Engine-Powered Electric Vehicles Gain Popularity, Transforming the Automotive Market

![]() 08/25 2025

08/25 2025

![]() 639

639

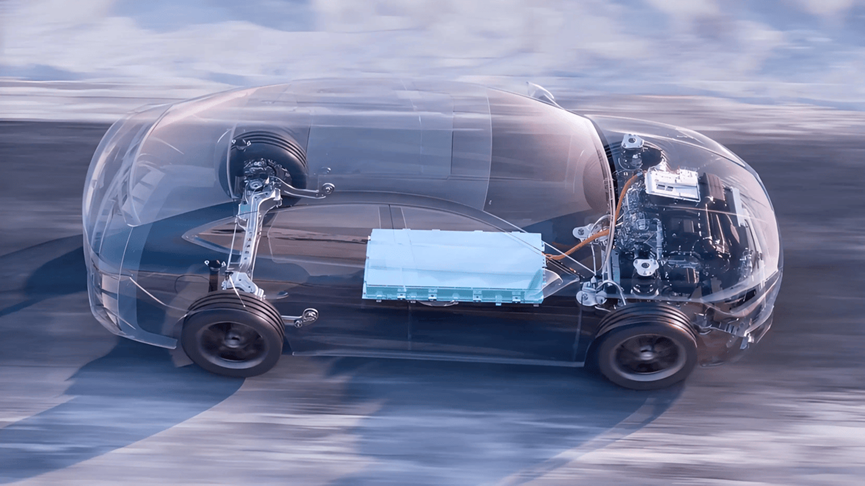

Once deemed 'backward,' the extended-range technology route has now become a hotly contested field among major automakers.

Recently, GAC unveiled its Xingyuan extended-range technology, concurrently launching the Aion Hyper HL extended-range version into the market. Equipped with a 60kWh CATL XiaoYao super extended-range battery, this new model boasts the longest pure electric range of 350km in its class and a combined range of 1369km.

On August 1, IM Motors officially announced the launch of its two extended-range electric vehicles, IM LS9 and IM LS6, scheduled for the third and fourth quarters. IM LS6 has already commenced presales and is expected to hit the market in early September. Additionally, Chery Fengyun T11 has emerged in the Ministry of Industry and Information Technology's new car catalog as a full-size extended-range SUV.

Joint-venture automakers have also exhibited unprecedented enthusiasm for electrified models equipped with engines.

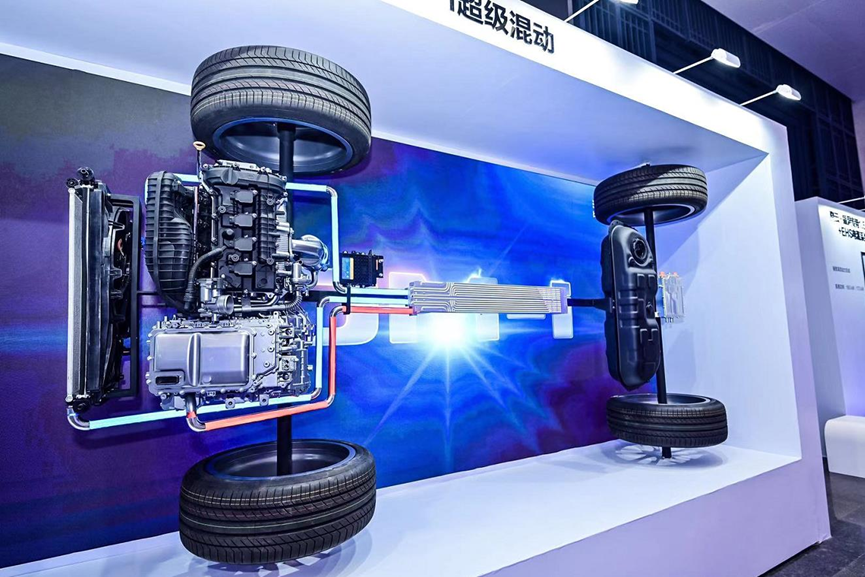

On August 7, SAIC-GM-Wuling introduced the Zhenlong extended-range system, born from the XiaoYao architecture, which will debut on the upcoming Buick Envision L7.

