The Mass 'Exodus' of Luxury Cars at the Chengdu Motor Show: Not a Reflection of the Event's Appeal

![]() 09/05 2025

09/05 2025

![]() 592

592

Lead

Introduction

The current state of the Chengdu Motor Show is a direct reflection of the prevailing trends in the automotive market.

The absence of over 20 automakers has left many feeling that this year's Chengdu Motor Show lacks its usual vibrancy.

From an exhibition standpoint, while the Chengdu Motor Show is indeed one of China's four major A-class auto shows, its strategic focus and the concentration of major product launches differ from those of the Beijing and Shanghai Auto Shows. It also lacks the ceremonial sense of year-end summaries and future outlooks that characterize the Guangzhou Auto Show. Instead, it serves more as a barometer for consumer trends in the Southwest market.

As a result, the perceptions of the Chengdu Motor Show among industry professionals and consumers are often intertwined with the city's renowned spicy cuisine, leisurely lifestyle, and cultural diversity. These elements continuously shape their views of the Chengdu Motor Show through their passion for automotive products, admiration for the event's atmosphere, and the consumption it generates.

Among these experiences, viewing luxury cars has become a highlight of attending the Chengdu Motor Show.

On one hand, Chengdu, as China's largest automotive market, is well-known for its affinity for luxury vehicles. In the first seven months of this year, Chengdu saw the sale of 125,000 luxury cars, maintaining growth despite a slight decline in the domestic luxury car market. On the other hand, luxury brands have traditionally been enthusiastic participants in the Chengdu show. Brands such as Porsche, Bentley, Lamborghini, and Rolls-Royce have congregated in Chengdu, even designating Hall 16 as a dedicated luxury brand hall, creating a lively and upscale atmosphere.

This year, although the Western China International Expo City still brought together nearly 120 brands and over 1,600 models, the absence of luxury brands such as Porsche, Bentley, Lamborghini, Rolls-Royce, Maserati, and Jaguar Land Rover has left a significant void in terms of attention. As one viewer aptly put it, it's like 'watching football without Messi or Ronaldo, or basketball without James or Durant.'

Indeed, the collective absence of luxury brands at the 2025 Chengdu Motor Show has given the event a more 'mainstream' feel. However, this is more indicative of the structural adjustments taking place in the Chinese automotive market and serves as an important reflection of the transformation of the Chengdu Motor Show and the current automotive landscape.

01 Chengdu's Affinity for Luxury Cars Needs No Motor Show Validation

'Participating in the four major A-class auto shows in Beijing, Shanghai, Guangzhou, and Chengdu costs automakers at least tens of millions of yuan per show on average,' an insider from an automaker shared with 'Automobile Commune.' The cost of participating in A-class auto shows is excessively high, covering expenses such as venue rental, booth design and construction, and operations. When the cost-benefit ratio no longer meets expectations, automakers' withdrawal becomes a natural choice.

Just as challenging as the high participation costs is the difficulty automakers face in achieving profitability.

