Extended-Range Models: A Hard Sell Despite Potential

![]() 08/14 2025

08/14 2025

![]() 678

678

Introduction

The pace at which the 'pie' of the automotive market is growing pales in comparison to the influx of 'cannon fodder' players.

"If anyone wants to use this outdated technology, they're welcome to it."

Five years ago, extended-range technology was somewhat dismissively labeled by some in the industry. However, as time has passed, especially with the aggressive promotion and success of players like Lixiang and AITO, it has evolved into a significant force in China's automotive market.

Last year, sales surged, and more OEMs embraced this technological route.

Against this backdrop, a "radical opinion" emerged: in the near future, the new energy sector will likely see a three-way split between pure electric, plug-in hybrid, and extended-range models.

However, as we step into a new year, the narrative is not unfolding as expected.

It was anticipated that with the power of the 'fuel tank,' extended-range models would shine, but this has not been the case. For instance, in July, even during the so-called 'off-season,' new energy vehicles performed impressively, with a retail penetration rate of 54%, a record high.

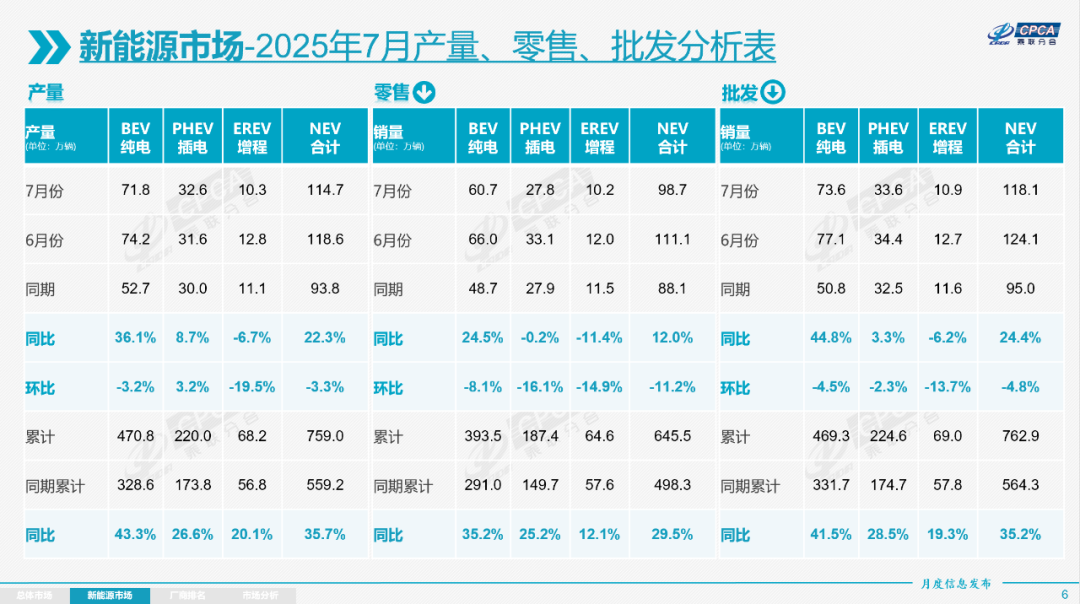

Breaking it down, pure electric vehicle sales reached 607,000 units, a 24.5% year-on-year increase; plug-in hybrid sales were 278,000 units, a slight 0.1% decrease; on the other hand, extended-range sales amounted to only 102,000 units, a 10.4% decrease. From January to July, the cumulative retail sales increase of 12.1% for extended-range models is also far lower than the 35.2% for pure electric and 25.2% for plug-in hybrids.

In any case, this reveals a slight sluggishness. Naturally, readers may wonder what has caused the protagonist of this article to hit a growth bottleneck.

The answer is multifaceted.

01 Irreversible General Trends

The difficulty in selling extended-range models is straightforward.

Firstly, the explosion of pure electric vehicles has largely squeezed the space for extended-range models, especially in the mainstream market. The balance between OEMs and consumers is gradually tipping in favor of the former.

Simultaneously, early extended-range users are entering the replacement cycle, with a significant portion opting for pure electric vehicles. This trend has been observed over the past six months.

I have personally witnessed several such cases.

Deeper analysis shows that extended-range models in this segment are constrained by costs, limiting their pure electric driving range. This leads to increased refueling frequency and a decline in user experience. In terms of fuel consumption under power depletion, they cannot compete with plug-in hybrid models of the same class, leaving them in an awkward middle ground.

Often, they seem to be merely supplementing the product line.

For instance, among new forces in the automotive industry, NIO's popular SUVs are mainly pure electric, with extended-range models playing a supporting role. For new models like the B10 and BO1, priced around 100,000 yuan, there is no extended-range version.

Whether we admit it or not, in the mainstream market, it is more challenging than anticipated for extended-range models to compete with pure electric and plug-in hybrid models.

What about the mid-to-high-end market?

Undeniably, in recent years, thanks to Lixiang and AITO, these two "giants" have jointly created a thriving scene, and their "simultaneous rise in volume and price" has been envied by many OEMs.

Subsequently, many brands invested heavily in the extended-range race. However, what was once a "blue ocean" has quickly become overcrowded this year.

Competition is intensifying daily.

Taking Lixiang as an example, after the first seven months, it is evident that this new force in the automotive industry faces immense pressure. July deliveries plummeted year-on-year, from 50,000 units to 30,000 units, a dangerous signal.