In June, GAC Toyota announced the release of extended-range versions of the next-generation Highlander and Sienna. Earlier, Volkswagen had revealed its intention to adjust its electrification strategy, expanding its hybrid model lineup. SAIC Volkswagen ID.ERA represents Volkswagen's foray into the extended-range electric vehicle segment.

Beyond extended range, plug-in hybrids have emerged as a key development direction for major automakers. Besides local frontrunners like BYD, Geely, and Chery, international manufacturers such as Audi, Mercedes-Benz, Volkswagen, Toyota, GM, and Volvo are also focusing on the plug-in hybrid market. Audi and GM have already launched new plug-in hybrid products in China, with others set to follow suit.

These trends underscore the rapid rise of electrified vehicles powered by engines.

In recent years, due to challenges like delayed charging infrastructure development, user range anxiety, and high prices, global demand for pure electric vehicles has begun to wane. Conversely, engine-powered electric vehicles are gaining popularity in the global market, appealing to many consumers with their range anxiety-free and fuel-efficient characteristics.

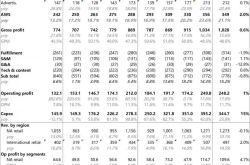

According to the China Association of Automobile Manufacturers, from 2022 to 2024, extended-range vehicle sales in China accounted for 3.6% to 9.1% of total new energy vehicle sales, with a rapid increase in market share. Simultaneously, the sales share of plug-in hybrid vehicles surged from 22.01% to 40%. Gasgoo Research Institute data reveals that in the first half of 2025, sales of new energy passenger vehicles reached 6.52 million units, up 38.7% year-on-year. Among them, the sales share of hybrid models hit 38%, a 17% increase from 2022.

Market performance highlights that many automakers have gained consumer recognition by integrating engines into electric vehicles. Li Auto, Wenjie, and Zero Running are prime examples. Automakers like Deep Blue and AITO have also achieved rapid sales breakthroughs after entering the extended-range market.

In the plug-in hybrid sector, even BYD, the leading player in new energy vehicles, has a significant advantage in plug-in hybrids over pure electric vehicles. In the first half of 2025, BYD sold 1,089,890 plug-in hybrid models, up 23.71% year-on-year, accounting for 52% of total sales. Geely's Galaxy brand has also excelled in the plug-in hybrid market, with models like the Galaxy Starship 7 EM-i, Galaxy Starlight 8, and Galaxy A7 becoming bestsellers.

Given these market dynamics, it is evident that more automakers will enter the extended-range and plug-in hybrid markets. As market competition intensifies, the automotive landscape will inevitably undergo transformations.

Currently, the market adjustment is evident.

Data shows that from January to July 2025, Li Auto delivered a total of 234,669 vehicles, a year-on-year decline of 2.21%. In July alone, Li Auto delivered 30,731 vehicles, down 39.7% year-on-year, and was pushed out of the top three in new force sales for the first time. Notably, this marks Li Auto's second consecutive month of year-on-year decline and the third decline in 2025. In the new energy SUV segment above 300,000 yuan, the combined market share of Li Auto's three main models, Li L7, Li L8, and Li L9, has dropped from 32% in the same period of 2024 to 26%.

This shift has resulted in Li Auto losing its position as the sales champion of 'new energy vehicle makers' for nearly two years, with Xiaopeng, Zero Running, and Wenjie taking turns to occupy the top spot. It is clear that Li Auto's extended-range stronghold is weakening.

After years of market cultivation, engine-powered electric vehicles have gained widespread consumer acceptance, and market maturity is steadily improving. With many traditional automakers announcing their entry into this segment, the future of the extended-range and plug-in hybrid markets looks increasingly competitive. Li Auto's current sales decline serves as a telling sign of this evolving landscape.

(Images sourced from the internet and will be removed upon infringement)