Europe Reluctant to Let Go of Fuel Vehicles

![]() 08/21 2025

08/21 2025

![]() 576

576

Introduction

While the European Union (EU) remains steadfast in its commitment to banning fuel engines, it faces significant opposition and lobbying from member states and automakers, often leading to concessions at critical junctures.

Surprisingly, the Big Three German Automakers (BMW, Benz, and Audi) are unanimously opposed to the EU's 2035 ban on fuel vehicles.

Recently, Mercedes-Benz took over from BMW and Audi in expressing dissatisfaction with the policy. In a media interview, CEO Ola Källenius's remarks were particularly bold, tying the future of the European automotive industry to fuel vehicles and warning of "collapse" without them.

Opponents speak with one voice, but so do supporters. Last September, Volvo Cars and dozens of industrial manufacturers strongly backed the EU, urging the implementation of the ban on internal combustion engine vehicles by 2035.

Volvo CEO Jim Rowan emphasized the importance of the 2035 target, stating, "It's crucial for coordinating all stakeholders and ensuring Europe's competitiveness."

Caught between supporters and opponents, the EU's stance wavers. On one hand, it is pushing forward with the policy; on the other, it has repeatedly caved in to lobbying, granting exemptions for synthetic fuels and postponing fines for missing emissions reduction targets.

The EU's broken promises and wavering attitude reflect the uneven progress and hidden crises of electric vehicles in Europe.

Currently, the popularity of electric vehicles in Europe remains low, and the public's attitude is lukewarm. Automakers are in a precarious position, with their electrification efforts falling short of expectations. Financial reports indicate that profitability has been affected, heavily reliant on fuel vehicles. If the EU pushes ahead with the 2035 ban, as Källenius warned, it could lead to the "collapse" of the European automotive industry.

With multiple interests at play, Europe remains reluctant to let go of fuel vehicles.

01 The Soil for Electrification Has Not Yet Formed

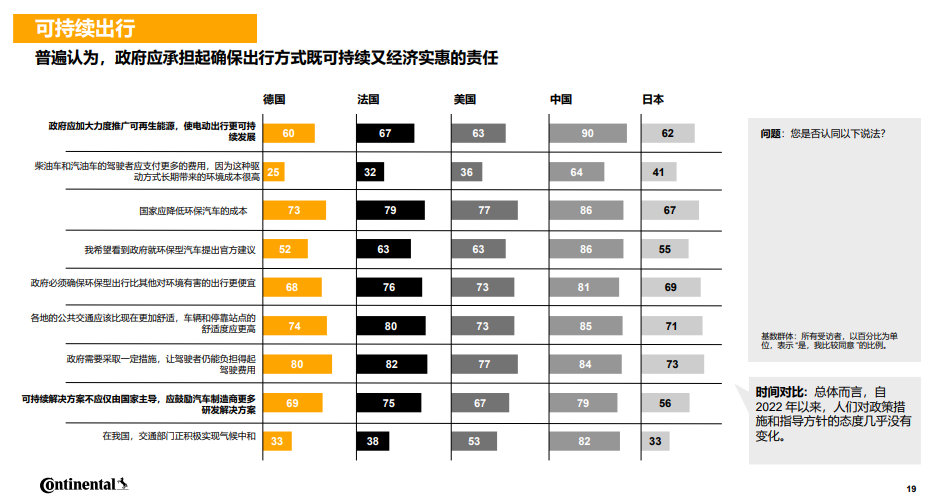

Even compared to China, which has the highest acceptance of new energy vehicles, the EU's ban on internal combustion engines seems overly aggressive. A survey shows that while 90% of Chinese consumers recognize sustainable mobility, only 60% of German, French, and other EU users share this view.

China's approach is more gradual, preferring hybrid technology to reduce fuel consumption and aiming for 85% pure electric vehicles by 2050. In contrast, the EU's policy is more uniform and radical, aiming for carbon neutrality by 2050 with a ban on internal combustion engines from 2035.

This means that neither synthetic fuel nor hybrid vehicles are on the list of salable vehicles, with only pure electric models being spared.

Data shows that in the first half of 2025, hybrid vehicles accounted for 34.8% of EU sales, while fuel vehicles accounted for 37.8%, and pure electric vehicles accounted for 15.6%. Despite the decline in fuel vehicle sales, consumers prefer hybrid models, indicating low electrification popularity.

In contrast, China sold 6.937 million new energy vehicles in the first half of 2025, with 4.415 million being pure electric models.

The low popularity of electrification in the EU is due to several factors, including low public acceptance, inadequate automaker efforts, insufficient government subsidies, and lack of infrastructure support.

Zidan Sheillet of Fitch Ratings noted that range anxiety and limited charging infrastructure inhibit consumer enthusiasm for electric vehicles. Additionally, affordability issues and the pace of technological change further limit their popularity.

