Why Does Toyota Remain Steadfast While Japanese Cars Encounter a Setback in China?

![]() 01/15 2026

01/15 2026

![]() 410

410

Introduction

The answer to this question not only lies in Toyota being the world’s largest automaker but also in the underlying logic of its global dominance.

In 2025, the fierce competition in China’s auto market served as a revealing mirror, clearly reflecting the current states of the three major Japanese automakers.

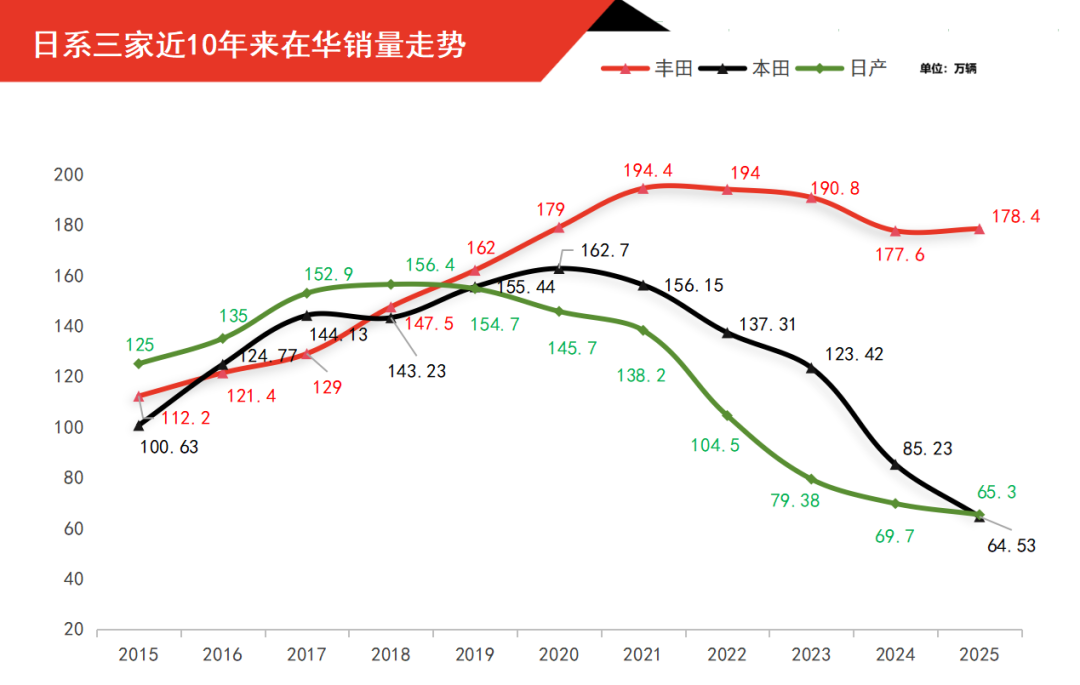

Recently, Toyota, Honda, and Nissan announced their 2025 sales performance in China. Toyota sold 1.784 million vehicles, marking a slight increase from 2024 and its first growth in four years. In contrast, Nissan’s sales fell by 6% year-on-year to 653,000 units, while Honda’s dropped by 20% to 645,300 units.

From a competitive standpoint, a decade ago, Nissan led among Japanese brands, Honda occasionally took second place, and Toyota even fell to the bottom. Today, Toyota has maintained its lead for seven consecutive years. For the first time in six years, Honda’s sales in China have dropped below Nissan’s, ranking third among Japanese automakers.

In recent years, Japanese automakers have faced significant challenges in China, with their market share halving from a peak of 25% to around 10%. Toyota has emerged as the sole “anchor,” while Honda’s sales have plummeted by nearly 1 million units in five years, and Nissan has experienced a decline for seven straight years. The once-balanced tripartite competition has now become unbalanced.

This divergence is not only reflected in sales data but also stems from deeper differences in the three companies’ understanding and adaptability to the Chinese market.