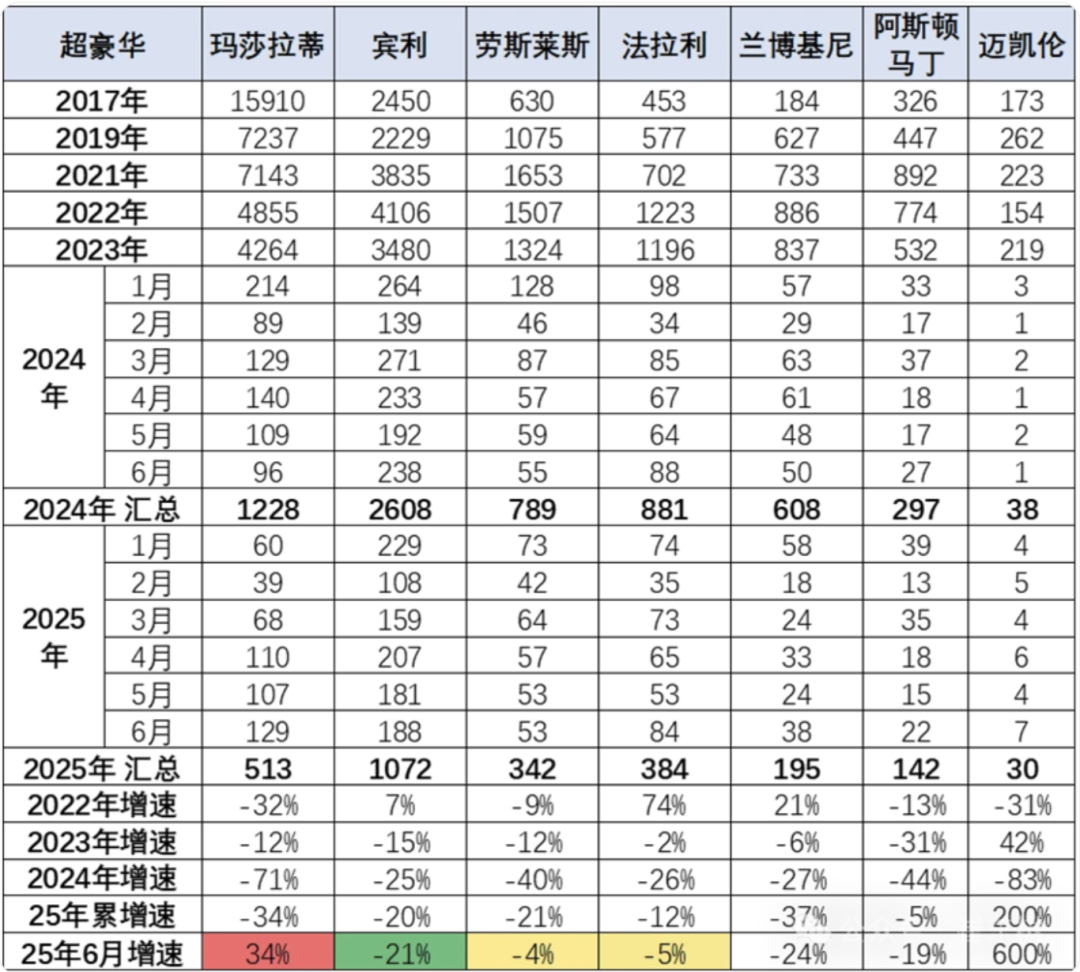

In recent years, the luxury car market has underperformed. In the first half of this year, sales of luxury brands declined by 13.3% year-on-year, with an inventory coefficient reaching 2.1. Among them, imports of ultra-luxury brands have continued to decline. For example, Porsche's sales in China in the first half of the year were only 21,000 units, down 28% year-on-year, marking its fourth consecutive year of declining sales in the Chinese market. Maserati's situation is even more dire, with domestic sales of only 1,209 units in 2024, a 58% year-on-year decline. Even traditional mainstream luxury brands like Mercedes-Benz, BMW, and Audi have experienced varying degrees of sales declines.

Furthermore, starting from July 2025, the threshold for the consumption tax on ultra-luxury cars has been lowered from a retail price of 1.3 million yuan to 900,000 yuan (excluding VAT), directly affecting the sales of models priced over 1.017 million yuan (including VAT) and further compressing the market space for ultra-luxury cars.

These challenging circumstances have forced luxury brands to undergo strategic adjustments and channel transformations. Some brands have begun to shift towards more refined channel layouts. For example, Porsche has reduced the number of its 4S stores and accelerated the opening of direct-sale stores in third- and fourth-tier cities with high GDP. Lexus has shifted its channel focus to pop-up stores in high-end shopping districts, adopting a lightweight asset model to reduce costs.

Of course, the decline in luxury car sales cannot be attributed to Chengdu. Or rather, the cooling luxury car market does not diminish Chengdu's residents' love for luxury cars.

In 2024, Chengdu saw the sale of 665,000 new vehicles, an 8.8% year-on-year increase, ranking first in sales among automotive cities nationwide. Among them, the luxury car consumption market was particularly robust. According to incomplete statistics, Chengdu residents purchase over 40,000 luxury cars annually, a rare feat in other cities. During a previous luxury car exhibition, an astonishing scene unfolded: a mysterious buyer purchased a 'hypercar king'—the Saleen S7, which produces only four units annually—for 30 million yuan.

The consumption enthusiasm of Chengdu's residents is not limited to luxury cars; luxury homes and goods are equally popular. As early as 2011, Dior's perfume and cosmetics sales in Chengdu were outstanding, topping the global sales charts. Louis Vuitton's directly operated store in Chengdu consistently ranks among the top in nationwide sales. Zegna's men's wear store in Chengdu achieved a top-three national sales ranking within just three months of opening.

Based on the burst of consumption enthusiasm among Chengdu's residents, luxury cars have consistently performed well in Chengdu. Of course, it's not just luxury cars; Chengdu's diversified consumption structure makes it friendly to numerous brands, including German, American, Japanese, Korean, and domestic brands, all having a place. This is also a key reason why Chengdu has become the largest automotive sales market in China.

Data shows that in the first seven months of this year, the top ten brands in Chengdu's passenger car market were BYD, Volkswagen, Geely, Toyota, Tesla, Audi, Li Auto, BMW, Changan, and Mercedes-Benz, all of which also ranked in the top ten last year.

