European Auto Market | Italy, August 2025: MG, Chery, and BYD Shine Brightly

![]() 09/05 2025

09/05 2025

![]() 518

518

Presented by Zhineng Technology

In August 2025, the Italian new car market continued its sluggish performance, with a total of 67,272 units sold, marking a 2.7% decline compared to the same period last year. Cumulative sales for the year so far have dropped by 3.7% year-on-year and are still 21.5% lower than the pre-pandemic levels of 2019. Private consumption kept contracting, while manufacturer self-registrations and leasing operations bolstered the overall sales framework, sparking concerns about the market's vitality.

From an energy structure standpoint, gasoline and diesel models continued their steep decline, whereas hybrid, plug-in hybrid, and battery electric vehicles (BEVs) sustained growth, with plug-in hybrids nearly doubling their sales.

Regarding brand and model performance, the domestic brand Fiat experienced a robust rebound, with the Panda series remaining a cornerstone of its sales, while the new Panda swiftly captured mainstream attention.

International brands displayed mixed results, with Kia's Sportage making its debut in the top 10, highlighting the potential breakthroughs for Korean models. Meanwhile, Chinese brands such as BYD, Chery Omoda, Jetour, MG, and others continued their impressive growth trajectory, emerging as new forces in the market.

01 Shifts in the Italian Market and Energy Structure

The Italian auto market remained sluggish in August 2025, with sales dipping to 67,000 units year-on-year and a cumulative drop nearing 4%. Compared to pre-pandemic levels, the market was still 285,000 units smaller, indicating an extended period of contraction.

Structural Trends:

◎ Private car purchases declined by 14.6%, with their market share dropping from 62.7% to 55.1% year-on-year. Consumer purchasing sentiment remained low due to high interest rates, inflationary pressures, and economic uncertainty.

◎ In contrast, manufacturer self-registrations surged by 41%, while long-term and short-term leasing increased by 5.9% and 46.9%, respectively. Dealer and leasing channels stepped in to bridge the retail gap.

The transition in powertrain technologies became more pronounced:

◎ Traditional gasoline vehicles saw a 13.9% year-on-year decline, accounting for less than a quarter of the market.

◎ Diesel vehicles experienced a steeper drop of 41.4%, with their market share shrinking to just 8.1%.

◎ Liquefied petroleum gas (LPG) models also witnessed a decline.

In stark contrast, hybrid and new energy vehicles experienced growth:

◎ Hybrid vehicles rose by 8.7% year-on-year, capturing nearly half of the market and becoming the dominant force.

◎ Plug-in hybrids nearly doubled their sales, with their market share increasing to 7.1%.

◎ Battery electric vehicles (BEVs) maintained a 26.9% growth rate, accounting for nearly 5% of the market. The auto market's energy structure is rapidly shifting towards electrification. While the base for BEVs remains small, growth is primarily driven by policy incentives and new product launches. Whether the market can sustain this expansion remains uncertain.

At the brand level:

◎ Domestic brand Fiat emerged as August's standout performer, with sales increasing by 31.7% year-on-year, reclaiming the top spot. Its 9.3% market share remained slightly below the year-to-date average, but the strong performance of the Panda series undoubtedly boosted market confidence.

◎ Toyota, Volkswagen, and Dacia all saw sales declines, while BMW, despite an 8.1% drop, maintained its fifth-place ranking, a historical high.

◎ French brands faced significant setbacks, with Renault, Peugeot, and Citroën showing mixed results. Renault and Peugeot saw sales drops exceeding 20%, while Citroën surged by 75.4%, indicating a localized recovery driven by product renewals.

At the model level:

◎ The Fiat Panda maintained its top position, with a 24% year-on-year increase and a 6.1% market share.

◎ The Dacia Sandero saw a decline but held onto second place.

◎ The Jeep Renegade grew by 11%, returning to third place.

◎ The Toyota Yaris Cross ranked fourth.

◎ The Dacia Duster slipped to fifth.

◎ Mid-tier competition intensified, with MG ZS, Volkswagen Tayron, and Toyota Yaris maintaining steady performance, while the Ford Kuga faced significant pressure.

◎ Most notably, the Kia Sportage made its debut in the top 10, ranking tenth and achieving its best-ever result in the Italian market. This indicates that Korean brands are gradually breaking through established patterns and achieving breakthroughs in the mainstream compact SUV segment.

02 Performance of Chinese Automakers

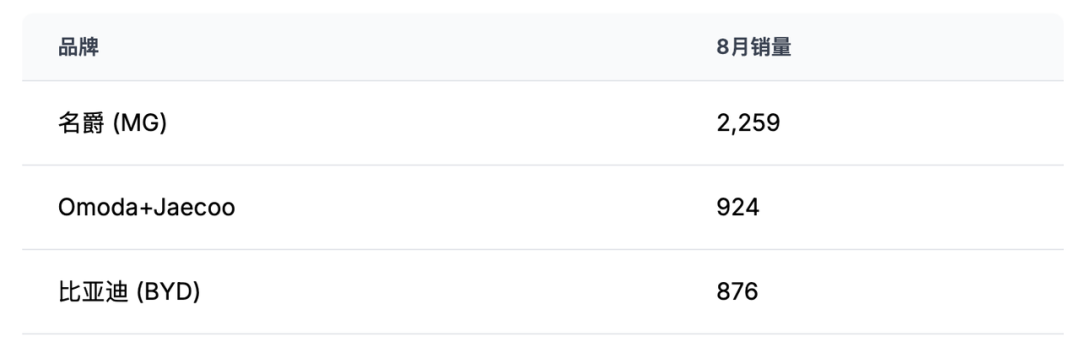

BYD's sales nearly tripled year-on-year, while Chery's Omoda+Jaecoo combination saw nearly double-digit growth, and MG achieved double-digit improvement. These brands defied the sluggish market trend, reflecting Italian consumers' recognition of their competitive pricing and advanced configurations.

◎ MG ranked 14th overall with 2,259 units sold, up 12.8% year-on-year. Its MG ZS SUV model broke into the top 10 in Italy's SUV segment, with monthly sales reaching 1,358 units.

◎ BYD's surge was particularly remarkable, with 876 units sold in August, marking a nearly 293% year-on-year increase. The Seal U plug-in hybrid SUV alone contributed 549 units, marking a significant breakthrough into mainstream European family markets.

◎ Chery's Omoda+Jaecoo combination maintained strong growth, with monthly sales reaching 924 units, a nearly 200% year-on-year increase, entering the top 22 for the first time.

◎ DFSK, though still relatively small in scale, achieved 93 units sold with its low-cost multifunctional models, a year-on-year increase exceeding 150%.

Summary

The Italian auto market remained under pressure in August 2025, with the persistent contradiction between weak private consumption and overall market contraction. The decline of traditional fuel vehicles is now an established trend, while hybrid and new energy vehicles have emerged as the growth engines.