Price Battle: King of Affordability VS Tech Innovator! Did Leapmotor and XPENG Shine in Q3?

![]() 11/19 2025

11/19 2025

![]() 629

629

Authored by | Guanchejun

The 'Q3 Exam' results for the new energy vehicle (NEV) sector have been released. Recently, Guanchejun delved into the data from Leapmotor and XPENG, uncovering a fascinating and representative contrast.

These two automakers exemplify distinct survival strategies, akin to two divergent life paths for individuals. One is a 'pragmatist,' grounded in reality and rapidly accumulating resources; the other is a 'visionary,' gazing at the stars and investing heavily in the future.

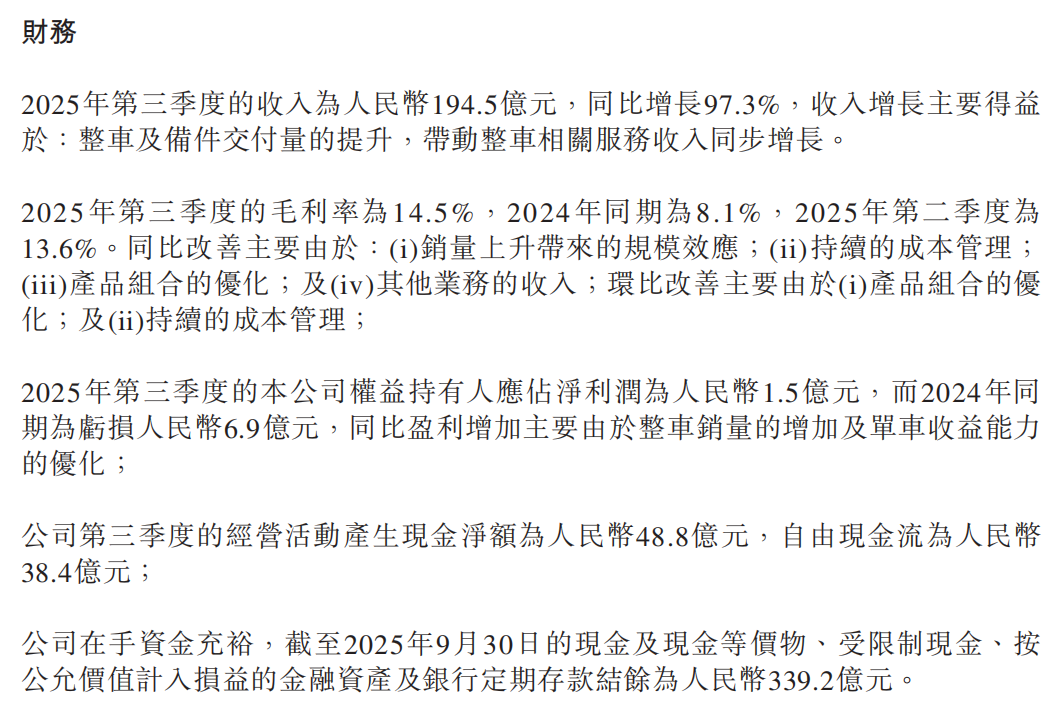

Let's begin with Leapmotor's data. Doesn't it evoke the image of a determined individual from a humble background, giving it their all?

In Q3, Leapmotor sold 173,000 vehicles, surpassing 70,000 units in October alone, firmly claiming the title of 'New Energy Sales Champion.' Most impressively, it reported a net profit attributable to shareholders of 150 million yuan.

From Guanchejun's perspective, Leapmotor's approach is steeped in pragmatic wisdom. Its pricing strategy is aggressive: the A-series aims to bring LiDAR-equipped models under the 100,000 yuan mark, while the D-series promises 'a million-yuan experience at a 300,000-yuan price point.'

This is primarily achieved through stringent cost control and self-developed supply chains, extracting profits in price ranges where competitors often incur losses. Leapmotor's standout feature is its 'global self-research,' with over 65% of core components developed in-house.

This reflects a manufacturing-centric mindset that prioritizes supply chain control and cost reduction. Its technological evolution focuses on optimizing existing routes and cost reductions, proceeding methodically.

