Porsche Hits Pause on Electrification, Reins in Reckless Pursuit

![]() 09/24 2025

09/24 2025

![]() 575

575

Technological idealism has collided head-on with the hard reality of commercial constraints.

Amid profound transformations sweeping the automotive industry, Porsche's strategic adjustment, announced on September 22, has garnered widespread attention.

The German luxury automaker, celebrated for its iconic 911 sports car, declared that it would recalibrate the pace of development for internal combustion engines and electrification—advancing electrification with caution while preserving the unique allure of its legendary fuel-powered models.

"The automotive industry is undergoing dramatic shifts, prompting us to comprehensively advance Porsche's strategic adjustments. Through this, we aim to adapt to the new market environment with products that make a strong impression, meet evolving customer demands, and generate stable financial returns for investors," stated Oliver Blume, CEO of both Porsche and Volkswagen Group.

This decision underscores the intricate interplay between technological pathways, market dynamics, and sustainability imperatives in the luxury automotive sector.

Frequent Profit Warnings

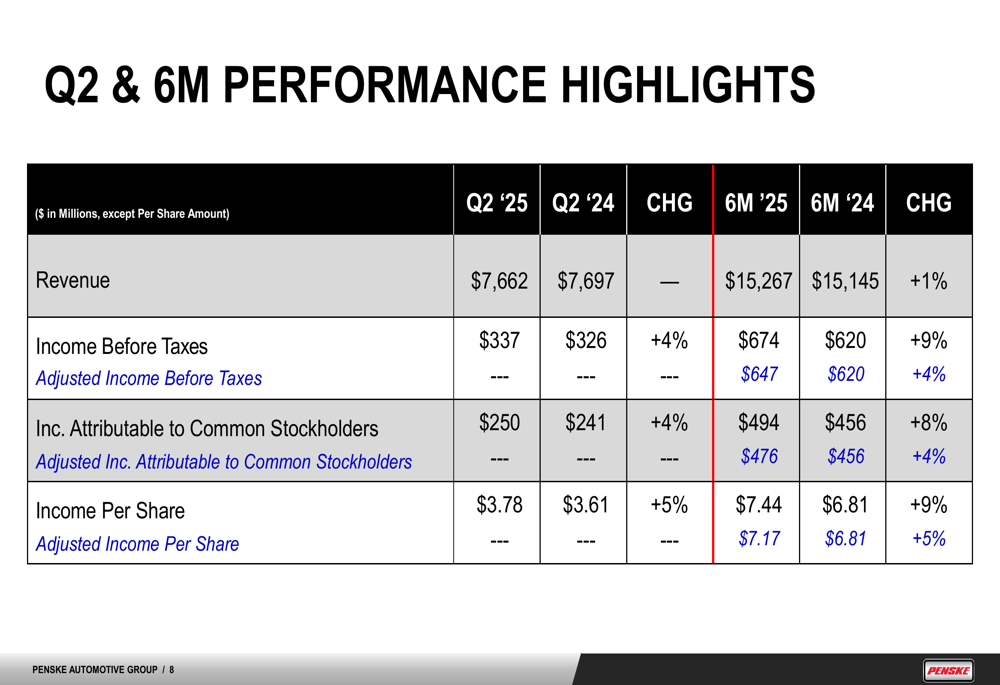

The primary impetus behind Porsche's strategic shift stems from changes in its financial performance, as costs have surged during its electrification transition.

In 2024, its R&D investment in electric models soared from 15% of total spending in 2021 to 37%, causing the overall profit margin to plummet from 18.3% to 14.5%. As part of this adjustment, Porsche opted to postpone the development of its SSP electric platform, originally scheduled for 2030, to 2032, a move expected to save approximately €5 billion in capital expenditures.

Porsche conceded, "We need to strike a balance between technological idealism and commercial pragmatism."

Due to this adjustment, Stuttgart will shoulder an additional significant one-time burden of around €1.8 billion, augmenting the previously announced €1.3 billion.

Porsche's full-year operating profit margin is projected to barely turn positive or reach a maximum of 2%. Previously, Blume had set an operating profit margin target of 5% to 7% of sales. Through this strategic realignment, Porsche aims to positively influence its financial performance over the next few fiscal years.

Given the multi-billion-euro burden, its parent company, Volkswagen Group, has also adopted a more cautious stance.

Volkswagen anticipates bearing approximately €5.1 billion in pressure this year due to impairments and follow-up costs. For Europe's largest automaker, this implies operating at a profit margin of only 2% to 3%, down from the previous target of 4% to 5%. Porsche SE, the holding company controlled by the Porsche and Piëch families, subsequently lowered its profit outlook.

Moreover, Porsche has been ensnared in a sales crisis over the past few quarters, particularly in the Chinese and U.S. markets.

U.S. import tariffs have also weighed on its business, causing a sharp decline in Porsche's profits. From January to June this year, the group's net profit was €718 million, a 71% year-on-year decrease.

Porsche shareholders will also experience a more pronounced shift in dividends. The company plans to propose a dividend payout for the current 2025 fiscal year at a level significantly higher than its original policy of distributing 50% of after-tax profits. However, even so, the dividend payout will still be notably lower than previous levels.

For Volkswagen, the total €5.1 billion in special charges is divided into two parts: approximately €3 billion in impairment of goodwill for Porsche AG and €2.1 billion in follow-up costs from "an adjusted vehicle project."

Wolfsburg stated that in its dividend distribution, it would not factor in the non-cash impairment of its Porsche holding. However, Volkswagen has downgraded its cash flow expectations for the automotive business this year from a previous net inflow of €1 billion to €3 billion to merely achieving cash neutrality.

