Chengdu Auto Show 2025: A Fierce Battle Among Pure Electrics, Plug-in Hybrids, and Extended-Range EVs

![]() 08/28 2025

08/28 2025

![]() 511

511

Introduction

No single player can dominate the market, but winners will inevitably emerge.

"I'm skipping this year."

"I don't see any groundbreaking models."

"Better to take a break than waste time."

"September and October are coming; the competition will resume then."

On the eve of the 28th Chengdu Auto Show, I had a conversation with a media colleague who provided the responses at the beginning of this article.

It's unclear when this southwestern automotive extravaganza, once a key event, began to lose significance among Chinese automakers.

Despite still holding the title of an "A-class auto show," for most participants, it feels more like a routine appearance to assure the outside world that "I'm doing well."

This year, there was even a wave of collective absences.

Porsche, Lamborghini, Rolls-Royce, Maserati, Bentley, Lexus, Jaguar Land Rover, Infiniti, Genesis, Dongfeng Honda, Dongfeng Kia, Dongfeng Peugeot, Dongfeng Citroen, Chevrolet, FAW Besturn, Dongfeng Fengxing, Baojun—from ultra-luxury to mainstream joint ventures and independent brands, they were all absent.

What was proven by their absence?

From the OEMs' perspective, as mentioned earlier, the importance of the Chengdu Auto Show is waning, and attendance is simply a choice based on weighing pros and cons.

In my view, the wave of collective absences also reflects the increasingly fierce competition in China's automotive market. Amidst market volatility, many automakers are undeniably lost.

Precisely against this backdrop, I didn't want to miss this excellent opportunity to observe the true state of the entire market.

Therefore, I packed my bags and decided to attend this year's Chengdu Auto Show. The most pressing topic naturally focuses on the fierce competition among pure electric, plug-in hybrid, and extended-range electric vehicles, and how far they have progressed.

01 "Chengdu Residents Genuinely Love Electric Cars"

Rationally and objectively speaking, this year's Chinese auto market has witnessed a stalemate between new energy vehicles and traditional fuel vehicles.

The former has not completely crushed the latter as anticipated.

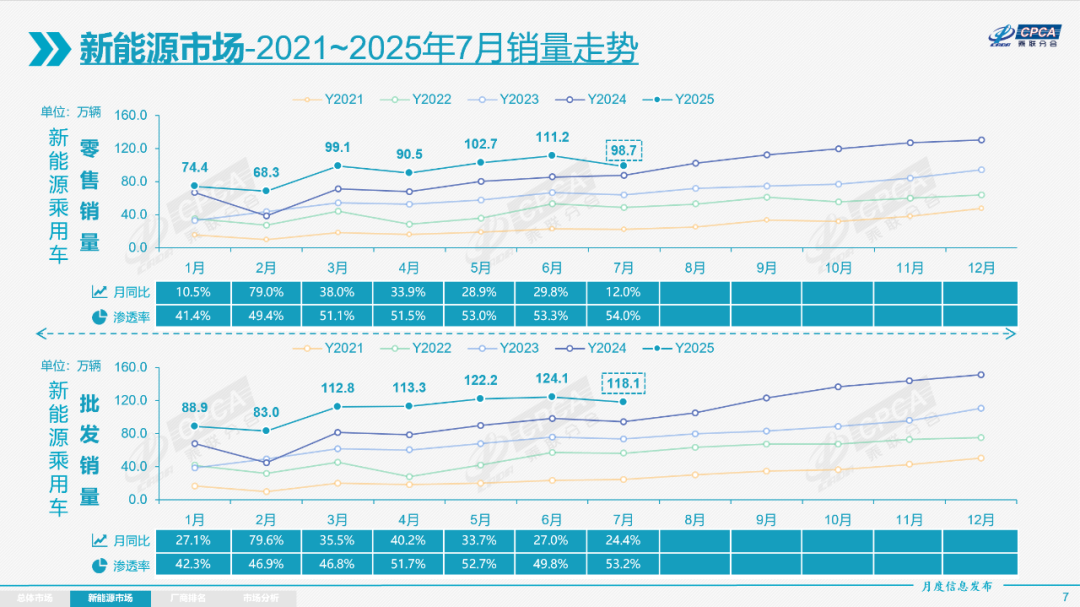

However, when the retail penetration rate of new energy vehicles reached a historic high of 54% in July, it can be said that the "price-cutting strategy" of traditional fuel vehicles trying to gain a temporary advantage with low prices is becoming less effective.

