Over 30 Years of Strategic Planning: The New Energy Vehicle Industry is Poised to Reap Rewards

![]() 11/19 2025

11/19 2025

![]() 562

562

Introduction

China's new energy vehicle (NEV) industry is on the verge of achieving the pinnacle of a national strategy that emphasizes "easy entry, but strict exit."

In 1991, China incorporated electric vehicle (EV) research and development into its "Eighth Five-Year Plan" for scientific and technological advancements, marking the beginning of a long and arduous journey for the NEV sector. Over the past three decades, sustained policy support and market development have propelled China's NEV industry to achieve remarkable leaps and transformations.

By October 2025, China's NEV sales accounted for over 50% of total automobile sales for the first time, surpassing traditional fuel-powered vehicles.

Undoubtedly, the rapid growth of China's NEV industry owes a significant debt to robust policy support. Since 2014, the purchase tax exemption policy has been extended four times, providing a sustained boost for the rapid expansion of the NEV market.

These policy incentives have been precisely tailored to attract fuel vehicle users looking to make the switch, accelerating the transition from fuel to electric vehicles.

Chen Shihua, Deputy Secretary-General of the China Association of Automobile Manufacturers (CAAM), highlighted that the high growth of NEVs this year can be attributed, in part, to the continued effectiveness of trade-in subsidy policies and, in part, to consumers bringing forward purchases ahead of next year's purchase tax policy adjustments.

The guiding role of policies has been pivotal, offering clear expectations for enterprises and strong momentum for the market. Data from October 2025 reveals that monthly NEV sales reached 51.6% of total new automobile sales, signaling a fundamental transformation in China's automotive industry.

The era when purchasing a car meant defaulting to a fuel vehicle is truly drawing to a close.

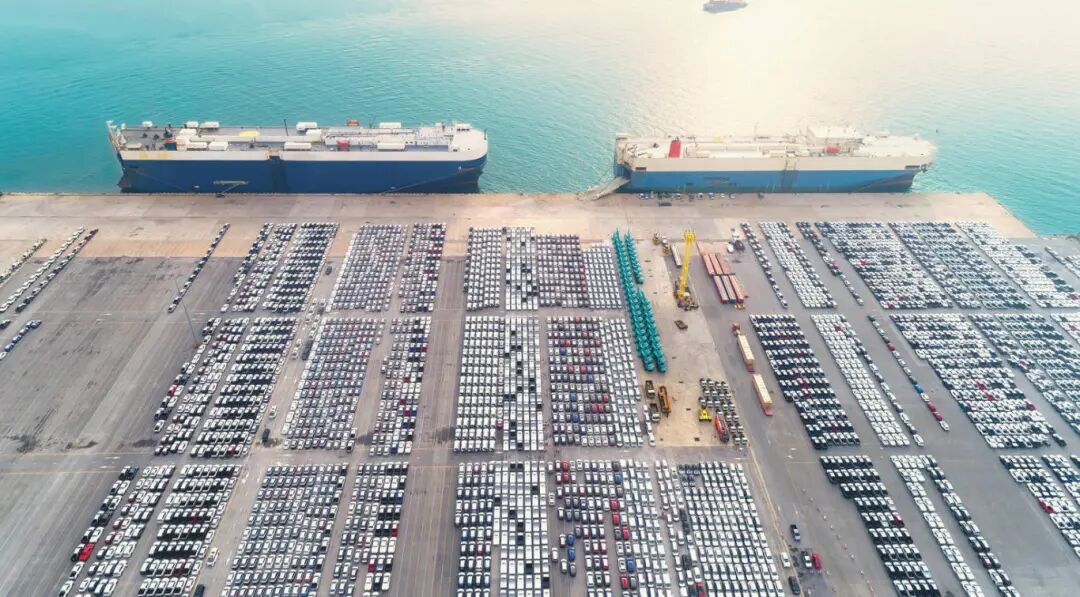

This historic leap is not only evident in the domestic market but also holds significant implications for exports. In the first ten months of this year, China's NEV exports reached 2.024 million units, while conventional fuel passenger vehicle exports declined by 7%. This stark contrast clearly demonstrates a fundamental shift in China's automotive industry competitiveness.

