Geely: Is It Able to Break Through Successfully Against BYD?

![]() 11/24 2025

11/24 2025

![]() 598

598

On November 17, 2025, Beijing time, during the lunch break of the Hong Kong Stock Exchange, Geely Auto unveiled its Q3 2025 report. Here are the key highlights:

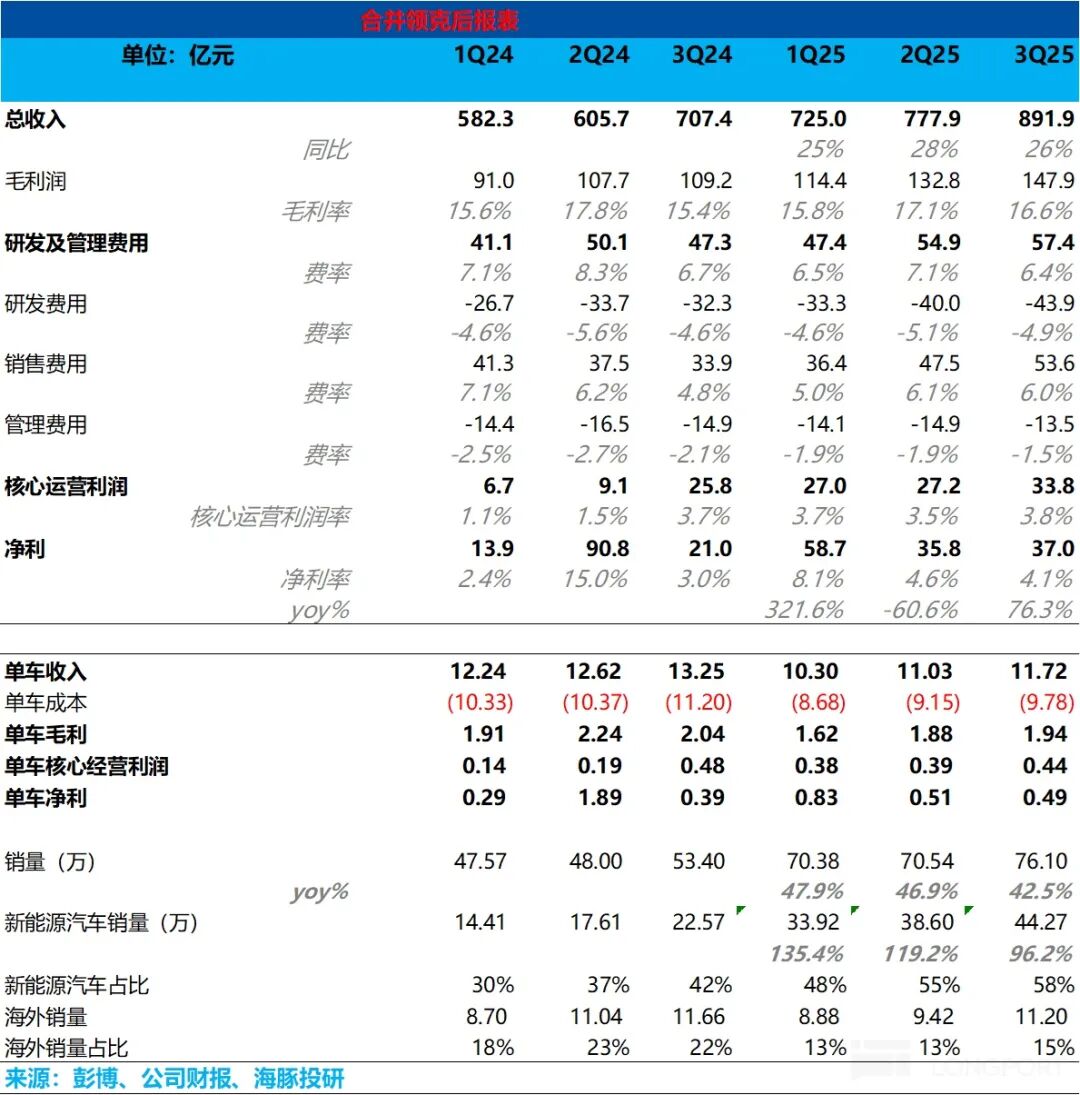

1. Revenue largely in line with expectations: The total revenue for the quarter hit RMB 89.2 billion, marking a 26% year-on-year increase and aligning closely with Dolphin Research's projections.

