Traditional Giants Unleash New Energy: Are We Prepared for the Seismic Shift?

![]() 09/05 2025

09/05 2025

![]() 448

448

Preface

Introduction

The new energy brand landscape now includes offerings from traditional automakers, encompassing both domestic and joint - venture players.

Which brand stole the limelight at this year's Chengdu Auto Show? Without a doubt, Hongmeng Zhixing cemented its position as one of the most sought - after booths. After all, in previous auto shows, Hongmeng Zhixing's four “Jie” (boundary) brands had always been the center of attention. Now, with the addition of Shangjie, Hongmeng Zhixing has reached unprecedented levels in terms of both scale and influence.

Displaying the logos of five “Jie” brands side by side creates a visually stunning impact that leaves every passerby in awe. In fact, it's not just Hongmeng Zhixing. After Huawei's collaboration with multiple traditional automakers, these companies swiftly filled the gaps in their intelligent capabilities for the new energy era, setting the stage for a new round of intense competition.

For a long time, new car - making forces were the undisputed mainstream in China's new energy vehicle (NEV) sector. However, as time passed and through successive rounds of competition, the number of new car - making forces has dwindled from hundreds to just a handful. This is an inevitable outcome of the automotive industry's evolution. Introducing a 'catfish' into the fishpond isn't about nurturing the catfish but about invigorating the other fish.

Now, the new energy brands nurtured by traditional automakers have grown robustly. Brands such as Geely Galaxy, Changan Qiyuan, and eπ Tech, among others, are starting to make a significant impact in terms of sales.

01 Breaking Doubts with Data

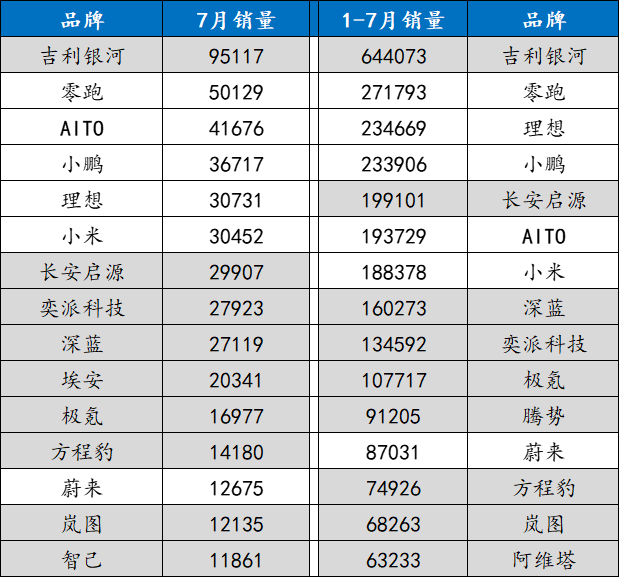

The latest NEV sales data for July and the period from January to July clearly reveal a trend: new energy brands from traditional automakers are gradually taking center stage and becoming a formidable force in the market.

In this chart, brands like Geely Galaxy, Changan Qiyuan, Shenlan, eπ Tech, Aion, Zeekr, and Voyah, mostly affiliated with traditional automotive groups, not only show steady sales but some have even surpassed certain new forces, marking a profound transformation in the competitive landscape of China's NEV market.

Looking at the specific data, new energy brands with traditional automaker backgrounds are performing impressively. Geely Galaxy leads the pack with 95,117 units sold in July and a cumulative 644,073 units from January to July, far outpacing many new forces. Shenlan and Changan Qiyuan, under Changan Automobile, achieved monthly sales of 27,119 and 29,907 units, respectively, with cumulative sales exceeding 130,000 units each. Additionally, brands like eπ Tech from Dongfeng Motor, Aion from GAC Group, and Zeekr from Geely, have also entered the top ranks in terms of sales.

It's particularly noteworthy that these brands exhibit strong sales stability. For instance, Geely Galaxy's cumulative sales from January to July have exceeded 640,000 units, while eπ Tech has reached 160,000 units, demonstrating sustained market penetration capabilities. In contrast, some well - known new forces like NIO and XPeng have seen their sales surpassed by multiple new energy brands from traditional automakers.

There was a time when China's NEV market was almost entirely dominated by new forces like NIO, XPeng, and Li Auto. However, with traditional automakers fully entering the fray, the market landscape has gradually shifted from being new - force - dominated to a multi - party competition.

On one hand, new forces are facing increasing pressure. For example, Li Auto sold 30,731 units in July, still ranking high but was surpassed by Geely Galaxy and Leapmotor. NIO and XPeng, on the other hand, have relatively lagging sales, indicating sluggish growth. On the other hand, the market share of new energy brands from traditional automakers continues to rise, even starting to encroach on the market share of new forces.

This competitive dynamic is not only reflected in sales but also in product lineup and technological routes. New energy brands from traditional automakers typically adopt multi - brand, multi - model strategies, covering various market segments from entry - level to premium. For instance, Geely Group has multiple brands like Zeekr and Galaxy targeting different consumer groups, while Changan Automobile achieves market stratification through brands like Shenlan and Qiyuan.

The rapid rise of new energy brands from traditional automakers is no accident; it's supported by multiple factors.

