Xiaopeng Motors' Momentum-Driven Q2: Revenue Soars 125%, Range-Extended Models and Robotaxi Set for Launch

![]() 08/20 2025

08/20 2025

![]() 701

701

Preparing for a Competitive Product Landscape

Author | Wang Lei

Editor | Qin Zhangyong

The finish line seems to be in sight.

Following Zero-Run Automobile's announcement of quarterly profitability, Xiaopeng Motors' financial report has arrived, setting new benchmarks in core metrics such as revenue, profit levels, and deliveries.

With a gross margin of 17.3% and losses reduced to 478 million yuan, Xiaopeng Motors is gearing up for a competitive product battle.

Regarding future development goals, He Xiaopeng reiterated the objective of achieving profitability in the fourth quarter, marking a new phase of self-sustaining profitability for the company starting from that quarter.

It's worth mentioning that Xiaomi, another member of the "small" generation, has also released its semi-annual report covering the automotive business, reporting automotive revenue of 21.3 billion yuan, 13% higher than Xiaopeng Motors' total Q2 revenue. Xiaomi delivered 81,302 vehicles, a year-on-year increase of 197.7%, with losses narrowed to a record low of 300 million yuan.

During the earnings conference call, Lu Weibing even boasted that profitability in a single quarter would be achieved in the second half of the year. This suggests that Xiaopeng and Xiaomi, both members of the "small" generation of automakers, may compete to become the third new carmaker to achieve quarterly profitability.

01

Entering the Range-Extended Era, Officially Announcing Robotaxi

What does it mean to be "on a high" when good news comes? Just look at He Xiaopeng's demeanor during the financial report conference call, buoyed by the company's strongest performance to date.

He boldly stated that monthly deliveries after September will not only exceed 40,000 units but that sales growth will more than double this year, with profitability expected in the fourth quarter, achieving positive free cash flow for the full year.

Underpinning these goals is an aggressive product offensive. He Xiaopeng revealed that starting from the fourth quarter of this year, with the launch of the range-extended X9, Xiaopeng will enter a significant product cycle of "one car, two capabilities".

At last year's Xiaopeng AI Technology Day, the Xiaopeng Kunpeng Super Electric System was unveiled. Kun represents the super range-extended system utilizing next-generation range-extended technology, while Peng stands for Xiaopeng's pure electric system.

The Kunpeng Super Electric X9 is the first model under the "one car, two capabilities" system, boasting a pure electric range exceeding 450 kilometers and a combined range exceeding 1,500 kilometers. Positioned at the 400,000 yuan level, it will fully complete the domestic and overseas launch of super electric models next year.

He Xiaopeng mentioned that multiple super electric models will be launched in the future, all targeting the longest pure electric range and fastest 5C ultra-fast charging among similar new energy products.

Another highly anticipated model is the upcoming all-new Xiaopeng P7, which will be officially launched next week, priced at the 300,000 yuan level.

Although He Xiaopeng did not disclose pre-sale data during the conference call, he noted, "The attention on this new P7 is extremely high, far exceeding the expectations when planning for this year at the end of last year. The preliminary order data has broken all previous records for the same period, including those for MONA M03 and P7+."

Therefore, He Xiaopeng's expectations for the sales of the all-new Xiaopeng P7 are that it will "become one of the top three in the pure electric sedan market under 300,000 yuan", and he even boldly stated that "the goal is for the company's monthly deliveries to steadily exceed 40,000 units starting in September."

From a user perspective, the all-new Xiaopeng P7 has also broken through traditional demographics, attracting a high proportion of male users, with P7 users being the youngest among Xiaopeng's vehicle models.

Furthermore, supporting the continued growth of Xiaopeng Motors' future performance are the L4 models and Robotaxi set for mass production next year.

During the conference call, He Xiaopeng previewed the progress of the L4 model launch, with L4-supported models going into mass production in 2026. Upon obtaining relevant policy approvals, Robotaxi operations and services will be piloted in some regions.

In He Xiaopeng's view, there will be two types of vehicles in the future: one with L4 capabilities but still needing a driver, and the other with L4 capabilities without a driver. Of course, this will take several years to achieve and requires policy and regulatory approval.

Although entering the market a bit late, He Xiaopeng does not seem concerned. He believes that while there are already L4-level Robotaxis on the market, they are all aftermarket installations. "Xiaopeng will be the first Chinese automaker to truly have L4 computing power, software, and hardware capabilities in the pre-installed mass production of Robotaxis."

There are no regional restrictions either, as it adopts a mapless mode, and Xiaopeng's Robotaxi does not need to use lidar to re-scan each location for high-definition matching.

It's worth mentioning that right after He Xiaopeng mentioned Robotaxi on the conference call, Yuan Tingting, a core executive in Xiaopeng Motors' autonomous driving field, was recruiting product experts for Robotaxi on the platform.

Additionally, He Xiaopeng clarified that there is a difference between Xiaopeng Robotaxi and Xiaopeng's self-sold vehicles. The Ultra version of Xiaopeng's self-sold vehicles does not have hardware or cloud takeover-related services. By 2026, both the Ultra version and Xiaopeng Robotaxi will carry the same source model, but their functions are not identical. For instance, Robotaxi may be able to stop on demand, while Xiaopeng's self-sold vehicles cannot. Their training methods and reinforcement learning are distinct.