Looking at the rankings, BYD was the best-selling brand in Chengdu this year, with 34,000 units sold, while Volkswagen, the champion last year, ranked second with 33,000 units. Geely and Toyota ranked third and fourth, respectively. New energy brands Tesla and Li Auto occupied the fifth and sixth positions, while the traditional luxury trio of BBA (Mercedes-Benz, BMW, Audi) remained favorites among some Chengdu consumers.

02 The State of the Motor Show Is Determined by the Automotive Market

Shifting the perspective from Chengdu's streets back to the exhibition hall, the participating luxury brands also presented varying content.

For instance, traditional mainstream luxury brands like BBA (Mercedes-Benz, BMW, Audi) brought few notable new models.

Mercedes-Benz only introduced the all-new electric CLA and the more nostalgic all-new AMG CLE 53 convertible coupe, with a smaller lineup compared to previous years. BMW also focused on nostalgia, with a replica of the classic M3 E46 GTR as the main attraction on its stand, lacking new model debuts but featuring various 'Black Night Edition' models.

Meanwhile, the two Audis continued to compete at the Chengdu Motor Show. The SAIC Audi stand featured both the four-ring logo and the letter logo, while FAW Audi had its own separate stand. FAW Audi did not bring any heavyweight new models, with its technical highlights centered on the debut of the first model from the PPE all-electric platform.

Second-tier luxury brands like Cadillac, Lincoln, and Volvo, which still chose to participate, adopted more pragmatic exhibition strategies, such as reducing booth size and prioritizing regional promotions over new model launches, resulting in less impressive displays. If one had to pick notable models from the luxury lineup, they would be the Volvo XC70 and the two A5 models from FAW Audi and SAIC Audi.

However, whether it's Volvo and Audi, which brought new models, or other luxury brands without standout exhibits, they all face varying degrees of criticism. From accusations regarding their technical routes to doubts about their in-house technology development, from disdain for their product popularity to pessimism about their future development, the harsher side of attendees seems to have surfaced compared to previous years when luxury brands were more prominent.

The Western China International Expo City's Hall 16, left vacant by the departure of ultra-luxury brands, was not idle but remained bustling.

The central spot in the hall was given to Xiaomi, whose booth featured a humanoid robot performing a pre-programmed dance routine. At Hongqi's 'Oriental Luxury' exhibit, visitors lingered on massage chairs. Before CATL's battery dissection model, a group of tech enthusiasts gathered. Domestic brands have effectively taken over the crowd-pulling ability previously held by ultra-luxury brands.

Additionally, a battle for dominance in the luxury market has commenced.

Among the ultra-luxury brands, BYD's Yangwang U8L, with a pre-sale price reaching 1.3 million yuan for the Dingshi Edition and featuring a 24K gold emblem, attracted significant attention. The Zunjie S800, which recently announced over 12,000 reservations, also made an appearance at the HONGMENG ZHIHANG booth.

In the 300,000 yuan and above luxury car segment, Zeekr's 9X, NIO's newly launched third-generation ES8, AITO's M8 all-electric version, and Xiangjie's S9T, along with the highly anticipated Li Auto i8, are all potential contenders for the customer base lost by the absent luxury brands at this year's show.

Meanwhile, these domestic luxury brands are not just showcasing exhibition models. For example, Li Auto, which has dominated the extended-range electric vehicle market, aims to address its limited technological routes with pure electric models MEGA and i8. HONGMENG ZHIHANG has expanded its coverage across more price segments with the Zunjie S800 and Shangjie H5. NIO has also catered to different user groups through its brands LEADAO and YINGHUOCHONG.

Whether it's the collective 'exodus' of luxury brands or the strong replacement by domestic new energy vehicles, factors such as shifts in consumer preferences, reshaping of the market landscape, and the evolution of auto show functions play a role. While it may indicate, to some extent, that market influence has shifted, consumers have become more rational, and domestic brands have achieved breakthroughs through technology and product strength, the overall state of the Chengdu Motor Show undoubtedly reflects the current automotive market.

Why do we say that? Let's explore further.

On the eve of the motor show, 'Automobile Commune' discussed the significant changes at the Chengdu Motor Show with the organizers, who stated, 'This year, there is no dedicated media day as in previous years. The show allows public admission on the first day, making it less desolate.'

On the first day of the motor show, sales teams lined up neatly, chanting 'Big sales, big sales,' evoking a familiar atmosphere at the Chengdu Motor Show. However, the debut of the Xiaohongshu (Little Red Book) booth in Hall 16, expanding the lifestyle community into a 'content + experience' ecosystem, is constantly transforming traditional automotive marketing models. It's worth noting that before Xiaohongshu, this spot belonged to Autohome and Dongchedi.

Editor-in-Chief: Yang Jing Editor: Wang Yue

THE END