Analyzing volume and price: The average revenue per vehicle stood at RMB 117,000, up RMB 7,000 from the previous quarter, primarily attributable to an enhanced model mix. Vehicle sales for the quarter soared to 761,000 units, an 8% sequential rise, propelled by the robust sales of Geely's Galaxy models (Galaxy Star 8, Galaxy M9, Galaxy A7) and Lynk & Co models (Lynk & Co 10 EM-P, Lynk & Co 900).

2. Gross margin saw a sequential decline: The gross margin for the quarter was a mere 16.6%, down 0.5 percentage points sequentially. Dolphin Research attributes this dip mainly to the transformation of Lynk & Co products and increased discounts for inventory clearance. However, with the ongoing improvement in the model mix and the anticipated recovery of Lynk & Co's gross margin in Q4, a sequential rebound in the gross margin is expected.

3. Core operating profit margin witnessed a sequential improvement, thanks to reasonable cost control post-'One Geely' integration: From the perspective of core operating profit (gross profit - operating expenses - SBC expenses), the core profit margin rose by 0.3 percentage points sequentially to 3.8%, primarily due to reasonable cost control after 'One Geely' integration and the leverage effect of increased sales. The net profit per vehicle for the quarter also climbed by RMB 500 sequentially to RMB 4,400.

Dolphin Research's Perspective:

Overall, Geely's vehicle sales in Q3 maintained a steady pace. Last quarter, management raised the 2025 sales target to 3 million units, and sales in the first three quarters reached 2.17 million units (up 46% year-on-year), achieving 72.3% of the target. Given that Q4 is traditionally a peak sales season, coupled with pre-purchase demand ahead of the reduction in purchase tax incentives and the launch of several facelift models in Q4, Dolphin Research anticipates Geely's full-year sales in 2025 to reach 3.1 million units (with Q4 sales estimated at 930,000 units), surpassing the sales target.

Meanwhile, Geely's transition to new energy vehicles (NEVs) is progressing smoothly. NEV sales in Q3 reached 443,000 units, up 15% sequentially. The proportion of NEVs in the overall model mix also increased by 3 percentage points sequentially to 58%.

The primary drivers of NEV sales growth this quarter were Geely's Galaxy models (Galaxy Star 8, Galaxy M9, Galaxy A7) and Lynk & Co models (Lynk & Co 10 EM-P, Lynk & Co 900).

In the first three quarters, Geely's NEV sales reached 1.17 million units, achieving 78% of the revised 2025 full-year target of 1.5 million units.

Dolphin Research believes that Geely's continued breakthroughs in the new energy sector are largely attributable to its 'head-to-head competition' with BYD:

a) Cost reduction through technological shifts: By transitioning from a three-speed DHT (Dedicated Hybrid Transmission) solution to a single-speed DHT solution in its plug-in hybrid technology (saving approximately RMB 5,000 in costs) and reducing engine horsepower, Geely essentially shifted from a solution catering to all driving scenarios (particularly advantageous in high-speed scenarios) to one focusing more on urban driving, where most users in the RMB 70,000-150,000 price range operate, with cost-effectiveness as the primary driver (translation note: 'driver' here means 'key factor' or 'main consideration').

b) BYD's price war restrained by 'anti-self-competition' policies, providing Geely with a competitive edge: The sustained strong sales of Geely's Galaxy series, which directly competes with BYD, are not solely due to technological advancements and cost reductions through technological shifts but also because BYD's price war has slowed down due to 'anti-self-competition' policies, granting Geely a competitive window.

Regarding high-end models, Geely's three high-end offerings—Zeekr 9X, Lynk & Co 900, and Galaxy M9—have all garnered strong order volumes and sales:

① The Zeekr 9X was launched on September 29, priced between RMB 455,900 and RMB 589,900. It secured over 10,000 firm orders within 13 minutes of launch (benefiting from its spacious interior, luxurious features, and the Zeekr brand's appeal). The gross margin for the Zeekr 9X is expected to hover around 40%.

② The Galaxy M9 was launched on September 17, priced between RMB 173,800 and RMB 238,800. It received over 23,000 firm orders within 24 hours of launch and sold 10,000 units in its first month. Its gross margin also reached 20%-25%.

