NIO Q2 2025: Pivoting at the Crossroads of Success

![]() 09/03 2025

09/03 2025

![]() 493

493

Produced by ZhiNeng Technology

After enduring fierce competition and operational pressures over the past two years, NIO aims to revitalize market confidence by introducing new models, enhancing cost efficiency, and leveraging its long-term technological advancements.

During the Q2 earnings call, Li Bin emphasized that automotive product competitiveness hinges on three pillars: technology roadmap, product strategy, and product definition. Judging by NIO's recent sales performance and future product roadmap, it's evident that this pioneering new-energy automaker stands at a pivotal structural turning point, despite the challenges and uncertainties it faces.

01 Decade-Long Technological Accumulation and Strategic Planning

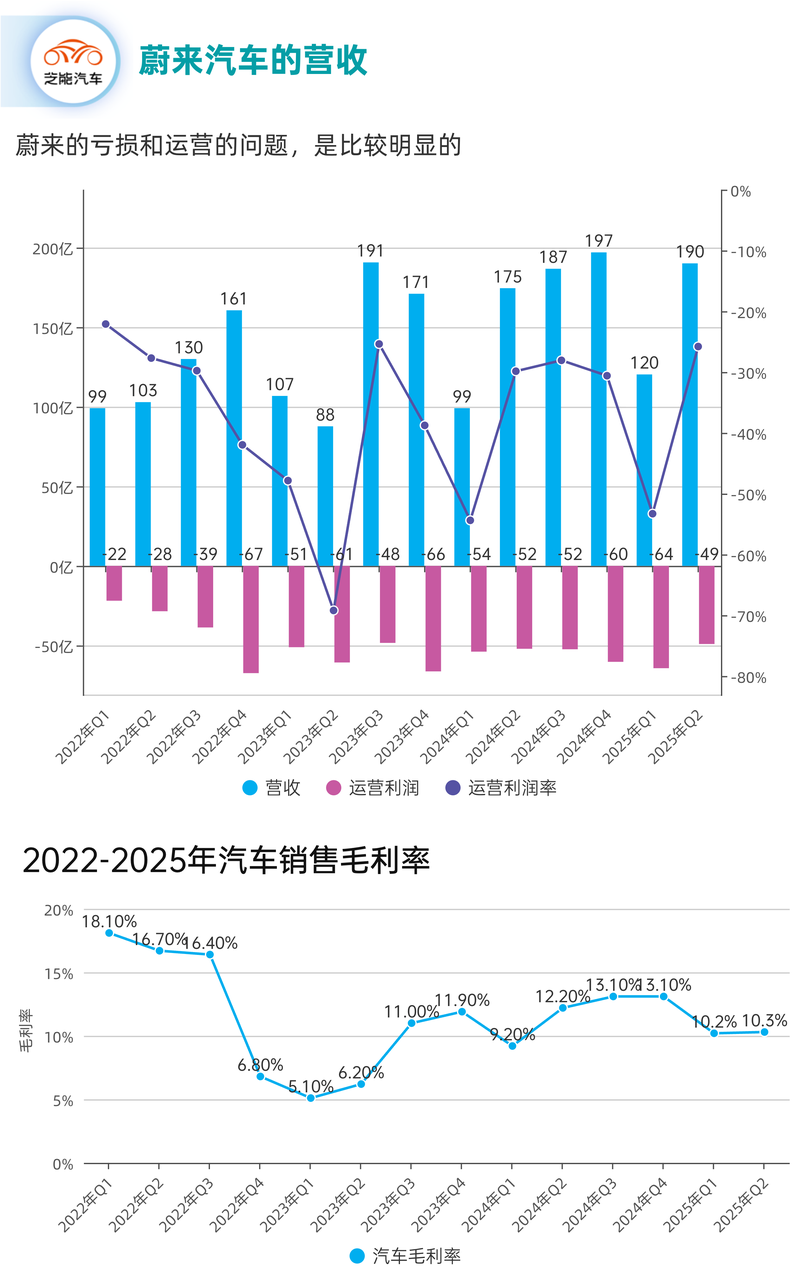

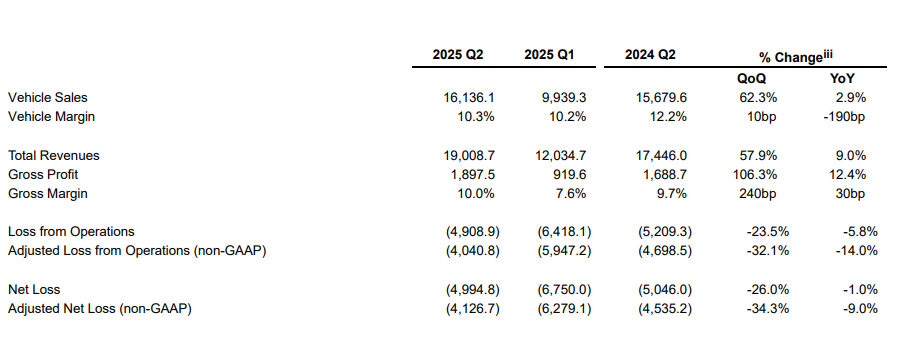

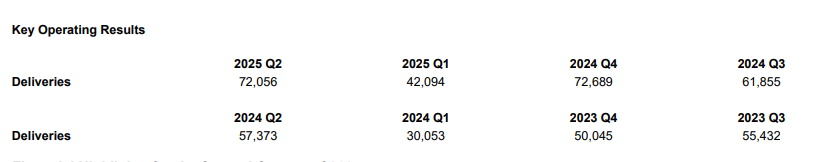

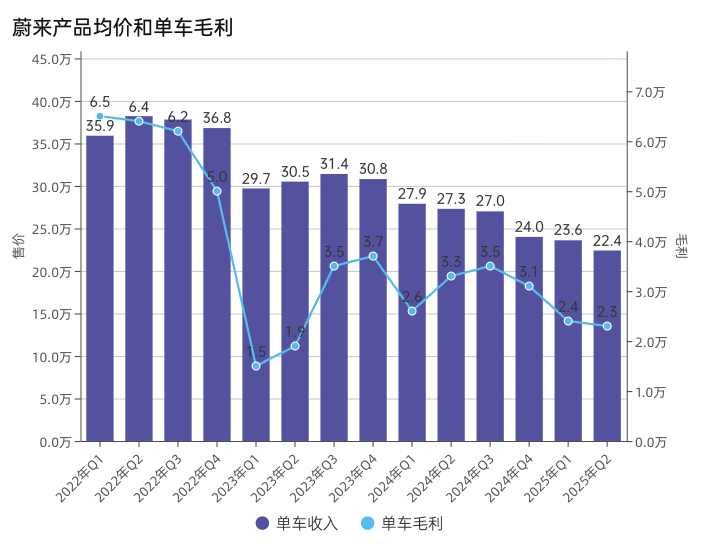

In Q2 2025, NIO delivered 72,056 vehicles, marking a 25.6% YoY increase and a 71.2% QoQ surge. This robust sales performance drove revenues to RMB 19.01 billion, up 9% YoY and 57.9% QoQ.

Fueled by a significant sales rebound, the overall gross margin improved to 10% in Q2, with the vehicle gross margin and other sales gross margin turning positive for the first time at 8.2%, setting a new record high.

Overall cash flow and cash reserves increased quarter-over-quarter, signaling a resurgence in financial stability.

Looking ahead to Q3, the company anticipates delivering 87,000 to 91,000 vehicles, representing a 40.7%-47.1% YoY growth, with revenue guidance ranging from RMB 21.81 billion to RMB 22.88 billion, both setting new highs.

Li Bin reiterated during the earnings call that "choosing the right technology roadmap is crucial for product competitiveness." Since its inception, NIO has steadfastly adhered to the pure electric path, a bold decision amidst the industry's widespread embrace of extended-range and hybrid vehicles.