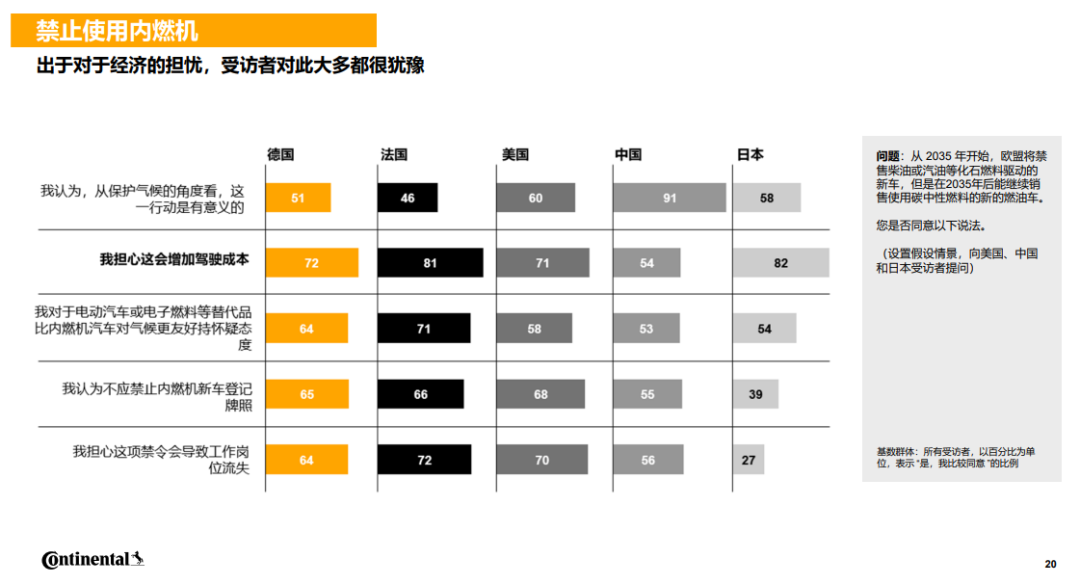

Price is also a significant factor in European consumers' opposition to the ban. Over half of German and French users are skeptical about electric vehicles being more environmentally friendly, worrying about increased driving costs and job losses.

These concerns are valid. The automotive industry is a pillar in Europe, providing nearly a million jobs in Germany alone. With fewer parts in electric vehicles compared to internal combustion engine vehicles, many small businesses supplying parts face the risk of unemployment.

Public concerns stem from insufficient government support. Subsidies for electric vehicles have waned in many EU countries, including the UK, France, and Germany. For instance, Germany has eliminated subsidies for pure electric vehicles for individuals, impacting sales.

Additionally, the EU's charging infrastructure faces significant challenges. With about 882,000 charging stations, the EU is far from its goal of 3.5 million by 2030. Achieving this means installing 410,000 public charging points annually, nearly triple the current rate.

Even if the EU meets its 2030 goal, it may not support a full transition to electric vehicles. The European Automobile Manufacturers Association (ACEA) believes the number of charging points needed may rise to 8.8 million by 2030.

Automakers also face challenges. Many European automakers have struggled with the new energy transition. Financial reports indicate that most companies' revenue and profit sources are still heavily reliant on fuel vehicles. Abruptly cutting them off would be disastrous for traditional brands.

Mercedes-Benz, a strong opponent of the ban, sold only 8.4% of its global vehicles as pure electric models in the first half of 2025, down from 9.7% the previous year. Including plug-in hybrids, new energy models accounted for only 20.1%. This impacted Mercedes-Benz's first-half financial performance, with electrification challenges being a significant factor.

02 Frequent Concessions at Crucial Moments

The contradiction between the current reliance on fuel vehicles and the EU's electrification goals is concentrated in the 2035 ban policy. This has led to the EU being determined yet frequently caving in to lobbying and criticism, making concessions at crucial moments.

The EU set an interim target of reducing carbon emissions from fuel vehicles by 15% in 2025 compared to 2021. Industry predictions suggest that automakers not meeting these targets could face losses of up to 16 billion euros in fines.

Volkswagen, for example, warned of a 1.5 billion euro loss if it failed to meet emissions targets. Some automakers have even purchased "carbon credits" from Tesla and BYD to offset their carbon footprint.

At the critical juncture, the EU made concessions. In March 2025, the European Commission postponed fines for automakers missing emissions targets from 2025 to 2027, allowing a three-year grace period. This was seen as a setback for the EU's ban on internal combustion engines.

Despite these concessions, some automakers remain unsatisfied. BMW's Senior Vice President of Engine Production, Klaus von Moltke, stated, "Internal combustion engines are our foundation." Audi CEO Markus Duesmann also announced no clear timeline for ending fuel vehicle sales. Mercedes-Benz CEO Ola Källenius expressed even stronger opposition, warning of industry collapse.

There is still a slim chance of a turnaround regarding the 2035 ban. At a 2023 meeting led by Germany, the policy made concessions: if internal combustion engine vehicles use carbon-neutral fuels, they can continue to be sold after 2035.

While the concessions offered are modest, and synthetic fuels offer meaningful assistance primarily to niche sports car brands, the EU's actions reveal a stance that, despite its tough exterior, remains somewhat ambivalent. Should this policy flexibility endure, the landscape in 2035 could very well witness fresh transformations.

Caught between the vision of environmental protection and the realities of practical challenges, Europe's transition away from fuel-powered vehicles is destined to be a prolonged farewell.

Responsible Editor: Cao Jiadong, Editor: He Zengrong

THE END