Fuyao Glass's Profits Surge by Over 37%, Hitting Daily Limit

![]() 08/21 2025

08/21 2025

![]() 608

608

Fuyao Glass continues to excel in its financial performance.

On the evening of August 19, 2025, Fuyao Glass released its semi-annual report. The company reported revenue of RMB 21.447 billion for the first half of the year, marking a 16.94% increase year-on-year. Net profit attributable to shareholders of listed companies reached RMB 4.8 billion, representing a 37.33% year-on-year growth.

On August 20, Fuyao Glass's A-shares hit the daily trading limit, and its Hong Kong shares also surged significantly, with a current market value exceeding RMB 160 billion.

Since its listing in 1993, Fuyao Glass has maintained a steady growth trajectory. Revenue has soared from just over RMB 100 million to RMB 39.252 billion in 2024, while net profit attributable to shareholders has expanded from tens of millions to RMB 7.498 billion in the same year.

However, the company has faced some challenges. Notably, from 2018 to 2020, revenue stagnated, and net profit attributable to shareholders declined significantly, from RMB 4.12 billion to RMB 2.6 billion, a cumulative drop of 37%.

This downturn was primarily due to two factors: firstly, glass prices remained low due to supply and demand issues; secondly, the COVID-19 pandemic in 2020 caused global automotive sales to plummet by 13%, with the US market hitting a decade-low and multiple European countries experiencing declines exceeding 25%.

Starting in 2021, despite the pandemic's lingering effects, China's new energy vehicle market began to thrive, driving a substantial recovery in demand for automotive glass. Additionally, glass prices rose continuously, propelling the company's performance back into a high-growth phase. From 2021 to 2023, the compound annual growth rate of revenue and profit reached 18.5% and 33.8%, respectively. In the first quarter of 2024, they even increased by over 25% and 51% year-on-year.

Regarding profitability, from 2018 to 2023, Fuyao Glass's gross profit margin declined from a peak of 42.6% to 35.4%, while the net profit margin fell from 20.3% to 17%. The latter's decline was relatively modest, indicating the company's effective control over major expense rates.

The drop in gross profit margin was not due to a decline in terminal automotive glass prices, which have maintained an overall upward trend. Market Value Observation believes this is mainly attributed to the sharp rise in upstream energy and soda ash prices, putting pressure on profitability.

In fact, in 2023, China's auto parts sector's gross profit margin was only around 18%, and the net profit margin was approximately 5%, significantly lower than Fuyao Glass's profit levels. Compared to peers, Fuyao Glass's gross profit margin exceeded Xinyi Glass and was much higher than that of overseas competitors such as Plate Glass, Asahi Glass, and Saint-Gobain.

While past performance does not guarantee future results, Fuyao Glass's continued growth prospects are promising, supported by favorable industry dynamics. The global automotive glass market is a highly monopolistic industry with significant barriers to entry.

In 2023, the global automotive glass market size exceeded USD 15 billion. With modest growth in automotive sales and an increase in the average glass price, there remains considerable potential for future expansion.

The global automotive glass market already exhibits a highly concentrated structure. According to Marklines data, the top five global manufacturers in 2021 were Fuyao Glass, Asahi Glass, Plate Glass, Saint-Gobain, and Xinyi Glass, with market shares of 28%, 26%, 17%, 15%, and 8%, respectively. Among them, Fuyao Glass dominates the Chinese market with a 65% share.

This market concentration suggests that major players will continue to divide the large market pie. The trend of the strong getting stronger is evident, and Fuyao Glass is expected to further expand its market share. According to People's Daily, citing institutional data, this share increased to 34% in 2023.