He Xiaopeng also left room for future flexibility by first operating Robotaxi independently and possibly seeking cooperation partners in the future to explore how to commercialize Robotaxi.

In addition to Robotaxi, the conference call also touched on the topics of high-level intelligent driving and humanoid robots. Xiaopeng Motors aims to enhance its capabilities based on the Turing chip + VLA model by dozens of times compared to the industry's mainstream urban assisted driving capabilities in the next 18 months, benchmarking L3 human-driven in terms of safety, full scenarios, and user experience.

Based on Xiaopeng's Turing chip, VLA, and VLM, the mass-producible version of Xiaopeng's robot with initial L4 capabilities is planned for launch in the second half of 2026.

02

Gross Margin Surpasses Tesla

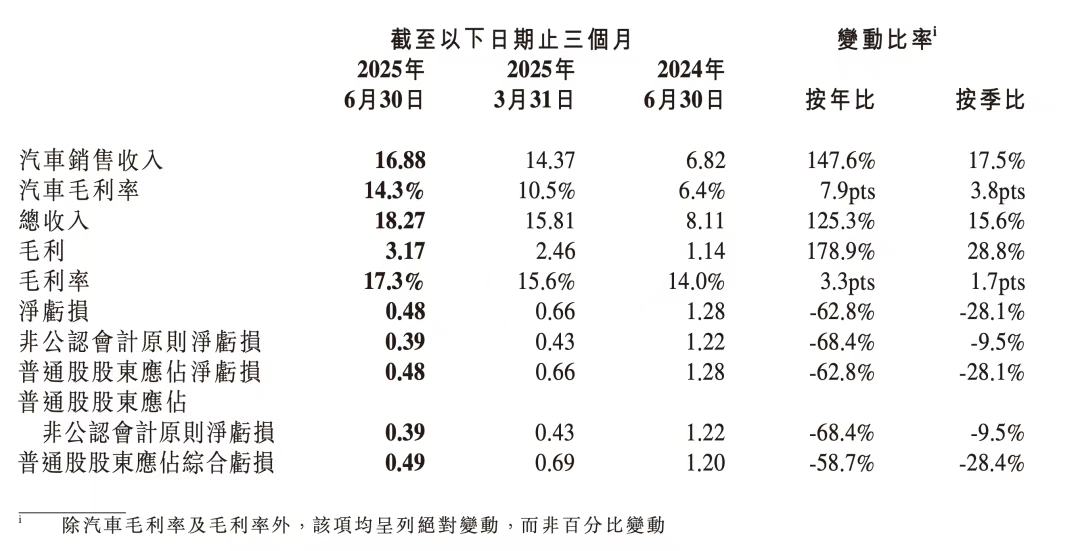

In the first half of this year, Xiaopeng Motors' total revenue was 34.09 billion yuan, a year-on-year increase of 132.5%, with vehicle sales revenue reaching 31.25 billion yuan, a year-on-year increase of 152.8%.

In the first half of the year, Xiaopeng Motors' sales experienced explosive growth, with a total delivery volume of 197,000 units, a year-on-year increase of up to 279%. With the leap in sales, revenue doubled. In terms of profits, Xiaopeng Motors' net loss in the first half of the year was 1.14 billion yuan, significantly narrowed compared to the net loss of 2.65 billion yuan in the same period last year. The gross margin in the first half of the year also increased, from 13.5% in the same period last year to 16.5%.

If we focus solely on the second-quarter performance, it becomes evident that Xiaopeng's profitability inflection point is approaching.