However, dialectically speaking, this victory remains precarious at this stage. After all, a profit of 150 million yuan pales in comparison to nearly 20 billion yuan in revenue, translating to a profit margin of less than 1%.

It's akin to dancing on a knife's edge; any disruption—such as rising battery raw material prices, another round of price cuts by competitors, or fluctuations in carbon credit revenue—could swiftly turn profits into losses.

Nevertheless, compared to previous years, Leapmotor has undoubtedly risen to prominence.

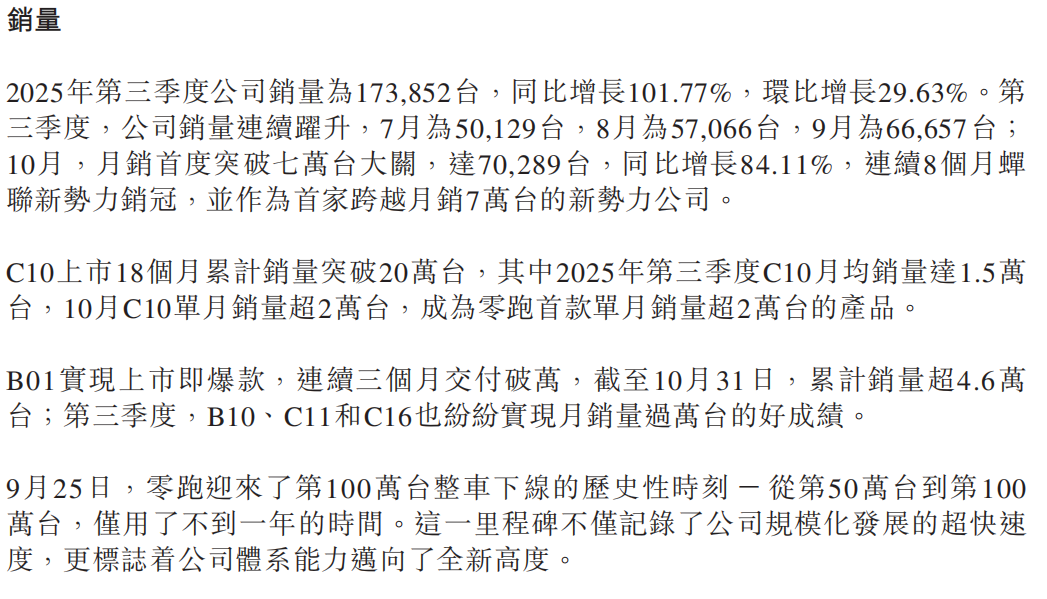

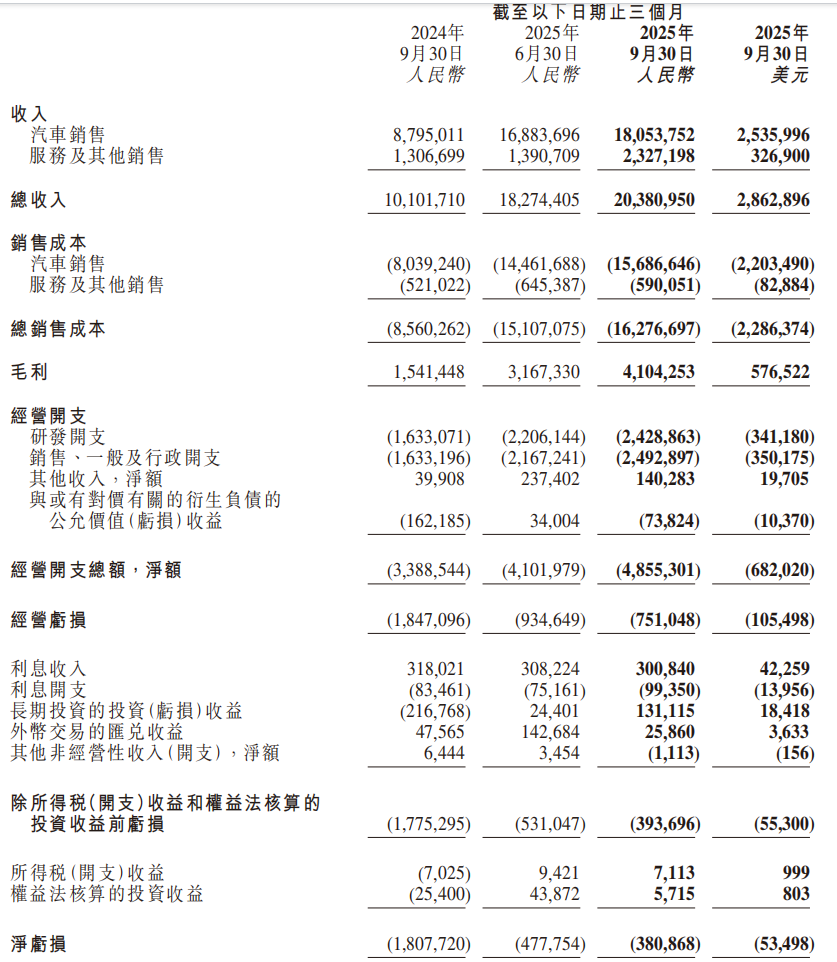

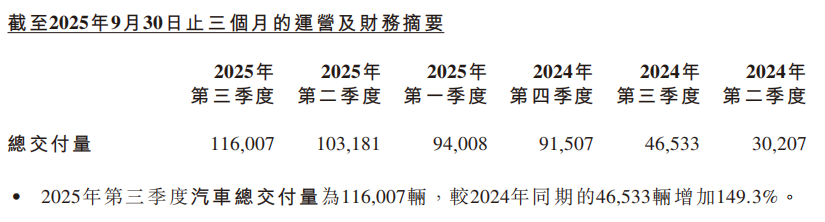

In contrast, XPENG resembles the classmate from a well-off family who dedicates themselves to cutting-edge technology. With a total revenue of 20.38 billion yuan in Q3, doubling year-on-year and surpassing Leapmotor, it delivered 116,000 vehicles—a respectable figure. Yet, it reported a net loss of 380 million yuan, as illustrated below:

Where did it go astray? Technology is a double-edged sword. XPENG's gross margin of 20.1% indicates its vehicles command a certain brand premium, allowing for higher prices. However, this premium is nearly offset by its R&D expenses (2.43 billion yuan, double that of Leapmotor) and marketing expenditures (2.49 billion yuan).

The much-hyped Robotaxi and humanoid robots in its financial report, these 'physical AI' narratives, are captivating stories in the capital markets but represent a financial black hole in current financial statements.

