BYD Invests 30.9 Billion Yuan in R&D for H1 2025, Reaffirming Its Position as the A-share 'R&D King'

![]() 09/02 2025

09/02 2025

![]() 555

555

Recently, the second-quarter and half-year financial reports of A-share listed companies have been released, and the R&D investment figures of technology-driven enterprises have garnered significant attention.

Data reveals that in the first half of 2025, BYD's R&D investment amounted to 30.9 billion yuan, nearly double its net profit for the same period, marking a year-on-year increase of 53%. This positions BYD as the 'R&D King' among A-share listed companies.

For technology-centric enterprises, the conversion of R&D investment into innovative competitiveness is crucial for their future sustainability. BYD, for instance, has directly benefited from its substantial past R&D investments, which have fueled its sales growth. Moreover, continuous R&D investment remains the core driver for BYD's future sales expansion.

BYD's R&D Investment: Surpassing 210 Billion Yuan in Total

BYD's financial report indicates that in the first half of 2025, the company achieved operating revenue of 371.3 billion yuan, a year-on-year increase of 23%. Net profit attributable to shareholders of listed companies was 15.5 billion yuan, up 14% year-on-year. Notably, BYD's R&D investment during this period reached 30.9 billion yuan, almost twice its net profit.

A longitudinal analysis shows that BYD's commitment to R&D is consistent: from 2011 to 2024, R&D investment exceeded net profit in 13 years, with cumulative investment surpassing the 210 billion yuan mark.

According to data from the China Association for Public Companies, the year-on-year growth rate of R&D investment for listed companies across the market in the first half of the year was only 3.27%, whereas BYD's growth rate of 53% significantly outpaced the industry average.

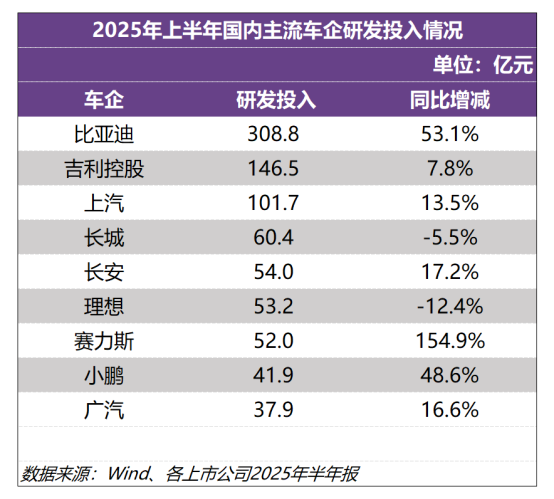

In a horizontal comparison, in the first half of this year, Geely Holding, SAIC Motor, and Great Wall Motor invested 14.7 billion yuan, 10.2 billion yuan, and 6 billion yuan in R&D, respectively. BYD's R&D investment alone is equivalent to the combined total of these three companies.

Beyond the automotive industry, BYD has emerged as the R&D leader among all A-share listed companies, surpassing renowned enterprises such as China State Construction Engineering Corporation, ZTE Corporation, and China Mobile.

Explosion of Automotive New Technology: R&D Achievements Translate into Market Competitiveness

BYD's substantial R&D investment has translated into innovative competitiveness. In recent years, BYD has launched numerous innovative achievements, including the Tian Shen Zhi Yan intelligent driving assistance system, the super e-platform supporting megawatt flash charging, and the Ling Yuan vehicle-mounted drone system. Notably, in July 2025, BYD announced that it would fully cover the safety and liability for intelligent parking for all Tian Shen Zhi Yan vehicles in the Chinese market, signaling a global technological breakthrough comparable to L4-level intelligent parking.

BYD's technology commercialization process is swift. Only six months after launching the 'National Intelligent Driving' strategy, sales of models equipped with Tian Shen Zhi Yan exceeded 1.2 million units, making BYD the domestic auto enterprise with the highest sales volume of intelligent driving assistance models. Tian Shen Zhi Yan has also become the largest assisted driving system installed in the Chinese market.

Market Validation: Global Layout, High-End Breakthrough

Cutting-edge technologies have effectively bolstered BYD's global market competitiveness, leading to a significant increase in overseas business revenue. In the first seven months of 2025, BYD's overseas sales of passenger vehicles and pickup trucks reached 550,000 units, surging by over 130% year-on-year. These seven-month sales figures have already surpassed the total sales for the entire year of 2024.

As of July 2025, BYD's new energy vehicles have been sold in over 112 countries and regions worldwide, securing the top position in new energy vehicle sales in Italy, Turkey, Spain, Brazil, and other countries.

BYD's high-end strategy has also yielded remarkable results. The three brands Fangchengbao, Denza, and Yangwang sold a cumulative total of 160,000 units in the first half of the year, with a year-on-year increase of over 75%, demonstrating the brand's upward trajectory powered by technology.

Technical Foundation: Leading in Patents, Accumulated Through Years of Effort

In the patent ranking data recently released by the China Automotive Technology and Research Center, BYD ranked first in three categories: 'Global Automobile New Energy Technology China Patent Authorization Volume', 'Global Automobile Hybrid Technology China Patent Authorization Volume', and 'Global Automobile Pure Electric Technology China Patent Authorization Volume'.

As electrification and intelligence become pivotal in the global automotive industry's transformation, the intensity of R&D investment has emerged as a key metric for assessing automotive brands' future competitiveness. With its massive R&D investments far exceeding the industry average, BYD is poised to establish a technological moat in the new energy era, propelling China's auto industry from a 'follower' to a 'definer', and earning greater recognition for Chinese autos on the global stage.