Amid intense competition from domestic brands in both traditional fuel and new energy sectors, why has such a stark contrast emerged in just a few years? What are the root causes of Honda and Nissan’s declines? Is Toyota’s stability solely attributable to its title as the world’s largest automaker?

The answers likely extend beyond that. Precise product matrix positioning, strong support from high-end brands, and deep insights into Chinese market demands—including strategies and market performance for each model—hold the keys to Toyota’s counter-trend growth.

01 Toyota, Honda, Nissan: A Tale of Two Extremes

While social media is filled with hostility toward Japanese cars and celebration over their market share declines, the reality is that Japanese automakers have not experienced a uniform collapse. Instead, they have diverged sharply. This shift reflects not just total sales but also differences in specific models and strategies.

Take Toyota, for example. Over the past decade, it has demonstrated “steady growth with controlled volatility.” From 1.122 million units in 2015, it peaked at 1.944 million in 2021. Despite a slight subsequent decline, sales rebounded to 1.784 million in 2025, marking a 60% increase over ten years with annual volatility below 7%. Toyota is the most resilient of the three brands.

Notably, in 2025—a challenging year for Japanese automakers in China—Toyota’s sales still grew by 0.2% year-on-year, showcasing its remarkable capability.

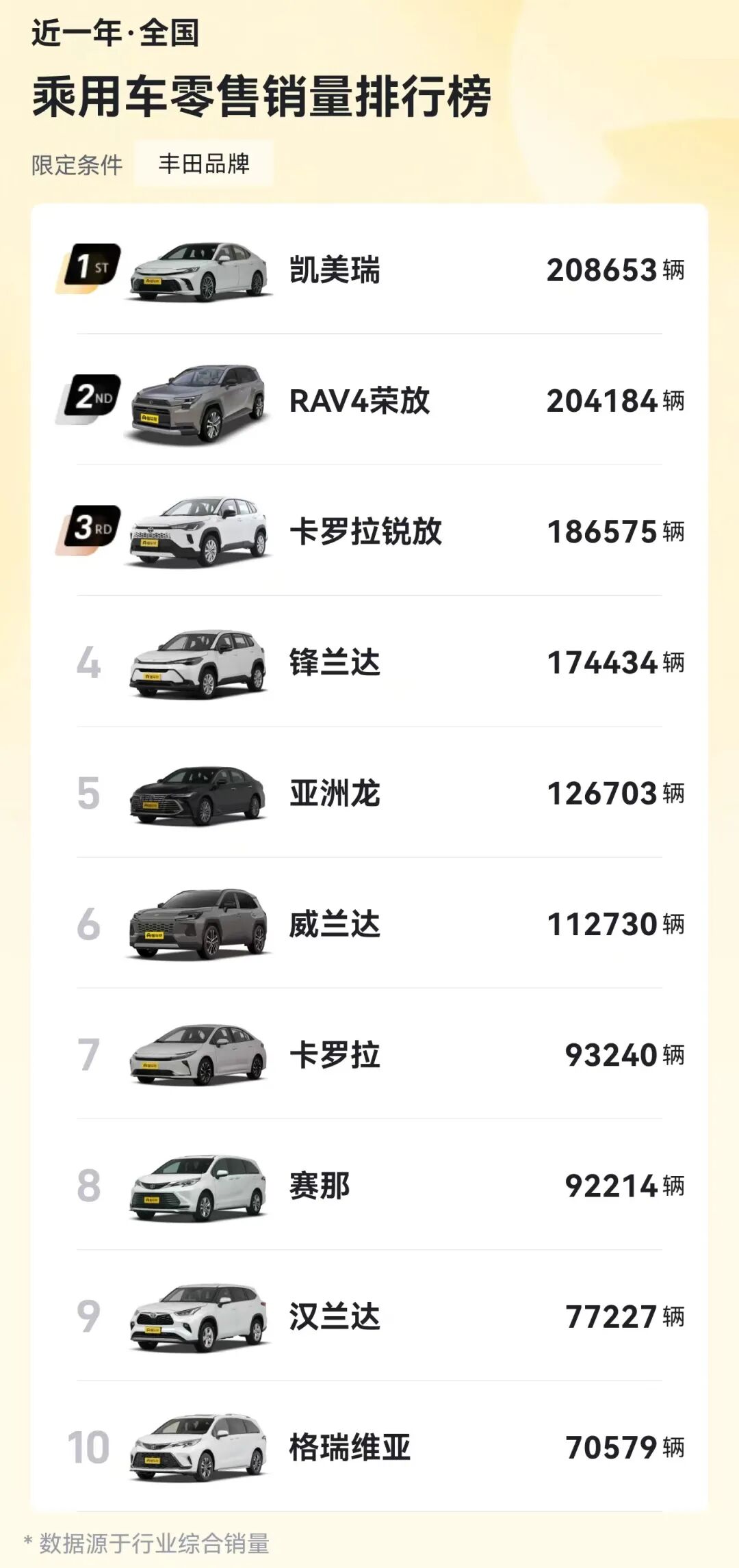

Why Toyota? A review of its 2025 model sales reveals a “no-weak-link product lineup.”

