Tesla's Dominance Faces Challenges as August Sales Reflect Market Shifts

![]() 09/02 2025

09/02 2025

![]() 594

594

A year ago, a commercial battle ended in defeat, but now the tide has turned in favor of new prospects.

In September 2024, amidst the launch of numerous new energy SUVs by Chinese automakers, Li Bin made a rare complaint, stating, "Six major factions surround the Model Y, but Ledo is the one that suffers." However, when November 1 arrived and automakers released their sales figures, models like the XPeng G6, Zeekr 7X, IM Motors R7, IM Motors LS6, Ledo L60, and AITO 07 all performed impressively, yet Tesla's Model Y continued to set new sales highs. In weekly sales, the Model Y's volume alone surpassed the combined sales of several other SUVs.

Fast forward to September 2025, with automakers releasing their August sales figures. There are striking similarities among the sales numbers, with more than five automakers achieving record-breaking performances. The market competition is fierce, and automaker CEOs, industry experts, and analysis agencies have collectively recognized a fact: China's auto market has transitioned from an incremental to a stock market. This means that the market base is fixed, and to achieve sales growth, automakers must capture market share from competitors.

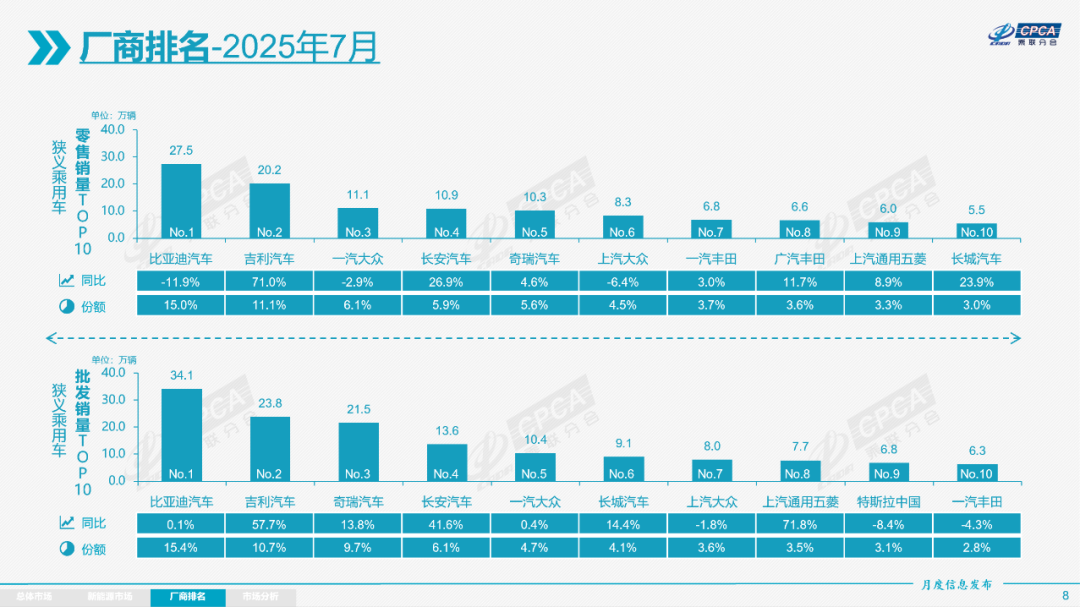

Indeed, from independent brands to new forces, China's leading automakers are growing rapidly. Considering Tesla's current situation, data from the Passenger Car Association reveals that in the first seven months of this year, Tesla China's cumulative retail sales reached 304,000 units, a 6.3% year-on-year decrease, marking the largest decline among the top 10 new energy vehicle manufacturers. Furthermore, the new version of the Model 3, with a range of 830 kilometers, officially reduced its price by 10,000 yuan within a month of its launch. Both consumers and automakers are asking: Is Tesla's golden era in China over?

Fact: From a significant lead to a competitive edge

Analyzing the situation from the brand perspective, Tesla's strong competitors are on the rise.

