Annual Sales Fall Short of 10,000 Units: When Will Volkswagen's Premium Electric Lineup Shine?

![]() 02/11 2026

02/11 2026

![]() 394

394

"Without effective adaptation to the Chinese market, even Volkswagen's renowned German engineering and Xpeng's cutting-edge intelligent technology may struggle to achieve breakthroughs."

Author | Shen Tianxiang Editor | Li Guozheng Produced by | Bangning Studio (gbngzs)

On a bustling weekend at Beijing's Solana Blue Harbor commercial district, the area thrives with activity. By noon, open-air plazas are teeming with people, while restaurants along the Liangma River are lined with long queues. Amidst this lively scene, the Gold-Standard Volkswagen ID. UNYX experience center stands out for its relative quietness.

In fact, this automotive experience store features a stylish design, with a yellow-painted display vehicle at the entrance attracting considerable attention. However, few passersby take the initiative to step inside. Occasionally, some individuals stop by to scan codes for gifts but quickly browse and leave.

The store's desolation may mirror the true state of the Gold-Standard Volkswagen's current market position.

What is the Gold-Standard Volkswagen?

It is neither a product from mainstream joint ventures like FAW-Volkswagen or SAIC Volkswagen, nor an extension of Volkswagen's imported vehicles. Instead, it represents the third joint venture company in China established by Germany's Volkswagen Group—Volkswagen Anhui—which focuses on intelligent pure electric vehicles.

At the 2024 Beijing Auto Show, Volkswagen unveiled its new intelligent pure electric category, ID. UX, in China, featuring a unique gold Volkswagen logo for the first time. Developed and manufactured by the Volkswagen Hefei Intelligent Connected Electric Vehicle Center in Anhui, it marks a significant stride in Volkswagen's intelligent new energy transformation.

The Gold-Standard Volkswagen targets the youth-oriented pure electric market, aiming to differentiate itself from joint venture partners FAW-Volkswagen and SAIC Volkswagen while shouldering Volkswagen Group's electrification transformation and its "In China, For China" strategy.

However, the results have been less than satisfactory. As the sole model currently available under the Gold-Standard Volkswagen brand, the ID. UNYX 06 (formerly named ID. UNYX) has seen lackluster performance—public data shows its insured sales volume failed to reach 10,000 units in 2025.

▍01 Three-Year Losses Exceed 10 Billion Yuan

In July 2024, when the ID. UNYX was launched, three versions were introduced: Pro Long Range, Ultra Long Range, and Max High Performance, priced between 209,900 and 249,900 yuan.

However, just over three months later, it underwent significant price reductions. During the "Double 11" shopping festival that year, the entire lineup was discounted by 40,000 yuan, with limited-time transaction prices starting at 169,900 yuan.

The ID. UNYX faced unfavorable timing. At that time, China's automotive market was embroiled in fierce price wars, with joint venture brands like SAIC Volkswagen and FAW-Volkswagen slashing prices on their ID series pure electric vehicles. The lowest price for an ID.3 base model fell below 110,000 yuan.

Benefiting from these price cuts, the ID. series sold over 200,000 units in China that year, yet the Gold-Standard Volkswagen's insured sales volume reached only about 2,000 units.

