Leapmotor: “Leading” Momentum Encounters an Obstacle, How to Forge Through the Intense Competition?

![]() 11/19 2025

11/19 2025

![]() 449

449

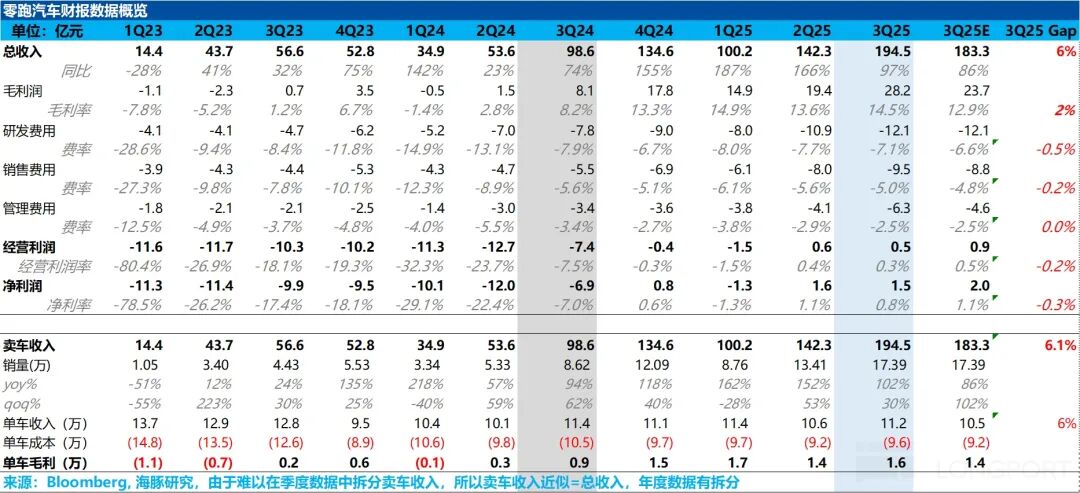

On November 18 (Beijing Time), after the market closed in Hong Kong, Leapmotor unveiled its financial report for the third quarter of 2025. The report presented a mixed bag of results, failing to uphold Leapmotor's usual streak of outperforming market expectations. Key highlights are as follows:

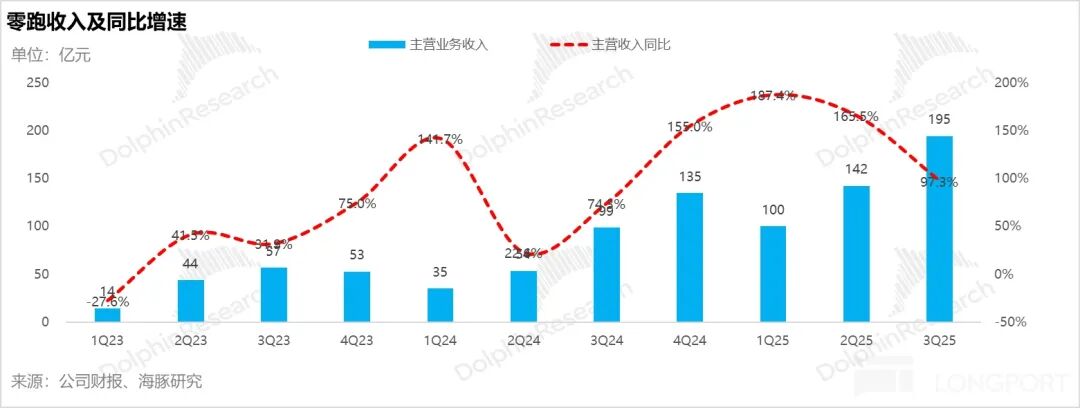

1. Robust revenue performance: The total revenue for the third quarter soared to RMB 19.45 billion, significantly outpacing the market consensus of RMB 18.33 billion. This surge was primarily propelled by the recognition of RMB 250 million in carbon credit revenue and a sequential uptick in the average selling price (ASP) of vehicles.

