Auto Market News: Multiple Regions Introduce Favorable Policies for the Automotive Industry

![]() 08/25 2025

08/25 2025

![]() 534

534

Weekly Report on the New Energy Vehicle Industry

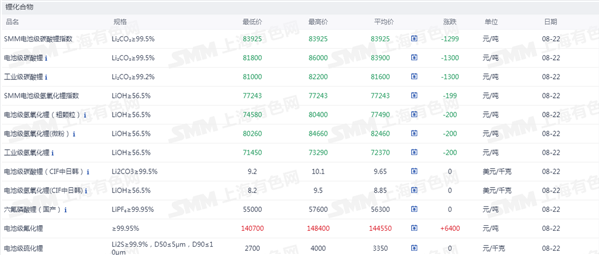

According to SMM, lithium salt manufacturers were reluctant to sell spot orders this week, leading to continued price hikes. Coupled with the fact that most upstream enterprises also possess lithium carbonate capacity, they tend to link lithium hydroxide monohydrate quotes with the futures and spot prices of lithium carbonate, further elevating the central price.

On the demand side, despite having full orders, some ternary material factories turned to the spot market for restocking due to reduced customer supply. To ensure production continuity, there have been instances of accepting goods at high prices, providing robust support for lithium hydroxide prices. Overall, the current supply and demand pattern is tight, and it is anticipated that the prices of lithium hydroxide and lithium carbonate will have limited downward space in the short term, remaining high and volatile.

01. Institutional Perspectives

Southwest Securities believes that a new vehicle cycle has commenced, and market demand is expected to surge against the backdrop of supply optimization and policy stimuli. The China Passenger Car Association predicts that retail sales of passenger vehicles will reach 24.35 million units in 2025, marking a 6% year-on-year increase.

Additionally, the Ministry of Finance and other departments issued the "Implementation Plan for the Fiscal Discount Policy for Personal Consumer Loans," clearly including the household vehicle sector within the scope of interest subsidies. The subsidy rate stands at 1 percentage point, effectively enhancing consumers' spending power by reducing car purchase costs, thereby boosting auto sales growth.

In the field of robotics, this year's World Robot Games features a special scenario competition, emphasizing practical applications and establishing four major scenarios: factories, warehousing, hospitals, and hotels. This fully reflects the key directions for the future development of robots.

Recommendations for Attention:

① Passenger Vehicles: Focus on high-quality leading auto companies engaged in differentiated competition, accelerating the promotion of intelligence, and expanding overseas.

② Smart Cars: Component enterprises that have made early layouts in the field of intelligence and possess market and technological advantages.

③ Robots: Pay attention to component enterprises with in-depth layouts in the robotics field that are progressing in an orderly manner.

④ Heavy Trucks: Policy efforts will help maintain high industry sentiment in Q3, with a focus on high-quality leading companies.

⑤ Two-Wheeler Sector: Electric two-wheeler brands with strong market positions, product capabilities, and rapid advancements in intelligence, as well as motorcycle companies with cost-effective advantages in the overseas expansion of large-displacement models.

02. Macro Events

Shanghai: Accelerating the application of robots and supporting the deployment of industrial robots in key industries such as electronics, automobiles, and equipment.

On August 19, the Shanghai Municipal Commission of Economy and Informatization and two other departments jointly issued the "Implementation Plan for Accelerating the Development of 'AI+Manufacturing' in Shanghai." The plan proposes to expedite the application of robots, supporting key industries like electronics, automobiles, and equipment to deploy and utilize industrial robots in highly repetitive, high-risk, and health-hazardous work scenarios, thereby enhancing production efficiency and safety.

It promotes the large-scale application of intelligent robots in assembly, welding, painting, material handling, and other links. Additionally, it encourages the creation of human-machine collaborative intelligent manufacturing units in industries such as steel and shipbuilding to achieve unmanned complex processes. Safety and reliability inspection and testing methods for humanoid robots in industrial scenarios will be formulated to promote the "licensed operation" of products.