BYD sold 373,600 units in August, a slight increase from 373,100 units in the same period of 2024. The main reason for maintaining this slight growth in the current market is the rise of its export business. From January to August this year, BYD's cumulative sales exceeded 2.8 million units, and its monthly exports in August surpassed 80,000 units, outpacing XPeng's sales for two months combined.

SAIC Motor sold 363,400 units, up 41.04% year-on-year, while Geely ranked third with a year-on-year increase of 38%. Among the 250,200 sales figures, new energy vehicles accounted for more than 50%, with pure electric sales of 93,000 and plug-in hybrid sales of 54,000, both increasing by over 90% year-on-year. Changan sold 233,000 units, with new energy vehicle sales increasing by 80% year-on-year, reaching 88,000 units in a single month.

Among the data of new force automakers that attract more attention, Zero Running delivered 57,100 units, up 88% year-on-year; Hongmeng Zhixing delivered 44,500 units; XPeng delivered 37,700 units, up 169% year-on-year; NIO delivered 31,300 units, up 55.2% year-on-year; Xiaomi delivered over 30,000 units; Hozon Auto delivered 13,500 units, up 119% year-on-year.

Geely's internally integrated Zeekr Technology delivered 44,800 units, up 11% year-on-year; Dongfeng Motor's internally integrated E-Pi Technology delivered 29,100 units, up 62.39% year-on-year; AITO delivered 10,500 units, up 185% year-on-year. Additionally, Lixiang Auto delivered 28,500 units, and IM Motors delivered 6,100 units.

Considering the above figures as a whole, the core highlights include:

1. Multiple automakers have set new sales records, including NIO surpassing 30,000 units, Ledo L90 exceeding 10,000 units in a single month, XPeng surpassing 37,700 units, Zero Running nearing 60,000 units, and more.

2. Automakers with declining sales include Lixiang Auto and Hongmeng Zhixing. Compared to August 2024's performance of over 48,000 units, Lixiang Auto's sales declined by 41% year-on-year and about 7% month-on-month. Meanwhile, Hongmeng Zhixing also experienced two consecutive monthly declines, with a decline of 9.47% in July and 6.64% in August. However, Huawei's subsequent potential is significant, with the Wenjie H5 set to launch in September, and large-scale deliveries of models such as Wenjie M8 and IM Motors R7 expected in September.

Regarding Tesla's sales, the following factors are influential:

Companies with overlapping price points with Tesla include NIO, Ledo, Hozon Auto, Lynk & Co, Zeekr, Xiaomi, AITO, Lixiang Auto, and Hongmeng Zhixing.