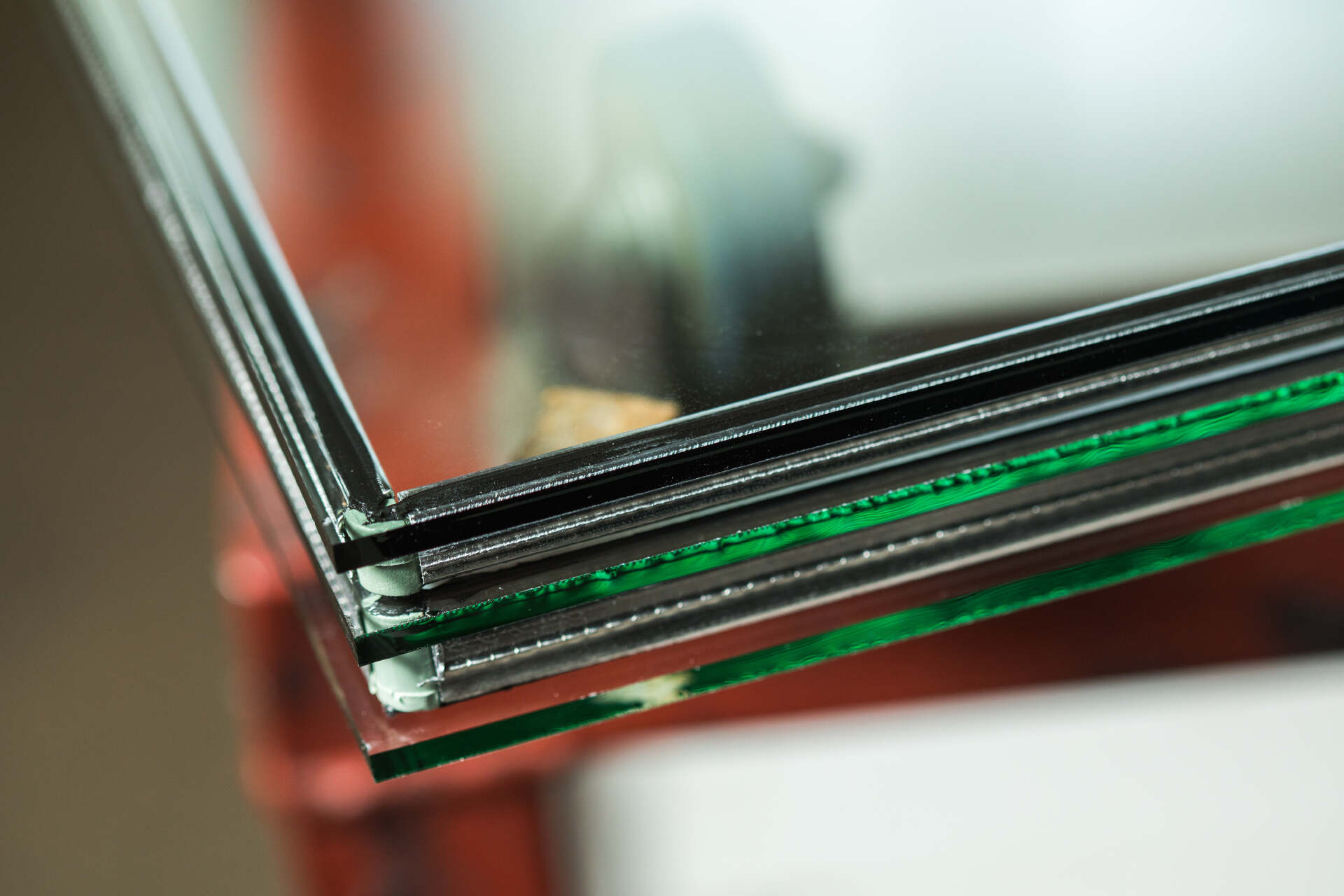

The current monopolistic market structure is primarily due to the high barriers to entry in the automotive glass industry. This asset-intensive model deters capital from non-industry players. Additionally, the fragility of glass and high transportation costs necessitate manufacturing plants near vehicle assembly plants, requiring a decentralized and global capacity layout. The investment in glass production lines is substantial, with establishing a line with an annual capacity of 4 million square meters costing roughly EUR 40-60 million in Europe, USD 70 million in the US, and RMB 200 million in China.

Fuyao Glass previously planned a capacity of 5.5 million sets/year in the US, investing up to USD 400 million. This asset-heavy model, coupled with uncertain returns, discourages outside capital.

Furthermore, automotive glass demands high customization, placing stringent requirements on suppliers' design, development, and support capabilities. As products continue to upgrade, manufacturers must invest in R&D to introduce high value-added products and meet market demands. From 2019 to 2023, Fuyao's R&D investment increased from RMB 813 million to RMB 1.4 billion, with the R&D expense ratio mostly maintaining a level of 4%.

The cycle from supplier certification to the final launch of customized products can span several years. Once a cooperative relationship is established, it often covers the entire lifecycle of new car models, making it difficult for competitors to enter.