Henan: Promoting the integrated and clustered development of strategic emerging industries and accelerating forward-looking layouts for future industries.

On August 21, the General Office of the Henan Provincial People's Government issued the "Action Plan for Cultivating and Strengthening Strategic Emerging Industries and Forward-Looking Layouts for Future Industries in Henan Province." The plan aims to promote the integrated and clustered development of strategic emerging industries by adhering to this model, focusing on extending, complementing, and strengthening industrial chains. This is intended to continuously enhance the scale, level, and competitiveness of strategic emerging industries such as new-generation information technology, high-end equipment, new energy and intelligent connected vehicles, biomedicine, new materials, and the low-altitude economy.

Heilongjiang: From August 23, subsidies will be provided in three tiers for car replacement and upgrades, with a subsidy of 5,000 yuan for each new fuel vehicle priced below 150,000 yuan.

On August 19, Heilongjiang adjusted its subsidy policy for trade-ins of consumer goods. It mentions that from August 23 onwards (inclusive), individual consumers participating in Heilongjiang's car replacement and upgrade subsidy policy will receive subsidies in three tiers based on the purchase price (excluding tax) of the new car. Specifically, new fuel vehicles priced below 150,000 yuan (exclusive) will receive a subsidy of 5,000 yuan each; those priced between 150,000 yuan (inclusive) and 250,000 yuan (exclusive) will receive 8,000 yuan each; and those priced above 250,000 yuan (inclusive) will receive 11,000 yuan each. The subsidy standards for new energy vehicles are 2,000 yuan higher than those for fuel vehicles in each tier.

03. Industry News

CPCA: From August 1 to 17, retail sales of passenger vehicles in the national market reached 866,000 units, an increase of 2% year-on-year.

On August 20, the China Passenger Car Association released data indicating that from August 1 to 17, retail sales of passenger vehicles in the national market amounted to 866,000 units, marking a 2% year-on-year increase compared to the same period last year and an 8% increase compared to the previous month. Cumulative retail sales since the beginning of the year have reached 13.611 million units, representing a 10% year-on-year increase. During the same period, retail sales of new energy vehicles in the national passenger vehicle market reached 502,000 units, a 9% year-on-year increase compared to the same period last year and a 12% increase compared to the previous month. The retail penetration rate of new energy vehicles in the national passenger vehicle market was 58.0%. Cumulative retail sales since the beginning of the year have reached 6.958 million units, a 28% year-on-year increase.

CADA: In the first half of the year, the operating conditions of dealers of independent new energy brands were better than those of traditional fuel vehicle brands.

On August 18, the China Automobile Dealers Association released the survey report on the survival status of national auto dealers in the first half of 2025. In the first half of 2025, the survival status of auto dealers further deteriorated, with the proportion of losses rising to 52.6%, a break-even ratio of 17.5%, and a profit ratio of 29.9%. Notably, the operating conditions of dealers of independent new energy brands were superior to those of traditional fuel vehicle brands, with a profit ratio of 42.9% compared to 25.6% for dealers of traditional fuel vehicle brands.

The survey also revealed that manufacturers' rebate cycles for dealers are concentrated at 2-3 months, with some manufacturers implementing quarterly assessments having rebate cycles exceeding 3 months. The CADA recommends that manufacturers simplify rebate policies, implement a single monthly assessment, eliminate quarterly and annual assessment targets, fulfill rebates within 2 months, and abolish restrictive conditions for the use of rebates.

04. Company Developments

IM Motors' L4 autonomous Robotaxi service officially launches on the Shanghai International Tourism and Resorts Special Line.

On August 20, the L4 autonomous Robotaxi tourism special line jointly launched by IM Motors, Enjoy Trip, and Saike Intelligence commenced operations, connecting the Shanghai International Tourism and Resorts Zone with Pudong International Airport. Users can request the service with one click through the "Robotaxi" section of the Enjoy Trip app for a free experience. Additionally, the driverless L4 Robotaxi jointly launched by IM Motors, Qiangsheng Taxi, and Saike Intelligence began charging operations in Lingang on August 15.