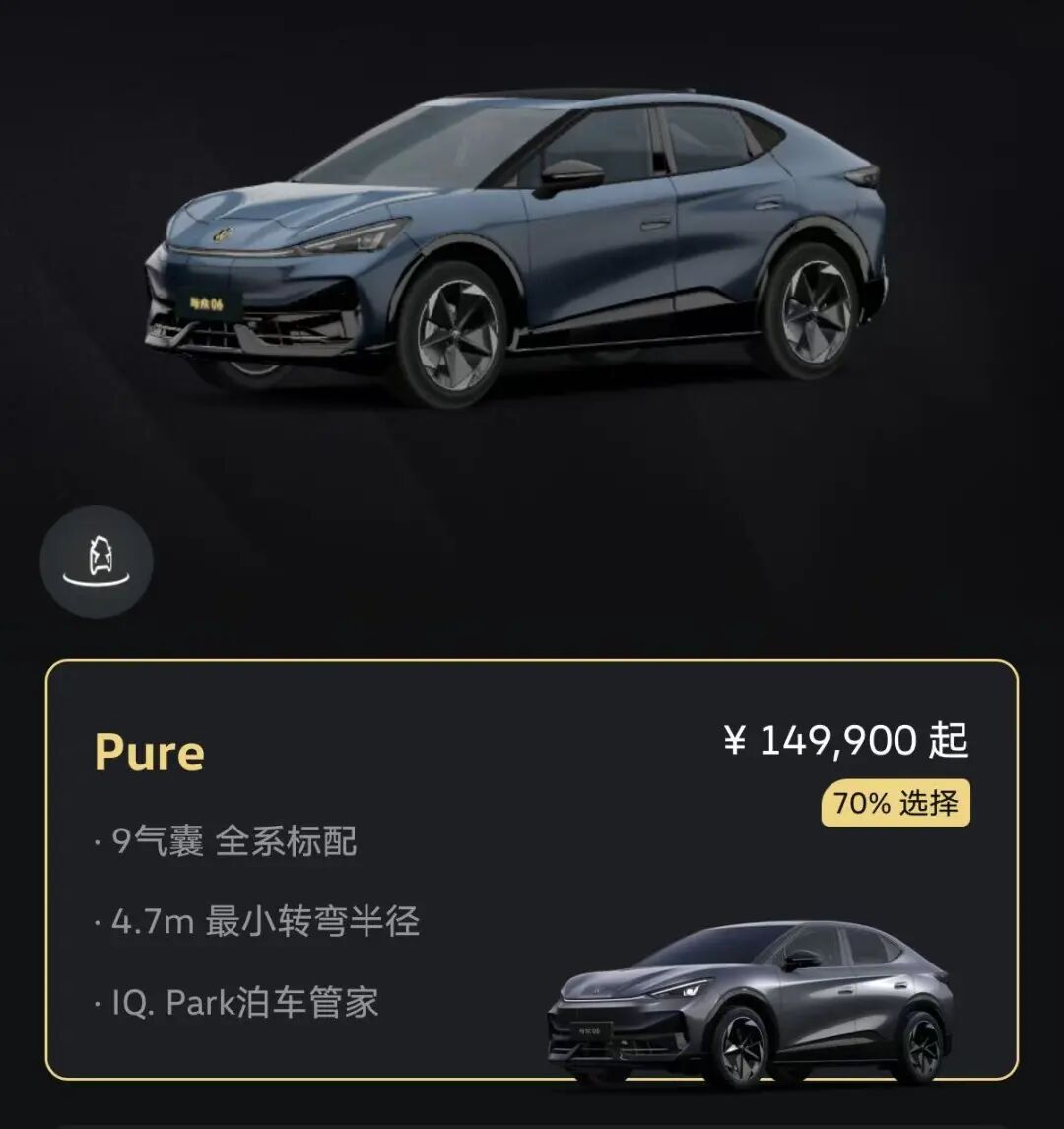

At the 2025 Shanghai Auto Show, the Gold-Standard Volkswagen introduced a new naming convention, rebranding the ID. UNYX as the UNYX 06, with upgrades in intelligence, entertainment, and personalized configurations. The new model's limited-time fixed price started at 149,900 yuan, representing a further 20,000 yuan reduction from the November 2024 price cut.

However, the UNYX 06 still failed to gain traction, with annual insured sales remaining below 10,000 units. Affected by competition from local rivals, Volkswagen's ID series sold 115,500 units in China in 2025, a 44.3% year-on-year decline.

Public data shows that Volkswagen Group delivered over 8.98 million vehicles globally in 2025, including 983,100 pure electric vehicles, a 32% year-on-year increase. However, in China, its pure electric vehicle sales dropped by more than 40%, creating a stark contrast with the global trend.

Sluggish sales have led to massive losses for the Gold-Standard Volkswagen, dragging down JAC Motors' overall performance and leaving Volkswagen Group's electrification efforts in an awkward position of high investment but low returns.

