"Double Defeat in Oil and Electric Vehicles: BBA Urgently Needs to Play the 'China Card'"

![]() 08/14 2025

08/14 2025

![]() 493

493

CATL's CTP batteries, Momenta's BEV perception algorithms, and Huawei's 192-line LiDAR are redefining the essence of 'luxury' for engineers in Stuttgart.

When Audi sales consultants begin touting 'Kunlun Intelligence' instead of 'quattro' as a selling point, and Munich's design team frequently visits Shanghai Zhangjiang Science and Technology Park, these details highlight a harsh reality: In the Chinese luxury vehicle market in 2024, BBA's proud mechanical aesthetics are encountering 'dimensionality reduction attacks' on the intelligent front.

The latest insurance data shows that sales of new energy vehicles by the three German giants in China declined by 12.3% year-on-year in the second quarter of this year, while orders for models equipped with Huawei ADS 3.0 surged by 67% over the same period. This contrast is particularly evident in the configuration sheets of the recently launched Audi Q6L e-tron family and A5L.

Among the five core selling points of its high-end models, Huawei's intelligent cockpit, vehicle-machine interconnection, and advanced intelligent driving system occupy three positions, while the traditionally proud MLB Evo platform has retreated to the last place.

"This is not a simple supply chain substitution, but a reconstruction of the entire vehicle value system," a technical director of a German company in China admitted privately. Just as Japanese automakers taught Detroit 'lean production' in the 1980s, now more and more Chinese companies such as CATL's CTP batteries, Momenta's BEV perception algorithms, and Huawei's 192-line LiDAR are redefining the essence of 'luxury' for engineers in Stuttgart.

German media described this technological migration with 'Tschüss, Deutschland (Goodbye, Germany)', and BBA perhaps should ponder: When the engine compartment becomes a computing center, besides embracing China, how many cards do they have left in their hands?

"Abandoned" BBA

Squeezed by the lag in the global new energy transition and intensified competition in China's market, the three German luxury vehicle giants (Benz, BMW, Audi) experienced a 'collective collapse' in performance in the second quarter of 2025. According to the latest financial reports, the net profits of all three brands showed double-digit percentage declines.

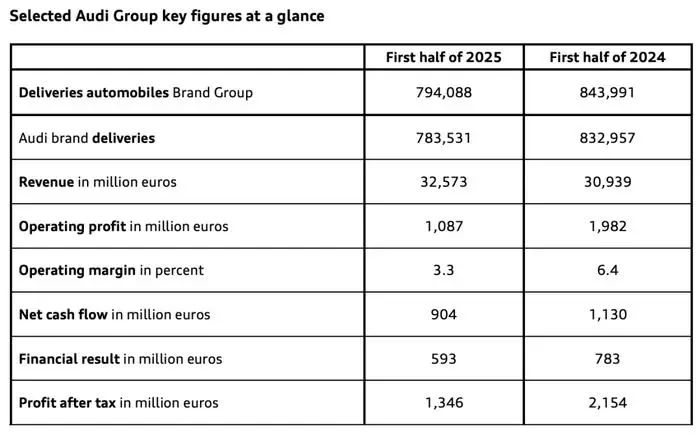

Among them, Audi performed the worst with a year-on-year decline of 37.5%, and its after-tax profit shrank to 1.346 billion euros. Audi's global deliveries fell by 6% year-on-year to 794,000 vehicles, showing typical characteristics of 'electric growth, fuel loss'. Although pure electric models achieved a year-on-year growth of 32%, they accounted for only 18% of total sales (about 143,000 vehicles), unable to compensate for the 14% decline in fuel vehicle sales. This phenomenon of 'imbalance in the transition between old and new driving forces' also emerged in the financial reports of Benz and BMW.

The Chinese market has become one of the main reasons for Audi's performance decline. Sales declined by an expanded year-on-year rate in the second quarter, and cumulatively declined by 10.2% to 288,000 vehicles in the first half of the year. The North American market also performed weakly, with sales plunging by 16.2% in the second quarter, and the market advantage that once served as a 'safe haven' is no longer present.

The latest financial report data from the Mercedes-Benz Group also caused market shock. In the second quarter of 2025, this century-old luxury automaker suffered a 'double hit to revenue and profit'.

The financial report shows that revenue in the second quarter of 2025 was 33.153 billion euros (down 9.8% year-on-year), and net profit was 957 million euros (down 68.7% year-on-year), creating the worst single-quarter performance since the supply chain crisis in 2021. More severely, cumulative net profit in the first half of the year was 2.688 billion euros (down 50.1% year-on-year), and revenue was 66.377 billion euros (down 8.6% year-on-year), with multiple core indicators showing an accelerating deterioration trend.

In terms of sales, Benz's global deliveries in the second quarter declined by 9% year-on-year to 547,100 vehicles, among which sales of pure electric models plummeted by 18% to 41,900 vehicles, and plug-in hybrid models increased by 34% but on a limited scale. The Chinese market has become the 'main reason' for the decline, with sales falling by 19% year-on-year to 140,400 vehicles in the second quarter, and cumulatively declining by 14% in the first half of the year.

