Japan's Best-Selling Imported Car: Surprisingly Not Chinese

![]() 09/08 2025

09/08 2025

![]() 519

519

Lead-in

Introduction

In the cutthroat era of electrification and intelligence, the ideas of 'taking shortcuts' and 'settling for second best' will ultimately prove unsustainable in the long run.

A decade ago, in 2015, Indian Prime Minister Modi announced that vehicles produced by Maruti Suzuki, Suzuki Motor's Indian subsidiary, would be officially exported to Japan as part of the 'Make in India' initiative.

The changes over the past decade were beyond Modi's expectations.

By 2025, Suzuki has revolutionized the history of Japan's imported car market with models produced in India. In April and June of this year, the company's Indian-made vehicles surpassed strong competitors like Mercedes-Benz and BMW to top Japan's imported car sales rankings.

What Modi couldn't have anticipated is that Suzuki cars produced in India are about to be exported to over 100 countries and regions worldwide.

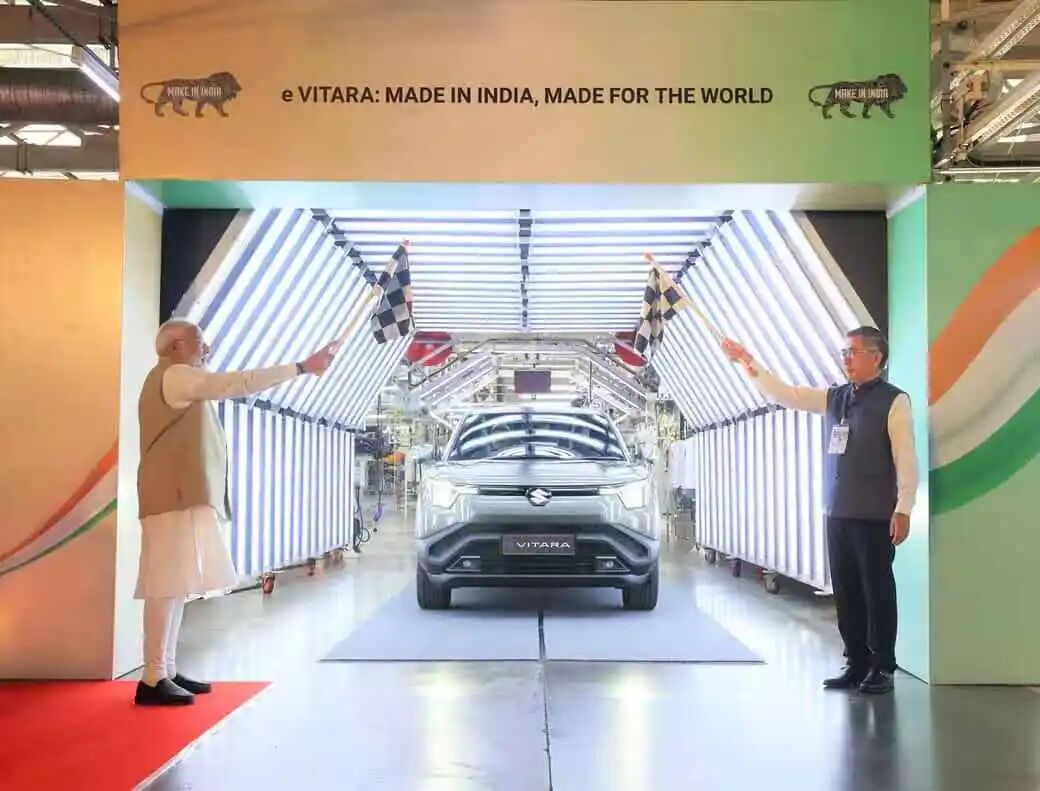

In late August, Suzuki began shipping its Indian-made all-electric vehicle, the Vitara e VITARA, to Europe. At the handover ceremony, Suzuki President Toshihiro Suzuki announced plans to transform the Gujarat plant in India into the first international electric vehicle production base, with Suzuki models sold in more countries to bear the 'Made in India' label.