2. Persistent sequential rise in ASP: Despite the mass - scale production and delivery of the budget - friendly B01 model, which constituted 18% of the vehicle mix in the third quarter (an increase from the previous quarter), the overall vehicle mix continued to shift towards lower - priced options. Nevertheless, the actual ASP of RMB 112,000 witnessed a sequential increase of RMB 6,000. Dolphin Research attributes this to: (1) the absence of promotional discounts for older models in the third quarter (in contrast to the second quarter); (2) a 0.4 percentage point sequential rise in the proportion of overseas sales (reaching 10% of the vehicle mix); and (3) the recognition of carbon credit revenue.

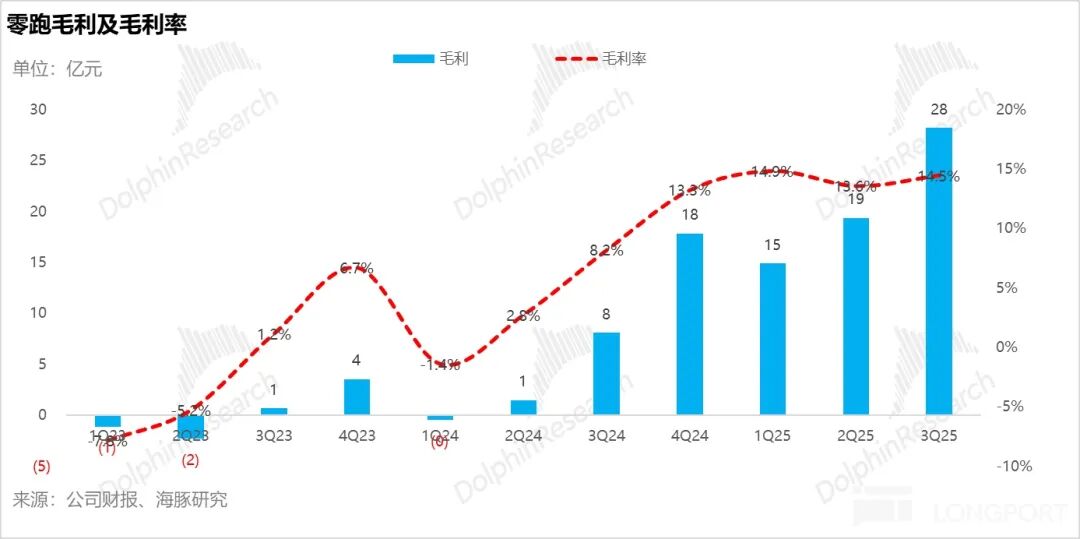

3. Vehicle gross profit margin also surpassed expectations: The vehicle gross profit margin climbed by 0.9 percentage points sequentially to 14.5% in the third quarter, exceeding the market consensus of 12.9%. This was mainly due to: (a) the sequential rise in ASP; (b) the recognition of carbon credit revenue with a full gross profit margin; and (c) a decline in per - unit depreciation and amortization costs driven by economies of scale.