As the industry matures, policy incentives are being systematically phased out. According to a joint announcement by three ministries, the purchase tax exemption policy for NEVs will terminate on January 1, 2026, and be replaced by a 50% reduction, resulting in an actual tax rate of 5% and a maximum tax reduction of 15,000 yuan per NEV passenger vehicle.

Meanwhile, the future of the trade-in subsidy policy, which significantly boosted automobile consumption, remains uncertain.

Behind the policy rollback lies the inevitable logic of the industry's transition from policy-driven to market-driven growth. Subsidies serve as short-term regulatory measures during periods of market instability or economic weakness, capable of addressing immediate issues but unable to eliminate long-term uncertainties in industry development. As the subsidy cushion is gradually withdrawn, the industry's competitive logic will inevitably shift from policy-driven to product value-driven.

In fact, in the latter half of 2025, the national level intensively issued several new regulations to address industry chaos. On November 13, the Ministry of Public Security drafted the "Technical Conditions for the Safe Operation of Motor Vehicles" for public consultation, imposing explicit restrictions on electric door handles, assisted driving, and zero-to-100 km/h acceleration times in response to frequent safety issues in NEVs.

The draft mandates that passenger vehicles default to a zero-to-100 km/h acceleration time of no less than 5 seconds after each power-on and requires pure electric and plug-in hybrid passenger vehicles to be equipped with pedal misapplication acceleration suppression.

For electric door handles, the draft introduces more detailed requirements to ensure that non-collision side doors can be opened via exterior handles after an accident. More importantly, the draft explicitly stipulates that "power batteries shall not catch fire or explode within two hours of thermal runaway," directly addressing the most significant safety hazard in electric vehicles.

If fully implemented, these regulations will become the strictest motor vehicle safety technical regulations in history, steering the industry from wild growth to a more moderate and healthy development trajectory.

In the export sector, regulation is also being strengthened. On September 26, the Ministry of Commerce, the Ministry of Industry and Information Technology, the General Administration of Customs, and the State Administration for Market Regulation decided to implement export license management for pure electric passenger vehicles, with the announcement taking effect on January 1, 2026.