In the era of intelligence and electrification, China has become the preferred destination for many multinational automakers to manufacture new vehicles for global sales. Several years ago, due to excessive reliance on small cars and slow electrification efforts, Suzuki Motor withdrew from China in 2018. After cutting its losses, it chose to bet on India.

Today, Suzuki, a niche player, can only rely on India.

If China has upgraded from its former status as the 'world's factory' to a 'world-class innovation and manufacturing center,' India resembles a 'massive project in progress.' It possesses unique potential but remains primarily a regional production base serving domestic and neighboring markets. The era of Suzuki Chairman Osamu Suzuki is now history. As current Chairman Toshihiro Suzuki continues to bet on India, does he also lament the lost Chinese market?

01 India: A 50 Billion USD Gamble

In April of this year, Suzuki Motor, with models produced in India, surpassed traditional powerhouses like Mercedes-Benz and BMW in the Japanese market, selling 3,990 units to top the imported car sales rankings for the first time.

In June, Suzuki once again led Japan's imported car market, a phenomenon that has drawn widespread attention from the Japanese automotive industry. Japanese media even described this pivotal shift as a 'structural transformation of Japan's imported car market.' The 'Made in India' label's penetration into the global automotive supply chain has first impacted Suzuki's own Japanese home base.

Recognizing India's immense manufacturing potential, Suzuki plans to capitalize on this momentum. Starting in July this year, it will increase production of its mainstay model, the Jimny Nomad, in India. In the future, imported Suzuki cars from India are expected to capture an even larger market share in Japan.

Cost remains king.

According to Nihon Keizai Shimbun, the core reason for Suzuki's historical achievement this year lies in the production capacity of its Indian factories. Models like the Jimny Nomad benefit significantly from cost advantages through localized component supply chains in India.

Compared to its historical peak, Japan's domestic automotive production has declined by 37% at present, while the proportion of 'Made in India' vehicles among imported cars is rising at an annual rate of 23%.

Currently, Suzuki has established three core production bases in India: the Gurgaon and Manesar plants in Haryana, and the Gujarat plant in Gujarat. The combined annual production capacity of these three plants is approximately 2.35 million units.

At present, the newly added Kharkhoda plant in Haryana has become operational, and the construction of a new plant in Gujarat is underway. To prepare for potential growth in electric vehicles, especially for exports to overseas markets, Suzuki has begun planning capacity expansion. It aims to achieve an annual production capacity of 4 million units in India within the next five years, covering a full range of models from sedans to SUVs.

Having tasted success in Japan, Suzuki's sights are now set on the global market.

Late last month, Suzuki President Toshihiro Suzuki announced that the company will invest 700 billion Indian rupees (approximately 57 billion yuan) in India over the next five to six years to increase local production of new vehicles, launch new models, and consolidate market share.

The 700 billion rupees investment is equivalent to one-third of India's total annual automotive industry investment, underscoring its significance.

According to the plan, the Gujarat plant will be transformed into Suzuki's global 'mega factory,' with an annual production capacity of 1 million units. As the global production center for Suzuki's first electric vehicle, the Vitara e Vitara, it will export to over 100 countries worldwide in the future.

This also means that Suzuki Motor's positioning of India has shifted from being the 'largest single market' after abandoning China to an upgraded 'global manufacturing base.'

Indian Prime Minister Modi also attaches great importance to this development.

He not only personally attended the production launch ceremony of the Vitara in India but also publicly stated before his upcoming visit to Japan that Maruti Suzuki is a prime example of the strong commercial ties between India and Japan. He hopes that more 'Maruti Suzukis' will emerge in the Indian market in the future. After the 700 billion rupees investment, Suzuki may have other major moves in store.