It's a principle that holds true: "Some trends are irreversible."

Take Chengdu as an example. As an important city in the southwest, it sold over 340,000 new cars in the first half of the year, firmly ranking first in the country.

A further breakdown reveals no surprises: new energy vehicles accounted for more than 50%. Among them, sedans had a penetration rate of 52.47%, SUVs 50.84%, and MPVs even reached 56.07%.

It's worth noting that Chengdu does not restrict car purchases and does not offer free "green license plates" like Shanghai. Faced with such data, I can't help but sincerely exclaim: "The local people genuinely love electric cars."

And they especially love domestic electric cars.

BYD, Geely, Xiaomi, HarmonyOS Smart Auto, NIO, XPeng, Li Auto—they have all made it onto everyone's shopping list.

Of course, the "giant" like Tesla is also doing very well in Chengdu, with deliveries surging year-on-year in the first half of the year.

In any case, I have always firmly believed that aside from policy factors, the vibrant Chengdu auto market can be fully regarded as a typical and most convincing microcosm of the electrification transformation process in China's auto market.

Thus, focusing on its new energy sector again, there is an interesting trend: The sales growth rate of pure electric vehicles is significantly faster than that of plug-in hybrids and extended-range electric vehicles.

In fact, as early as the end of last year, I predicted: "As time goes on, the three technical routes are likely to share the market equally."

But as we stride into a new year, we find that the plot is not developing as expected.

Instead, pure electric vehicles have regained their vitality, while plug-in hybrids and extended-range electric vehicles, which were once highly anticipated, have performed lukewarmly.

The most fundamental reason behind this is, on the one hand, the significant upgrade in the product strength of the pure electric camp, attracting more and more first-time buyers and replacement users.

It is said that the next car for plug-in hybrid and extended-range electric vehicle owners will be a pure electric vehicle, and this is quietly becoming a reality.

On the other hand, it is the change in the supply and demand relationship at the terminal. In other words, focusing solely on the market below 200,000 yuan, the influx of new pure electric vehicle models this year has dazzled potential consumers and further grabbed the original share of plug-in hybrid models.

And in the mid-to-high-end segment where extended-range electric vehicles previously had an absolute advantage, with the entry of popular models such as Tesla's refreshed Model Y, Xiaomi YU7, LeDao L90, all-new ES8, and Li Auto i8, signs of gradual loosening have begun to appear.

In short, pure electric vehicles are poised to launch a comprehensive "counterattack".

At this year's Chengdu Auto Show, if you attend in person, you will surely feel that the voice of this camp has quietly risen to an unprecedented height.

At various price points, they are breaking past constraints. And because of this, the situation of "sharing the market equally" among pure electric, plug-in hybrid, and extended-range electric vehicles is almost impossible to achieve.

Of course, "dominating the market alone" is also difficult.

02 "Essentially, It's a Game of Three Kingdoms"

At the beginning of this section, let me first present a set of data.

In 2021, the share of pure electric vehicles in China's new energy vehicle sales was 82%; in 2022, it dropped to 75.7%; in 2023, it continued to shrink to 67%; and by 2024, it was only 58.5%.

Corresponding to this downward curve is the rapid rise of plug-in hybrids and extended-range electric vehicles.

And in the first half of this year, the share of pure electric vehicles rebounded to 62%, finally stopping the decline after a long time.

It is undeniable that positive signals have emerged.

In my view, I have always believed that with the continuous evolution of technical routes, the steady-state relationship between pure electric, plug-in hybrid, and extended-range electric vehicles will likely move closer to "70%, 20%, 10%".

Continuing to take this year's Chengdu Auto Show as an example, you will see that the small car market below 100,000 yuan has almost been completely taken over by pure electric vehicles.