Over the past decade, NIO has invested over RMB 60 billion in R&D, focusing on areas such as intelligent driving chips, operating systems, and intelligent chassis. From 2022 to the present, its quarterly R&D investment has consistently hovered between RMB 2 billion and RMB 3 billion, with R&D expenditures remaining unaffected even under severe financial pressures. This "countercyclical" commitment has gradually allowed NIO to build its technological barriers.

CFO Qu Yu noted that the cost reduction benefits of L90 and ES8 stem from in-house development of key components, as well as leveraging long-term procurement and economies of scale. The goal is to achieve a single-vehicle gross margin of 20% in Q4, reflecting the transformation of technological value into profitability.

At the product strategy level, NIO is catering to different user segments through a multi-brand approach. The NIO brand continues to target the high-end market, while Letao serves the mid-range mass market, and Firefly focuses on small cars and younger consumer groups.

This strategy avoids internal competition and allows each brand to pursue distinct gross margin targets: NIO aims for over 20%, Letao maintains 15%, and Firefly targets around 10%. Through a differentiated brand matrix, NIO aims to establish a sustainable profit model amidst intense price competition.

Post-2026, the company plans to continue launching multiple new vehicles annually to ensure continuous product innovation.

02 Refining Product Definition and Market Rhythm

While the technology roadmap and product strategy set NIO's long-term direction, product definition serves as the "finishing touch" that determines its competitive edge.

Li Bin acknowledged during the earnings call that NIO had experienced setbacks in product definition.

Certain models deviated from market expectations in terms of functional configuration, pricing strategy, and user experience, leading to sales pressure and impacting overall profitability. While this process was challenging, it provided invaluable lessons for NIO.

Letao L90 epitomizes NIO's refined product definition.

As a large five-seat pure electric SUV, it strikes a balance between space, performance, and price while maintaining NIO's technological prowess in intelligent driving and energy efficiency.

Deliveries exceeded 10,000 units in the first month, setting a new record for NIO, demonstrating that its product definition aligns closely with user needs. The phenomenon of L90 driving L60 sales further confirms the halo effect of a hit product on the overall brand.

The all-new ES8 embodies the strategic importance of the high-end market.

As a large seven-seat SUV, it has undergone comprehensive upgrades in battery capacity, chassis structure, and intelligent cockpits. Market response has been overwhelmingly positive, with order volumes surpassing the company's initial conservative estimates. As a result, the supply chain has accelerated capacity expansion, underscoring the growing popularity of pure electric three-row SUVs.

Li Bin stated directly, "The golden age of extended-range three-row SUVs is waning, and the era of pure electric three-row SUVs is dawning." This assessment not only captures market trends but also underscores NIO's confidence in its technology roadmap.

Financial data also supports the effectiveness of these adjustments.

◎ Q2 2025 revenue reached RMB 19.01 billion, up 9% YoY and 57.9% QoQ;

◎ Overall gross margin improved to 10%, with net losses narrowing by 26% QoQ;

◎ Cash reserves increased to RMB 27.2 billion.

If the gross margin reaches the targeted 16%-17% in Q4, the company is poised to achieve single-quarter profitability. This represents not only a financial milestone but also a critical moment for NIO to regain trust in the capital market.

Enhanced organizational efficiency has also played a supporting role.

NIO's implementation of the CBU (Basic Business Unit) reform has made product line operations more agile and efficient, with each unit independently accountable for profitability. This lean management approach, akin to Toyota's, reduces internal friction and accelerates market response.

Coupled with efficient R&D measures, NIO has achieved higher ROI with limited resources. The sales and financial improvements in Q2 have initially showcased the positive impact of this transformation.

Summary

Reflecting on NIO's development journey, technological accumulation, product strategy, and product definition collectively form the cornerstone of its competitiveness.

Over the past few years, while NIO has consistently invested in technology and strategy, deviations in product definition led to operational hurdles. However, the market success of L90 and the all-new ES8 demonstrates that NIO is addressing these weaknesses and re-establishing a user-centric product philosophy. We eagerly anticipate whether it can achieve profitability in Q4.