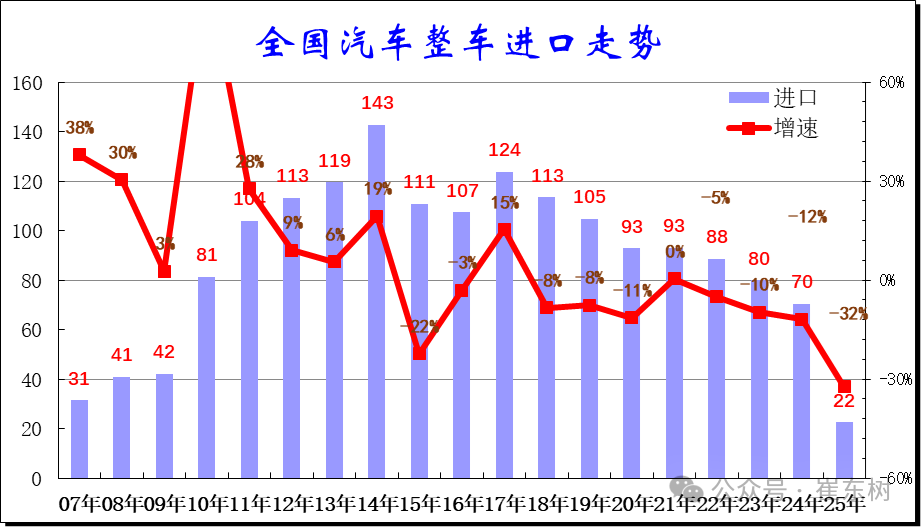

With similar introductions and substantial declines, the downward trend in imported car sales is no longer unusual. Looking back, sales of imported cars peaked at 1.43 million units in 2014.

However, since 2018, the market size for imported cars has continued to shrink, with no signs of recovery yet. By last year, the total number of imported cars had dwindled to about 700,000, primarily supported by luxury brands.

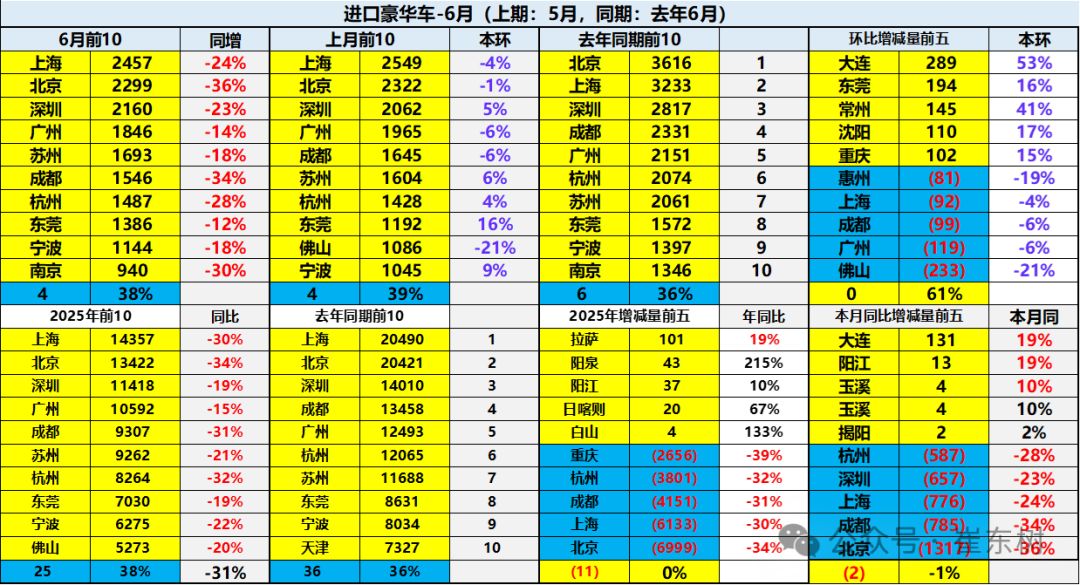

In the first half of this year, the decline in imported car sales intensified further, with only 220,000 units sold. Among them, Lexus "stood out" with sales of 91,000 units, almost half of the total, and a year-on-year increase of 12.2%. However, "one flower does not make spring"; apart from Lexus, there were few highlights in the imported car market, with some luxury brands even witnessing declines exceeding 50%.

