Will the Auto Price War Draw to a Close?

![]() 09/05 2025

09/05 2025

![]() 538

538

The large - scale auto price war, which was ignited by “maximum price cuts of RMB 90,000,” has been raging for nearly two and a half years. Recently, however, it has shown signs of gradually cooling off.

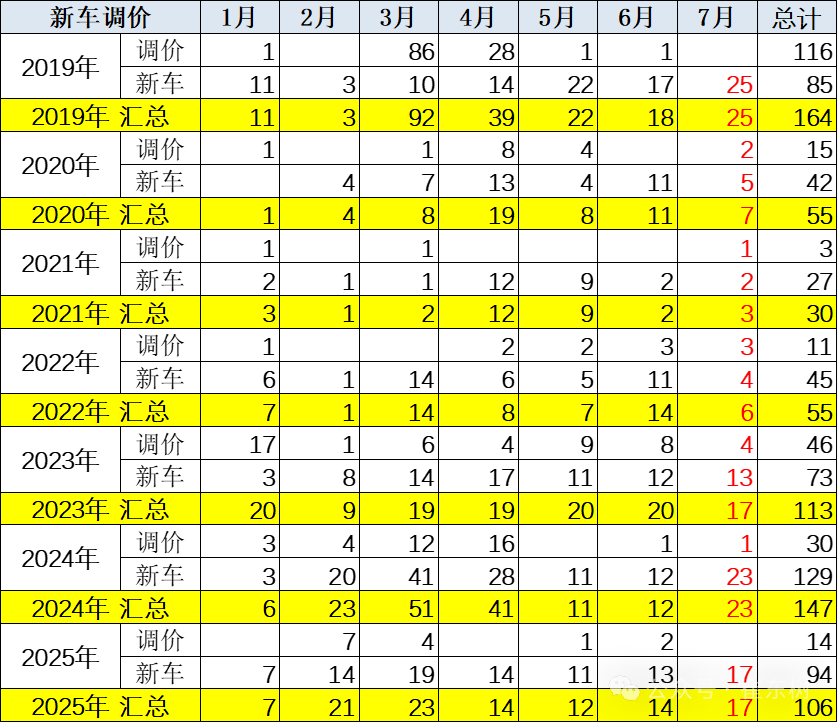

Data released by the China Passenger Car Association (CPCA) in August reveals that, based on the criteria of counting official price cuts announced by automakers or significant reductions in the lowest guided prices of new models over the past two years, 17 models experienced price reductions in July this year. This figure is relatively stable compared to the 23 models in the same period last year and the 17 models in the same period of 2023.

From 2020 to 2022, the number of models with price cuts from automakers between January and July was only around 50. In the same period of 2023, this number soared to 113. During the first seven months of 2024, the number of price - reduced models further climbed to 147. From January to July this year, 106 new models saw their prices drop.

Image source: Cui Dongshu

Image source: Cui Dongshu

In terms of the number of price - reduced models during the same period, it is evident that the price war has eased significantly since the beginning of this year. The intensity of price cuts and promotional activities has also dropped markedly. Especially after April, the number of price - reduced models has plummeted. Although it has not fully reverted to the pre - price - war level, there is a discernible trend of “cooling down.”

The CPCA analysis indicates that in 2025, promotions and price cuts in the passenger car industry will return to a rational state, and the market order will see a substantial improvement.

On one hand, the national trade - in policy has yielded remarkable results. It has boosted market sales and significantly curbed the phenomena of internal competition and price cuts, thus alleviating the operational pressures on the industry. In June, the automotive industry's profit margin reached a high of 6.9%, reflecting the positive outcomes of industry scale expansion and stabilized price promotions. On the other hand, executives from automakers, industry associations, and regulatory bodies such as the Ministry of Industry and Information Technology, the National Development and Reform Commission, and the State Administration for Market Regulation have repeatedly called for and emphasized the need to standardize the industrial competition order, effectively “halting” the price war.

Given the current market landscape where competition is continuously intensifying, will the price war come to an end?