Xiaomi Group: Revenue from the smart electric vehicle and AI innovation business segment was 21.3 billion yuan in the second quarter.

On August 19, Xiaomi Group released its financial report for the second quarter of 2025. The report revealed that in the second quarter of 2025, revenue from the smart electric vehicle and AI innovation business segment amounted to 21.3 billion yuan, of which smart electric vehicle revenue was 20.6 billion yuan and revenue from other related businesses was 600 million yuan. The gross margin of the smart electric vehicle and AI innovation business segment was 26.4%, with an operating loss of 300 million yuan. In the second quarter of 2025, 81,302 new vehicles were delivered.

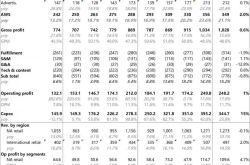

XPeng Inc.: Total revenue in the second quarter was 18.27 billion yuan, an increase of 125.3% year-on-year.

On August 19, XPeng Inc. released its financial report for the second quarter of 2025. The report indicated that total revenue in the second quarter of 2025 was 18.27 billion yuan, a 125.3% increase compared to the same period in 2024 and a 15.6% increase compared to the first quarter of 2025. The net loss in the second quarter was 480 million yuan. The gross margin in the second quarter was 17.3%, an increase of 3.3 percentage points year-on-year, of which the automotive gross margin was 14.3%, an increase of 7.9 percentage points year-on-year. As of June 30, XPeng Inc. had cash and cash equivalents, restricted cash, short-term investments, and term deposits totaling 47.57 billion yuan.

Li Bin of NIO: Over 18 billion yuan invested in charging and battery swapping over the past decade, with over 8,100 charging and battery swapping stations built nationwide.

On August 21, Li Bin, Chairman of NIO Inc., stated that the construction of the 318 charging and battery swapping route serves as a microcosm of NIO's resolute and continuous investment in charging and battery swapping over the past decade. Over the past decade, NIO has invested over 18 billion yuan in the field of charging and battery swapping. To date, a total of over 8,100 NIO charging and battery swapping stations have been established nationwide, including 4,715 charging stations and 3,458 battery swapping stations.

05. Secondary Market

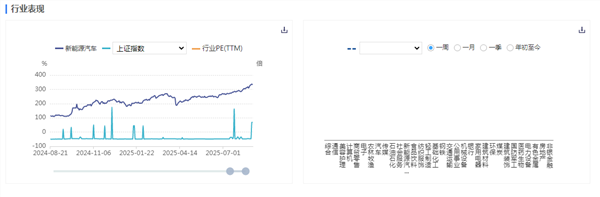

Industry Performance

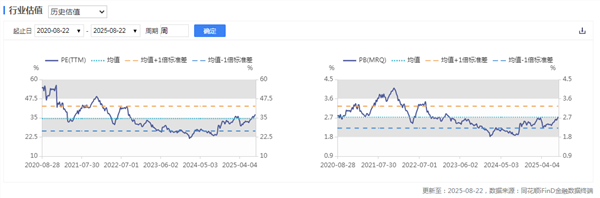

Industry Valuation

New Energy Vehicle Sales

06. Raw Material Prices

Spot Prices of Lithium Compounds

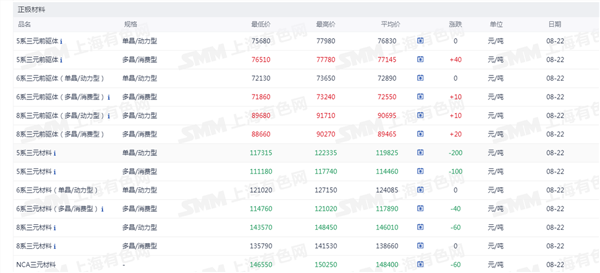

Cathode Material Prices

Electrolyte Prices

- End -

- End -