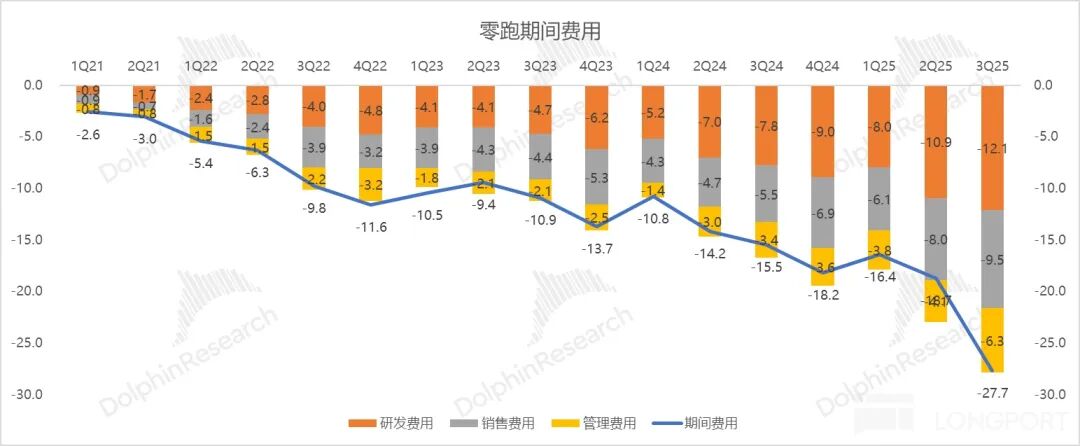

4. Steady increase in SG&A expenses, primarily due to rising investments in intelligence and channel expansion: Leapmotor continued to ramp up its SG&A expenses in the third quarter. Research and development (R&D) expenses reached RMB 1.2 billion, up by RMB 120 million sequentially, mainly due to ongoing investments in super extended - range models and intelligence technologies. The company had previously planned to achieve city - level Navigation on Autopilot (NOA) capability based on an end - to - end system by the end of the year. Selling expenses hit RMB 950 million in the third quarter, up by RMB 150 million sequentially and surpassing the market consensus of RMB 880 million. This was mainly attributable to expanded channel coverage, an increase in sales personnel, and higher marketing expenses. Leapmotor added 60 domestic retail channels, bringing the total to 866, as it continues to penetrate lower - tier markets in anticipation of the launch of the B - series and upcoming A - series models.

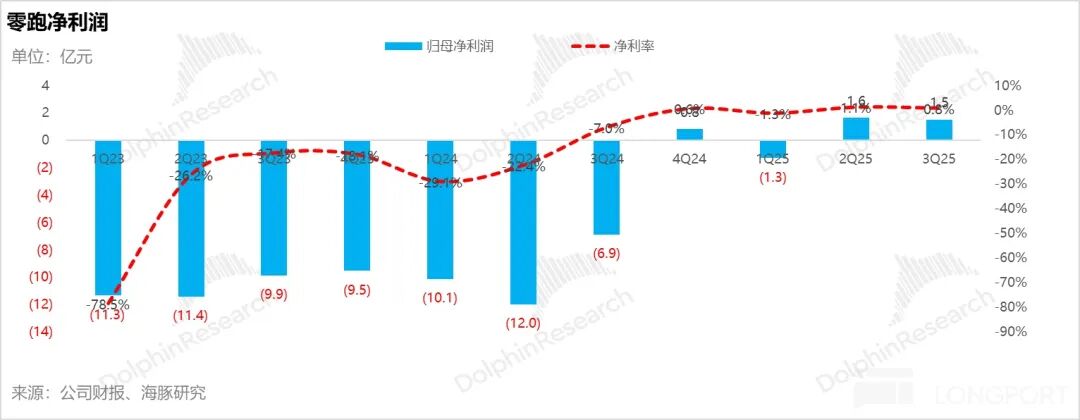

5. Net profit declined sequentially, falling short of market expectations: Despite the better - than - expected vehicle gross profit margin, the substantial increase in SG&A expenses ate into Leapmotor's net profit. Net profit for the third quarter was RMB 150 million, down sequentially and below the market consensus of RMB 200 million, thus dragging down profitability.

Dolphin Research's Perspective:

Overall, Leapmotor's total revenue and gross profit margin performed admirably in the third quarter, continuing to improve sequentially and surpassing market expectations. However, the significant sequential increase in SG&A expenses eroded the net profit, leading to a sequential decline and falling short of the market consensus of RMB 200 million.

Looking ahead to the fourth quarter of 2025 and 2026:

Leapmotor had previously set guidance for a full - year gross profit margin of 14% - 15%, net profit of RMB 500 million to RMB 1 billion, and sales volume of 580,000 to 650,000 units for 2025.

Given the current sales trend, despite the negative impact of reduced local subsidies in the fourth quarter, Leapmotor is implementing various measures to boost orders and sales volume:

(1) Enhanced promotional efforts in November: Specifically, the “B01” sedan now offers an additional RMB 2,000 in cash subsidies, while the “C11” SUV and “C10” SUV each offer an additional RMB 2,000 in cash subsidies. The “B10” SUV and “C16” SUV each offer an additional RMB 4,000 in cash subsidies.

(2) Leapmotor also launched the presale of the “Lafa5” hatchback in November.

Dolphin Research anticipates that Leapmotor's fourth - quarter sales volume will reach 218,000 units, up 25% sequentially, corresponding to a full - year sales volume of 613,000 units in 2025.