XPENG aspires to become an 'embodied AI company.' Its technological focus lies in equipping vehicles with a more powerful 'brain.' The LEAP3.5 architecture, dual 8797 chips, and 1280TOPS computing power—these parameters collectively create a smarter, more autonomous mobility future. In Guanchejun's view, its goal is not merely to build better cars but to redefine the interaction methods of the next era.

However, the business world is unforgiving, and time windows are limited. After calculations, Guanchejun found that XPENG's core vehicle business profitability actually weakened in Q3.

The overall gross margin improvement largely stemmed from the staggering 74.6% profit margin in services and other revenues, primarily from technology R&D services provided to other manufacturers.

This also indirectly reflects that XPENG's own technological monetization capabilities have not yet fully translated into equivalent profits in vehicle sales.

In terms of sales volume, XPENG's delivery of 116,007 vehicles, while up 149.3% year-on-year, still trails behind Leapmotor's 170,000 units.

In comparison, XPENG has chosen a more arduous and prolonged path, but one that may yield even more astonishing rewards. It is investing today to explore the ultimate form of the automotive industry.

The success of this high-stakes gamble hinges on its ability to strike a balance between technological leadership and commercial sustainability.

The charts in this article, unless otherwise stated, are sourced from publicly disclosed information from various channels. We hereby acknowledge and express our gratitude! The views expressed herein are for reference only and do not constitute investment advice.