"Technological idealism has collided head-on with the hard reality of commercial constraints," Blume's summary also reveals Porsche's helplessness in postponing electrification.

Therefore, given the evolving market environment, Porsche is charting a new strategic course.

Market Differentiation Becomes Reality

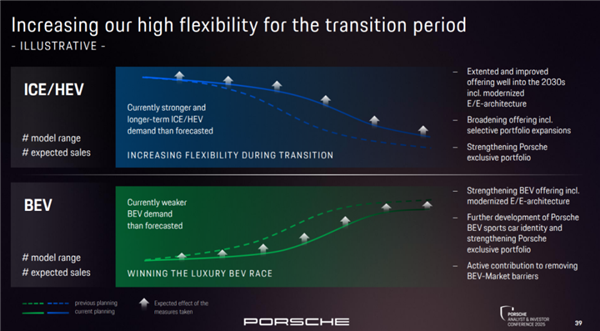

First, in response to shifts in the overall energy landscape, Porsche announced that the R&D timeline for its electric platform, originally slated for launch within 2030, will be recalibrated. Meanwhile, its new all-electric SUV series, positioned above the Cayenne, will initially introduce internal combustion engine and plug-in hybrid models. This indicates that Porsche will prioritize leveraging its fuel-powered vehicle market advantages over the next five years.

Porsche stated that the all-electric platform originally planned for 2030 would undergo technological restructuring in collaboration with other brands under the Volkswagen Group. However, Porsche confirmed that its existing electrified product lineup, including all-electric models like the Taycan, Macan, and Cayenne, would continue to receive updates.

Regarding its fuel-powered vehicle lineup, the board decided to extend the market lifecycle of existing internal combustion engine models and incorporate next-generation models into their lifecycle planning. Porsche will also introduce new internal combustion engine models with distinctive brand characteristics to its existing product matrix.

Porsche confirmed that internal combustion engine and plug-in hybrid versions of existing models like the Panamera and Cayenne would continue to be available into the 2030s.

It can be said that the core impetus behind Porsche's "electrification pause" lies in the significant differentiation in global luxury vehicle market demand. According to Porsche's sales data for the first half of 2025, the sales growth rate of its all-electric Taycan model slowed from 45% in 2024 to 18%, while customized orders for traditional fuel-powered models like the 911 and Cayenne increased by 22% year-on-year.

This trend is particularly pronounced in the two key markets of North America and China: U.S. consumers' waiting period for the 911 Turbo S has extended to 12 months, while Chinese high-end users' inquiries about the plug-in hybrid Panamera are three times that of the all-electric version.

Porsche noted, "Our customers are voting with their wallets—they want both the eco-friendly label of electrification and the soul of internal combustion engines."

Notably, Porsche will also adopt a more cautious stance toward the Chinese market.

Data reveals that in the first half of 2025, Porsche's sales in China declined by 28%, while North America supplanted China as Porsche's largest single market, with sales surging 10% to 43,577 units.

In fact, as competition in the Chinese automotive market intensifies and a wave of domestic brands and new energy players "encroach" on the luxury and even ultra-luxury segments, Porsche, which previously "prospered effortlessly," has begun to confront slowing demand.

"The rapid ascent of domestic electric vehicles has caught Porsche off guard. Now, we can acquire a Porsche alternative for half the price or even one-third," remarked one consumer.

For instance, the popular Xiaomi SU7 rivals the Taycan in terms of power and braking while integrating artificial intelligence. To compound matters, the SU7 costs roughly half as much as the Taycan.

More crucially, German automakers like Porsche have long relied on the Chinese market to offset sluggish demand elsewhere, causing them to overlook deeper structural issues in China: their reluctance to embrace technologies that have become mainstream in Chinese vehicles—electric cars equipped with advanced software that increasingly incorporates artificial intelligence.

"As German automakers, at premium prices, we must at least offer equal or superior innovation capabilities," stated Stefan Bratzel, director of the Center for Automotive Management in Bergisch Gladbach, Germany. "This has gradually been lost because Chinese automakers are now equally innovative, and some are even more so."

When discussing the challenges Porsche faces, Blume candidly stated that the Chinese market is undergoing structural adjustments, which will impact sales to a certain extent over a relatively prolonged period.

"In China, Porsche will adhere to a 'quality over quantity' strategy, proactively optimize its dealer network, and accelerate localized R&D," he said. To outsiders, Porsche remains reluctant to engage in the fierce competition in the Chinese automotive market.

Previously, Porsche initiated a large-scale organizational restructuring plan, including layoffs. While Porsche China denied layoffs in the region, it admitted to optimizing and reorganizing its internal structure. Regarding dealer network integration, Porsche plans to reduce its number of stores in China from approximately 150 currently to 100 by the end of 2026.

However, China is not the sole market struggling to sustain growth.

In the first half of this year, sales in Europe (excluding Germany) fell 8% to 35,400 units. Porsche's sales in its home market of Germany plummeted 23% to 16,000 units. Porsche attributed the poor performance in Europe/Germany to a pullback effect after robust growth in 2024.

The market widely believes that Porsche's decision may trigger a chain reaction in the luxury vehicle market.

Morgan Stanley analysts noted that this is tantamount to hitting the pause button for the industry, with Mercedes-AMG and BMW's M division already beginning to reevaluate their electrification timelines. Notably, Porsche still insists on its medium-term target of electric models accounting for 25% of sales by 2025, but its strategy has shifted from technology-led to demand-driven.

Note: Some images are sourced from the internet. If there is any infringement, please contact us for removal.

-END-