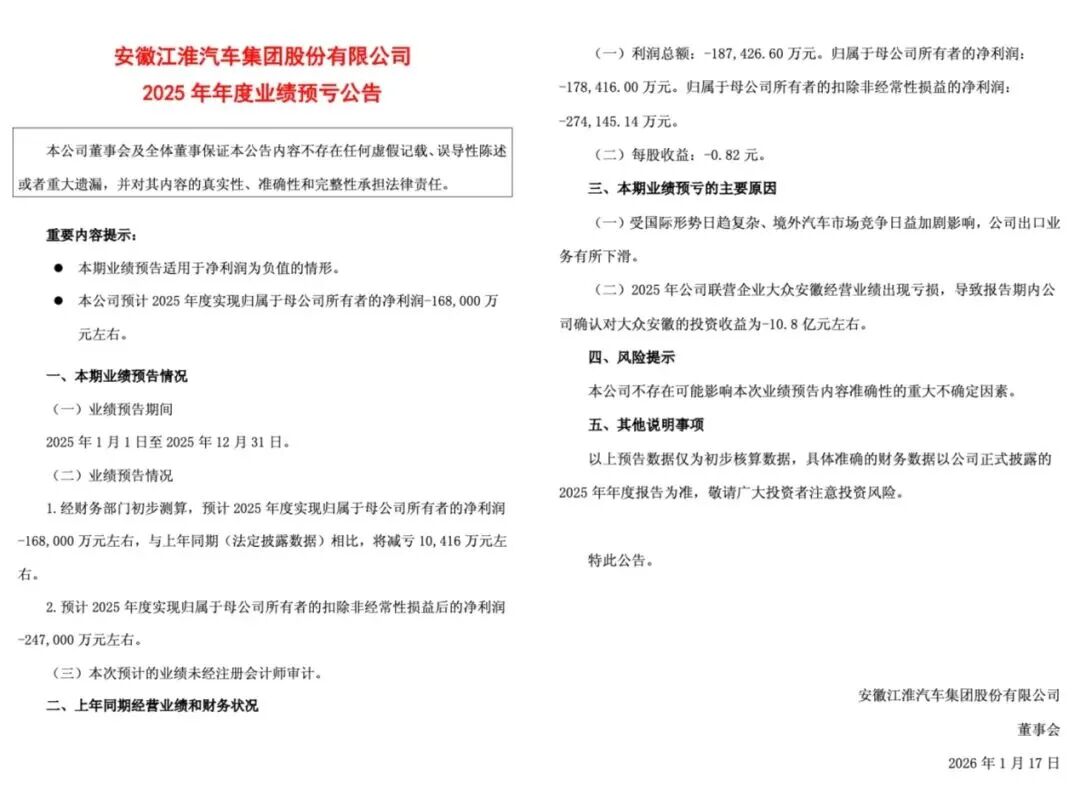

According to JAC Motors' performance announcements, Volkswagen Anhui, a JAC Motors associate, reported losses of 1.8 billion yuan in 2023, which widened to 5.348 billion yuan in 2024. Although losses narrowed in 2025, they still reached an estimated 4.32 billion yuan. By calculation, Volkswagen Anhui's cumulative losses over three years totaled approximately 11.5 billion yuan.

▍02 Users Demand Greater "Sincerity"

At a recent year-end communication meeting, the Gold-Standard Volkswagen team conveyed a message: In December 2025, monthly sales of the UNYX 06 exceeded 2,000 units.

The year-end sales surge was highly correlated with price incentives. A recent store visit by Bangning Studio revealed that the UNYX 06 Pure (base model) has an official price of 149,900 yuan, but with national subsidies, trade-in allowances, and insurance discounts, the actual purchase price drops to 119,900 yuan.

On the Volkswagen ID. UNYX mini-program's custom order page, the Pure model is marked as "70% chosen," indicating that 70% of users opt for the base version due to its cost-effectiveness.

However, on automotive forums, some netizens feel the model lacks sincerity.

This can be compared to another joint venture pure electric compact SUV—the GAC Toyota bZ3X. Its 119,800 yuan version offers a range of 520 km. The UNYX 06 Pure, priced similarly, provides a range of only 426 km. Meanwhile, the bZ3X's 430 km range version is priced below 100,000 yuan, and its laser radar-equipped version costs under 150,000 yuan.