The high barriers to entry in the automotive glass industry ensure a monopolistic market structure, with players enjoying exclusive access to a substantial market pie. From this perspective, Fuyao Glass is poised to continue benefiting from industry dividends in the future.

The global automotive glass market is vast and structurally advantageous. As the company with the highest global market share, Fuyao Glass's future performance is expected to maintain high growth, which can be analyzed from the dimensions of quantity and price.

Firstly, the burgeoning new energy vehicle market is driving up the demand for automotive glass per vehicle, supporting Fuyao Glass's sales growth. In 2023, global automotive sales totaled 92.72 million units, a 11.9% year-on-year increase, 0.7% higher than in 2019 but 3.1% lower than the historical peak in 2017. With the pandemic's impact waning and global economic recovery, automotive sales are anticipated to continue growing, albeit at a slower pace.

Additionally, the amount of glass used per vehicle holds promise. Historically, in the 1950s, the glass area per automotive vehicle was only 2.2 square meters, which has risen to 4.2 square meters since the 21st century.

As the penetration rate of panoramic glass roofs in new energy vehicles continues to climb, the glass area per vehicle is expected to further increase. Notably, a small sunroof glass area measures 0.2-0.6 square meters, panoramic sunroof glass 0.5-1.2 square meters, and panoramic glass roofs can reach 1-2 square meters.

In November 2023, the penetration rate of panoramic glass roofs in China's automotive market was 14%, compared to only about 2% at the beginning of 2021. Some institutions predict that this rate will exceed 55% by 2025. In this segment, Fuyao Glass holds 91% and 89% of the domestic market share for fuel vehicles and new energy vehicles, respectively (2021 data), poised to benefit from this glass product upgrade trend.

To meet potential future growth demands, Fuyao Glass is expanding its production capacity globally. Currently, its overseas capacity stands at 6.8 million sets, mainly in the US and Russia, while its domestic capacity is 34 million sets, distributed across Fuqing, Changchun, Chongqing, Shanghai, Guangzhou, and other locations. In early 2024, Fuyao Glass invested RMB 3.25 billion and RMB 5.75 billion to expand glass production capacity in Fujian and Hefei, respectively.

Secondly, Fuyao Glass's unit price continues to rise, with further growth potential.

From 2016 to 2023, Fuyao Glass's price per square meter increased from RMB 152 to RMB 213, with a compound annual growth rate of 4.94%.

With the rapid advancement of automotive electrification and intelligence, automotive glass products have undergone significant upgrades, particularly panoramic glass roofs and AR-HUD windshields (Augmented Reality Head-Up Display, which overlays and displays driving information within the driver's line of sight, such as dashboard data and navigation images).

Traditionally, the cost of traditional sunroof glass per vehicle was around RMB 100, which rose to RMB 300-800 for panoramic sunroof glass and further to approximately RMB 900 for panoramic glass roofs. Ordinary windshields cost around RMB 200, while AR-HUD windshields cost around RMB 1000. Notably, AR-HUD is gradually becoming a standard feature in mid-to-high-end vehicle models.

In terms of pricing, Fuyao Glass has also taken action on the manufacturing cost side. To ensure supply and reduce costs, the company has established float glass production lines in multiple locations, achieving an independent supply and marketing ratio of over 90% (float glass accounts for 34% of automotive glass costs). Additionally, the company has begun setting up upstream silica sand factories, with four factories in Hainan, Hunan, Inner Mongolia, and Liaoning, further lowering glass production costs. However, beyond float glass, there are significant fluctuations in the costs of raw materials such as energy and soda ash, which the company cannot control and may significantly impact production costs.

In summary, Fuyao Glass's automotive glass unit price is expected to continue rising due to product upgrades, and the company's upstream expansion efforts are aimed at continuously reducing production costs. Both factors are conducive to increasing product profit margins and enhancing profitability.

Disclaimer

This article covers content related to listed companies, based on the author's personal analysis and judgment using information publicly disclosed by listed companies in accordance with legal requirements (including but not limited to temporary announcements, periodic reports, and official interaction platforms, etc.). The information or opinions presented herein do not constitute any investment or other business advice. Market Value Observation assumes no responsibility for any actions taken as a result of adopting this article.

——END——