In the mass market of 100,000-200,000 yuan, consumer recognition of pure electric vehicles is rising at an extremely fast pace.

In the price range of 200,000-300,000 yuan, due to the presence of players mentioned earlier such as Xiaomi YU7, Tesla's refreshed Model Y, and LeDao L90, the wave of pure electric vehicles is also coming in strong.

As for the segment above 300,000 yuan, on the eve of the Chengdu Auto Show, due to the continuous showcasing of the power demonstrated by NIO's all-new ES8, Li Auto i8, and AITO M8 EV, a wave of change is also brewing.

From Li Bin to Li Xiang, and then to Yu Chengdong, they are all sparing no effort to promote their own pure electric six-seater SUVs, and even Tesla is trying to get a piece of the pie.

What's even more terrifying is that you will clearly find that many of the new players mentioned above are implementing the principle of "same price for oil and electricity" or even "electricity cheaper than oil" in the final pricing stage, as if flipping the table.

In other words, everyone has realized that it is difficult to obtain high premiums by selling pure electric vehicles. Only by revolutionizing oneself first can consumers feel "super value" and snatch a piece of the pie from plug-in hybrids and extended-range electric vehicles.

And the current environment, where everyone is shouting about consumption downgrading, happens to match the biggest strength provided by pure electric vehicles: "Once you use electricity every day, it's hard to go back to using oil."

Coupled with the continuous decline in the cost of raw materials for power batteries and the increasing number of players entering this field, it undoubtedly occupies the right time, place, and people.

This year, the rebound of pure electric vehicles feels like a natural progression.

Taking advantage of this trend, let's focus on this year's Chengdu Auto Show again. If you attend in person, you will find that plug-in hybrids are still the game of a few traditional independent giants.

For example, BYD, Geely, and Chery.

Whether it is the high threshold at the technical level or the complexity of the supply chain, they both keep most OEMs out.

Of course, once you can skillfully play with plug-in hybrids, you can achieve the enviable goal of "walking on two legs" and quickly obtain qualitative changes caused by quantitative changes.

From the mass market to the mid-to-high-end market, you can enjoy the orders and profit gains brought by it.

And it should be noted that plug-in hybrids are still the "bridgehead" for converting traditional fuel vehicle users. For those potential customers who want to experience new energy vehicles, it is undoubtedly a more compromise choice.

However, from a global perspective, if the timeline is extended, plug-in hybrids will still play the role of a "supplement" behind pure electric vehicles. The later it gets, the less screen time they may have.

As for extended-range electric vehicles, once benefiting from the continuous success of Li Auto and AITO, everyone always felt that there was a huge demand. But this year, the growth rate of this segment is slower than that of pure electric and plug-in hybrid vehicles.

