Plug-in Hybrid Vehicle Exports Double; China Association of Automobile Manufacturers: 'Involution' Rectification Achieves Positive Progress

![]() 08/14 2025

08/14 2025

![]() 558

558

The traditional off-season continued to assert its influence.

On August 11, the China Association of Automobile Manufacturers (hereinafter referred to as CAAM) released the July automobile market data. Despite the traditional off-season and annual equipment maintenance by some manufacturers, automobile production and sales experienced a seasonal decline month-on-month. However, the overall market remained resilient.

Simultaneously, the trade-in policy gained momentum, and "positive progress was made in the comprehensive rectification of the industry's 'involution,'" boosting consumer confidence in automobiles and "ensuring the smooth operation of the industry in the second half of the year."

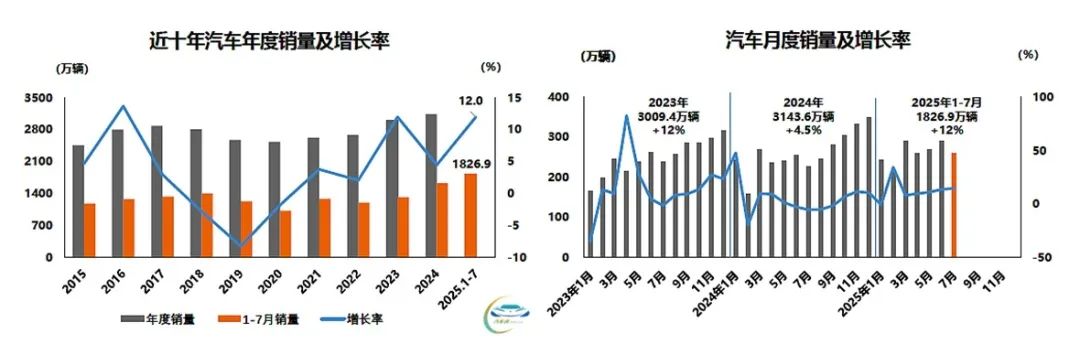

According to CAAM data, in July, automobile production and sales reached 2.591 million and 2.593 million units, respectively, down 7.3% and 10.7% month-on-month but up 13.3% and 14.7% year-on-year. From January to July, automobile production and sales totaled 18.235 million and 18.269 million units, respectively, up 12.7% and 12% year-on-year, with production and sales growth rates expanding by 0.2% and 0.6%, respectively, compared to the first six months.

Thus, while the off-season was evident in month-on-month data, year-on-year growth remained robust.