Even Lexus, which performed relatively stably, is facing a crisis. In just a few years, its sales pillar, the ES series, has fallen from being in high demand with price premiums to a situation where it is trading volume for price. The latest 2025 ES model has a bare car price that has dropped to the 200,000 yuan range.

Lexus is not the only one adopting a price-cutting strategy. In May, the newly launched Cadillac XT4 had an entry-level 1.5T version priced at 159,900 yuan, with even the top-of-the-line version costing less than 200,000 yuan.

In July, Jaguar officially launched a preferential policy, with the limited-time price of the Jaguar XEL 90th Anniversary Collector's Edition starting at 159,800 yuan. This represents a reduction of 174,800 yuan from the guidance price of 334,600 yuan, with the discounted price even exceeding the current selling price of the vehicle.

Also in July, Maserati dealers introduced a limited-time exclusive price of 388,800 yuan for the SUV model Grecale, a reduction of 262,000 yuan from the official guidance price of 650,800-1,038,800 yuan.

However, unlike Lexus, which achieved sales growth through price cuts, the sales of the aforementioned brands still declined in the first half of the year, albeit with a narrowing of the decline.

More severely, at the core levels of revenue and profit that companies focus on, traditional luxury brands generally performed poorly: the net profits of the three major BBA brands plummeted, Porsche lowered its full-year performance expectations, and some brands even swung from profit to loss.

02 Independent Luxury Brands Seize Market Share

The decline of traditional luxury brands is not due to market contraction. Data shows that from 2016 to 2024, the domestic luxury car market exhibited strong growth momentum, with luxury car sales climbing from 1.45 million units to 5.113 million units in 2024, and the penetration rate also increasing from 5.9% to 18.5%.

The market is expanding, yet the pie for traditional luxury brands is shrinking. Behind this seemingly contradictory phenomenon lies the precise layout and robust rise of independent luxury brands in the field of new energy.

In 2020, the penetration rate of new energy in the luxury car market was only 10.8%. Just four years later, independent luxury new energy models have seized more than 60% of the market share from traditional luxury brands, staging a dramatic takeover.

In the first half of this year, growth in China's luxury car market was no longer sustained. According to statistics from the CPCA and other sources, total sales of luxury cars (including domestically produced and imported) in China in the first half of 2025 were approximately 1.6 million units, a slight year-on-year decline of 5%-7%. High-end demand remains, but growth has significantly slowed.

The rare contraction in the luxury market may be related to tariff trade and consumption downgrading.

According to the WuPo Data Terminal, a total of 4,135 bankruptcy-related cases (including bankruptcy applications, appeals, and supervision) involving 23,035 enterprises occurred in the first half of 2025. In terms of geographical distribution, the eastern coastal regions accounted for 56.57%, while the central and western regions accounted for 43.43%, showing a characteristic of "dense along the coast and spreading inland".

According to the regional changes in luxury car sales statistics by the CPCA, the eastern coastal regions are the main force in imported luxury car sales.

Taking Shanghai, which purchased the most imported luxury cars in 2025, as an example. This year, during the May Day holiday, Shanghai-based brand Silede, which was first listed in the First Food Store, has exported its products to more than 50 countries and regions, with annual export sales of approximately US$50 million, 80% of which are exported to Europe and the United States.

However, under the high tariff policy of the United States, Silede's US orders have almost disappeared, and the factory has accumulated inventory for half a year. Export to domestic sales has become a "lifesaver" for foreign trade companies. Products that were once labeled for export at a price of 1,800 yuan are now sold for only 219 yuan, with an additional store coupon of 20 yuan off for every 200 yuan spent.

From 1,800 to 200, Silede's situation is a microcosm of many foreign trade companies in the Pearl River Delta and Yangtze River Delta under the impact of tariffs. In the past, when profits were still acceptable, enterprises could avoid consumption tax and offset part of their taxes by purchasing luxury cars. However, with a significant drop in profits, the demand for luxury cars has plummeted, resulting in a substantial loss of corporate users.