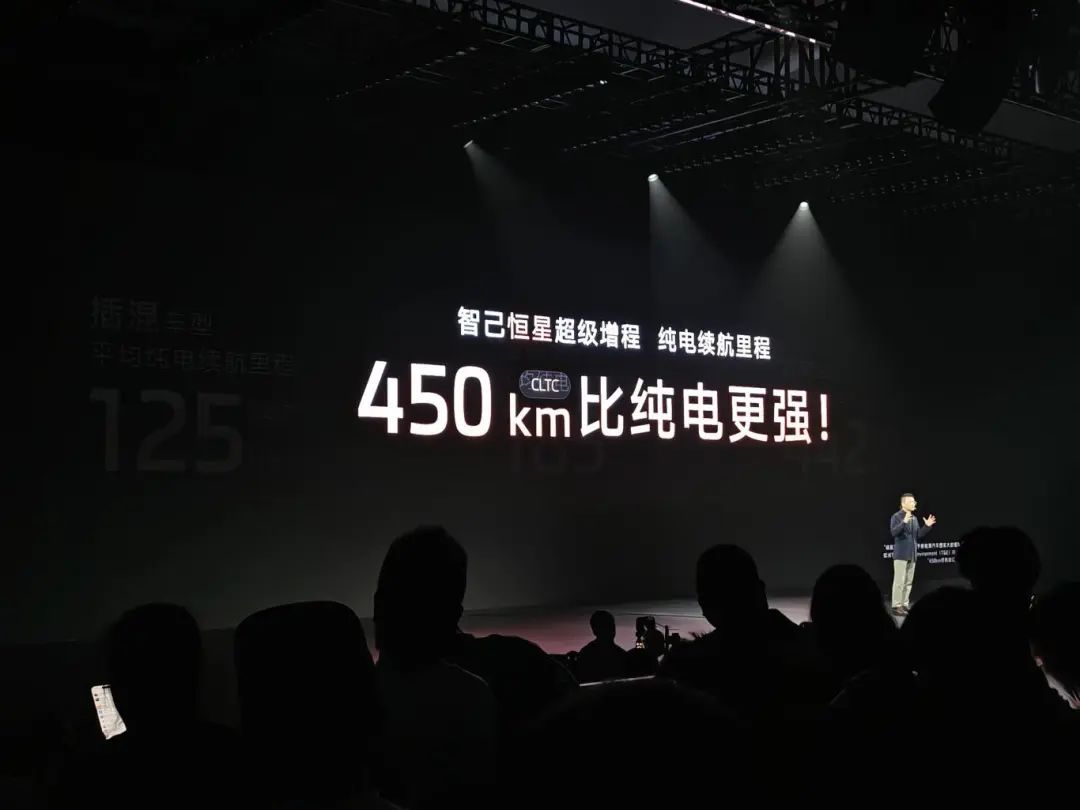

At this year's Chengdu Auto Show, combining the launch logic of several heavyweight products, "ultra-fast charging + large battery + long range" has slowly become the new mainstream trend in the industry.

After relentless promotion, this system has transformed into a "high-end configuration".

It seems that if a new energy vehicle wants to "sell expensively," whether it is an SUV or a sedan, once it has this support, the cost of terminal explanation will be much lower than that of pure electric competitors at the same level, and the enterprise can also obtain higher premiums and gross margins at the business level.

But the subsequent cost is clearly concentrated in the increasingly arrogant product pricing and shrinking audience.

After all, the previously controllable cost was the biggest advantage of extended-range electric vehicles. Nowadays, with the widespread adoption of "ultra-fast charging + large battery + long range," this advantage instantly disappears.

And for most brands, if they want to gain a foothold in the mid-to-high-end market, following the "ultra-fast charging + large battery + long range" trend is indeed a shortcut.

However, besides meeting technical standards, it also requires that there cannot be too many shortcomings in dimensions such as brand image, marketing methods, and product pricing.

At first glance, extended-range electric vehicles seem attractive, but few can feast on them.

The success of Li Auto and AITO has given too many automakers the illusion of "I can do it too." In the future, the true big winners of this game will most likely still be those few.

Of course, if you just follow them and pick up the overflowing traffic, then dabbling in extended-range electric vehicles is not a loss, but it is difficult to become a forever "lifesaver".

As I write this, the article is gradually approaching its conclusion. Finally, I want to say: "This year, the silent competition among pure electric, plug-in hybrid, and extended-range electric vehicles is essentially like an exciting game of Three Kingdoms, and the Chengdu Auto Show provides them with a top-level stage."

In the end, how close will the steady-state market share of the three approach, and will it move closer to the predicted "70%, 20%, 10%"? Time will soon give feedback.

And for now, what can be guaranteed is that the fiercer the competition among the three, the faster the share of traditional fuel vehicles will be squeezed.

As for how OEMs will allocate their subsequent R&D efforts, the only thing that can be affirmed is that pure electric vehicles are definitely the future, and plug-in hybrids and extended-range electric vehicles will not disappear.

Therefore, please invest resources according to your own situation.

And the vast territory of China has created a variety of vehicle usage scenarios and a grand spectacle of multiple technical routes advancing side by side.

The continuous development, iteration, and evolution of pure electric, plug-in hybrid, and extended-range electric vehicles are increasingly enhancing the experiences of consumers in this new era.

"As users, we couldn't be happier."

Editor-in-Chief: Yang Jing, Edited by: He Zengrong

THE END