In the premium segment (¥200,000–¥300,000), the Sienna (92,200 units), Highlander (77,200 units), Granvia (70,500 units), and Crown Kluger (60,000 units) formed a strong SUV+MPV dual-line strategy, meeting Chinese consumers’ demand for spacious vehicles. MPV models alone sold over 160,000 units, securing Toyota’s dominance in the MPV market and raising its average brand price.

In the mainstream segment (¥150,000–¥200,000), the Camry (208,600 units), RAV4 (204,100 units), and Avalon (126,700 units) solidified Toyota’s leadership in joint venture mid-size cars and SUVs. Domestic new energy vehicles (NEVs) have yet to make significant inroads in this segment, and new entrants have not captured core market share, allowing Toyota to retain pragmatic users.

In the volume segment (¥100,000–¥150,000), the Corolla Cross (186,500 units), Frontlander (174,400 units), and Wildlander (112,400 units) contributed over 460,000 units in total, aligning perfectly with strong demand in China’s SUV market.

As Toyota’s strongest pillar, the luxury brand Lexus performed exceptionally well, selling 182,000 units in 2025, a 0.7% year-on-year increase. It not only claimed the top spot in the luxury imported car market but also became the only imported and traditional luxury brand to achieve growth in 2025, solidifying Toyota’s brand strength.

In China’s booming NEV market, Toyota has also excelled. The bZ4X electric vehicle sold 70,000 units, becoming the top-selling joint venture EV. The bZ series sold 110,000 units in total, nearly doubling from 60,000+ units in 2024. Hybrid models accounted for over 50% of sales, creating a “stable fuel-electric dual presence.”