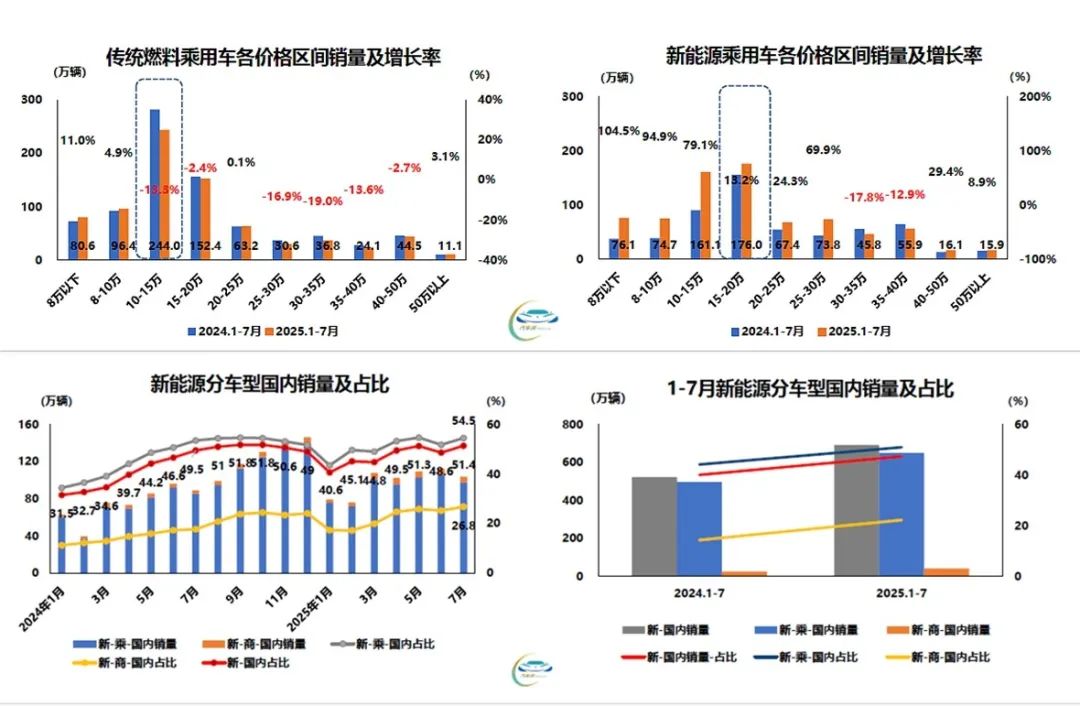

Furthermore, domestic sales of traditional fuel vehicles have maintained growth for two consecutive months: In July, domestic sales of traditional fuel vehicles reached 981,000 units, down 17.4% month-on-month but up 8.4% year-on-year. This indicates that mainstream consumption continues to fluctuate between traditional fuel and new energy vehicles.

Domestic automobile sales in July amounted to 2.018 million units, down 12.7% month-on-month but up 12.6% year-on-year. From January to July, domestic sales exceeded 14.588 million units, up 11.8% year-on-year. This year's market situation significantly outperforms 2024, with impressive growth rates.

According to Baidu search data, global automobile sales in the first six months of 2025 reached 46.32 million units, with new energy vehicles accounting for only 21.4%. Comparing global data with CAAM data, China's cumulative automobile sales have surpassed one-quarter of the global total, and the increase in new energy vehicle market share is largely attributed to China's robust new energy vehicle consumption.

Without comparison, one cannot fully appreciate the efforts of China's automobile industry nor form a clear concept of the world's largest automobile market.

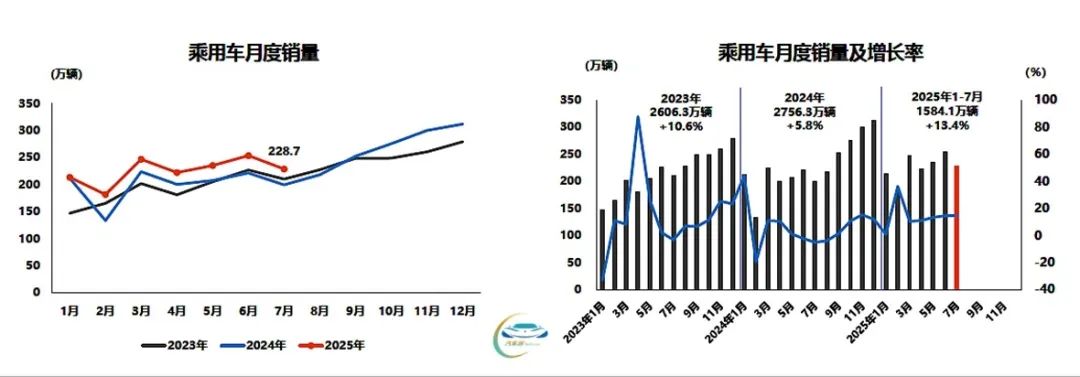

Returning to the main topic, passenger cars significantly impact overall market data: In July, passenger car production and sales reached 2.293 million and 2.287 million units, respectively, down 6% and 9.8% month-on-month but up 13% and 14.7% year-on-year. From January to July, passenger car production and sales totaled 15.838 million and 15.841 million units, respectively, up 13.8% and 13.4% year-on-year.

