Tesla Enters the Six-Seater SUV Arena: Can It Conquer the Electric Vehicle 'Home Turf'?

![]() 08/21 2025

08/21 2025

![]() 714

714

Lead

Tesla's one-model strategy is no longer yielding results. Starting in 2024, the company's core automotive business has entered a period of turbulence, and as of the second quarter of this year, it remains at its lowest point in recent years, with sales and volumes facing significant tests. Even Elon Musk admits that Tesla may experience several challenging quarters.

Produced by | Heyan Yueche Studio

Written by | Cai Jialun

Tesla's 'catfish effect' is gradually waning. As domestic brands of new energy vehicles rise rapidly, Tesla must compete in more market segments to maintain its position in the Chinese market. Facing an increasingly competitive Chinese market, Tesla, which has shifted from offense to defense, has launched the pure electric six-seater SUV Model YL. Is its sales trajectory now stabilizing?

Declining Trend to Be Halted

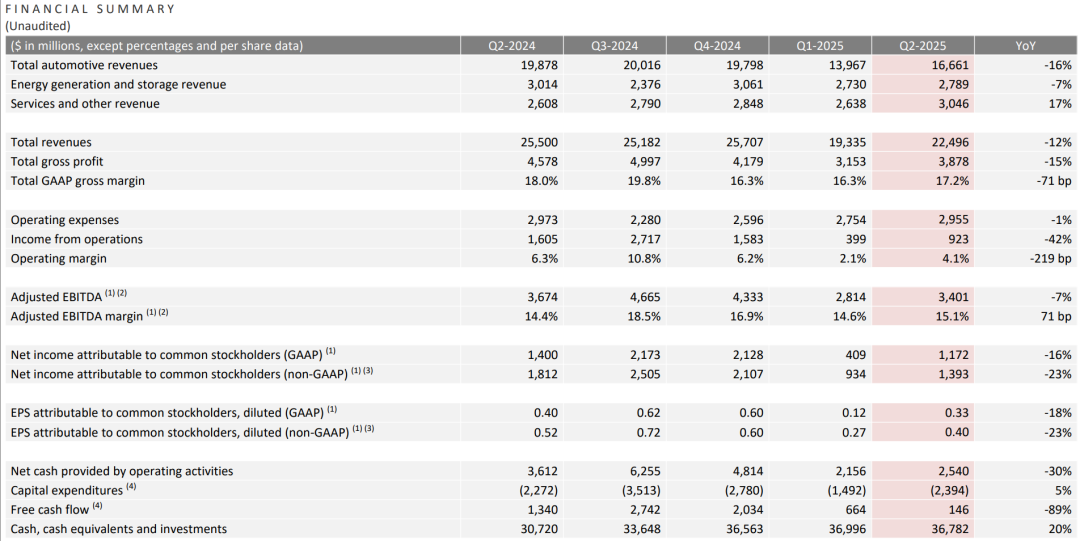

Tesla recently released its second-quarter financial report, with revenue of $22.496 billion, a year-on-year decrease of 12%; net profit of $1.172 billion, a year-on-year decrease of 6%. Although the overall comparison with the worst financial report in recent years in the first quarter has improved, with net profit increasing by 16% quarter-on-quarter, the declining trend has not been halted.

Revenue from the core automotive business was $15.7 billion, a year-on-year decrease of 16%; energy storage revenue was $2.789 billion, a year-on-year decrease of 7%. Although Tesla's second-quarter vehicle sales increased from 336,000 in the first quarter to 384,000, a quarter-on-quarter rebound of 16%, it is still far from its peak. Even worse, sales of its main models, Model 3/Model Y, plummeted by over 70% in multiple European countries.

Of course, amidst Tesla's overall declining financial report in the second quarter, there is a key to breaking the deadlock in the automotive field—Model Y.

With the domestic launch of Tesla Model Y in the first half of 2025, the price increased by $10,000, and the US market price increased by $1,000. Model Y single-handedly increased the gross margin of the automotive business from 16.2% to 17.2%, and Tesla's average selling price per vehicle also increased from $274,500 to $293,900.

As a volume contributor to Tesla's automotive business, Model Y not only continues to be popular in the Chinese and American markets but also shows strong market potential in Southeast Asia and North America. Musk mentioned that in North America, the number of Model Y test drives increased by 20% quarter-on-quarter, and new highs in delivery volumes were recorded in South Korea, Malaysia, Singapore, etc. With the official delivery of Model Y in the Indian market in the third quarter, global sales of Model Y are expected to increase.

Declining financial reports and rising Model Y sales have destined that Tesla will inevitably elevate Model Y to a strategic model positioning in the automotive field in the future.

In mid-July, Tesla officially announced the long-wheelbase version of Model Y exclusively for the Chinese market. According to information from the Ministry of Industry and Information Technology, Model YL did not follow the overseas version's design layout but instead adopted a three-row, six-seat layout.

At the end of July, during the earnings call, Musk clearly stated that the cheaper version of Model Y will be officially launched in the fourth quarter. Judging from the spy shots currently exposed online, it can be seen as a stripped-down, smaller version of Model Y.

Tesla's successive product actions on Model Y in July further illustrate that the company needs to quickly expand the Model Y universe while Model Y still retains product popularity and competitiveness globally.