Gradually Easing

In early March 2023, Hubei Province set off a frenzy of auto price wars. News of Dongfeng Motor Group's multi - brand combined price cuts of up to RMB 90,000 spread rapidly, triggering a chain reaction. Within just a few days, multiple local governments, mainstream automakers, and auto dealers joined the battle.

At that time, a relevant person in charge from the China Association of Automobile Manufacturers (CAAM) publicly stated in an interview with industry media, “Relying solely on price competition strategies is not a viable long - term solution. This round of promotional surge has, to some extent, misled consumers about auto prices. Therefore, it is crucial to closely monitor the negative impact of this phenomenon on industry development. In the long run, short - term irrational promotions will inevitably deplete future market sales and are not conducive to the healthy and sustainable development of the entire industry.”

However, by that time, the wave of price cuts had rapidly swept across the country. The short - term surge in sales and inventory clearance effects had deeply entangled automakers, dealers, and consumers.

As Li Xiang, CEO of Li Auto, said, “Price cuts may not necessarily boost sales, but they can certainly hit competitors.” After a major competitor announced an “official price cut,” other auto brands had few better strategies than to follow suit.

Although it was widely believed in the industry at the time that this round of price cuts would not last long and the impact would be limited, many automakers lamented the situation. After this round of frenzied price wars, there were concerns that the auto price system might collapse.

To everyone's surprise, not only did the price war persist until now before showing signs of easing, but the price systems for both new and used cars have suffered multiple blows. Over the past two - plus years, price inversions, declining gross margins, plunging net profits, significant reductions in R&D investment, cost - cutting measures, and layoffs have become key words in the auto industry.

According to statistics from the China Automobile Dealers Association, the price war intensified in 2024. New energy vehicles saw an average price reduction of RMB 18,000, a 9.2% decrease. The price war has also brought more severe development issues to the auto industry. In 2024, the auto industry's profit margin was only 4.3%, lower than the average profit margin of downstream industrial enterprises as a whole.

Subsequently, automakers deeply troubled by internal competition made their stances clear. Zhu Huarong, Chairman of China Chang'an Automobile Group, admitted, “Chang'an Automobile firmly opposes vicious competition without moral or legal boundaries.” Zeng Qinghong, Chairman of GAC Group, stated, “Without profitability, enterprises cannot survive, which will have adverse effects on taxation, employment, and upstream and downstream industries.” Li Shufu, Chairman of Geely Group, believed that endless internal competition and simple, brutal price wars would result in shoddy workmanship, counterfeiting, and unregulated, disorderly competition. He Xiaopeng, Chairman and CEO of XPENG Motors, expressed, “In the current competitive environment, we should not compete on price but on technology. We should go global beyond China.”

After executives from multiple automakers made their statements, not only has the number of price - reduced models gradually decreased this year, but after entering July, some automakers have even halted “limited - time fixed prices” and introduced new purchasing policies. Additionally, multiple brands have raised their model prices, including leading domestic brands, joint - venture brands, and traditional luxury brands.

Thus, the price war that has lasted for nearly two and a half years seems to be showing signs of abating.

Stricter Supervision

Over the past two years, the continuous spread of price wars has further accelerated the reshuffling of the auto industry. Multiple new energy brands and relatively weaker traditional brands have exited the public eye.

In previous market competitions, although the battles were fierce, the relatively stable market price system provided brands with opportunities to learn from mistakes and often allowed them to make a comeback with a popular model. However, under the sustained pressure of price wars, no brand could remain unscathed. They had to follow the trend despite increasing losses, eventually being quickly eliminated from the market due to broken capital chains.

This scenario has repeatedly unfolded over the past two years, plunging the entire industry into a dilemma of increasing sales but stagnant revenue. Many automakers and upstream and downstream enterprises have resorted to salary cuts, layoffs, factory shutdowns, and even reduced R&D spending, seriously hindering the healthy development of the industry. As the drawbacks of price wars continue to emerge, the industry has repeatedly called for change, and relevant national authorities have directly stepped up interventions.

