Seres Seeks Rebirth Amidst Industry 'Volcano'

![]() 02/05 2026

02/05 2026

![]() 492

492

In early 2026, on the A-share market, the K-line chart for Seres displayed a puzzling divergence.

The financial report data was impressive, and the delivery figures were outstanding. Yet, the stock price continued to climb. Even when AITO topped the sales charts in January 2026, achieved over 10% growth throughout 2025, and the M6 was officially announced, there was no reversal in the stock price trend.

Amidst this growing unease, Seres responded by introducing a new company named 'Phoenix'.

In January 2026, Tianyancha revealed a significant yet understated business registration: Shanghai Seres Phoenix Intelligent Technology Co., Ltd. was officially established with a registered capital of 50 million RMB, wholly owned by Seres Group. The company's business scope directly targets the core areas of artificial intelligence—intelligent robot research and development, basic software development for AI, and AI theory and algorithm software development.

Once hailed by the capital market as the 'leading indicator of Huawei ADS sentiment', Seres now stands at a perilous crossroads, grappling with collective anxiety as its core narrative is shaken. The capital market is reassessing the value of this 'Huawei partner'.

The Emergence of 'Temperature Difference' and the Fading Dividends

Rewinding two years, Huawei's flagship stores were nearly overwhelmed by visitors eager to see AITO. At that time, AITO was the sole four-wheeled mobile terminal in Huawei's showroom, enjoying 'pop idol' status with immense popularity.

Luxeed and Enjoy boundaries now occupy prime positions in Huawei stores.

However, feedback from sales at multiple Huawei core business district stores in Beijing and Shanghai indicates that customers' attention often bypasses the AITO M9, shifting instead to the more luxurious 'Zunjie', the more aggressively designed 'Xiangjie', or the cost-effective 'Luxeed'.

Did Seres make a mistake? Not necessarily. AITO is undoubtedly a good car, and the delivery efficiency of Chongqing's mega factory still outperforms many new entrants. However, this highlights the harsh reality of the business world—'aesthetic fatigue' and 'dividend dilution'.

In the overlapping fields of consumer electronics and smart vehicles, novelty is the core driver of premium pricing. As Huawei's 'technology shelf' begins to open up to multiple partners (Seres, Chery, BAIC, JAC), and even leans towards Zunjie in terms of brand momentum, Seres transitions from the 'only darling' to the 'eldest son'.

The eldest son is steady and reliable but also the most easily overlooked. Within the same ecosystem, people seek possibilities that are more unique and imaginative.

For Seres, this may signal a diversion of sales volume and, more critically, a downward shift in its 'valuation anchor'.

Previously, the market valued Seres as a 'tech stock' due to its exclusive role in carrying Huawei's intelligent driving technology. Now, with Huawei's expanding circle of partners, the market is leaning towards valuing it as a 'manufacturing' stock. This shift in logic can be highly damaging to a company.

When the flow of HarmonyOS no longer exclusively favors Seres, the critical moment for the company may have arrived.

From 'Local Risks' to 'Systemic Collapse'

A single-product model represents ultimate efficiency under favorable conditions but extreme vulnerability under adverse ones.

For companies reliant on a giant's ecosystem, 'local changes' within the giant can evolve into 'systemic risks' for the company.

Even minor adjustments in Huawei's strategy, such as tweaks to the traffic distribution mechanism of HarmonyOS Intelligent Driving or increased mentions of Zunjie at product launches, could result in billions of yuan in market capitalization evaporating for Seres.

Tracing back to the origins, Huawei's initial choice of Seres was a clear 'asymmetric game'. Huawei valued not Seres' brand premium but its extremely low profile, high-quality supply chain cluster, and, most importantly, absolute obedience. This cooperation model laid the foundation for Seres' early success and made it the most successful transformation sample in China's automotive industry history.

However, every gift comes with a hidden cost.

This deep binding has sown the seeds of today's concerns over the lack of an independent moat. When the 'Huawei concept' begins to generalize, and every automaker can connect to Huawei through the Hi mode or Intelligent Selection mode, Seres' scarcity diminishes.

The ultimate paradox Seres faces is that while it will not lose Huawei, it is losing the market's exclusive attention to the 'Huawei concept'.

