Who Can Save WM Motor?

![]() 09/10 2025

09/10 2025

![]() 600

600

Lead | Introduction

Recently, the long-silent official WeChat account of WM Motor has spoken out again. Although there were already signs indicating that WM Motor had received investor support, the formal release of the restructuring plan has still garnered significant attention. Can this 'ailing horse' be revived?

This article is produced by | Heyan Yueche Studio

Written by | Zhang Chi

Edited by | He Zi

Full text: 2,521 characters

Reading time: 4 minutes

Is WM Motor on the Verge of a Comeback?

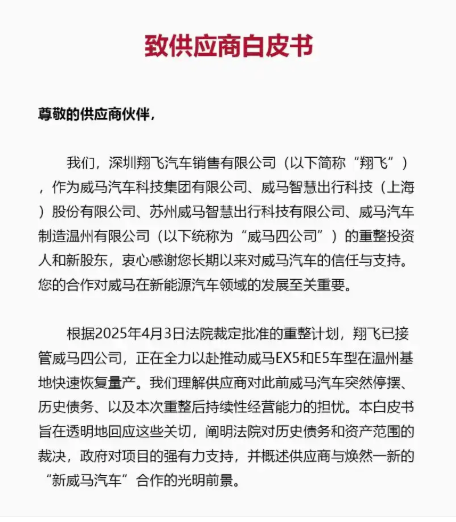

On September 6th, WM Motor Technology Group released a 'White Paper to Suppliers' (hereinafter referred to as the 'White Paper') on its official WeChat account. This white paper provides a detailed explanation of the company's restructuring status, the court's rulings on historical debts, and its development plan for the next six years. Through this white paper, the new WM Motor aims to boost the morale of its suppliers and restore their confidence in the company. After all, without the strong support of suppliers in the early stages, especially compromises on payment terms for molds and components, it would be difficult for WM Motor to achieve its goals. Following the release of this white paper, the emergence of Shenzhen Xiangfei Automobile Sales Co., Ltd. as the restructuring investor and new shareholder of WM Motor, along with its close ties to the Baoneng Group, has linked WM Motor's restructuring to the once equally renowned Baoneng/Qoros.

△ WM Motor Technology Group released the 'White Paper to Suppliers' on its official WeChat account.

As a first-generation new energy vehicle manufacturer that was once on par with 'NIO, Xpeng, and Li Auto' in China, WM Motor once took a completely different path from other new energy vehicle manufacturers seeking contract manufacturing by possessing its own vehicle manufacturing qualifications. In 2021, WM Motor's sales reached 44,000 units, enjoying a moment of glory. However, due to the failure of its listing plan and intense market competition, WM Motor's sales rapidly declined, leading to its bankruptcy review application in October 2023. Left with a mess, WM Motor completely faded out of the domestic automotive market.

What is WM Motor's Production Resumption Plan?

The new WM Motor has formulated a relatively detailed development and operation plan from 2025 to 2030.

In September 2025, the new WM Motor will first resume production of the EX5/E5 models at its Wenzhou base, ensuring an annual production and sales volume of 10,000 units and striving to achieve 20,000 units, thereby generating revenue of 1-2 billion yuan. Since these two models are existing ones from WM Motor, achieving production of 10,000 to 20,000 units should not be a major issue as long as suppliers can be persuaded to provide the necessary components.

△ The new WM Motor will produce the EX5/E5 vehicles.

However, it is noteworthy that the new WM Motor also mentioned achieving a combined production volume of 10,000 units for A00-class sedans and compact SUVs this year. Considering that WM Motor previously did not have models in this market segment, and Baoneng Motor's passenger vehicle brand, Youbaoli, has previously released the A00-class sedan Youbaoli A3, which has not yet been launched, it is highly likely that the Wenzhou WM Motor factory will also contract manufacture these two models.

△ The Baoneng-owned Youbaoli A3 will also be produced at the WM Motor factory.

From 2026 to 2030, the new WM Motor's strategy will be even more aggressive. By 2026, the new WM Motor aims to achieve full production capacity of 100,000 units, generating nearly 10 billion yuan in revenue and creating over 3,000 jobs. By 2028, sales will further expand to 300,000 units, promoting the mass production of high-level assisted driving models and initiating preparations for an IPO. By 2030, the new WM Motor will challenge annual sales of 1 million units, with revenue reaching 120 billion yuan. It will also establish a smart ecological mobility circle, becoming a new benchmark in the industry.