02 So, Why India?

The Vitara is Suzuki's first all-electric model. The reason for choosing India over Japan for production is that the Indian factory can achieve the lowest production costs. Junsei Ono, the head of research and development for this new vehicle, recently told Nihon Keizai Shimbun that the Indian factory currently has the highest production capacity and benefits from a low-cost component supply chain built over many years in India.

However, although Maruti Suzuki has been striving to maximize localized procurement of components, it cannot be denied that for core components like batteries, which account for 30%-40% of the overall cost of electric vehicles, Suzuki has chosen to use lithium iron phosphate batteries supplied by BYD's subsidiary, FinDreams Battery, a Chinese company. The battery packs produced in China are imported to India and then assembled into vehicles at the Gujarat plant.

Ono revealed that Suzuki Motor is importing batteries from China in the form of battery packs rather than individual battery cells because the company currently lacks relevant experience in battery development.

Importing battery packs, which are composed of approximately 120 cells, results in large volume, heavy weight, and low transportation efficiency. If smaller cells were transported and then assembled into battery packs, it would be easier to reduce costs.

'However, at present, it is too early for us to adopt CTP (Cell-to-Pack) technology,' Ono admitted. According to Suzuki's current technological accumulation, it is still challenging to achieve a 'one-step' solution at the level of key components.

A glimpse reveals the whole picture.

Why did Suzuki fail in China? Any enterprise that ignores changes in consumer upgrading, neglects refined regional localization, and disregards the latest directions in technological evolution will inevitably be eliminated by the times and the market.

In the Chinese market, Suzuki was forced to leave precisely due to the aforementioned reasons. Faced with difficulties and turning points, cutting losses is a neutral term, but for Suzuki, it ultimately proved to be a short-sighted move.

First, let's examine the market perspective.

On one hand, India's overall consumer purchasing power is not high, and its market potential has limitations. Although Maruti Suzuki is now India's largest automaker, India cannot replace China's position in the global automotive market. This is directly attributed to China's far superior economic development and wealth compared to India, leading to greater automotive consumption potential.

Secondly, India suffers from severe wealth inequality and high wealth concentration. The market segments where Suzuki has long excelled are at risk. The local poor may prefer cheaper two-wheelers and three-wheelers, while the wealthy will not be satisfied with the small and entry-level vehicles offered by Suzuki.

Now, let's consider the technological perspective.

Compared to India, China's advantages in automotive manufacturing are systemic and all-encompassing. This is not determined by a single factor but is the result of the combined effects of policies, industrial chains, and other aspects over the past two decades. Simply put, the mature automotive industry ecosystem that has formed in China, characterized by deep integration, high efficiency, and controllable costs, is something India cannot currently match.

At the supply chain level, India's supply chain depth and breadth are significantly inadequate. Many high-end components, precision molds, advanced steel, and high-end chips and batteries still need to be imported. While India may have certain advantages in some low-cost component areas locally, its overall technological level and scalability still cannot compare with China. This results in a ceiling for India's localization rate, and dependence on imports drives up costs and production complexity.

There is also a gap in infrastructure.

In India, infrastructure remains a major weakness. Congested roads, inefficient ports, outdated railway systems, and unstable power supply all bring logistical costs and uncertainties to manufacturing.

Finally, we must mention the spirit of innovation.

China and the United States are the two largest automotive markets globally, yet Suzuki abandoned them so decisively, leaving without a trace. Such recklessness, or perhaps an addiction to the easy profits in the Indian market, reflects a mindset of 'taking shortcuts' and 'settling for second best.' In the cutthroat era of electrification and intelligence, such an approach will ultimately prove unsustainable in the long run.

In 2018, when Suzuki withdrew from the Chinese market, Suzuki Chairman Osamu Suzuki shocked the world with his statement: 'Even if I die, I will not bow to the Chinese market!' As the era of electrification arrives, Suzuki, which continues to bet on India, still has not compromised with China. Whether Suzuki regrets this move remains unknown.