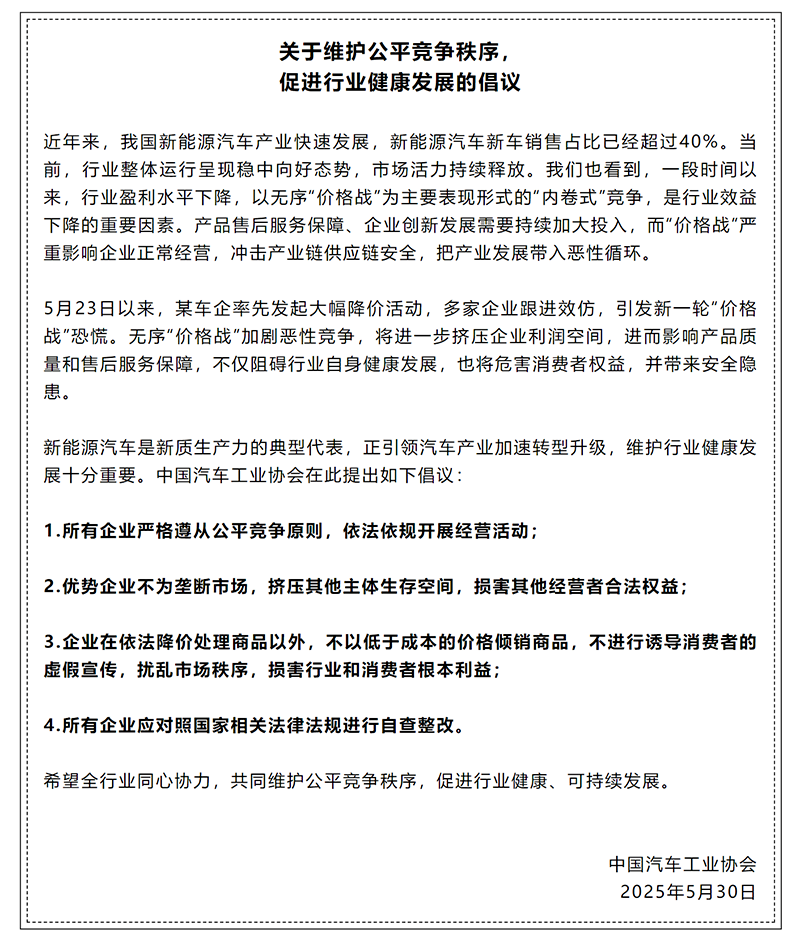

On May 30, the China Association of Automobile Manufacturers issued the “Initiative on Maintaining Fair Competition Order and Promoting Healthy Industry Development,” which received positive responses from the industry. The Ministry of Industry and Information Technology expressed its approval and support for the initiative, stating that it would intensify efforts to rectify “involutionary” competition in the auto industry, strengthen product consistency inspections, cooperate with relevant departments in anti - unfair competition law enforcement, and take necessary regulatory measures to resolutely maintain a fair and orderly market environment.

Image source: China Association of Automobile Manufacturers

Image source: China Association of Automobile Manufacturers

On June 3, the All - China Federation of Automobile Dealers also voiced its concerns, pointing out that the price war has severely impacted dealer operations and calling on the entire industry to resist “involutionary” competition, maintain a fair and healthy market environment, and promote high - quality development of the automotive industry.

On July 16, the State Council executive meeting pointed out the need to focus on promoting high - quality development of the new energy vehicle (NEV) industry. In response to various irrational competition phenomena in this sector, a long - term and comprehensive approach should be adopted to effectively standardize the competitive order of the NEV industry. It emphasized the need to strengthen cost investigations and price monitoring, intensify supervision and inspection of product production consistency, and urge key automakers to fulfill their payment term commitments. Efforts should be made to establish a long - term mechanism for standardized competition, strengthen industry self - regulation, better leverage the role of standards in leading industrial upgrading, and guide enterprises to enhance competitiveness through technological innovation and quality improvement.

In the view of many auto industry executives, the tide of electrification and intelligence in China's auto industry has entered its second half. The strategy of sacrificing profits for market share is unsustainable. Competing on technology, experience, services, branding, and systems will be the key to winning future market competitions.