③ The Lynk & Co 900 currently sells around 7,500 units per month, with a stable gross margin of around 40%.

In Q4, the Zeekr 9X and Galaxy M9 will enter a full delivery season, further enhancing the model mix in Q4. Combined with the realization of scale effects in Q4 and the continued acceleration of Lynk & Co's new energy transition, Lynk & Co's gross margin is expected to rise from 11% in Q3 to around 15%-16% in Q4. Dolphin Research anticipates further increases in Geely's gross margin and net profit per vehicle in Q4.

Looking ahead to 2026:

① Geely will sustain its robust product cycle:

Geely plans to launch at least 1-2 new models per quarter in 2026, totaling nearly 10 new models for the year, spanning Zeekr, Lynk & Co, Galaxy, and China Star. This extensive product cycle will underpin Geely's continued market share growth in the new energy sector.

② Strong momentum for overseas expansion: With robust momentum for new energy overseas expansion, Geely aims to expand its overseas channels to 1,100-1,200 and expedite the overseas launch of new energy models. Overseas sales are projected to grow by 50%-80% in 2026, reaching 600,000-720,000 units (compared to 300,000 units in 2025), including nearly 300,000 NEVs, accounting for 45%-50% of overseas sales.

Geely's overseas models boast higher gross margins and net profits per vehicle. The gross margin for overseas models is 10 percentage points higher than that for domestic models, and the net profit per vehicle for overseas models has reached RMB 10,000, continuing to drive Geely's profitability recovery.

③ Cost reduction and efficiency gains post-'One Geely' integration: Zeekr will be consolidated into the financial statements by the end of the year, and synergies will be fully realized in 2026. Operating expenses are expected to continue to decline.

With management guiding for a higher proportion of overseas sales, the realization of scale effects, and cost reduction and efficiency gains from 'One Geely' integration, net profit per vehicle is expected to continue to increase by 30% year-on-year in 2025.

Geely's current share price corresponds to a 2025 P/E ratio of only 9 times and a 2026 P/E ratio of less than 8 times. This 'undervalued' status is primarily due to market concerns about a potential industry-wide downturn following the reduction in purchase tax incentives next year.

However, with Geely's new energy transition nearing 60% and steady progress in overseas expansion and high-end models, particularly the relatively strong progress in high-end models, the fundamentals remain solid.

- END -

// Reprint Authorization

This article is an original piece by Dolphin Research. To reprint, please add WeChat: dolphinR124 for authorization.

// Disclaimer and General Disclosure

This report is intended solely for general comprehensive data purposes, catering to users of Dolphin Research and its affiliated institutions for general reading and data reference. It does not take into account the specific investment objectives, investment product preferences, risk tolerance, financial situation, or special needs of any individual receiving this report. Investors must consult with independent professional advisors before making investment decisions based on this report. Any person making investment decisions using or referring to the content or information in this report assumes full risk. Dolphin Research shall not be held liable for any direct or indirect responsibilities or losses arising from the use of the data contained in this report. The information and data in this report are based on publicly available sources and are for reference purposes only. Dolphin Research strives to ensure but does not guarantee the reliability, accuracy, and completeness of the information and data.

The information or opinions expressed in this report shall not, under any jurisdiction, be construed as or deemed to be an offer to sell securities or an invitation to buy or sell securities, nor shall it constitute advice, a quotation, or a recommendation regarding securities or related financial instruments. The information, tools, and data in this report are not intended for or proposed for distribution to jurisdictions where distribution, publication, provision, or use of such information, tools, and data contradicts applicable laws or regulations or results in Dolphin Research and/or its subsidiaries or affiliated companies being subject to any registration or licensing requirements in such jurisdictions, nor are they intended for citizens or residents of such jurisdictions.

This report reflects only the personal views, opinions, and analytical methods of the relevant authors and does not represent the stance of Dolphin Research and/or its affiliated institutions.

This report is produced by Dolphin Research, and the copyright is solely owned by Dolphin Research. Without prior written consent from Dolphin Research, no institution or individual may (i) produce, copy, duplicate, reproduce, forward, or distribute in any form, directly or indirectly, copies or reproductions of this report, and/or (ii) redistribute or transfer this report to other unauthorized persons. Dolphin Research reserves all relevant rights.