Musk Demands a Salary of 400 Billion! Tesla's FSD Popularization Still Faces Numerous Challenges

![]() 06/17 2024

06/17 2024

![]() 513

513

After much effort, Musk finally secured his much-desired compensation at the shareholders' meeting in the early morning of June 14, Beijing time. The reward of approximately 400 billion yuan is a recognition of Musk's efforts and Tesla's development over the years.

After achieving his goal, Musk began to showcase Tesla's future plans to shareholders, including an unmanned taxi product, three new models, electric trucks, robots, and more. Tesla previously only had four passenger cars for sale, namely Model 3/Y/X/S, followed by the Cybertruck pickup truck and the Semi tractor truck. Now, three upcoming models have been announced, and from the pictures, it seems that one of them is an MPV, which is somewhat puzzling.

In fact, from Tesla's previously released financial reports, one can understand why Musk is eager to launch new products. In the first quarter of this year, Tesla's net profit plunged by 53.49%, and its gross profit was lower than BYD's. Many shareholders attributed this to Tesla's continuous price reductions and promotional activities, leading to a decline in product profit margins. However, I believe that price reductions have always been within Musk's plan, as he once stated that Tesla could sell cars at zero profit and rely on software to generate revenue.

Now that Tesla's net profit has been halved, although price reductions are a factor, the core issue may lie in software revenue, especially FSD subscriptions, which have fallen far short of Musk's expectations. What exactly went wrong with FSD, which Musk had high hopes for?

Promotion Obstacles

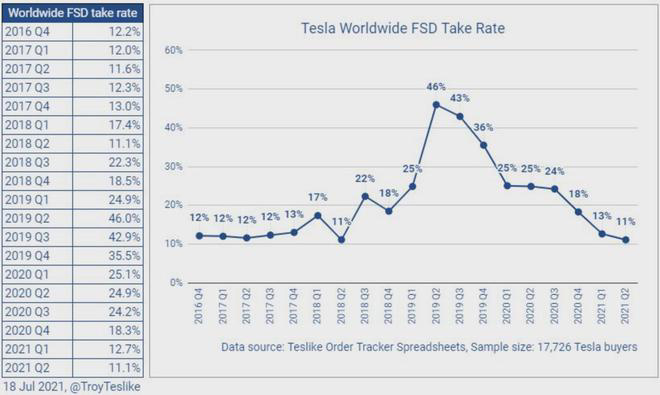

According to statistics from research firm Troy Teslike, FSD subscription rates have been declining since the second quarter of 2019 to mid-2022, reaching only 7.4% globally in the third quarter of 2022.

To promote FSD, Tesla has launched various campaigns multiple times, such as Musk sending two internal letters requiring after-sales service personnel to demonstrate FSD to consumers when picking up their cars and making mandatory FSD experiences part of the test drive. Additionally, new car owners can trial FSD for free for one month after delivery.

Recently, Tesla again offered a free one-month trial of FSD. However, Gary Black, a well-known Tesla investor and managing partner of Future Fund, stated that based on data from credit card data provider YipitData, less than 2% of users who trialed FSD subscribed to it.

In response, Musk specifically refuted this, stating that the actual data was much higher than 2%. However, Musk did not provide specific numbers, suggesting that the conversion rate of this FSD trial may not have reached the expected 6%.

Regarding why users are unwilling to subscribe to FSD, I believe there are three main reasons. First, distrust of autonomous driving functionality. Even though FSD stands for Full-Self Driving, it is still categorized as L2+, and there are too many vehicles on the road that do not support autonomous driving. Even with FSD enabled, it is difficult to avoid accidents caused by other vehicles.

Second, the price is too expensive. FSD has undergone multiple price adjustments, dropping from a peak of $15,000 to $8,000 (approximately 58,000 yuan), but it is still too expensive for ordinary consumers. In comparison, advanced intelligent driving systems from domestic automakers generally cost around 25,000 yuan, only about 50% of FSD's price.

I have always believed that consumers need to pay for hardware such as autonomous driving chips and sensors when purchasing a car, and paying extra to activate advanced intelligent driving systems amounts to double charging. Moreover, spending tens of thousands of yuan on a car and then an additional 50,000 to 60,000 yuan to activate intelligent driving does not seem worth it.

Third, FSD has not officially entered the Chinese market. As Tesla's largest market, China previously did not allow FSD to enter the country. However, Musk's recent visit to China is suspected to be related to FSD's entry into China. Domestic consumers not only buy more Tesla cars but also have a high acceptance of intelligent driving. Many videos of consumers using advanced intelligent driving systems can be found on video platforms such as Douyin, Kuaishou, and Bilibili.