In the 'White Paper,' the new WM Motor also provided special explanations regarding support from the supply chain and local governments. It has already contacted 215 historical suppliers, with the vast majority expressing their willingness to develop together with the new WM Motor. Additionally, it has restarted the establishment of a dealer network. Regarding local government support, the new WM Motor mentioned that its resumption of production has received strong support from relevant departments in Shanghai and Wenzhou. In particular, the Wenzhou Municipal Government will consider providing subsidies for WM Motor's resumption of production and production line technological upgrades. Meanwhile, the new WM Motor's models will also be included in the local government procurement catalog, thereby strengthening the confidence of the entire supply chain and consumers in the new WM Motor.

Can Baoneng + WM Motor Carve Out a Path to Success?

Do Consumers and the Supply Chain Still Trust WM Motor? After WM Motor fell into difficulties, various services for consumers, such as connected vehicle services and Vehicle warranty (vehicle warranty), could not be continued. For consumers, purchasing a model from a brand that is still on the brink of survival in the short term is undoubtedly a huge gamble. For dealers and suppliers, they face the same dilemma as consumers. Investing additional resources in this brand will make future recovery difficult. The automotive industry is a capital-intensive sector, and without dealers' upfront investment in sales networks and suppliers' initial investment in research and development and mold making, automakers themselves will face significant financial pressure. Moreover, WM Motor still owes a substantial amount of money to suppliers. Relying solely on a public announcement to restore confidence across the entire supply chain is an uphill battle.

△ The difficulty of re-establishing the new WM Motor's dealer network far exceeds that of resuming production at the factory.

Are the EX5/E5 Models Still Competitive? During the two to three years when WM Motor was inactive, the domestic automotive market has undergone profound changes. Both new energy vehicle manufacturers and traditional automakers that are currently ranked high have launched models that balance product strength and cost-effectiveness. The two models that WM Motor plans to resume production lag far behind their competitors, not just by one generation. Under these circumstances, unless these two models are priced extremely attractively, it will be difficult for them to gain a foothold in the market.

△ Do the EX5/E5 models still have competitiveness?

What Role Can Baoneng Motor Play? As the restructuring investor and new shareholder of WM Motor, Xiangfei and Baoneng Motor, the company behind Xiangfei, will play a crucial role. However, Baoneng Motor is currently also in a difficult situation. Whether it is the models developed by Baoneng Motor itself or the Qoros models it previously acquired, there have been no significant actions in the domestic automotive market in recent years. With Baoneng Motor and the Baoneng Group facing financial shortages, it will be challenging for them to serve as a long-term financial backer for WM Motor. Later-stage development of high-level driving assistance systems and ecological construction will likely need to rely on the new WM Motor's own capital accumulation.

Why Are These New Energy Vehicle Manufacturers Seeking a Comeback?

Apart from WM Motor, there have been rumors of resumption of production for HiPhi, Neta, and Aiways to varying degrees. Given that the domestic automotive market is widely recognized as having excess capacity and that price wars continue, why are there still capital inflows to revive these brands?

Chinese electric vehicles are still relatively competitive in overseas markets. Even for these new energy vehicle manufacturers on the brink of bankruptcy, their electric vehicle models still lead traditional automakers by a significant margin in terms of product strength and cost-effectiveness. Therefore, automakers like Aiways and Neta are pinning their revival hopes on overseas markets. However, overseas markets are no longer the previous blue ocean. From traditional automakers like BYD, Geely, and Changan to new energy vehicle manufacturers like Leapmotor, Xpeng, and NIO, all view overseas markets as key to their future sustainable growth. Therefore, establishing a foothold in overseas markets will likely require significant effort.

△ The Thai market has become the last hope for Neta's revival.

Strong support from local governments. Behind the resumption of production by the new WM Motor, the Wenzhou Municipal Government plays a key role. Apart from WM Motor, Wenzhou does not have other mainstream vehicle manufacturers. The advantages brought by vehicle manufacturers in terms of GDP, taxation, and employment far exceed those of other industries. In this context, the automotive industry naturally holds significant appeal for local governments. However, the current automotive market is overly competitive. During a time when competition was not as intense, WM Motor failed to prove itself. Now, with competition having reached a fever pitch and price wars becoming increasingly fierce, it will not be easy for the new WM Motor and other once-dormant new energy vehicle manufacturers to make a comeback.

△ What are the chances of success for WM Motor's resumption of production?

Commentary

The revival of WM Motor faces numerous difficulties. In the short term, the new WM Motor's sales will mainly target government procurement, car rental companies, or mobility service providers, competing in sectors like Didi Chuxing. The return of the new WM Motor is expected to bring another cost-effective brand to the domestic automotive market, intensifying the price war. However, throughout the century-long history of the global automotive industry, no passenger vehicle company has been able to survive solely relying on the B2B market. In the long run, convincing consumers to spend their hard-earned money on the new WM Motor will require considerable effort.

(This article is originally produced by Heyan Yueche and may not be reproduced without authorization.)