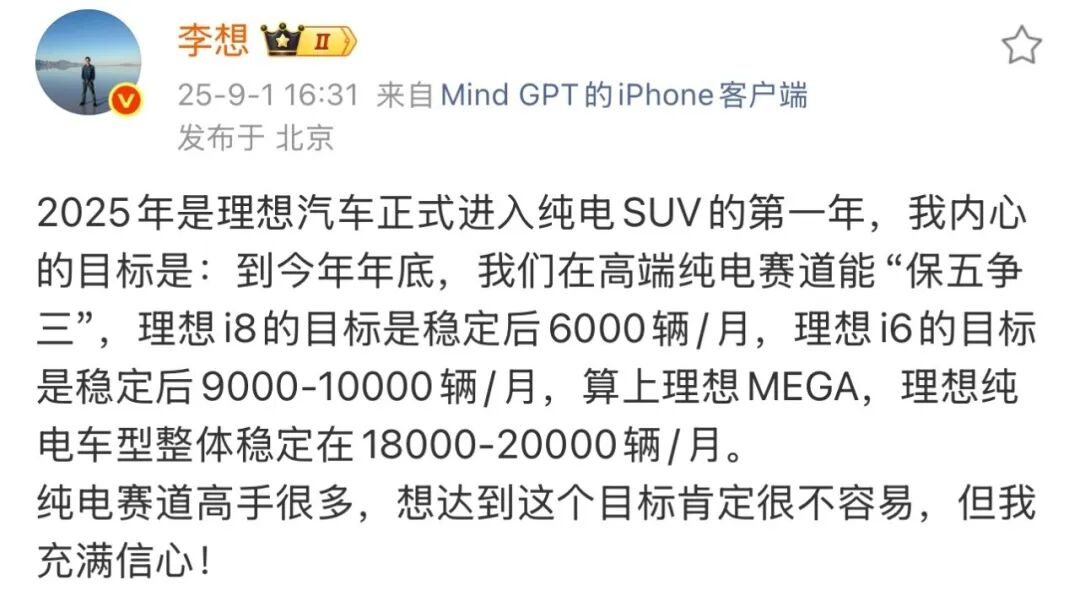

Apart from Lixiang Auto's declining sales, the sales of other automakers are growing. Although Lixiang Auto's sales have declined, the emergence of Lixiang i8 has effectively taken away Tesla Model Y's market share. Li Xiang has set a steady-state target for Lixiang i8 of 6,000 units per month.

However, is Tesla really struggling in China? The answer is not entirely so. The current reality is that Tesla's sedans are facing sales challenges in China and globally, but its SUVs still retain good market effectiveness. For example, the sudden launch of the Model Y L immediately attracted a large crowd to its stores, and Tesla has also altered its previous high-pricing strategy, with a starting price of 339,000 yuan, lower than the Lixiang i8, demonstrating its cost-effectiveness advantage.

Furthermore, Musk announced during a conference call that a "budget Model Y" will be launched in the fourth quarter of this year, with a price likely to drop to around 150,000 yuan.

All of the above indicates that Tesla's sales performance in China is no longer as dominant as it was from 2020 to 2024, but it maintains a relatively leading position in niche markets.

Are He Xiaopeng and Li Xiang's predictions beginning to falter?

Regarding how to interpret the current market sales situation, there can be two explanations. The first is that Chinese brands have obvious advantages in update speed, accurately grasping consumer demand, cost control, and new technology application. The most crucial evidence is that major brands almost annually launch at least two or more heavyweight new models to compete for sales, whereas Tesla's Model 3 and Model Y have significantly slower upgrade cycles.

The second explanation reveals more profound truths. Every era has its own top-tier celebrity brands, but when social perceptions change, these top-tier brands often suffer the greatest impact. In today's mobile internet era, everyone has abundant information access channels, making it easy to demystify overly mythologized things, and the boomerang of traffic can backfire.

For Tesla, can intelligent driving, or even autonomous driving, quickly reverse sales trends?

The answer to this question not only concerns Tesla but also the overall market trend.

What is happening now directly contradicts previous predictions and requires revision. For example, the previous judgments of Li Xiang and He Xiaopeng now need to be questioned.

For instance, from the perspective of intelligent driving assistance or even autonomous driving, He Xiaopeng has publicly stated multiple times that without AI capabilities, if autonomous driving cannot be achieved, and if annual sales cannot reach 3 million units, one will be eliminated in the upcoming elimination rounds.

His statements about elimination are divided into two types. One is from an internal letter at the beginning of 2025, stating that the elimination rounds in the automotive industry will take place from 2025 to 2027. The other is from an interview in July 2025, where he said that the next five years will be the final five years of the elimination rounds for China's automotive industry.

The main argument is that if strong AI capabilities, including intelligent driving, autonomous driving, and robotics, cannot be achieved, there will not be particularly good competitiveness. Simultaneously, he predicts that in the final five years of the elimination rounds, the current passenger vehicle market, with about 70 sub-brands, will undergo a large number of mergers and acquisitions, likely leaving only a dozen or even fewer, such as 5-7 companies.

However, combining the sales figures from January to August, this trend does not seem very clear. It is evident from the sales figures and structure of various automakers that when L2 intelligent driving assistance has almost become a standard configuration in the industry, while there may be a significant breakthrough in the future, the growth it can currently bring is limited.