For Tesla, continuing to iterate and upgrade its intelligent driving system to demonstrate the capabilities of FSD and providing more preferential policies to consumers are the keys to increasing FSD subscriptions. At this shareholders' meeting, Musk has already revealed a lot of important information related to intelligent driving.

Bombshell News

Addressing consumers' concerns, Musk plans to enhance the capabilities of intelligent driving on one hand and showcase Tesla's strength on the other.

At the shareholders' meeting, Musk stated that the HW5 platform is under development and its performance can reach 10 times that of HW4. Tesla's intelligent driving system has not only evolved its software algorithms into the era of end-to-end large models, but its hardware is also constantly iterating and upgrading. The current HW4 platform equipped in mass-produced vehicles achieves 3-8 times the performance of HW3.

The upcoming HW5 may be based on Samsung's 4nm process technology, offering a 10-fold performance improvement. It may also be optimized for end-to-end use, comprehensively enhancing intelligent driving capabilities and preparing for the era of L3 autonomous driving.

Secondly, Tesla's Robotaxi is also on the horizon. While many may believe that Robotaxi will be one of Tesla's future revenue pillars, I believe that Robotaxi is the best way for Tesla to showcase its strength, allowing local consumers to experience FSD up close.

Robotaxi will become a window for Tesla to showcase its intelligent driving capabilities, attracting other consumers to purchase Tesla cars and subscribe to FSD, playing a crucial role in Tesla's overall sales and revenue.

Lastly, there are preferential policies. Not only is FSD expensive, but under normal circumstances, it is not allowed to be transferred to other vehicles, resulting in significant costs for users every time they change cars. At the shareholders' meeting, Musk revealed plans to launch an FSD transfer campaign that may last for a quarter.

While this campaign may not significantly help FSD's subscription rate, it may stimulate consumers to change cars, increase new car sales, and reduce inventory backlog. If such campaigns can be launched frequently, they may give users confidence in subscribing to FSD without worrying about having to repurchase it when changing cars in the future.

I believe that the subscription system for intelligent driving is inherently unreasonable. Subscriptions should be tied to accounts, not devices. Allowing FSD to be freely transferred, with a maximum limit on the number of transfers, is the way the subscription system should work.

It is evident from these strategies that Musk has spared no effort in promoting FSD, enhancing intelligent driving capabilities and exposure from all aspects. However, will Musk's efforts truly increase FSD's subscription rate?

A Turnaround

After FSD entered version V12.3, its excellent end-to-end performance has led many users to state that FSD not only helps users drive cars but also operates them almost indistinguishably from experienced drivers. It is difficult to tell whether it is autonomous driving or a human driver operating the car from outside the vehicle.

Nonetheless, FSD still hasn't attracted enough subscriptions from car owners, and the key factor remains safety concerns among consumers. While Tesla has proposed many plans to enhance FSD's capabilities and exposure, most of them are difficult to implement in the short term and may not have much effect on FSD's subscription rate.

From a policy perspective, there are still not many countries worldwide that have legally approved the full commercialization of L3 autonomous vehicles. Before L3 autonomous driving is legally allowed, consumers are inevitably lacking in trust in autonomous driving.

Various indications suggest that intelligent driving technology worldwide is likely to switch to the L3 track within three to five years, especially as nine domestic automakers recently obtained approval and road test qualifications, which is generally considered to indicate that L3 implementation in China is not far off. On the other hand, companies that have obtained road test qualifications are also considered by users to have stronger autonomous driving capabilities, indicating that consumers' acceptance of advanced intelligent driving and L3 autonomous driving is increasing.

Of course, there is still a gap between the commercialization and popularization of L3. Globally, consumers who can afford luxury cars are always in the minority, but it is unlikely that consumers of mid-to-low-end cars would be willing to spend 40,000 to 50,000 yuan to subscribe to an intelligent driving function that cannot be transferred. With insufficient popularization, it is difficult to ensure the safety of intelligent driving, and therefore, the subscription price and system for intelligent driving also need to be changed.

Autonomous driving is approaching an inflection point, but there is still much room for improvement. However, Tesla, headquartered in the United States, faces relatively low competition intensity and lacks sufficient pressure to make improvements and breakthroughs in subscription prices and systems. Perhaps we can look forward to domestic brands such as XPeng and Huawei finding suitable routes for intelligent driving system subscriptions first and then promoting global peers to make improvements. At that time, Tesla may be able to find truly feasible ways to promote FSD.

Source: LeiTech