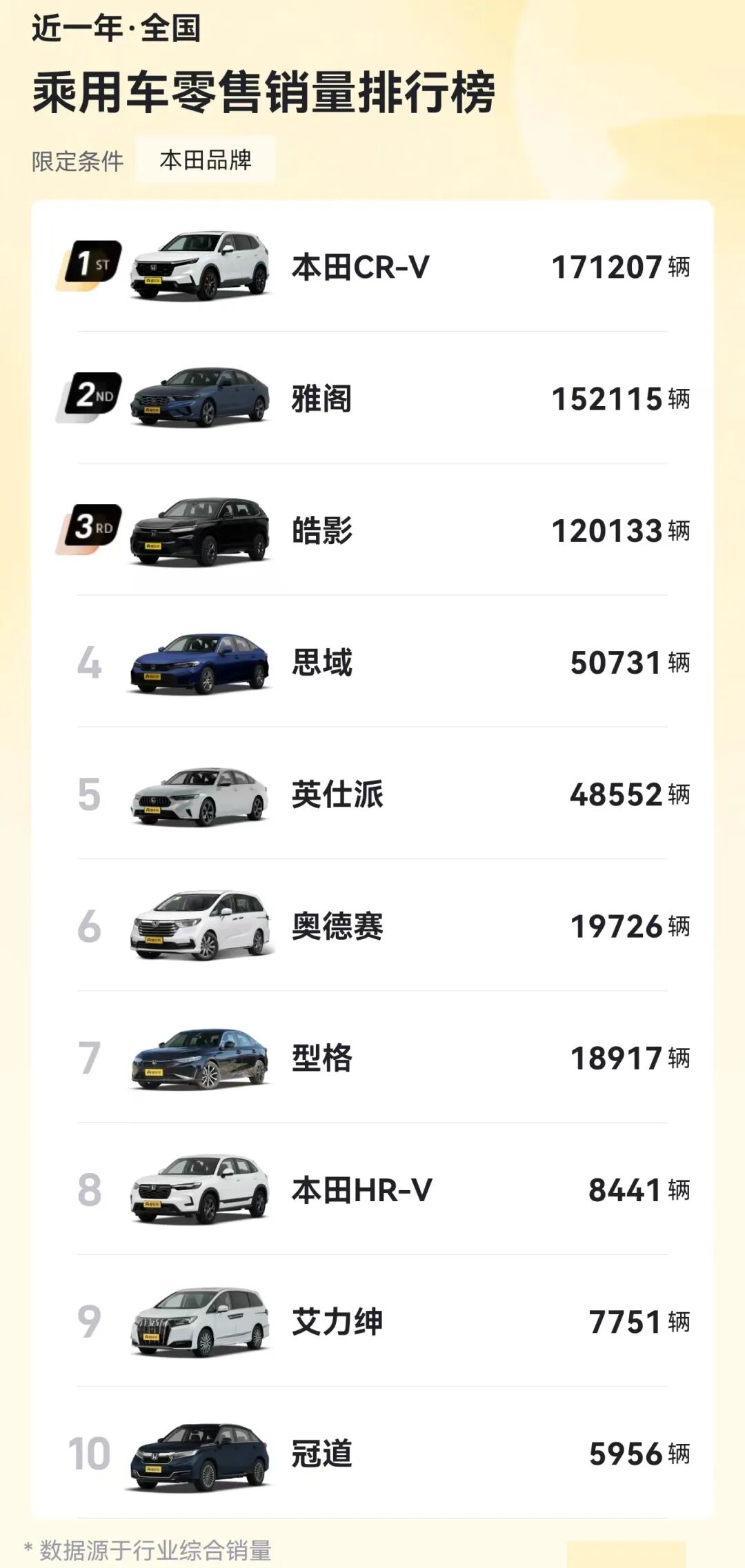

Honda faces a less favorable situation. After peaking at 1.627 million units in 2020, its sales declined for five consecutive years, reaching just 645,300 units in 2025—a nearly 1 million-unit drop (over 60%) from its peak. Sales fell over 24% in both 2024 and 2025. The core issue lies in its “fragmented product matrix.”

In 2025, Honda offered nearly 30 models—two more than Toyota—but sales were extremely low. Only the CR-V (171,200 units), Accord (152,100 units), and Breeze Shadow (Breeze, 120,000 units) performed well, while other mainstays collapsed.

The once-popular Civic sold just 50,000 units, a nearly 60% year-on-year decline. The Inspire sold under 50,000 units, while the Odyssey and Integra sold under 20,000 units each. Other models failed to break 10,000 units, unable to sustain overall sales.

Honda’s NEV performance was dismal. Despite launching new models, total NEV sales in 2025 were under 30,000 units, a decline from 2024.