If joint venture pure electric models can offer such configurations and pricing, even more so can domestic brands with stronger product competitiveness.

"Why choose the Gold-Standard Volkswagen?" At the store, when a customer asked this question, the sales advisor's pitch was: "The Gold-Standard Volkswagen is part of Volkswagen China, and its products are exported to Europe, so the quality is different from other cars. Look, this car is sturdier and uses better materials than others," one sales advisor said.

However, today's Chinese consumers are highly rational and prone to wait-and-see attitudes, knowing they can always expect better configurations and lower prices. Moreover, they demand features like "fridges, TVs, and sofas," spacious interiors, and high intelligence—in short, they want it all.

Clearly, the Gold-Standard Volkswagen has not grasped what Chinese new energy vehicle users want with the UNYX 06.

On forums, user complaints about the UNYX 06 focus on its lagging intelligence (including severe infotainment system issues) and insufficient charging efficiency (though charging failures have been gradually resolved).

While competing domestic brand models generally feature advanced intelligent driving systems and smooth infotainment ecosystems, the UNYX 06 only comes with a basic IQ. Drive intelligent driving system, unable to support urban NOA (Navigate on Autopilot). Its infotainment ecosystem is also relatively closed, failing to meet users' core demands for intelligence.

The vehicle uses a 400V platform, requiring about 32 minutes to charge from 20% to 80%, far slower than competing 800V platform models. Its space has also been criticized, with a sloping roofline and short wheelbase design resulting in cramped rear-seat space, undermining its appeal for family use.

These shortcomings should guide the Gold-Standard Volkswagen's future product improvements.

▍03 New Model Pricing is Key

The Gold-Standard Volkswagen has designated 2026 as its "Year of Advancement," planning to launch breakthrough strategies around products, channels, charging infrastructure, and services. This represents both a self-rescue effort and a critical gamble for Volkswagen's electrification transformation in China.

Products will undoubtedly be the core of this breakthrough. In 2026, the Gold-Standard Volkswagen plans to introduce three all-new models and one facelifted model, covering various market segments.

The UNYX 08, set to debut in Q1 and launch in early Q2, is positioned as a B-segment pure electric SUV targeting the premium market. In Q2, the pure electric sedan UNYX 07 and the 2026 UNYX 06 are scheduled for a joint launch, completing the mainstream market layout. In Q4, a B-segment pure electric sedan will be introduced to further enrich the product lineup.

More critically, new models will switch to the CEA architecture jointly developed by Volkswagen and Xpeng. Designed specifically for the Chinese market, this architecture reduces system complexity, improves development efficiency, lowers costs, and incorporates technologies like Horizon Robotics' intelligent driving and 800V fast charging to address intelligence shortcomings. It will also feature distinctive designs, such as a wolf head emblem, to create differentiation.

In terms of channels, the plan is to expand the number of stores to 200 and extend into third- and fourth-tier cities. For charging, the goal is to access over 1.15 million charging terminals.

For the Gold-Standard Volkswagen ecosystem, these new models represent a major test.

Pricing, in particular, will be crucial. With intensifying industry competition, domestic brands continuing to bring advanced technologies to lower-priced segments, and new energy vehicle startups accelerating product iterations, joint venture brands' market share has fallen below 30%. If the Gold-Standard Volkswagen cannot quickly adapt to Chinese market demands, even with Volkswagen's renowned German engineering and Xpeng's cutting-edge intelligent technology, it will struggle to break through in this fiercely competitive market.

The experience with the UNYX 06 demonstrates three key points: First, German mechanical quality is no longer a core advantage in new energy vehicles; second, brand premium cannot offset shortcomings in intelligence and localization; third, mere price reductions cannot win over discerning Chinese users.

For Volkswagen, the UNYX 06's poor reception is not an endpoint but a critical warning—only by truly understanding the Chinese market, meeting user needs, and aligning products, channels, and marketing can the Gold-Standard Volkswagen truly shine.