FAW Group's Stake Acquisition in Leapmotor: A Closer Look

![]() 08/21 2025

08/21 2025

![]() 702

702

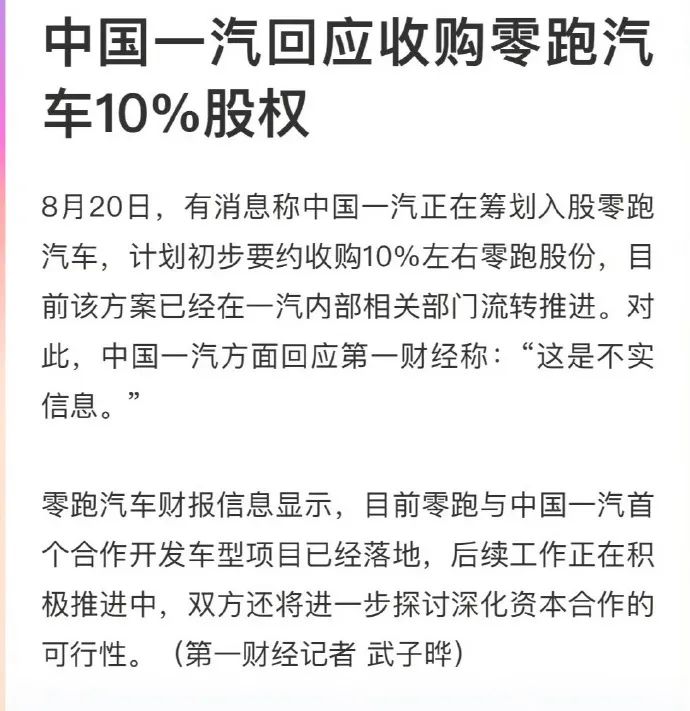

On August 20, Cailian Press reported that China's FAW Group was contemplating acquiring a stake in Leapmotor, initially aiming to tender for approximately 10% of the latter's shares. This plan is currently circulating and being promoted within relevant FAW departments.

That evening, however, China Business News cited FAW Group as denying the reports, stating, "This is false information."

According to Leapmotor's interim earnings announcement for 2025, on March 3, 2025, FAW Group and Leapmotor signed a "Memorandum of Understanding on Strategic Cooperation." Both parties aim to leverage their respective technical expertise in research and development to jointly develop new energy passenger vehicles and collaborate on components. The first joint development vehicle project between the two has already commenced, and follow-up efforts are actively progressing. Additionally, both parties are exploring the feasibility of deepening capital cooperation to achieve resource coordination across the entire industry chain.

Twenty days later, the FAW Group Electronic Bidding and Procurement Trading Platform revealed that the procurement for joint development and platform license fees for the Hongqi brand G117 product vehicle had been completed, with Zhejiang Leapmotor Technology Co., Ltd. as the successful bidder.

The strategic cooperation between FAW and Leapmotor encompasses two primary dimensions. Firstly, both parties will utilize their R&D technical accumulations to jointly develop new energy passenger vehicles and collaborate on components, enhancing product competitiveness through technology integration. Secondly, they will explore the feasibility of deepening capital cooperation, enabling resource coordination across the entire industry chain through financial means.

Public data indicates that in 2024, FAW Group delivered a total of 3.2 million new vehicles, including 1,659,107 from FAW-Volkswagen, 800,199 from FAW-Toyota, 411,777 from FAW Hongqi, and 150,777 from FAW Besturn. This suggests that joint venture business accounts for over 76.85% of FAW Group's overall operations.

In contrast, in 2024, Changan Automobile's share of independent brands was 83%, SAIC Motor was 60%, Dongfeng Motor was 55%, and GAC Group was 40%. FAW Group's independent business accounted for less than 25% of the group's total operations, which contrasts sharply with its status as a leading automaker in China.

Furthermore, unlike other automakers actively seeking collaboration with Huawei, FAW Group has remained silent in this area. Its pursuit of cooperation with Leapmotor is seen as an attempt to forge a different path.

Meanwhile, Leapmotor recently released its "strongest ever" half-year report, achieving its first positive half-year net profit, entering the Fortune China 500 list for the first time, and surpassing 50,000 deliveries in a single month for the first time. With 221,664 deliveries, revenue of 24.25 billion yuan, and a gross margin of 14.1%, Leapmotor has become the second Chinese new energy vehicle company to achieve half-year profitability.

In October 2023, Stellantis N.V., the world's fourth-largest multinational automaker, announced an investment of approximately 1.5 billion euros (approximately 11.595 billion yuan) to acquire approximately 20% of Leapmotor's equity. This investment made Stellantis Group an important shareholder in Leapmotor.

The cooperation between the two primarily involves two key aspects. Firstly, Stellantis strategically invested in Leapmotor to acquire approximately 20% of its equity and secured two of the nine board seats. Secondly, Stellantis Group and Leapmotor established a joint venture named "Leapmotor International" with a 51%:49% ratio, focusing on export business. The first batch of products is scheduled for overseas delivery in the second half of 2024.

At the time, Zhu Jiangming, chairman of Leapmotor, stated in an interview, "Our collaboration with Stellantis leverages their 'multi-brand' business philosophy and extensive channel resources, including finance, insurance, service, and other mature networks. Additionally, there are overseas manufacturing resources. For instance, as sales volume increases in a specific market, we can rely on Stellantis's global manufacturing plants to produce Leapmotor brand products. This cooperative model provides us with an advantage over other competitors in the future."

Now, following the signing of the "Memorandum of Understanding on Strategic Cooperation" between FAW Group and Leapmotor in March this year, rumors have resurfaced that FAW Group intends to acquire approximately 10% of Leapmotor's shares through a tender offer. This may indicate that the cooperation between the two parties is poised to enter a new phase.

Jiang Kaishi, a media person from Electric Vehicle Finance, noted that a tender offer is typically the most costly method. The acquirer must issue a tender offer to all Leapmotor shareholders, proposing a quotation, and existing shareholders then decide whether to accept the offer. Regulatory requirements stipulate that acquisitions exceeding 30% must be conducted through a tender offer, while 10% is not subject to this restriction. Private placement or open-market purchases are generally more cost-effective alternatives. The reason FAW may have chosen a "tender offer" could be related to FAW Group's relatively low electrification penetration rate of approximately 10%.

Affected by this news, on August 20, FAW Jiefang's (000800.SZ) share price hit the daily limit, closing with a 6.65% gain.