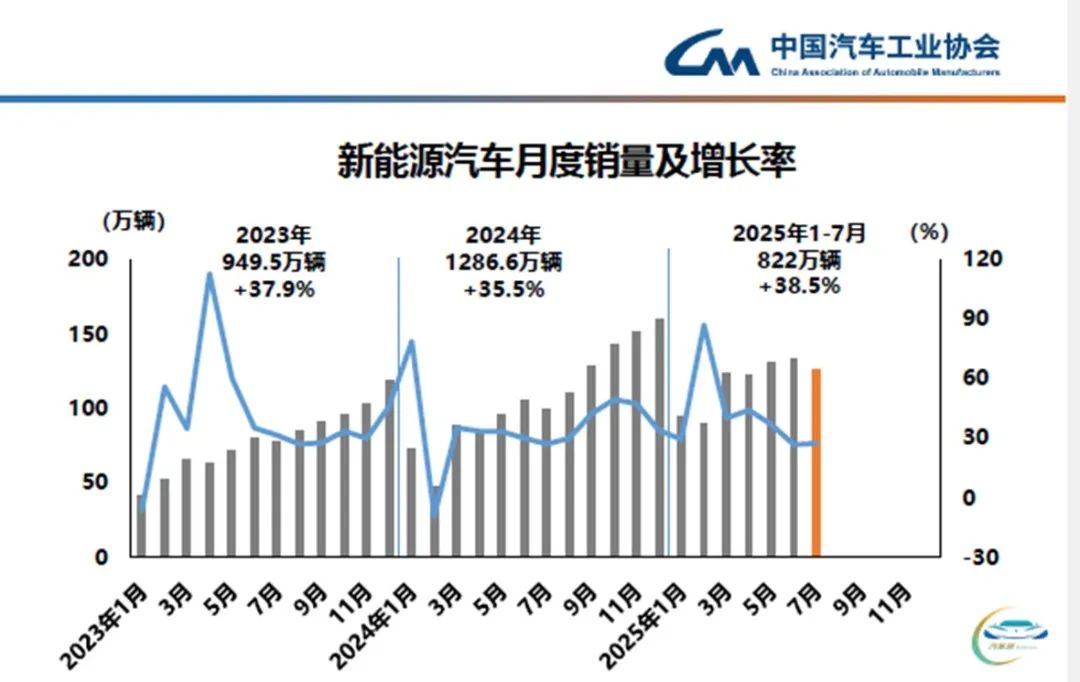

As previously mentioned, mainstream consumers remain indecisive between traditional fuel vehicles and new energy vehicles. This is evident in new energy vehicle production and sales data. According to CAAM data, in July, new energy vehicle production and sales reached 1.243 million and 1.262 million units, respectively, up 26.3% and 27.4% year-on-year, with new energy vehicle sales accounting for 48.7% of total new vehicle sales.

From January to July, new energy vehicle production and sales totaled 8.232 million and 8.22 million units, respectively, up 39.2% and 38.5% year-on-year, with new energy vehicle sales accounting for 45% of total new vehicle sales.

The 50% mark serves as a threshold for new energy vehicles. Despite explosive growth over the past two years, new energy vehicles have consistently hovered around this mark without surpassing half of total sales.

Delving deeper into the new energy market, pure electric vehicles remain the mainstay, with July sales of 811,000 units, up 47.1% year-on-year, and plug-in hybrid vehicle sales reaching 451,000 units, up 2.8% year-on-year. Cumulatively, from January to July, pure electric vehicle sales totaled 5.246 million units, up 46.9% year-on-year, and plug-in hybrid vehicle sales reached 2.972 million units, up 25.9% year-on-year.

New energy passenger car sales at various levels also exhibit new trends: From January to July, sales were concentrated in the A and B segments, with cumulative sales of 2.265 million and 2.017 million units, respectively, up 22.2% and 10.2% year-on-year. The A0 and A00 segments maintained high growth momentum driven by policies.