AITO also experienced fluctuations in the first half of the year. Fortunately, with the entry of the M9 and M8, the downturn was reversed. With the M7, it is bound to regain momentum.

However, with Huawei's endorsement, it remains in the minority.

Overall, the fierce internal competition in the mid-to-high-end extended-range segment has caused widespread suffering. More severely, the growth rate of the corresponding 'pie' is slower than the increase in competitors. This year alone, there are no less than 15 extended-range six-seat SUVs, but the market size has remained largely unchanged.

Additionally, potential customers' enthusiasm for "expensive cars" is waning due to the current economic environment. According to the China Passenger Car Association, luxury vehicle retail sales in July were only 170,000 units, a 20% year-on-year drop.

Essentially, a dangerous "alarm" has sounded.

For extended-range models, being hard to sell will not be short-lived but will persist. In this process, only leading players with brand halos like Lixiang and AITO can easily share the pie. Most pursuers blindly betting on this resource-poor racetrack are likely to become "cannon fodder."

In short, whether in the mainstream or mid-to-high-end market, "extended-range is indeed tempting, but not easy to digest."

02 Extended-Range Becomes a High-End Configuration

As mentioned earlier, based on current trends, it is almost impossible for pure electric, plug-in hybrid, and extended-range models to achieve a "three-way split" of the market.

As an observer, referring to industry trends, I am increasingly convinced that: "Over time and with technological development, the mainstream market will see pure electric vehicles dominate, plug-in hybrids serve as a supplement, and extended-range models account for a minimal share. In the mid-to-high-end market, extended-range models will remain significant. With a mature energy replenishment system, the market share of pure electric vehicles will gradually expand, while plug-in hybrids will become a minority."

In other words, the real opportunity for extended-range models is clear.

Recently, the launch logic of several key products has made it increasingly evident that "ultra-fast charging + large battery packs + long range" is the new industry trend.

For example, the ultra-luxury market's "traffic star," Zunjie S800, has a 63 kWh battery and a pure electric driving range of over 330 kilometers.

IM Motors, which recently unveiled its "Hengxing" extended-range technology, introduced a 66 kWh battery pack and an 800V ultra-fast charging high-voltage platform in collaboration with CATL, offering a pure electric driving range of over 450 kilometers.

Xpeng, which announced its entry into the extended-range race last year, has finally unveiled the long-awaited extended-range version of the X9 in the latest issue of the Ministry of Industry and Information Technology's catalog, with a reported pure electric driving range of 450 kilometers.

"We are witnessing a trend where extended-range vehicles are equipping larger batteries. Isn't the purpose to further reduce the use of the range extender? Originally, it might be used five or six times a year, but now it might only be used once or twice. Carrying around a few hundred kilograms daily doesn't seem cost-effective. Take humans as an example; if you have to carry such heavy luggage daily, it doesn't make sense."

Interestingly, after the Ledao L90 launch, Li Bin shared his views, implying, "If extended-range models are equipping larger batteries, why not just buy a pure electric vehicle?"

The reasoning is sound, and I have communicated with many extended-range car owners.

Firstly, they buy extended-range models due to range anxiety. Secondly, they mostly use pure electric mode because recharging is cheaper than refueling. The pain points? Short pure electric driving range and slow refueling speed top the list.

Equipping extended-range models with large battery packs and ultra-fast charging is the result of OEMs continuously iterating and evolving to meet urgent needs. "Whether it's reasonable or not, if people want it, we'll give it to them."

Reflecting on Li Bin's statement, "From NIO's perspective, the intention is good, but don't try to educate users. For many extended-range car owners, even if the range extender is used once or twice a year, having it is more reassuring than thousands of battery swap stations."

China's vast automotive market shapes which technological route will dominate.

Personally, I believe, "In the past, extended-range models had a clear advantage over pure electric models - lower overall manufacturing costs. However, with the significant decline in power battery raw material costs, this advantage has gradually eroded."

Conversely, extended-range models equipped with "ultra-fast charging + large battery packs + long range" this year have higher costs than some pure electric models of the same class. After relentless promotion, this powertrain system has become a "high-end configuration" in many minds.

More bluntly, for a new energy vehicle model aiming for the mid-to-high-end market, whether it's an SUV or a sedan, once equipped with this technology, the cost of terminal explanation will be lower than for pure electric models of the same class, allowing the enterprise to obtain higher premiums and gross margins.

This explains why Lixiang and AITO are so envied: "Extended-range technology is not outdated; it's simply a profit cow."

Going forward, for most brands, from joint ventures to domestic brands, embracing extended-range technology will be inevitable if they want to sell "expensive cars."

Extended-range models are hard to sell but irresistible, especially as "high-end configurations." The insider knowledge, gameplay, and rules have undergone adjustment and reshaping.

To firmly establish a presence in the mid-to-high-end market, "ultra-fast charging + large battery packs + long range" is the shortcut. Besides the technology, dimensions like brand image, marketing methods, and product pricing cannot have significant shortcomings. Reflect carefully.

From the sales structure from January to July this year, extended-range models account for less than 10% of the entire new energy vehicle market, always a game for a select few.

Yet, there are always cannon fodder who overestimate their abilities and rush in...

Editor-in-Chief: Cui Liwen Editor: He Zengrong

THE END