However, judging from the performance of independent luxury brands, they have been relatively less affected.

In the first half of the year, HarmonyOS Intelligence sold 204,600 units, with the AITO brand alone contributing 154,000 units; NIO delivered 114,100 new vehicles, an increase of 30.6% year-on-year. Additionally, brands such as Zeekr, LIXIANG, Xiaomi, IM Motors, AVATR, FANGCHENGBAO, DENZA, and NIO look up at are also working together to form an important force for Chinese brands to make breakthroughs upwards.

Correspondingly, in the face of domestic market adjustments and tariff barriers, independent luxury brands have not only held onto their positions but also achieved breakthroughs in exports. In the first half of 2025, China exported 3.083 million automobiles, an increase of 10.4% year-on-year, of which 1.06 million were new energy vehicles, a significant increase of 75.2% year-on-year.

This also means that more sales concessions will need to be made by traditional luxury brands.

03 Transformation is Imminent

"When actions fail, seek the cause within oneself."

The retreating traditional luxury brands cannot avoid their own lag in transformation amidst the tide of the times. The reconstruction of the external market and the rise of the independent camp are more like a mirror reflecting their sluggish pace in the new energy and intelligence races.

In the race for new energy transformation, independent luxury brands have already completed the breakthrough from 0 to 1. From NIO's battery swapping ecosystem to HarmonyOS Intelligence's full-stack in-house research and development, Chinese brands have built full-industry chain advantages in batteries, motors, and electronic controls over the past decade.

In contrast, most traditional luxury brands still rely on "oil-to-electricity" conversions of fuel vehicle platforms in the early stages of electrification, leading to frequent issues such as exaggerated range claims and poor user experience. Even when pure electric platform models are launched later, the product iteration speed is far slower than that of independent brands.

The gap in the field of intelligence is even more pronounced. When independent brands use "intelligent cockpits," "city NOA," and "driver big models" as their core competitiveness, the intelligent driving systems of traditional luxury brands are still stuck in the high-speed assistance stage, with severely inadequate localization and adaptation, making it difficult for them to compete with independent brands.

The good news is that leading traditional luxury brands have begun to accelerate their catch-up efforts. For example, BBA has intensively established deep cooperation with Chinese intelligent driving enterprises in recent years:

BMW has partnered with Momenta to create a truly "indigenous" China-exclusive intelligent driving assistance solution based on the intelligent architecture and hardware platform of future locally produced BMW new-generation models.

The next-generation CLA pure electric version of Mercedes-Benz will be equipped with L2++ mapless high-level intelligent driving technology, led by Momenta and adapted by the Chinese team, with domestic production expected in 2026.

Audi has reached in-depth cooperation with Huawei Kunlun, with multiple models equipped with Kunlun intelligent driving technology ready to be launched.

Meanwhile, the pure electric platform models of these three brands have also been successively launched, with the proportion of their electrified products increasing year by year. Long-standing problems cannot be solved overnight, and it will take time to verify the chemical reaction from technological cooperation to product launch. However, they have demonstrated a firm determination to transform after experiencing pain.

In contrast, the response of ultra-luxury brands is still slightly sluggish. Brands such as Ferrari, Lamborghini, and Bentley are currently less impacted because their user base values the "irreplaceability" of centuries-old brand heritage and handcrafted customization more, and the electrification wave will have a limited impact on them in the short term.

However, this "safety" is being breached by the rise of independent ultra-luxury brands. The large order data of over 10,000 units for Zunjie and the high-end attempt of NIO look up at U8 are both shaking up the long-silent moats of ultra-luxury brands.

For ultra-luxury brands, the real crisis may not lie in current sales but in their disregard for the attempts of independent ultra-luxury brands to break through.

From traditional luxury to ultra-luxury, the cruelty of the Chinese market lies in the fact that there are no enduring moats; only an acute awareness of trends and a swift response matter.

Independent brands are tearing open a gap with new energy and intelligence, forcing the entire luxury car camp to redefine the connotation of luxury.

The key to this reconstruction has always been in the hands of those players who proactively embrace change.

Editor-in-chief: Cui Liwen | Editor: He Zengrong

THE END