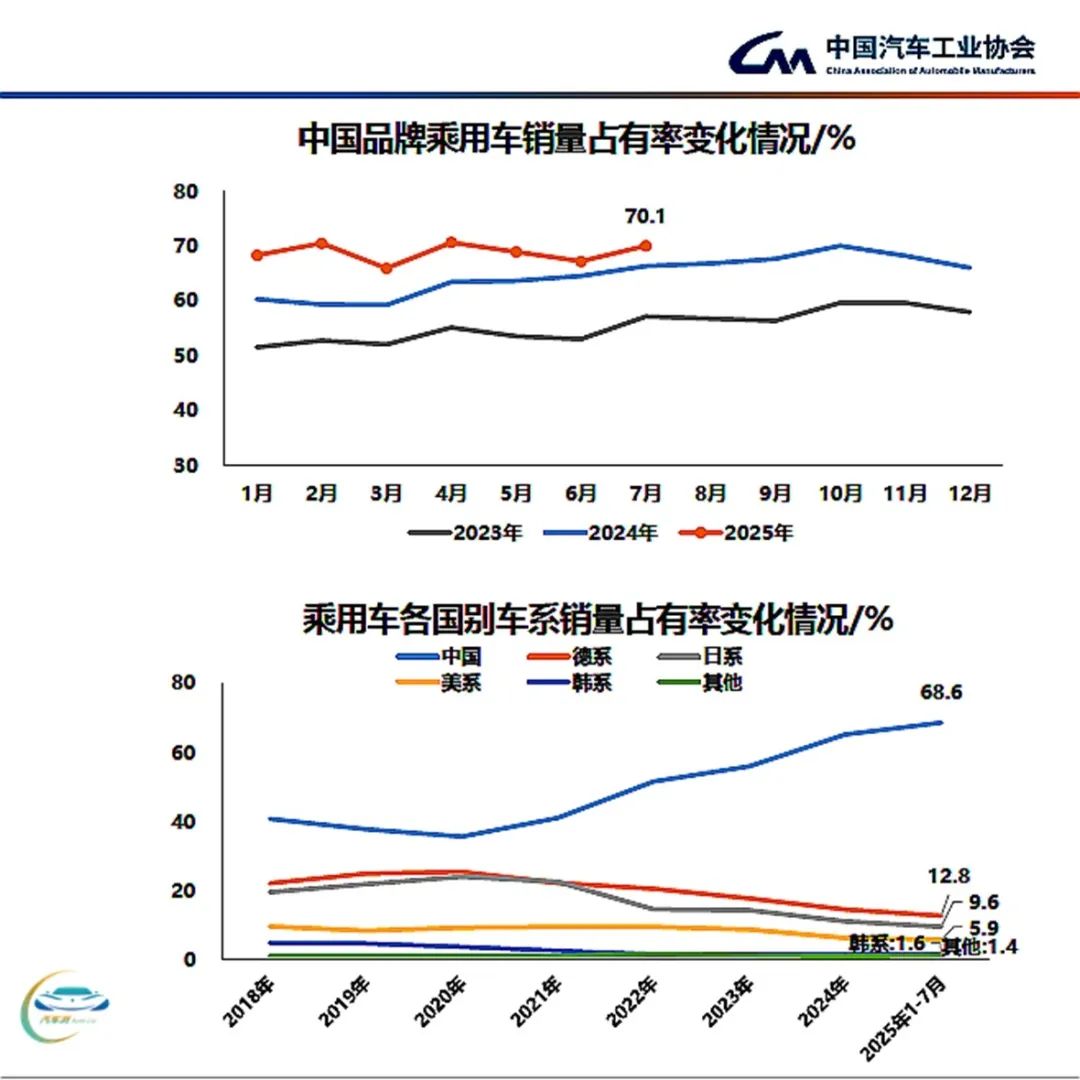

Domestic consumers' confidence in Chinese brand passenger cars continues to grow. According to CAAM data, in July, sales of Chinese brand passenger cars reached 1.604 million units, up 21.3% year-on-year, with a market share of 70.1%, an increase of 3.8% from the same period last year. From January to July, total sales of Chinese brand passenger cars reached 10.873 million units, up 24.4% year-on-year, with a market share of 68.6%, an increase of 6.1% year-on-year.