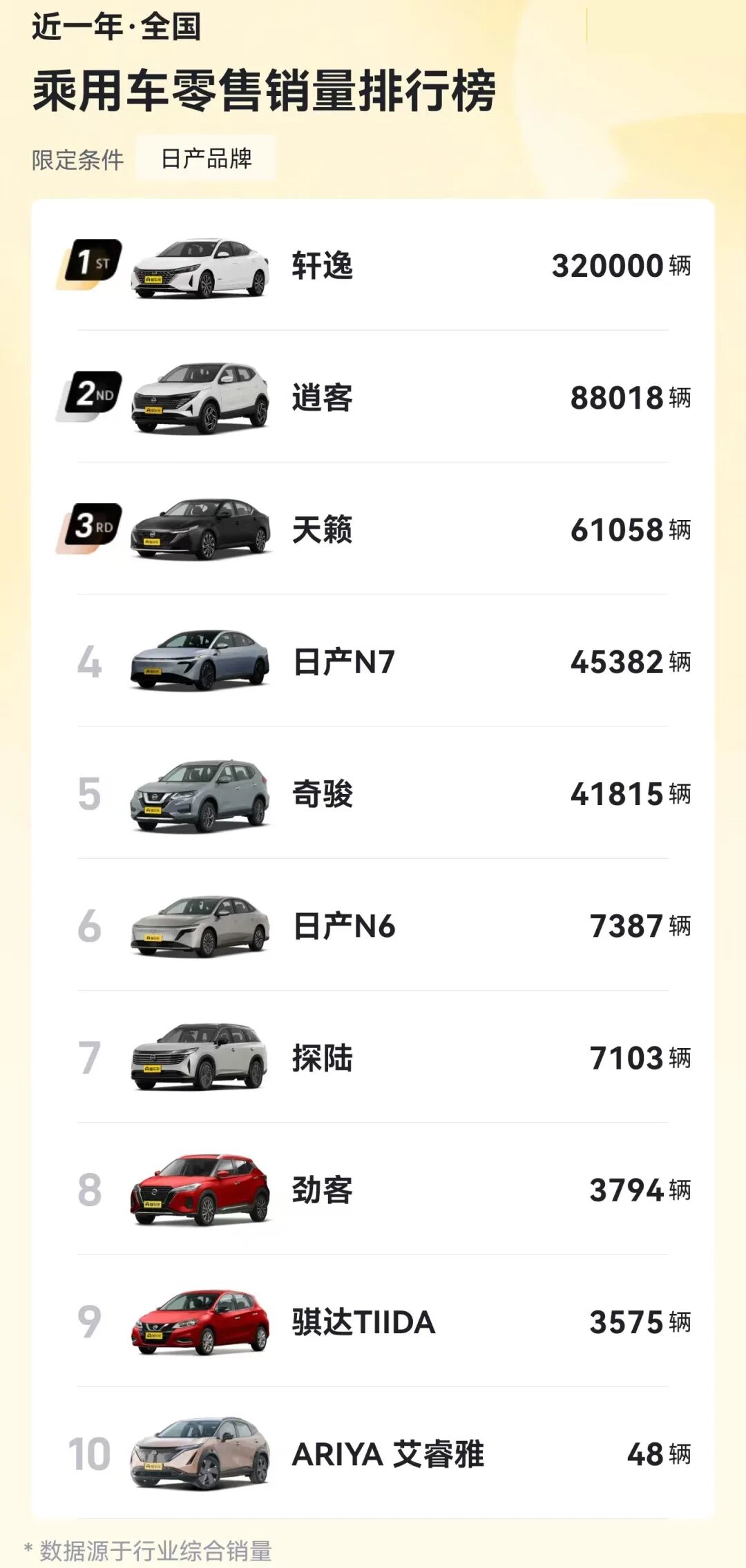

Nissan’s situation is similarly dire. After peaking at 1.564 million units in 2018, its sales declined for seven straight years, reaching 653,000 units in 2025—nearly a 50% drop from its peak, with annual declines exceeding 10%. Its lineup relies heavily on the Sylphy.

With terminal prices dropping to the ¥60,000 range, the Sylphy sold 320,000 units in 2025, becoming the top-selling Japanese model in China. However, a stark gap exists between the Sylphy and the second-best-selling Qashqai (88,000 units). The Teana (61,000 units) and X-Trail (41,000 units) underperformed in their segments.

