European Auto Market | France August 2025: MG and BYD Surpass 1,000 Sales Milestone

![]() 09/03 2025

09/03 2025

![]() 561

561

Produced by ZhiNeng Technology

August 2025 marked the first year-on-year growth in the French new car market, albeit from a low base. The market is swiftly embracing electrification and hybridization, with traditional gasoline models seeing significant declines.

While French local brands maintain a leading position, Chinese brands, notably BYD, are making significant inroads into the new energy sector.

01 Overview and Competitive Dynamics of the French Market

In August 2025, French new car registrations totaled 87,850 units, up 2.2% year-on-year, signaling the market's first recovery. However, last year's sales were at a decade-low, limiting the growth rate's significance. Cumulative sales for the first eight months fell 7.1% to 1,046,432 units.

The shift towards electrification is evident in the powertrain mix:

◎ Gasoline car sales dropped by 32.4%, reducing their market share to just 20.9%;

◎ Diesel car sales declined even more, down 26.9% year-on-year, with their share dipping below 5%.

In contrast, hybrid and electric vehicles continue to gain traction:

◎ Hybrid models accounted for 45.2% of total sales, with plug-in hybrids maintaining a 6.7% share despite a 5% decline;

◎ Pure electric vehicle sales rebounded strongly, reaching 16,992 units in August, up 29.3% year-on-year, and capturing a 19.3% market share, the highest since September 2024.

This transformation underscores French consumers' gradual shift towards new energy vehicles, balancing energy prices, policy incentives, and vehicle acquisition costs.

In terms of brand performance, local manufacturers dominate:

◎ Renault led with 13,108 units and a 14.9% share;

◎ Peugeot followed closely but recorded a 1.1% decline in August;

◎ Dacia, in third place, fell by 6.4% year-on-year, showing signs of fatigue;

◎ Citroen benefited from a low base last year, surging 30.9% this month, re-entering the top five;

◎ International brands like Toyota, Volkswagen, BMW, and Skoda showed mixed results, with Hyundai growing by 31% and its market share rising to 4%, a three-year high;

◎ Notably, MG grew by 56%, and Nissan, Mini, and Cupra saw increases exceeding 60%, demonstrating the agility of second-tier joint ventures and emerging brands.