Regarding the fourth - quarter gross profit margin, despite increased discounts, Dolphin Research expects it to continue improving sequentially due to the recognition of RMB 500 million in carbon credit revenue with a full gross profit margin and the continued decline in per - unit fixed depreciation and amortization costs driven by economies of scale.

Looking ahead to 2026:

Leapmotor had previously set targets of 1 million domestic sales and 100,000 to 150,000 overseas sales for 2025, representing nearly double the sales volume compared to the previous year. It also provided a net profit guidance of RMB 5 billion for 2026.

The current stock price does not seem to reflect this continued high - growth sales expectation. Dolphin Research believes this is mainly due to two core concerns from the market:

(1) The negative impact of reduced purchase tax incentives in 2026, as Leapmotor's main models are priced in a segment where users are highly price - sensitive.

(2) Potential pressure on brand upward mobility for Leapmotor's models, with concerns that the sales performance of the three new D - series models may fall short of expectations.

However, Dolphin Research believes that Leapmotor's core competitiveness can still underpin its growth logic:

(a) Leapmotor continues to strengthen its cost advantage through a high degree of vertical integration and a high proportion of self - developed, self - produced, and self - supplied components. This enables Leapmotor to consistently launch models with higher cost - performance ratios compared to competitors, converting cost advantages into price advantages and solidifying its strategy of “lower prices, larger space, and higher configurations.” This approach caters to the demand for high cost - performance among price - sensitive users in the RMB 100,000 to RMB 200,000 price range. Leapmotor expects to increase its self - developed and self - supplied proportion to 80% next year, second only to BYD.

(b) In overseas markets, Leapmotor's partnership with Stellantis provides strong certainty in its overseas expansion, likely making it a leader among new energy vehicle (NEV) startups. Leapmotor can leverage Stellantis' brand strength, channels, and production capacity in Europe. Both shareholders have agreed to prioritize sales volume over profitability in the initial export phase, allowing Leapmotor to continue accumulating and expanding its sales volume in Europe by leveraging its cost - performance advantage.

The A - series models to be launched by Leapmotor in 2026, along with the currently launched B - series models, align with Europe's demand for low - priced small cars (compact and subcompact cars, which account for 60% - 70% of sales in Europe). Currently, Leapmotor's overseas expansion is accelerating significantly, with overseas orders reaching 27,000 units in October - November. It is expected to have little difficulty achieving the 2026 overseas sales target of 100,000 to 150,000 units.

- END -

// Reproduction Authorization

This article is an original work by Dolphin Research. Authorization is required for any form of reproduction.

// Disclaimer and General Disclosure

This report is intended solely for general comprehensive data purposes, targeting users of Dolphin Research and its affiliated entities for general reading and data reference. It does not take into account the specific investment objectives, investment product preferences, risk tolerance, financial situation, or special needs of any individual receiving this report. Investors must consult with independent professional advisors before making investment decisions based on this report. Any person making investment decisions using or referring to the content or information in this report assumes full risk. Dolphin Research shall not be liable for any direct or indirect responsibilities or losses that may arise from the use of the data contained in this report. The information and data in this report are based on publicly available sources and are intended for reference purposes only. Dolphin Research strives to ensure, but does not guarantee, the reliability, accuracy, and completeness of the information and data.

The information or opinions expressed in this report shall not, under any jurisdiction, be considered or construed as an offer to sell securities or an invitation to buy or sell securities, nor shall it constitute advice, a quotation request, or a recommendation regarding relevant securities or related financial instruments. The information, tools, and materials in this report are not intended for, nor are they intended to be distributed to, jurisdictions where the distribution, publication, provision, or use of such information, tools, and materials conflicts with applicable laws or regulations, or to citizens or residents of jurisdictions where Dolphin Research and/or its subsidiaries or affiliates are required to comply with any registration or licensing requirements.

This report reflects only the personal views, insights, and analytical methods of the relevant contributors and does not represent the stance of Dolphin Research and/or its affiliated entities.

This report is produced by Dolphin Research, and all copyrights are owned by Dolphin Research. Without prior written consent from Dolphin Research, no entity or individual may (i) produce, copy, duplicate, reproduce, forward, or create any form of copies or replicas in any manner, and/or (ii) directly or indirectly redistribute or transfer to any other unauthorized persons. Dolphin Research reserves all related rights.