NIO Secures Additional 10 Billion Yuan in Funding, with Stock Price Skyrocketing by 100%! Li Bin Launches a Turnaround Campaign

![]() 09/15 2025

09/15 2025

![]() 533

533

Once ensnared in losses and almost dismissed as being "on the verge of collapse," NIO is now orchestrating a remarkable resurgence.

With a substantial 10 billion yuan funding infusion and a stock price that has soared like a rocket, NIO has dispelled the previous gloom.

Li Bin stands poised, ready to embark on a brilliant turnaround campaign.

1. Over 10 Billion Yuan in Financing Secured

Manufacturing cars is a costly venture; in the automotive arena, financial resources are paramount. Recently, NIO's announcement sent shockwaves through the market.

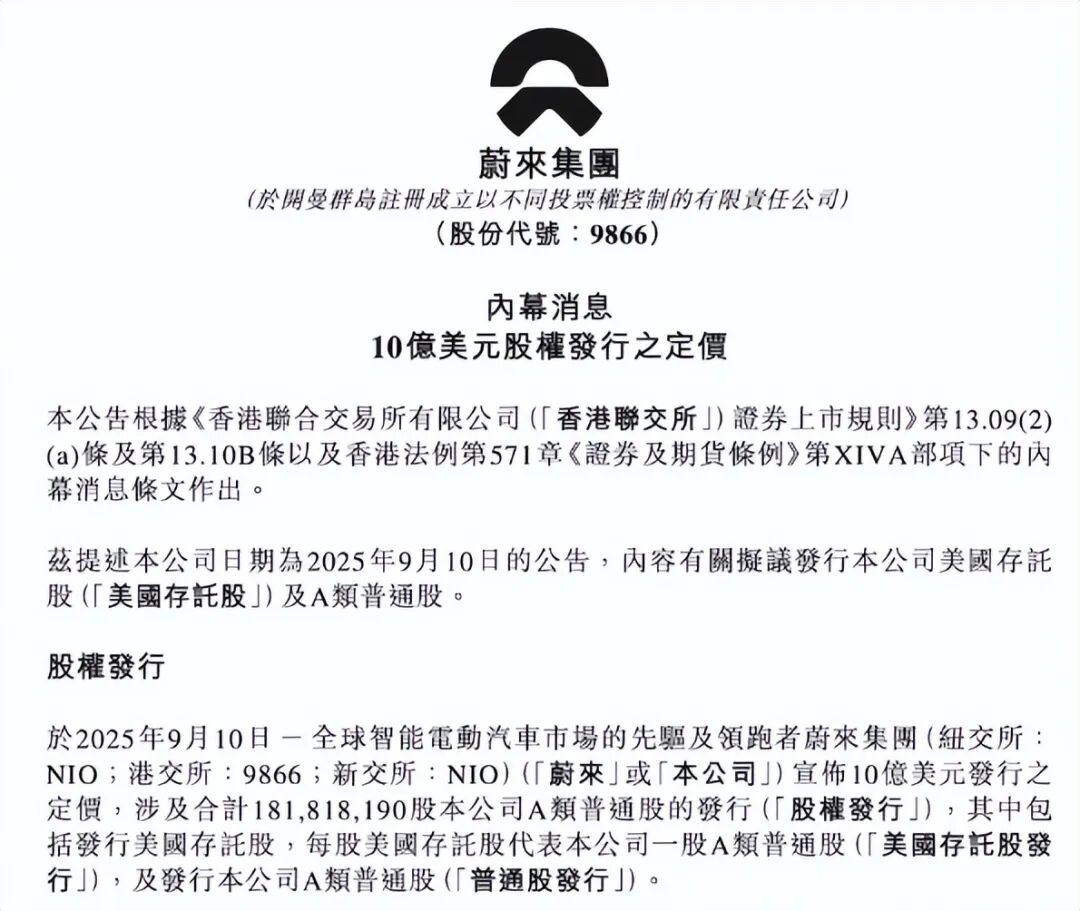

It officially declared the completion of an equity rights offering, raising a total of $1 billion (approximately 7.12 billion yuan), with American Depositary Receipts (ADRs) publicly issued at $5.57 per share and Class A ordinary shares priced at HK$43.36 each.

In simpler terms, NIO has successfully procured another substantial sum from the capital markets, amounting to a hefty 7.12 billion yuan.

It's particularly noteworthy that this marks the second public financing round within the same calendar year.