While Nissan’s NEV performance improved, with the N7 selling 45,000 units and total NEV sales reaching 70,000+ units (a significant increase from 30,000 in 2024), the N7’s sales dropped from a peak of 10,000 monthly units to under 2,000 in four months, signaling underlying concerns.

Overall, while Japanese automakers hold just over 10% of the Chinese market, Toyota’s sales far exceed the combined total of Honda and Nissan, meaning Toyota now dominates the Japanese segment in China, with the other two reduced to “marginal players.”

02 Strategic Divergence: Why Toyota Holds Firm?

Facing the same Chinese market transformation, Toyota, Honda, and Nissan have taken divergent paths. The core gap lies not in technological speed or NEV innovation but in market understanding and execution precision.

Toyota’s success stems from recognizing China’s market complexity. Instead of blindly betting on NEVs, it built a closed loop: “stable fuel vehicle foundation, hybrid profitability, and EV incremental growth.” Its early NEV models, like the C-HR EV/IZOA E, were pioneers, but market acceptance of joint venture EVs was low at the time.

As compact sedans faced pressure from domestic models, Toyota deprioritized the Levin, Lingshang, and Allion, shifting focus to high-demand, high-value segments like SUVs and MPVs.

After learning from past mistakes, Toyota abandoned “global model” imports for China-specific developments. From the early bZ3 trial to the China-led bZ4X, pricing aligned with market expectations, unlike Honda’s rigid premium pricing.

Partnerships with BYD established local supply chains, ensuring production capacity and cost control, giving Toyota’s EVs price competitiveness. More critically, its decentralized RCE decision-making system empowered Chinese teams with model development authority, enabling rapid market response—an advantage Honda and Nissan lack.

Honda’s struggles stem from its “hesitation between fuel and NEV” and unclear understanding of the Chinese market, bordering on arrogance.

Its fuel car mainstays, the Civic and XR-V, suffered from delayed iterations and inferior configurations compared to domestic models’ “feature-packed” approaches, leading to rapid market share loss. Despite an early NEV transition, Honda refused to leverage Chinese supply chains, insisting on “fuel-to-electric” conversions.

Amid intense NEV competition, its new EV models clung to the ¥250,000 price range, lacking smart cockpit advantages or long-range capabilities, creating a vast gap with domestic NEVs and new entrants. Even after price cuts of ¥60,000, demand remained weak.

More critically, Honda’s rigid R&D decision-making—where all product plans require approval from Japan—left local teams voiceless. R&D personnel, unfamiliar with Chinese consumer habits, failed to grasp market demands, causing product launches to miss optimal windows.

Nissan’s strategy of “prioritizing short-term survival” through aggressive Sylphy price cuts has eroded brand premium, trapping it in a vicious cycle: “price cuts → profit shrinkage → R&D underinvestment → product competitiveness decline.”

While the N7 boosted NEV sales, its success remains isolated. The N6’s launch further marginalized the N7, exposing product matrix gaps and leaving Nissan defensive rather than competitive.

The divergence of Japanese automakers in China reflects a clash between “product excellence” and “experience-driven” approaches. Toyota’s caution, Honda’s conservative adjustments, and Nissan’s desperate moves represent three survival strategies amid industrial transformation. Toyota’s stability stems from avoiding trend-chasing and instead building a comprehensive product matrix based on market demands: mainstream hits defend share, Lexus elevates brand prestige, and NEVs secure incremental growth.

Toyota’s success proves that in times of change, resilience matters more than speed, and strategic positioning trumps ambition. Future competition among Japanese automakers in China will hinge not on “who has superior technology” but on “who better understands Chinese users, offers more comprehensive products, and makes flexible decisions.” Toyota’s stability offers all joint ventures a lesson: respecting the market, precise positioning, and agile adjustments are the survival mantras in a saturated era.

Editor-in-Charge: Shi Jie Editor: He Zengrong

THE END