Redefining Car Manufacturing: A Decade of Evolution and Renewal

![]() 08/21 2025

08/21 2025

![]() 500

500

Source | BohuFN

At China's new energy vehicle industry table, three internet-savvy founders are confronting the harshest reshuffling phase since their startups: Li Auto's L8 and NIO's LeTao L90 are viewed as the "last stands" for their respective transformations; XPeng's newly unveiled P7 version embodies the brand's aspiration to reclaim the high-end market.

The debut of Li Auto's L8 and NIO's LeTao L90 ignited a massive public opinion war, with executives from both sides exchanging barbs on Weibo, and the market, users, and media inevitably pitting the two newcomers against each other. The rivalry between these two brands is brimming with tension.

XPeng cannot afford to sit idly by. Despite returning to the top three in new force sales rankings this year, following MONA M03's successful incursion into the 100,000-yuan market, XPeng now faces the challenge of re-entering the high-end segment.

This fierce competition feels eerily familiar. Linked by the "new force" label, NIO, XPeng, and Li Auto have been intertwined in the new energy vehicle market for a decade and are now once again at pivotal junctures in their respective histories.

However, this round of competition will be doubly intense. Beyond scale and profitability, identifying a unique niche in the new competitive landscape will determine how steadily and far these players can advance in the next leg of the new energy race.

01 Ten Years: Each Player's Response

Between 2014 and 2015, NIO, XPeng, and Li Auto emerged, differentiating themselves through unique product positioning, thereby attracting the attention of capital markets and target groups.

Back then, a "compelling story" was the best ticket to the capital market. As the first tier of new forces, "NIO, XPeng, Li Auto" supported each other, realizing that only by collectively narrating the new energy vehicle story could they collectively enlarge the pie. A 2020 group photo of the three founders captures their revolutionary camaraderie.

However, with "NIO, XPeng, Li Auto" all listing on the capital market, this also meant they had crossed the "life-and-death line" and were now facing independent tests. "NIO, XPeng, Li Auto" began to diverge: NIO positioned itself as a high-end brand, embracing the battery swap model; Li Auto bet on family cars, opting for the extended-range route; XPeng, labeled as technology-driven, focused on intelligent driving and supercharging systems.

NIO has consistently anchored its positioning in the high-end luxury market, committed to building an ecosystem encompassing the entire lifecycle of car usage for owners, transforming services into NIO's core competitiveness.

In practice, NIO has expanded a highly recognizable user service system centered around the "battery swap model": NIO Houses dotted across cities; a community system built on car owners' interests and hobbies; exclusive services like 24-hour rescue and dedicated service groups; and the NIO Life design brand, gathering top designers worldwide.

NIO's brand identity is clear: premium cars, exceptional service, and battery swapping, with its user reputation evident to all. This embodies Li Bin's "Utopia" vision, emphasizing long-termism—establishing technology and brand moats through substantial early-stage investments to occupy commanding heights in future industry competition.

However, beneath NIO's "idealism" lies the pressure of cumulative losses amounting to billions of yuan. Amid increasing profit pressure, Li Bin had to compromise with reality.

Since last year, NIO has initiated a series of organizational changes and membership system adjustments, including streamlining the structure, strengthening supply chain management, and reducing membership benefits. The birth of NIO's sub-brand LeTao signifies the brand's unshackling from "service constraints," allowing competition to refocus on the product itself, engaging in direct rivalry with competitors through product capabilities.

Since its inception, XPeng has positioned "intelligence" as the core of its brand development, evolving from early focus on intelligent assisted driving technology to now encompassing five major segments: AI cars, AI chips, AIOS, AI robots, and flying cars, transforming into a "global AI technology company."

However, in XPeng's early stages, "intelligence" hadn't yet solidified as a clear brand identity. Firstly, the intelligence gap among new energy vehicle brands was insignificant in the early years, naturally obscuring XPeng's advantages. Secondly, compared to competitors' unique service and extended-range positioning, "intelligence" struggled to translate into a distinct brand mindset.

Thus, despite XPeng's substantial R&D investments, consumers remained unconvinced, even describing the brand, not adept at marketing, as a "science-biased student." This contradiction erupted post-XPeng G9's failure.

Subsequently, Wang Fengying was appointed President of XPeng Motors amidst the crisis, further streamlining the product matrix while reshaping the supply chain and marketing systems. The fruits of these reforms are most evident in MONA M03, which not only successfully ventured into the 100,000-yuan market but also marked the beginning of XPeng's self-disruption with a youth-centric, visually appealing, and fun-focused marketing campaign.