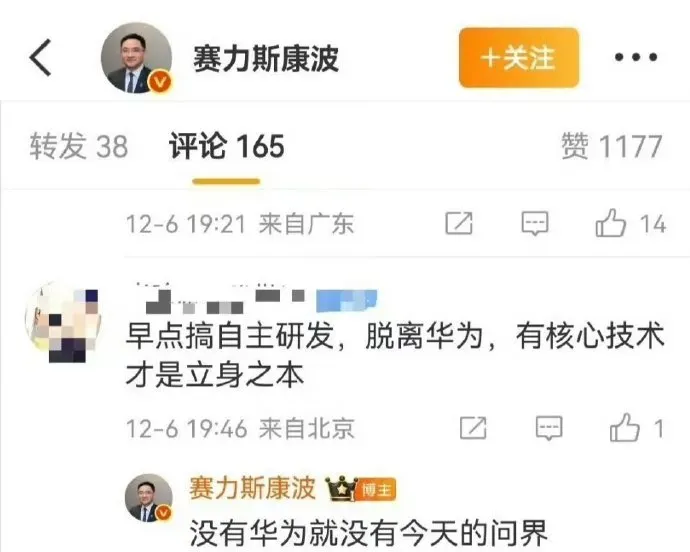

'Without Huawei, there would be no AITO today,' Kang Bo, Vice President of Seres Group, responded to a netizen's suggestion to 'pursue independent research and development and break away from Huawei' during an interaction on his personal Weibo account.

The more successful Seres becomes, the more challenging its future success becomes. Huawei's empowerment capabilities are vividly displayed in AITO's impressive sales figures, and replicating this path is now a more cost-effective model for Huawei.

Huawei will not go all-in with Seres, but Seres needs to be all about Huawei.

The 'Phoenix' Takes Flight: A Strategic Defensive Offense

Amidst these changes, Seres must act 'urgently'.

A recent business registration disclosed by Tianyancha provides insight into Seres' true state of mind: Shanghai Seres Phoenix Technology Co., Ltd. was quietly established with a registered capital of 50 million RMB, wholly owned by Seres.

What is noteworthy is its business scope—no longer limited to car manufacturing, but explicitly stating 'research and development of intelligent robots, basic software development for AI, and AI theory and algorithm software development'.

The name 'Phoenix' is thought-provoking. It symbolizes rebirth from the ashes and a transformation from a mere 'car shell manufacturer' to an 'incubator of intelligent life forms'.

More importantly, the company is based in Shanghai, not Seres' stronghold of Chongqing. This indicates an aim to attract top AI talent and engage in capital operations from the outset, representing a 'new species' independent of the existing car manufacturing system.

Most importantly, the Phoenix seeks rebirth from the ashes. Meanwhile, Seres' frequent contacts and in-depth cooperation with Volcano Engine (ByteDance) have heightened this 'urgency'.

The fire of the Phoenix may very well be fueled by Volcano.

After acquiring Huawei as a full-stack technology ally and even nearly surrendering its soul to Huawei, why is Seres now embracing ByteDance? This seems somewhat 'counterintuitive' in business logic and may even be interpreted by some aggressive investors as 'having second thoughts'.

However, from Seres' management perspective, watching the stock price decline late at night, this move becomes extremely reasonable: it is a defensive offense and a gamble on a 'second computing power pillar'.

While Huawei provides ADS and HarmonyOS cockpits, Seres does not want to remain a mere executor in the fields of embodied intelligence and broader AI application scenarios. What Seres values are the core capabilities of ByteDance behind Volcano Engine: recommendation algorithms and generative large models.

If autonomous driving requires perception and control, humanoid robots require more generalized decision-making and human-machine interaction capabilities. In this regard, ByteDance has unique advantages.

This is a perfect 'borrowing force to strike force'. By introducing Volcano Engine, Seres has not deviated from Huawei, but it has cleverly introduced another super variable into its capital story.

However, the drawbacks of this operation are also evident: the 'pure-blood HarmonyOS' label that once belonged to Seres gradually fades, and reverting to being a contract manufacturer for technology giants becomes a visible outcome.

The Future Gamble: A Perilous Leap from 'Cars' to 'Intelligent Agents'

If Seres does not undertake this endeavor, its valuation logic will forever be locked within the 'manufacturing' ceiling, and its price-to-earnings (PE) ratio will oscillate violently with AITO's sales fluctuations, eventually reverting to the 10-15 times PE of an ordinary automaker. This is a mediocrity that the current Seres absolutely cannot accept.

In the future, Seres is highly likely to pursue a 'dual-drive' approach: continuing to hold tightly onto Huawei's leg with its left hand, utilizing AITO to maintain massive cash flow and profits as the foundation for survival; while betting heavily with its right hand through the cooperation of 'Phoenix' and 'Volcano' in the fields of embodied intelligence and humanoid robots.

This transformation is fraught with risks. The implementation cycle of the robot industry is much longer than that of automobiles, and the investment is a bottomless pit. However, in 2026, Seres seems to have no other choice.

When danger gradually approaches, the originally safe shelter turns into a grave. Seres is well aware of this, so it must act 'urgently' and must change. This may be the most dangerous moment for Seres, but it could also be the beginning of its true independence. After all, in the capital market, there is nothing more terrifying than 'losing imagination'.

Even if this seems like a certain degree of 'betrayal', in the face of survival, all loyalty is for the sake of staying alive. For investors, understanding Seres' anxiety may be more important than understanding its financial reports.