After all, Model Y's user perception and influence are significant. Whether it's the six-seater Model YL or the stripped-down version of Model Y to be launched in the fourth quarter, Tesla only needs to invest minimal promotional costs to gain significant market attention.

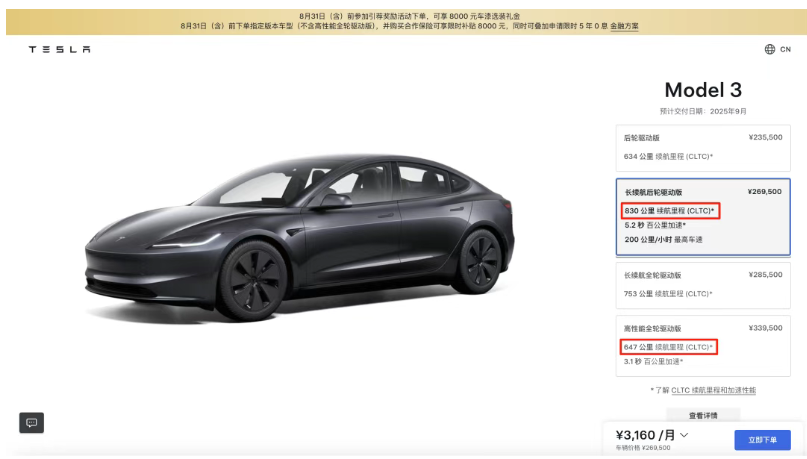

As for Model 3, based on the long-range rear-wheel-drive version launched on August 12, it offers a CLTC range of 830 kilometers, accelerates from 0-100 km/h in 5.2 seconds, and starts at a price of $269,500. Tesla obviously wants to position Model 3 as an elite commercial vehicle, further raising its selling price while slightly replenishing Model 3's popularity.

Model YL is Coming

Will the upcoming Model YL, placed in the fiercely competitive large six-seater SUV market in 2025, be able to compete?

Size is the most noticeable upgrade for Model YL, increasing by a full 150mm compared to Model Y, with a length of 4976mm, a width of 1920mm, a height of 1668mm, and a wheelbase of 3040mm. The elongated dimensions make Model YL Tesla's largest mainstream SUV, surpassing Model X.

With the extended wheelbase, the sloping rear lines of Model YL become gentler, mainly to maximize the headroom for third-row passengers. If the line adjustments from Model Y to Model YL still seem abstract.

Of course, the adjustments to Model YL's size and shape must have referenced the market performance of the North American seven-seater version of Model Y, especially its less-than-ideal third-row space. If directly replicated onto Model YL, it might undermine Model YL's prospects in the fierce competition among large six-seater SUVs.

To better meet the rear space requirements, Model YL's second and third rows, each with four independent seats, incorporate a flat-folding design. The second-row independent seats can move forward and backward, and the third-row seats adopt a sunken design, ensuring sufficient headroom. Regarding safety, the third row incorporates a 600MPa aluminum-silicon alloy bracket, with strength increased by 30% compared to Model Y.

In terms of performance, Model YL is equipped with a dual-motor system modeled 3D3/3D7, with maximum powers of 142kW/198kW, respectively, representing only a slight increase compared to the long-range version of Model Y. Considering Model YL's curb weight of 2088KG, which is 93KG heavier than the long-range version of Model Y, and without a significant increase in motor power, Model YL already exhibits a clear comfort orientation.

If Model YL's upgrades in size, power, and seat layout are minor compared to Model Y, the inclusion of the HW5 intelligent driving assistance chip is a pleasant surprise, with HW5's intelligent driving computing power being five times higher than that of the previous generation.

Judging from the product information currently exposed for Model YL, it continues the steady approach of the refreshed Model Y overall, neither as large as the Li Auto i8 or AITO M8 in size nor as price-surprising as the Letao L90 or Lynk & Co 900. However, returning to Tesla's brand attributes and the increasingly large Chinese large six-seater pure electric SUV market, thanks to favorable timing, geography, and human factors, Model YL is likely to still have a significant impact when it is launched in the future.

Compared to the competitive siege by rival products, Tesla's biggest challenge in satisfying the needs of six-seater consumers with the Model YL lies in overturning the handling label established by Model 3/Model Y.

Even though the chassis suspension of the second-generation Tesla Model 3/Model Y has been optimized to make the rear seats more comfortable compared to the first-generation products, there is still a noticeable difference when compared to comfort-oriented family SUVs. Therefore, whether Model YL can further improve rear-seat comfort is one of the key points for consumers to accept the new vehicle. It should be noted that among the current crop of domestic large six-seater SUVs, models like the Li Auto i8 and Letao L90 already excel in accommodating the comfort of third-row passengers.

Commentary

Tesla's slow pace of updates and iterations in the automotive field has been frequently criticized by the industry. After all, Musk, as a pure businessman, is currently focusing his main energy on the field of AI. As for the pressure of selling cars, it can only temporarily rely on Model Y to hold up. Can the arrival of the new Model YL alleviate Tesla's current sales pressure?

(This article is originally created by Heyan Yueche and may not be reproduced without authorization)