Li Auto was the first of "NIO, XPeng, Li Auto" to "land." Relying on its family car positioning and the extended-range technology's differentiated advantage, it achieved rapid sales growth through the "doll strategy" in this nearly untapped segment market.

However, as more auto companies joined the extended-range bandwagon, Li Auto's "moat" began to erode. Moreover, when Li Auto attempted to crossover into the pure electric segment, it realized that the previously unstoppable "doll strategy" might not suit the fiercely competitive pure electric market. If Li Auto doesn't step out of the L series' comfort zone, it will struggle to genuinely expand into new user circles.

With increasing auto companies joining the fray, "NIO, XPeng, Li Auto" face respective pressures and anxieties. In today's landscape where almost all auto companies are "new forces," "NIO, XPeng, Li Auto" cannot merely focus on their own affairs but must actively seek ways to break the deadlock.

02 New Forces: Learning to "Listen to Advice"

Many insiders and auto industry leaders predict that the new energy vehicle industry will undergo intense reshuffling, potentially leaving only about 5-7 companies in the Chinese market.

When the wind vane disappears, the naked swimmers have nowhere to hide. If "NIO, XPeng, Li Auto" wish to survive, they must grow stronger. Hence, these new force founders have learned to "listen to advice," confront their weaknesses head-on, and draw inspiration from others' shining points.

First, they must reconstruct their respective product strategies. If the hallmark of an adult's growth is learning to reconcile with oneself, the decade-old "NIO, XPeng, Li Auto" are probably in the same boat.

Admittedly, "NIO, XPeng, Li Auto" all had their blockbuster hits over the past decade, but the new energy vehicle circle's iteration speed is too swift, with original products facing issues like outdated styling, lagging technology, disconnected functions, and inadequate intelligent experience. Continuously adjusting product strategies has thus become the key to self-breakthrough for new forces.

Take XPeng as an example; the first-generation XPeng P7's initial launch price was in the 250,000 yuan range, but now its best-selling main products, like Mona M03 and P7+, have entered the sub-200,000 yuan price band, also achieving the popularization of intelligent driving. This is the culmination of XPeng's continuous optimization of marketing, technology, and cost capabilities.

Initially, Li Auto didn't consider venturing into the pure electric route. It wasn't until battery costs and charging facilities continually improved that Li Auto softened its stance, announcing plans to launch pure electric models in 2023 during the 2020 fourth-quarter earnings call. To this end, Li Auto has undertaken substantial preparatory work, such as introducing a 20kW DC charging pile with a charging speed three times that of a 7kW AC charging pile.

Judging from the shifts in "NIO, XPeng, Li Auto's" product strategies, they're continuously balancing their product matrices in actual operations, enriching their initially relatively singular brand positioning, and gradually converging towards traditional auto companies' multi-brand coordinated development strategy.

Secondly, they must gain control of the supply chain. Most new force auto company founders lack professional training and experience in supply chain management, making them prone to falling into the dilemma of uncontrollable procurement costs.

In the new energy vehicle industry's early all-out rush, market expansion's heat often masked the acuity of cost issues; however, as industry competition deepens, every cost difference may directly impact product pricing strategies and market competitiveness. Thus, building a mature, efficient, and resilient supply chain system has become a lesson new forces must learn.

In 2023, XPeng launched internal anti-corruption efforts within the supply chain, with He Xiaopeng personally leading the restructuring of the senior management team. Coupled with a series of reforms led by Wang Fengying, supply chain costs were reduced by 20%. In the same year, Li Xiang established the "Supply Chain Strategy Group" to strictly control supply expenditures and promote vehicle model platformization and parts commonalization, enabling Li Auto to achieve its first profit turnaround that year.