Benz attributed the decline in performance to multiple factors, including surging tariff costs due to global trade frictions, intensified pricing pressure in the Chinese market, and high investments in the new energy transition but with returns falling short of expectations. Group CEO Ola Källenius said that they will accelerate the 'oil and electric dual-track' strategy, planning to launch over 40 new models by 2027 and increase localized R&D efforts in China.

Against the backdrop of the accelerated restructuring of the global automotive industry, the latest financial report of the BMW Group, like those of Audi and Benz, also presents a stark contrast of 'cooling in the East, warming in the West'.

In the second quarter of 2025, the BMW Group generated revenue of 33.93 billion euros (down 8.2% year-on-year) and EBIT of 2.66 billion euros (down 31.4% year-on-year), creating the largest single-quarter decline since 2022. The performance of a net profit of 4 billion euros (down 29% year-on-year) in the first half of the year highlights that this German luxury vehicle giant is facing unprecedented transformation pain.

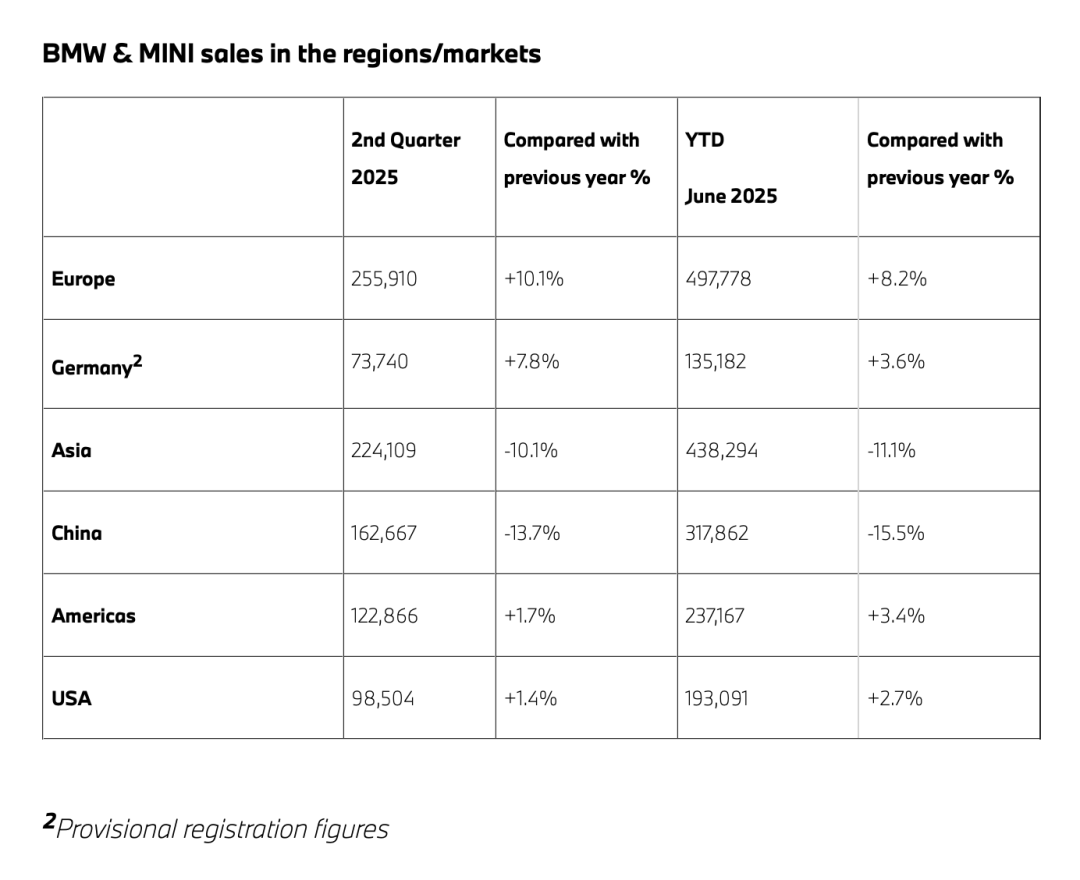

BMW's global deliveries in the second quarter increased slightly by 0.4% year-on-year to 621,500 vehicles, but it was also plagued by the Chinese market, where deliveries declined by 13.7% year-on-year to 162,700 vehicles, and cumulatively declined by 15.5% in the first half of the year. BMW pointed out that intensified competition in the Chinese market and local new energy brands seizing market share with intelligent configurations and price advantages have led to the erosion of its market share.

To address the challenges, BMW is advancing the construction of the new 'Neue Klasse' platform, optimizing the layout of electric vehicle production capacity, and planning to launch over 40 new models by 2027. CFO Nicolas Peter admitted that the impact of tariffs was most significant in the second quarter, and expected that the EBIT margin of the automotive business for the full year will be under pressure.