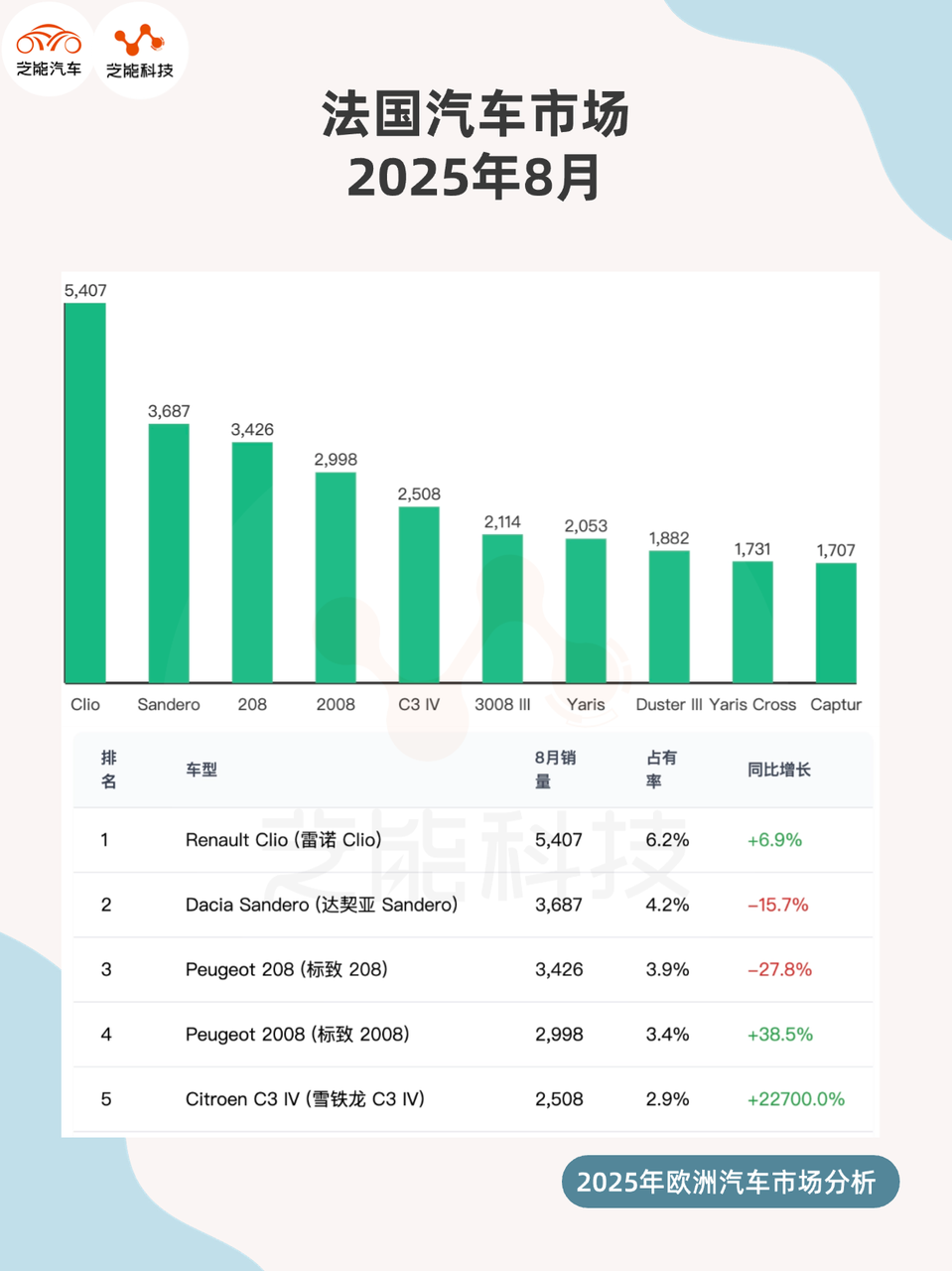

Model Performance

◎ Renault Clio led with 5,407 units and a 6.2% share, reclaiming the top spot;

◎ Dacia Sandero and Peugeot 208 saw declines of 15.7% and 27.8%, respectively;

◎ Peugeot 2008 bucked the trend with a 38.5% increase, highlighting the SUV segment's resilience;

◎ Citroen C3 and Peugeot 3008 also ranked highly;

◎ Among new energy models, Renault 5 emerged as the best-selling pure electric vehicle in France with 1,412 units, reflecting consumer confidence in local EVs;

◎ BYD Seal U entered the top 40 with 645 units sold, marking a strategic entry for the Chinese brand and indicating its gradual penetration into the competitive French market.

After two years of decline, the French auto market is seeking growth through the transition to new energy. Local brands dominate, but the international competitive landscape is opening up, providing opportunities for new entrants.

02 Chinese Brands' Performance in the French Market

In this transformation, the growth of Chinese brands stands out.

◎ BYD sold approximately 1,050 units in August, a year-on-year increase of 600%, with market share rising to 1.2%, up from 0.2% in the same period last year. Its flagship model, Seal U, sold 645 units in a single month, surging 1854.5% year-on-year, marking the first time a Chinese model entered the French top 40.

Given France's evolving subsidy policies for new energy vehicles and increasing consumer acceptance of EVs, BYD's performance indicates that its strategy of balancing technology and affordability is gaining recognition.

◎ MG continued to expand on its cost-effectiveness, selling 1,622 units in August, up 56% year-on-year, and solidifying its position among the market's top 15.

This achievement not only underscores MG's established presence in Europe but also highlights the burgeoning success of Chinese brands in the French market.

Not all Chinese automakers have achieved rapid breakthroughs. New entrants like Zero Running and JeepCool have yet to make significant sales in France, due to the market's conservatism and consumers' reliance on robust after-sales service networks.

From a competitive standpoint, Chinese brands' advantage lies in the maturity of their electric vehicle industry chain.

While electric vehicles account for nearly 20% of the French market, local manufacturers rely heavily on models like Renault 5 and a few hybrids, lacking a comprehensive product matrix. BYD's strength lies in its full-line electric platform and battery self-sufficiency, enabling it to offer competitively priced models in the popular mid-size SUV segment.

Summary

The French auto market is undergoing a structural transformation, with traditional gasoline models declining rapidly, making way for new energy vehicles. Local manufacturers remain strong, but the emergence of Chinese brands, particularly BYD's entry into the top 40 with Seal U, signifies that Chinese automakers are no longer fringe players but legitimate competitors in the global arena.