Renault and Geely Make a “Triple Leap” in Collaboration, Reshaping Industry Dynamics!

![]() 12/30 2025

12/30 2025

![]() 345

345

From "product exports" to "technology sharing," Chinese automakers are revolutionizing the landscape of global automotive industry collaboration. Through diverse reverse joint venture models, they are transitioning from followers to active participants in shaping industry rules.

On November 18, within the Elton Senna Industrial Park in Curitiba, Brazil, Renault and Geely announced the establishment of a joint venture, "Renault Geely Brazil," and finalized an investment plan of RMB 5.1 billion. This partnership is not a mere coincidence but the culmination of three years of progression, evolving from initial engagement to deep integration. Their collaboration now boasts a three-dimensional framework encompassing "technology-capital-market."

Renault and Geely's “Triple Leap” in Collaboration

The essence of Renault and Geely's partnership lies in the precise alignment of their complementary resources.

In May 2022, Geely, through a subsidiary, acquired a 34.02% stake in Renault Korea Motors, marking the start of their collaboration. Geely contributed its CMA modular architecture and hybrid technology from its Swedish R&D center, while Renault provided local design expertise and sales network support. The collaboration yielded immediate results: the Renault Austral, based on the Geely Xingyue L, garnered 7,000 pre-orders upon launch. From 2023 to the first half of 2024, Geely earned RMB 330 million in dividends.

In May 2024, the HORSE Powertrain Company, a 50-50 joint venture, was established, focusing on hybrid and fuel system R&D with an annual production capacity of 5 million units, serving nine core clients across 130 countries. This strategic move integrates Renault's traditional manufacturing prowess with Geely's technological advancements in new energy powertrains, creating a synergistic effect of "global R&D, regional supply."

The latest Brazil collaboration exemplifies the "reverse joint venture" model: Geely acquired a 26.4% stake, gaining access to Renault's factory with an annual production capacity of 400,000 units and a mature distribution network. This enabled the rapid introduction of models like the EX5 and EX2 (Xingyuan) to the local market. Renault, leveraging Geely's GEA new energy architecture, filled its gap in the South American electric vehicle market. According to the plan, both parties will launch two Geely-architected models in 2026 and introduce a new Renault model based on a jointly developed platform in 2027, achieving "technology sharing, dual-line growth."

For Renault, this collaboration is the "key to breakthrough": By integrating Geely's technology, its electric vehicle R&D cycle has been shortened from three years to 20 months. For instance, on November 6, the Renault Twingo E-Tech made its global debut, marking the electric transformation of this classic urban model beloved by European users since 1992, achieved in just 21 months. The utilization rate of the Brazilian factory will increase from 50% to full capacity, resolving long-standing asset idle issues.

For Geely, this is a "globalization accelerator": Without the need to build production and sales systems from scratch, it can rapidly enter high-growth markets by leveraging Renault's localization resources in South America and Korea. As Geely CEO Gan Jiayue stated, the scale effect formed by this "intercontinental synergy" enables Chinese technology to "reach global users at the lowest cost."

For the industry, it signifies a "power shift" in global automotive division of labor: The traditional model of "Europe and the U.S. exporting technology, China providing the market" has been overturned, with Chinese automakers now participating in global rule-making as "technology providers."

From "Market for Technology" to "Technology for Collaboration"

The deep integration between Renault and Geely starkly contrasts with Renault's previous strategies in the Chinese market, reflecting the dramatic transformation of China's automotive industry over the past two decades.

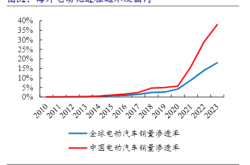

In 2013, Renault established a joint venture with Dongfeng Motor, entering the Chinese market through a "technology licensing + local production" model. However, this collaboration remained mired in "internal combustion engine thinking": The main models, the Koleos and Kadjar, were both adapted from internal combustion engine platforms, missing out on the explosive growth of China's new energy vehicle market after 2015. In 2020, Dongfeng Renault was officially dissolved, with Renault China CEO Su Weiming citing the core reason as "products failing to keep pace with electrification and intelligence" – at that time, China's new energy vehicle penetration rate had exceeded 5%, while Renault had no pure electric models in China.

After exiting the complete vehicle joint venture, Renault did not abandon China but established a China division in 2024, upgrading the Shanghai ACDC R&D center as the core for global electrification R&D. Unlike the initial attempt to "seek market," Renault's core objective this time was to "learn technology and leverage the ecosystem": The ACDC R&D center adopted a "simultaneous engineering" model, reducing the prototype development cycle for the Twingo E-Tech from 3-4 months to 4 weeks. Collaborating with 30 Chinese suppliers, including CATL and Fuyao Glass, it reduced project development costs by 50% and mold costs by 40%. Consequently, the Twingo E-Tech's price will be below €20,000.