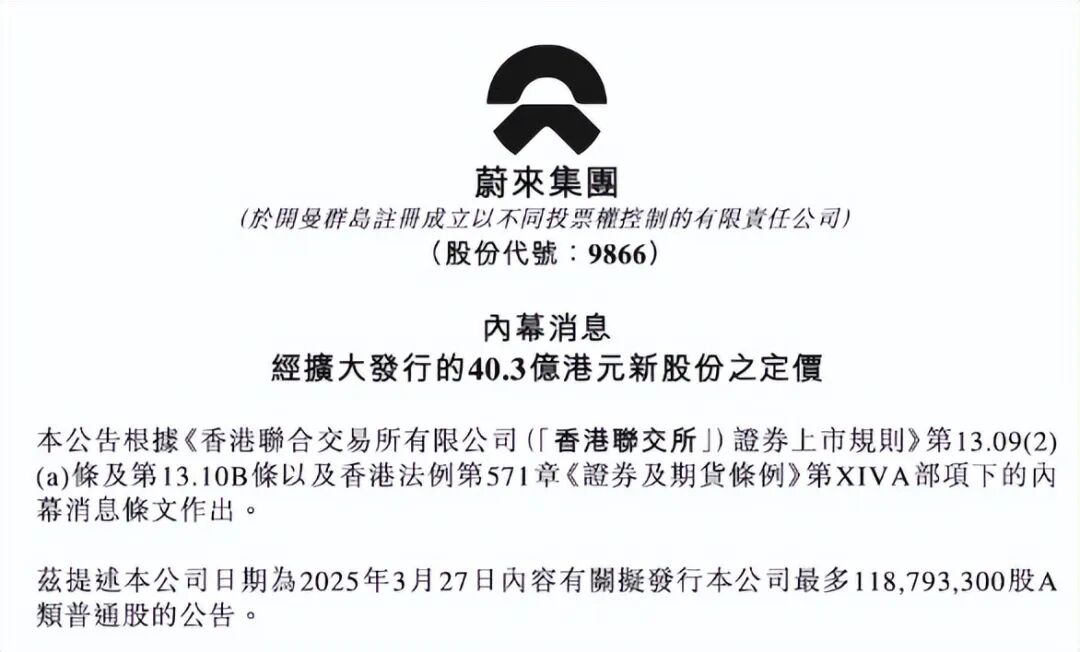

Back in March, NIO announced it had successfully raised HK$4.03 billion (approximately 3.68 billion yuan) through a "lightning-fast" placement, with transactions finalized at HK$29.46 per share.

The financing rounds in March and September have witnessed significant enhancements in two key indicators for NIO. The placement price escalated from HK$29.46 to HK$43.36, and the total financing amount surged from 3.68 billion yuan to 7.12 billion yuan.

With these two public financing rounds, NIO's total capital market financing for the year has surpassed 10 billion yuan, reaching a staggering 10.8 billion yuan.

This infusion of funds is not merely a lifeline; it's also a buildup of strength and a supercharged fuel for NIO's upcoming journey.

2. Stock Price Skyrockets by 100%

Since its inception in the automotive manufacturing sector, NIO has concentrated on high-end new energy vehicles and pioneered the battery swap model. This business model is highly capital-intensive, and NIO has been mired in losses, attracting significant criticism from the external world.

NIO's Hong Kong stock data reveals that from its listing in 2018 to 2024, spanning over seven years, it has accumulated massive losses totaling approximately 109.3 billion yuan.

In the first half of this year, NIO incurred an additional loss of 12 billion yuan. This implies that over the past seven and a half years, NIO's cumulative losses have reached a staggering 121.3 billion yuan.

With such substantial losses, questions arise about NIO's ability to sustain its capital-intensive operations. Naturally, as long as it can continuously secure new funding, NIO can persist in its endeavors.

Li Bin has a meticulous plan, utilizing capital market funds to buy time for achieving profitability.

In reality, NIO has not only been receiving positive news in terms of financing but has also witnessed a remarkable performance in its stock price. Over the past two months, NIO's stock price has been on an upward trajectory, continuously ascending.

In early July, NIO's Hong Kong stock price hovered around HK$25, and by early September, it had surged to over HK$50. In essence, NIO's Hong Kong stock price doubled within two months, soaring by 100%, and its market capitalization doubled as well.

Capital is highly sensitive, and there are underlying reasons for such frenzied buying of NIO.

3. Li Bin Launches a Turnaround Campaign

Various indicators suggest that NIO is at a critical juncture, and Li Bin is initiating a turnaround campaign.

Firstly, NIO has reversed its product downturn and welcomed two blockbuster models. The arrival of the Ledo L90 and the NIO ES8 has significantly enhanced NIO's presence and influence in the automotive market.

NIO's "blockbuster" effect is becoming increasingly pronounced, with the Ledo L90 and the new ES8 serving as the "twin engines" propelling NIO forward.

Especially noteworthy is the Ledo L90, which has been highly favored by consumers. Just as the MONA M03 single-handedly rescued XPeng from its predicament, the Ledo L90 has emerged as NIO's savior.

Secondly, aided by these blockbuster models, NIO's sales are thriving.