BYD has achieved a balance between high-speed intelligent driving assistance and intelligent parking assistance. Its sales increased slightly in August, and from the financial report, its reduced profit was also impacted by the rising cost of standard intelligent driving assistance. Similarly, among the two automakers that currently perform best in intelligent driving assistance, XPeng's single-brand sales trend is indeed good, exceeding 30,000 units for multiple consecutive months. However, the boost to sales only hovers around a few thousand units.

The sales figures from January to March were 30,300, 30,400, and 33,200 units, respectively, and from April to June, they were 35,000, 33,500, and 34,600 units, respectively. The sales figures for July and August were 36,700 and 37,700 units, respectively.

Huawei does not directly manufacture cars, so although Hongmeng Zhixing's sales have fluctuated month-on-month, combined with the market performance of Hozon Auto, AITO, Audi, etc., its penetration rate is clearly increasing rapidly.

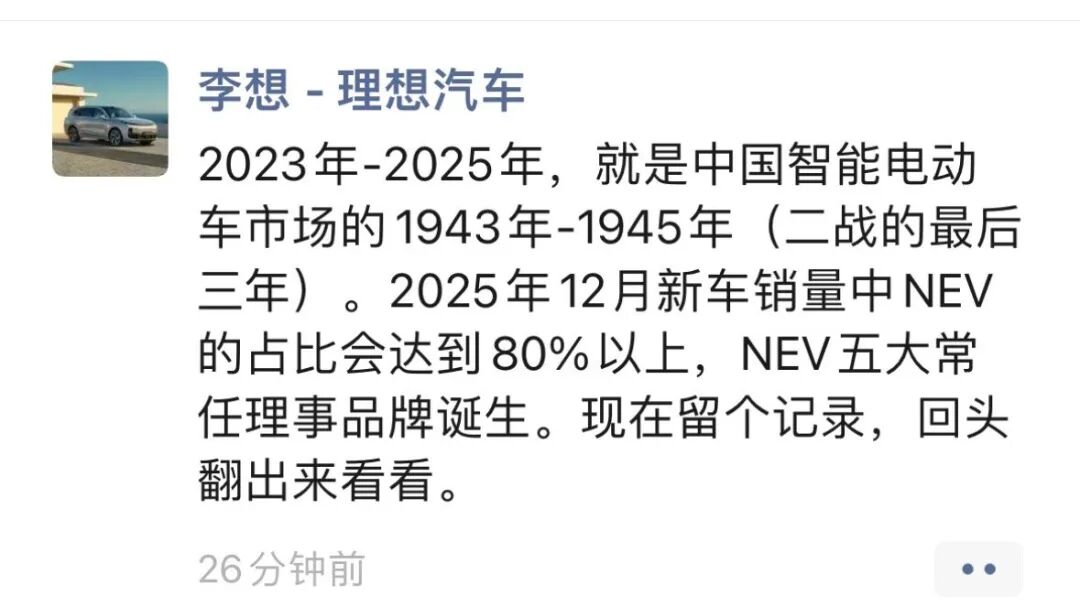

In addition, Li Xiang has also made relevant predictions. In 2023, he stated that by the end of 2025, the penetration rate of new energy vehicles will reach over 80%, and the market will be dominated by five major brands.

However, from the sales performance trend throughout 2025, it is clear that the automotive market's trend is not as highly concentrated in the hands of a few companies as smartphones, nor is it possible for anyone to achieve unsurpassable success by relying solely on a unique technology.

Final Thoughts

Cars require more consideration of overall performance, which is distinct from other smart devices such as computers, mobile phones, tablets, or glasses.

Apart from the topics mentioned above regarding intelligent driving, AI, Tesla, etc., more trend shifts can be observed. For example, automakers have now entered an era of systematic competition, where those with stronger systemic capabilities can maintain vitality.

For instance, Geely is currently promoting various graded applications of the Leishen electric hybrid across