More symbolically, Renault terminated its rare earth-free motor project with Valeo in 2025, turning to Chinese suppliers instead. This marks its shift from "European technology supremacy" to "Chinese supply chain dependency," as ACDC Director Philippe Brunet stated: "Without being part of the Chinese ecosystem, one cannot compete in the electric vehicle market."

The "two-way embrace" between Renault and Geely is essentially an inevitable choice under the restructuring of the global automotive industry: Traditional automakers urgently need to break through, while Chinese strength is rewriting the rules.

Renault's strategic anxieties stem from its dependence on the European market and sluggish electrification transformation.

In 2024, although Renault achieved record-high operating profits, its dependence on the European market remained at 63%, while its market share in European A-segment vehicles fell below 5%, intensifying pressure for electrification transformation. Meanwhile, compared to Volkswagen and BMW's annual R&D investments of hundreds of billions of euros, Renault struggles to bear the costs of a full new energy supply chain. The CATL CTP battery used in the Twingo E-Tech costs 20% less than similar products, a key factor in its pricing below €20,000.

More critically, Renault faces severe global production capacity idle issues. Apart from the Brazilian factory, Renault's plants in India, Cambodia, and other locations operate at less than 50% utilization, requiring external technology and market infusions to revitalize assets.

In contrast, Chinese automakers possess globalization confidence derived from technological, ecological, and scale advantages.

On the supply chain front, Chinese automakers' technological influence continues to rise. For instance, China controls over 70% of global rare earth mining and nearly 90% of refining capacity; CATL dominates one-third of the global power battery market; Geely's GEA architecture and BYD's e-Platform 3.0 have achieved "reverse exports."

In terms of ecological synergy, China's automotive industry leads in efficiency. For example, Renault's ACDC R&D center and suppliers' "9-week fixed point" model and simultaneous engineering's parallel development have made China a "hub of efficiency" for Renault's global automotive R&D.

Regarding scale advantages, from January to October this year, the combined sales of China's top 15 automotive groups reached 25.582 million units, up 12.5% year-on-year, accounting for 92.4% of total automotive sales. Intense domestic competition compels companies to "go global." For Geely, the 85% year-on-year growth in Brazil's new energy vehicle market presents an ideal growth space.

The cooperation between Renault and Geely is not an isolated case; the trend of reverse joint ventures has become a "new paradigm" for Chinese automakers' globalization.

In recent years, Chinese automakers have shifted from "product exports" to "technology exports + capital cooperation," forming diverse reverse joint venture models. Collaborations such as XPeng and Volkswagen, Stellantis and Leapmotor, and BYD and Toyota outline a clear trajectory of technological influence shift.

Specifically, if XPeng and Volkswagen's "cross-power collaboration" can be termed intelligent technology export-oriented, then Stellantis and Leapmotor's "efficiency revolution" can be classified as platform licensing and sharing-oriented, while BYD and Toyota's "standard co-creation" represents joint R&D and co-building-oriented. These three models collectively prove that Chinese automakers have transitioned from "technology followers" to "rule participants" – XPeng reconstructs fuel vehicle upgrade paths with intelligent architectures, Leapmotor lowers electrification barriers with modular platforms, and BYD achieves standard mutual recognition through joint R&D. Reverse joint ventures are becoming a "standard path" for Chinese automotive globalization.

From the dissolution of Dongfeng Renault to the establishment of Renault Geely Brazil, in just five years, Renault has transformed from a "dominator" to a "collaborator" in the Chinese market, while Geely has grown from a "technology learner" to an "ecological enabler." Behind this identity swap lies the "triple leap" accomplished by China's automotive industry over 20 years: from assembly and contract manufacturing to independent R&D, from product exports to technology exports, and from passive joint ventures to actively defining cooperation rules.

Renault Group's Chief Growth Officer Cambolive's statement is highly representative: "We are no longer teaching Chinese automakers what to do but working together with them." When the Twingo E-Tech bears the label "Made in Europe, Powered by China," and when Geely's architectures support Renault's South American ambitions, the center of the global automotive industry has quietly shifted eastward. In the future, more cooperation stories of "Chinese technology + overseas networks" will unfold, serving as the best footnote for China's journey from an "automotive giant" to an "automotive powerhouse."

Note: This article was first published in the "Hot Topics" column of the December 2025 issue of Auto Review magazine. Please stay tuned.

Image: From the Internet

Article: Auto Review

Layout: Auto Review