Traditional automakers like Geely, Changan, and GAC possess years of automotive manufacturing experience, mature supply chain systems, and large - scale production capabilities. This gives them a natural advantage in terms of capacity ramp - up, cost control, and quality management. For example, Geely Galaxy leverages Geely Group's SEA architecture and global supply chain to quickly launch competitive products.

In fact, traditional automakers are not starting from scratch in the fields of electrification and intelligence. Through years of technological accumulation, they have gradually narrowed the gap with leaders like Tesla in terms of the three electric systems (battery, motor, electric control), intelligent cockpits, and autonomous driving. Besides self - research, Huawei's assistance to these automakers has also been instrumental.

Of course, one area where new car - making forces are most lacking is that traditional automakers typically have extensive and mature dealer networks and after - sales service systems, enabling faster market penetration and user reach. This is particularly crucial for the promotion of NEVs and the establishment of user trust. For instance, Changan Qiyuan and Shenlan quickly covered second - and third - tier markets through Changan Automobile's channel resources.

Compared to new forces, traditional automakers enjoy higher brand recognition and user trust, especially among consumers who prioritize reliability and after - sales service. This makes their NEV products more readily accepted by the market.

From sales data to market dynamics, the rise of new energy brands from traditional automakers is an undeniable fact. They are stepping onto the stage with steady strides, becoming significant players in the NEV market. This transformation not only reflects the maturity and evolution of China's automotive industry but also foreshadows a more diverse and intense future competition.

02 Joint Venture Brands Are Also Catching Up

At this year's bustling Chengdu Auto Show, a notable change occurred: Toyota's bZ series now has its own dedicated booth.

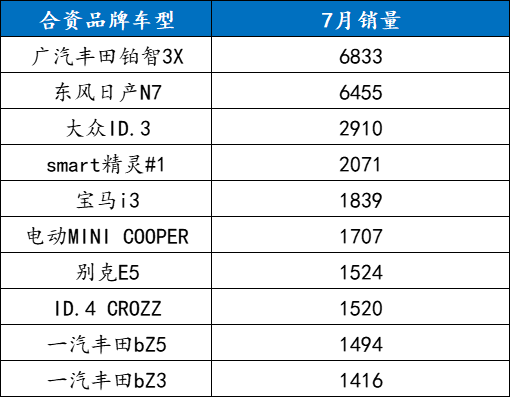

Behind this adjustment lies a profound market truth. From the sales data, GAC Toyota's bZ4X stood out among joint - venture brand's pure electric models in July, claiming the top sales spot. Moreover, subsequent models in the bZ series are about to make their debut, generating much anticipation.

Following GAC Toyota's bZ4X, Dongfeng Nissan's N7 also performed admirably, with 6,455 units sold in July, narrowly trailing behind the bZ4X by less than 400 units. These two popular models share a significant commonality: they are entirely developed and led by Chinese teams. Leveraging China's localized supply chain advantages, they precisely cater to Chinese consumers' needs, resulting in highly market - welcome models.

This year, the NEV market has taken on a new landscape. Traditional automakers among domestic brands are gradually moving towards the mainstream through their own strengths. Meanwhile, traditional joint - venture brands are not sitting idly by; they are beginning to make their move. Previously, Volkswagen took the lead with its ID series, achieving commendable market results with its outstanding performance and quality.

Now, in this new round of competition, with the addition of independent localized NEV brands like Buick Velite and AUDI, the market has become even more lively. It is foreseeable that in the future NEV market, the competition between joint - venture and domestic brands will become even fiercer.

Amidst the booming NEV market, where we witness numerous brands actively striving and expanding, our attention should also turn to those traditional automakers that have yet to form independent brand capabilities.

Take Great Wall Motors as an example. Amidst the trend of many brands launching multiple independent NEV brands for comprehensive market layout, Great Wall Motors' single WEY brand NEV may gradually show deficiencies in terms of product line richness and market coverage. This will undoubtedly affect its long - term development in the NEV market.

Looking at SAIC Group, as a giant in the domestic automotive industry with brilliant achievements in the traditional fuel vehicle sector, its lack of an independent NEV brand raises questions. In today's rapidly expanding NEV market, without an independent and influential NEV brand, it is difficult to fully enjoy the benefits of the NEV market's development.

Then there's Chery Automobile, whose Chery Fengyun carries many expectations but has yet to rank independently. In the increasingly fierce brand competition in the NEV market, if Chery Fengyun fails to emerge independently and shine soon, Chery's development pace in the NEV sector may be hindered.

For these traditional automakers, establishing independent NEV brands is not only an inevitable choice to align with market trends but also a crucial move for their long - term development. Only by accelerating their layout and launching competitive independent NEV brands can they secure a place in the market competition of the new era.

Of course, on the bright side, at least these brands have NEV plans. For instance, Great Wall has WEY, SAIC has Shangjie, and Chery has iCar, indicating that large groups are still considering things comprehensively. The most challenging situation now is for small brands like Haima, Skyworth, and Landian. In the accelerating market differentiation, their fates are predictable.

Editor - in - Chief: Yang Jing Editor: Wang Yue

THE END