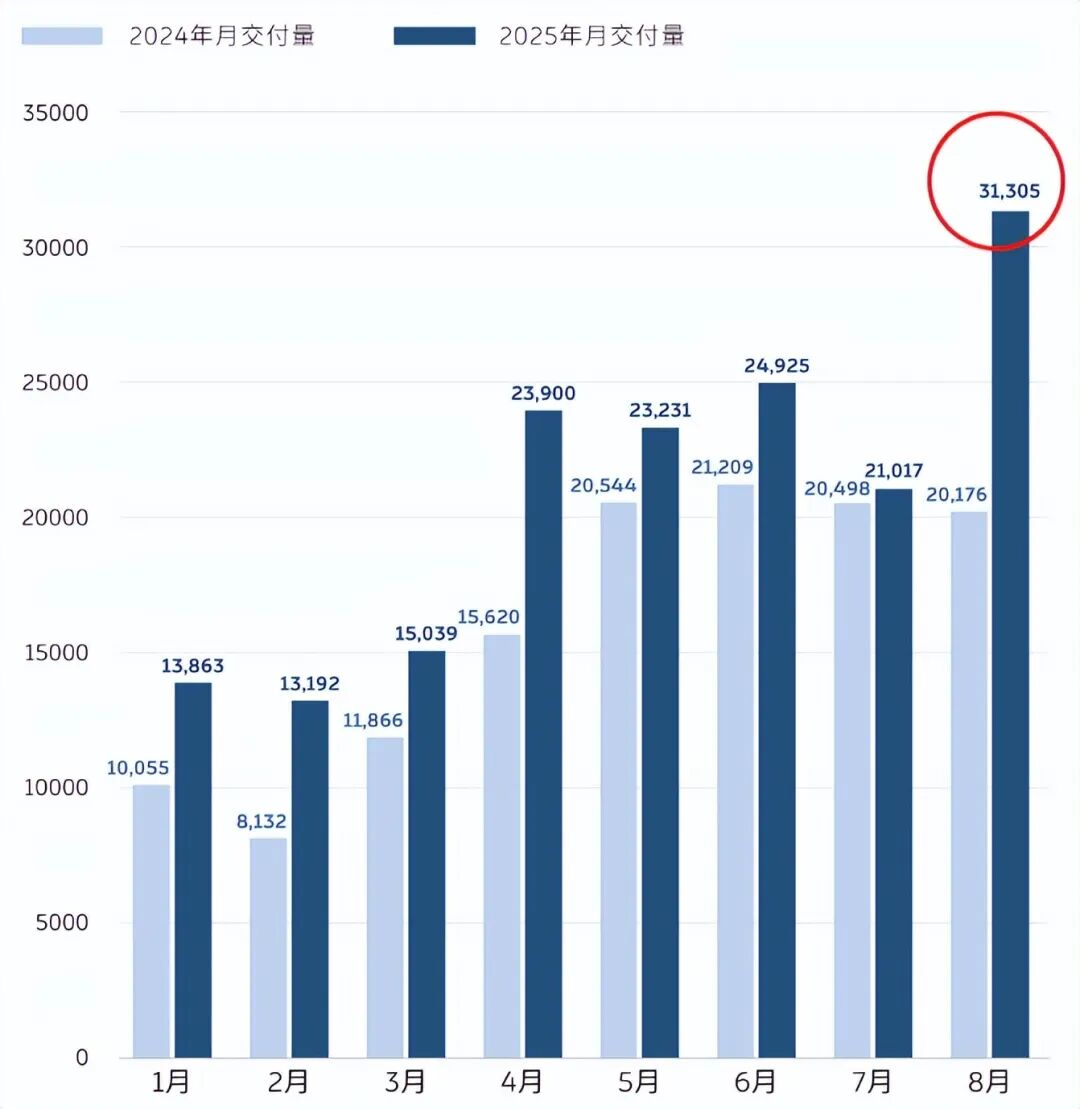

In August this year, NIO delivered 31,305 new vehicles, marking a year-on-year increase of 55.2% and setting a new historical record. Among them, the Ledo L90 delivered 10,575 units in its inaugural month on the market, making it the fastest model in NIO's history to exceed 10,000 units in sales.

NIO's monthly sales have surged from 10,000 units at the beginning of the year to 20,000 units in the middle of the year, and now to 30,000 units, exhibiting an unstoppable momentum.

Moreover, NIO's future appears even brighter. In the third quarter of this year, NIO anticipates selling between 87,000 and 91,000 units, representing a year-on-year increase of 40.7% to 47.1% and setting another historical record.

Finally, NIO aims to achieve profitability in the fourth quarter of this year.

Li Bin pointed out that if NIO reaches 150,000 units in the fourth quarter, it is expected to attain profitability. This implies that NIO needs to sell 50,000 units per month, a challenging yet attainable goal.

For Li Bin, this indeed represents the closest moment to profitability since venturing into the car manufacturing business.

If profitability is truly realized in the fourth quarter, it signifies that NIO will finally transition from a "money-burning mode" to a "money-making mode," and Li Bin will evolve from a storyteller to a seasoned commercial practitioner.

We eagerly anticipate Li Bin initiating a turnaround campaign, transforming from the "most beleaguered individual" to a bona fide automotive magnate.