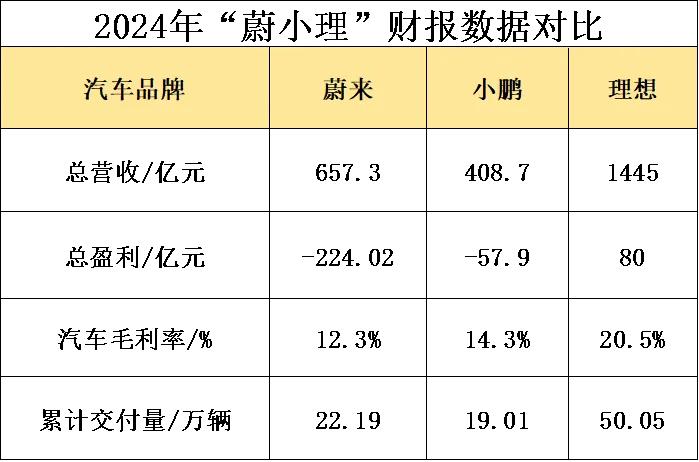

Finally, they must prioritize profitability goals. Currently, "NIO, XPeng, Li Auto's" financial situations are quite differentiated. According to 2024 data, Li Auto continues to reign as the new force champion, leading NIO and XPeng in sales, revenue, profit, gross margin, etc.

In Q1 2025, XPeng impressed with revenue surging 141.5% year-on-year to 15.81 billion yuan and gross margin climbing to 15.6%. In contrast, NIO's losses were significant, with losses still increasing year-on-year in Q1 this year. The market feedback from supply chain reforms and LeTao L90's popularity is expected to materialize only in the second half of the year.

However, both NIO and XPeng have announced their goal of achieving profitability this year, signifying the end of the past "burn money for growth" internet thinking mode among new forces.

In today's more pragmatic new energy vehicle market, new forces must also face the profitability test like traditional auto companies, rather than relying solely on "storytelling" to gain capital market recognition.

03 "NIO, XPeng, Li Auto": Starting Anew

Under the shared goal of "profitability first," "NIO, XPeng, Li Auto," which once diverged, are once again at the same starting point. However, on this "no profitability, no stay" track, "NIO, XPeng, Li Auto" will inevitably tread paths taken by each other.

Ideal, which stumbled hard with the MEGA series, pins high hopes on LeTao L60 but fails to achieve a sales explosion; NIO, relying on LeTao L90 for a pivotal battle, still faces pressure to reclaim the high-end market, now also a concern for XPeng.

After all, it's easy for a brand to descend in dimensions but harder to elevate post-descent. While "cost-effectiveness" is a "quick fix" for new forces to boost sales, it lowers auto companies' average gross margin and invisibly intensifies brand profitability pressure.

Li Auto continues to progress post-MEGA uproar, but Li Auto L8's presence in the pure electric track remains weak. For XPeng, aiming to challenge the extended-range route next, this means stepping out of the comfort zone is no mean feat.

For auto companies aiming to simultaneously cover both extended-range and pure electric technology routes, it's not just a simple replication of product functions but also involves reconstructing core technical architectures, cross-dimensional user perception penetration, etc. Each technology route switch must be accompanied by a new strategy.

New forces exploring the new energy vehicle market from scratch inevitably pay more trial-and-error costs to more accurately capture market demand's pulse, thereby timely optimizing product strategies and continuously refining the user experience.

However, as the new energy vehicle market's trial-and-error window narrows, the "cards" "NIO, XPeng, Li Auto" can play are also gradually decreasing. They must delve deeper into each other's territories and even experience each other's "pains," which will also become a microcosm of China's new energy vehicle market in the future.

As the new energy vehicle sector enters the phase of elimination, auto companies that aspire to remain competitive can no longer rely solely on serendipitous success. Instead, they must adhere to the fundamental development logic of the industry, identify replicable strategies from industry precedents, and navigate the transition from chaos to order. This is an indispensable phase in the maturation of the new energy vehicle market.

Should the past decade have seen the emergence of new players as a "disruptive force," the next decade will demand these players to become even swifter and more adaptable, evolving in tandem with the new market dynamics. There are no perpetual winners in the market; only constant evolution endures.

Ultimately, whether "NIO, XPeng, and Li Auto" will all successfully maintain their positions or be consolidated through mergers and acquisitions to survive in alternate forms remains uncertain. Profitability, while essential, is merely the prerequisite for reaching the finals. To truly thrive in the next decade, "NIO, XPeng, and Li Auto" must strive to be the most rapidly evolving entities within the industry.

Regardless of who ultimately prevails, "NIO, XPeng, and Li Auto" have already etched their mark on the history of China's automotive industry. By infusing it with electrification and intelligence, they have paved the way for future entrants. This is a bold and distinctive chapter in the story of "NIO, XPeng, and Li Auto."

The cover image and illustrations used in this article are subject to the copyright of their respective owners. Should the copyright holder believe that their work is inappropriate for public viewing or should not be used without charge, please contact us promptly, and we will take immediate corrective action.