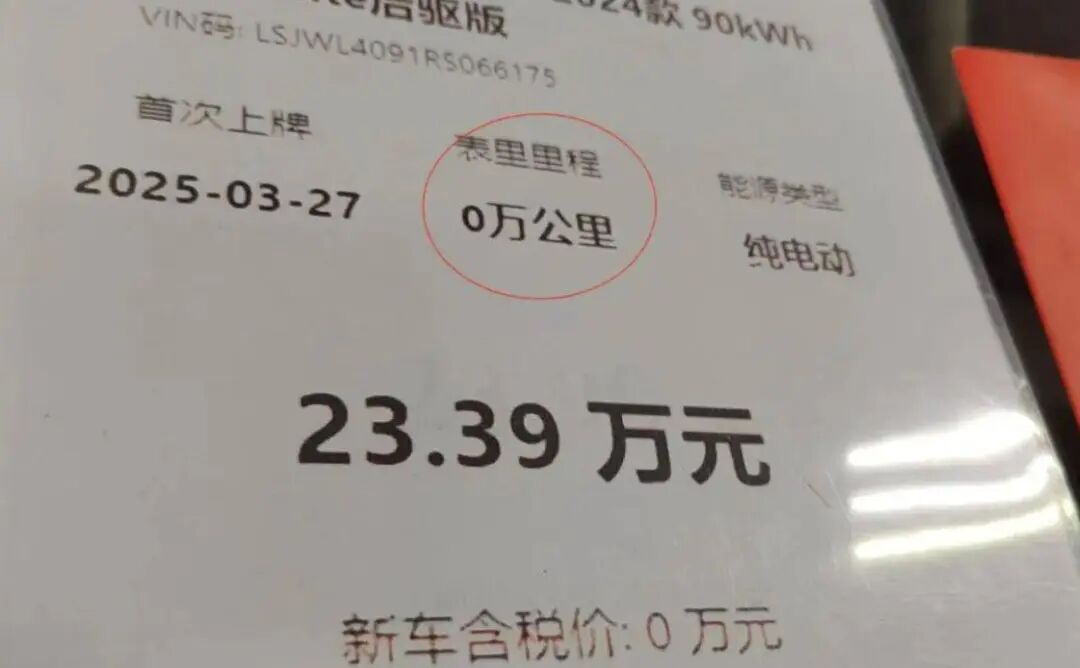

On November 14, the four departments issued the "Notice on Further Strengthening the Management of Used Car Exports," strictly controlling the export of new vehicles under the guise of used cars. The new regulations require that, starting January 1, 2026, for vehicles with a registration date less than 180 days prior to the export application, enterprises must submit an "After-Sales Maintenance Service Confirmation" issued by the vehicle manufacturer. Vehicles unable to provide the above materials will not be issued export licenses.

These policies precisely target industry malpractices. Previously, some enterprises evaded brand authorization and product certification requirements for new vehicle exports by registering new vehicles and then exporting them as "used cars," creating a gray operational chain where "domestically classified as used, overseas treated as new."

As generous incentive policies gradually phase out, competition in China's domestic NEV market is returning to its essence, shifting from "price wars" to "value wars." Tang Xuxia, Chief Analyst of the Automobile Industry at Guosen Securities, stated that NEVs have entered the mid-to-late stages of their growth phase, with branding and globalization being two crucial paths to counter internal competition.

Furthermore, intelligent driving is entering an accelerated phase, with general artificial intelligence poised to reshape the automotive industry landscape. 2025 has been dubbed the "First Year of Universal Intelligent Driving" by the industry, reflecting a struggle for industry definition rights.

Huawei is attempting to seize the definition rights for high-level intelligent driving by bundling its ADS 3.0 system with safety and usability, creating a competitive edge for its high-end brand. In contrast, BYD is pursuing a technology democratization route, with some institutions predicting it will introduce intelligent driving features in vehicles priced around 100,000 yuan. Both routes have their markets and are driving China's NEV industry to higher levels.

From the "Eighth Five-Year Plan" to 2025, after more than three decades of cultivation, China's NEV industry has finally reached a historic turning point. Initially, through an "easy entry" strategy of inclusive subsidies and relaxed access, we successfully stimulated market vitality, cultivated the world's most complete industrial chain, and the most vibrant sector, achieving a disruptive transformation and "overtaking through lane changes" from scratch.

However, wild growth also brought internal competition, safety, and reputation risks. Now, with the rollback of purchase tax exemptions and the early termination of trade-in subsidies, the policy "nurturing period" has ended. Meanwhile, the introduction of "strictest new regulations" such as the "Technical Conditions for the Safe Operation of Motor Vehicles" enforces "strict exit" standards in safety, quality, and export order, driving out inferior players and forcing industrial upgrading.

This "net tightening" does not signify an end but marks the industry's formal transition from a policy-driven greenhouse to a market- and rule-driven new phase. The national strategic layout has completed its sowing and cultivation, with the future course to be determined by mature markets, strict regulation, and the true core competitiveness of enterprises.

As many industry leaders have said, in the coming years, the top six automakers may capture over 80% of the market share. The qualifying round has ended, and the final battle has just begun. China's NEV industry is moving away from reckless adolescent growth and entering a phase of adulthood characterized by rationality and responsibility.

Editor-in-Charge: Li Sijia; Editor: He Zengrong

THE END