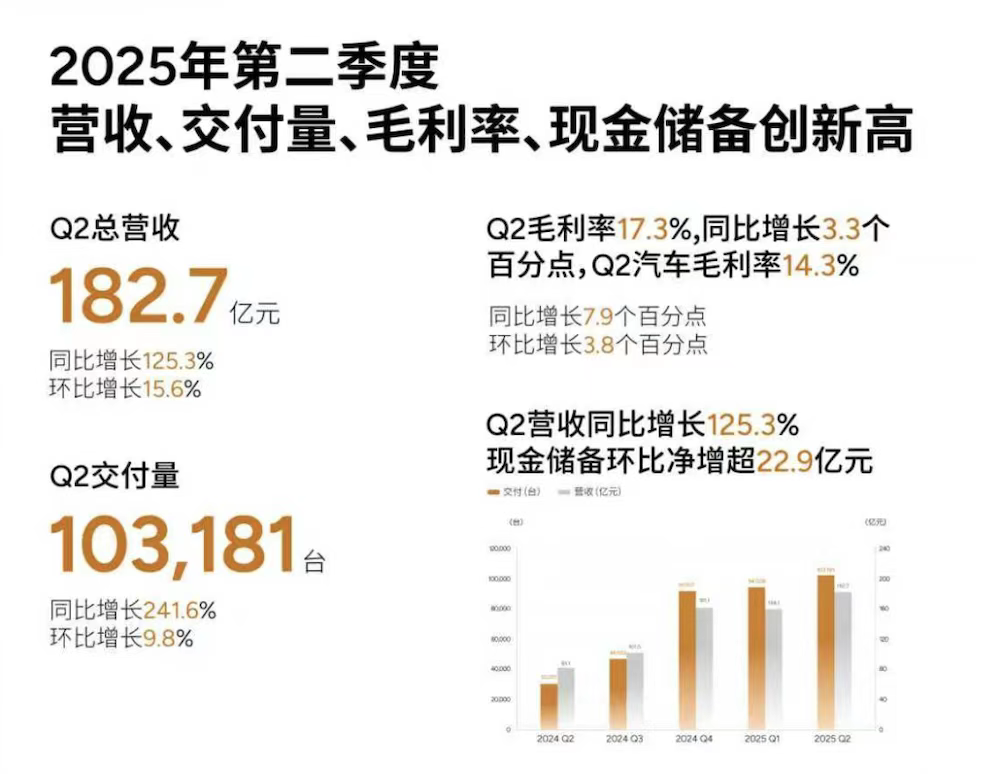

In the second quarter, new highs were achieved in core metrics such as revenue, profit levels, deliveries, gross margin, and cash reserves. Notably, the loss narrowed to 478 million yuan, the best performance since its listing, and the gross margin reached 17.3%, surpassing Tesla's 17.2%.

Let's delve deeper into each metric.

In the second quarter of this year, Xiaopeng Motors' revenue was 18.27 billion yuan, a year-on-year increase of 125.3% and a quarter-on-quarter increase of 15.6%. Automotive sector sales revenue increased to 16.88 billion yuan, a year-on-year surge of 147.6% and a quarter-on-quarter increase of 17.5%.

The increase in automotive sales revenue is naturally attributed to the sale of more vehicles. Xiaopeng delivered a total of 103,000 new vehicles in the quarter, setting a new single-quarter record. The total sales volume in the first half of the year has already reached 197,000 units. It's worth mentioning that this sales volume is already close to Lixiang's 204,000 units.

Although the sales pillar status of MONA M03 and P7+ lowered the average selling price of Xiaopeng Motors, the scale effect brought about by sales growth and cost improvements also drove an increase in Xiaopeng Motors' gross margin, reaching 17.3% in the second quarter, a year-on-year increase of 3.3 percentage points.

Of course, the improvement in the overall gross margin is also bolstered by other factors. In the second quarter, Volkswagen contributed 750 million yuan in gross profit to Xiaopeng Motors' "services and other businesses". However, excluding this part, Xiaopeng Motors' vehicle gross margin also reached 14.3%, a year-on-year increase of 7.9 percentage points, marking eight consecutive quarters of growth.

Moreover, it's worth noting that when Lixiang achieved profitability, its gross margin was above 20%, which to a certain extent also suggests that Xiaopeng Motors is already on the brink of profitability.

Another direct indication is the significant reduction in the magnitude of losses. Xiaopeng Motors' net loss in the second quarter of this year was only 478 million yuan, a significant reduction of 62.8% compared to 1.28 billion yuan in the same period last year and a narrowing of 28.1% compared to 660 million yuan in the first quarter of this year.

It's evident that operating conditions have been improving quarter by quarter since the beginning of this year, which is also what fuels He Xiaopeng's insistence on the goal of "profitability in the fourth quarter".

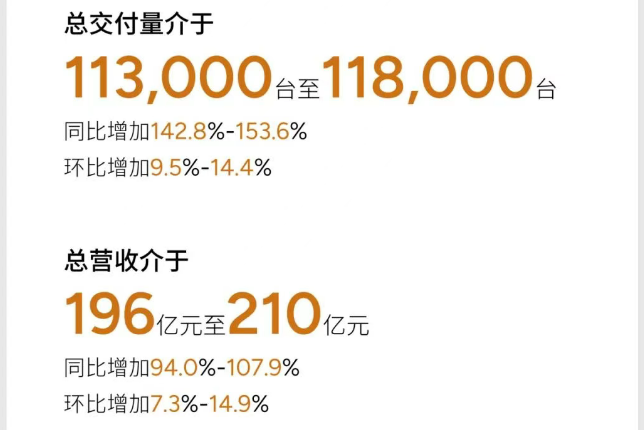

At the end of the financial report, sales and performance targets were also set for the third quarter of this year. Xiaopeng Motors expects vehicle deliveries to be between 113,000 and 118,000 units in the third quarter of 2025, a year-on-year increase of approximately 142.8% to 153.6%.

That is, the average monthly delivery volume should reach a level of 37,600 to 40,000 units. Judging from Xiaopeng Motors' monthly sales of 37,000 units in July, there should be no major obstacles. Don't forget that Xiaopeng Motors has a "popular incremental model" on the horizon.

Simultaneously, revenue guidance for the third quarter of this year was provided, with total revenue expected to be between 19.6 billion yuan and 21 billion yuan, a year-on-year increase of approximately 94.0% to 107.9%.

Next, it all depends on the performance of the all-new Xiaopeng P7.