Amidst growing domestic sales, China's passenger car exports maintain a steady growth trend.

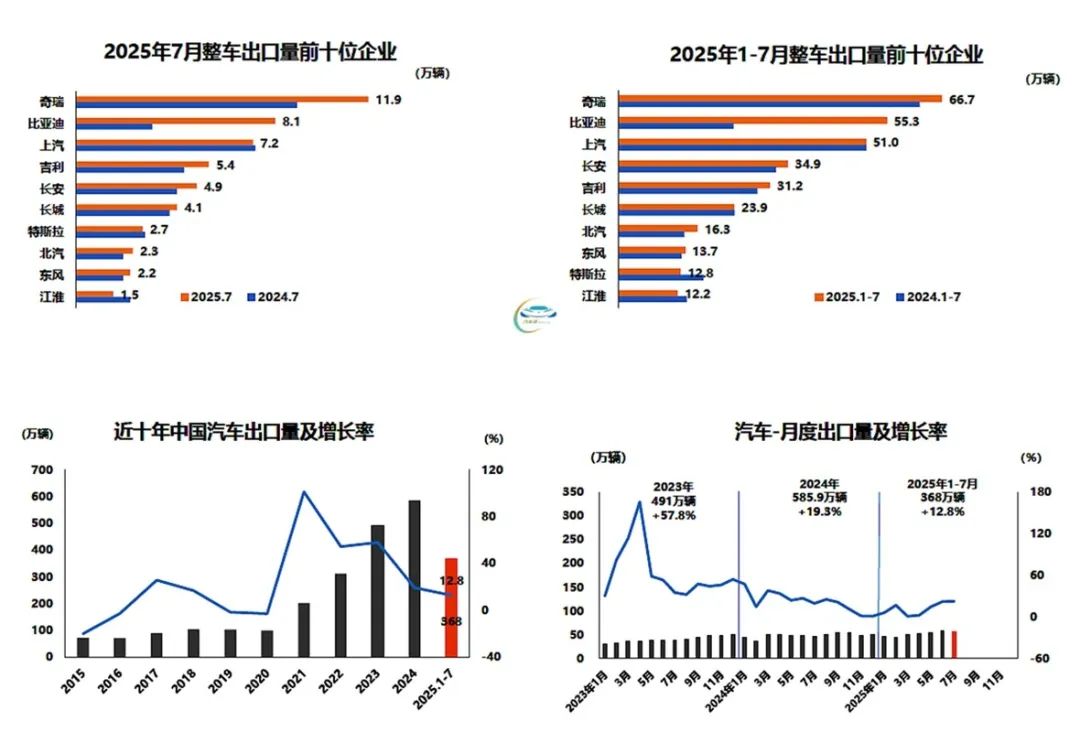

In July, passenger car exports reached 499,000 units, down 0.5% month-on-month but up 25.2% year-on-year. From January to July, passenger car exports totaled 3.103 million units, up 13.3% year-on-year.

In overseas markets, new energy vehicles are gaining popularity. In July, new energy vehicle exports reached 225,000 units, up 10% month-on-month and 1.2 times year-on-year. Among them, new energy passenger car exports amounted to 220,000 units, up 11.9% month-on-month and 1.2 times year-on-year.

From January to July, new energy vehicle exports totaled 1.308 million units, up 84.6% year-on-year. Among them, new energy passenger car exports reached 1.254 million units, up 81.6% year-on-year. Within new energy vehicle export data, plug-in hybrid vehicles performed impressively, with 85,000 units exported in July, up 12.9% month-on-month and 2.2 times year-on-year. From January to July, plug-in hybrid vehicle exports totaled 475,000 units, up 2.1 times year-on-year.