The second-quarter financial report season in 2025 not only revealed a harsh reality but also saw BBA collectively acknowledge for the first time in public documents that they have systematically lagged behind Chinese local brands in the two core racetracks that will determine the future of the industry – electrification and intelligence.

This gap is not only reflected in the speed of product iteration (Chinese brands average 12 months/generation vs. BBA 36 months/generation) but also in the occupation of user mindshare, with the proportion of consumers in the 30-50,000 yuan price range preferring Chinese brands reaching 43% (J.D. Power 2025Q2 data).

Analysts generally believe that if BBA fails to achieve a software self-research rate exceeding 50%, a proportion of local R&D teams in China exceeding 40%, and a positive gross margin for electric vehicle models by 2027, their market position in China may gradually be replaced by Chinese luxury brands.

Collective Turn for the Three Giants

After suffering continuous setbacks in China's new energy vehicle market, BBA finally realized that merely making localized adjustments in China is not enough; they must fully embrace Chinese smart vehicle solutions. Not only BBA, the German trio, but also foreign brands such as the Japanese 'Big Three' (Toyota, Honda, Nissan) and American Cadillac have already begun to announce cooperation with Chinese suppliers intensively.

For example, in the most critical three-electric and intelligent driving sectors of new energy vehicles, BBA has begun to fully embrace Chinese smart vehicle solutions, as they attempt to reshape consumers' perceptions of luxury with the help of Chinese intelligent technology.

Benz's previously announced new-generation L2++ mapless high-level intelligent assisted driving is led by the Chinese R&D team and optimized for Chinese road conditions in collaboration with Momenta. This system will be the first to be equipped on Benz's latest pure electric model, the CLA.

BMW's upcoming new-generation models have reached a cooperation with Alibaba in the field of intelligent cockpits. They have also officially announced a collaboration with Momenta to jointly develop a new-generation intelligent driving assistance system solution for the Chinese market. Both parties will focus on Chinese travel scenarios and user needs based on large AI models to provide full-scenario, point-to-point pilot driving assistance functions.

"We will integrate China's cutting-edge innovations, especially in artificial intelligence, into the Group's global innovation system," said BMW Group CFO Nicolas Peter.

Within the Audi camp, cooperation routes have diverged. SAIC-Audi announced a cooperation with Momenta during this year's Shanghai Auto Show to jointly create the industry's first intelligent assisted driving solution combining 'German electric luxury standards + Kunlun large model'. FAW-Audi, on the other hand, chose Huawei, with its first collaboration model, the Audi A5L, becoming the first fuel vehicle model to be equipped with Huawei's Kunlun Intelligent Driving System.

"The cooperation between traditional foreign brands and Chinese local enterprises in intelligence and electrification has become the mainstream trend. The development model of foreign automakers in China is evolving from localization of production and manufacturing to localization of technological research and development and ecological cooperation," an industry insider analyzed.

Undoubtedly, against the backdrop of the global automotive industry's accelerated transition towards electrification and intelligence, the Chinese market is transforming from BBA's 'largest market' to a global 'innovation engine'.

Ola Källenius, Chairman of the Board of Directors of Mercedes-Benz, clearly stated at the 2025 strategy conference: "China has surpassed its position as the 'world's largest single market' and become the core testing ground for Benz's technological iteration and business model innovation."

According to the plan, Benz will make China the R&D hub for its next-generation electric vehicles starting from 2025, launching at least five new models based on the MB.EA platform designed specifically for pure electric vehicles. Its local R&D strategy has been upgraded from 'in China, for China' to 'in China, for the world' – intelligent cockpit technology led by the Chinese team will be reverse-exported to the European market.

The BMW Group is deepening its layout in China with 'localization of the entire value chain'.

Currently, China has become BMW's largest R&D base outside of Germany, with four innovation centers (Beijing, Shanghai, Shenyang, Nanjing) and three software companies focused on autonomous driving, employing over 1,200 engineers. Milan Nedeljković, the BMW Group's Production Director, revealed: "The fifth-generation power battery developed by the Shenyang R&D center has been applied to global models, and the user data closed-loop system in the Chinese market will be promoted to other regions as a standard template."

Audi strengthens its localization capabilities through joint ventures and cooperation.

Ming Song, CEO of the Audi-SAIC cooperation project, said: "The innovation speed of China's new energy market is three times that of Europe, and the competitive environment here forces enterprises to compress the R&D cycle to within 12 months." It is reported that Audi has elevated the priority of its China projects to the global strategic level, with all key decisions requiring direct reporting to Audi's global CEO, Bram Schot, and inclusion in the weekly global executive meeting agenda.

"The electrification solutions successfully validated in China will become the core lever for Audi's global recovery," Ming Song emphasized.

Undoubtedly, the three German giants have unanimously positioned China as a 'source of technology', marking a shift in the competitive paradigm of the luxury vehicle industry from 'brand output' to 'local feedback to the global market'. This transformation is not only a recognition of China's supply chain advantages and market vitality but also the last chip in the life-and-death gamble of luxury brands in the Chinese market.

Note: Some images are sourced from the internet. If there is any infringement, please contact us for removal.

-END-