National VII Emission Standards Discussed, but Gasoline Vehicles Aren't Going Away

![]() 07/11 2024

07/11 2024

![]() 595

595

At the beginning of July, during a meeting between regulatory authorities and automobile manufacturer representatives to discuss matters related to the "National VII" emission standards, the joint venture automaker with annual sales of 1 million vehicles did not send any representatives to participate.

"Perhaps they won't even make it to the implementation of National VII and will withdraw before then." This has been a hot topic among engineers in the internal combustion engine circle of automobile manufacturers.

The reality seems to further corroborate previous rumors. This giant automaker with annual sales of 1 million vehicles may streamline the number of joint venture brands in China or even choose not to renew the joint venture agreement that will officially expire in 2027. Of course, due to confidentiality and non-compete agreements, no one can yet publicly discuss the news of X joint venture withdrawing from China.

Behind this significant news lies an even more important matter—National VII emissions. In March 2024, the third pre-research phase for the next stage of motor vehicle emission standards was launched, marking the official start of the formulation of National VII emission limits and measurement methods. The current month of July saw the convening of various automakers for a survey, followed by the successive release of drafts and detailed rules, which will once again reshape the technical routes of automakers.

This will be a vital change. Slight deviations in choice can result in a shift from mainstream to niche status in the market. For example, during the transition from National V to National VI a few years ago, the clearance price of the Cadillac ATS-L dropped to RMB 160,000, making it impossible for American luxury cars to sell at high prices since then.

National VII emission standards discussed, but gasoline vehicles aren't going away?

"Based on past patterns, the rules and standards for National VII emissions will be released in 2025." This is the consensus among automakers and relevant research institutions.

National IV was implemented in July 2013, National V in July 2017, and the formulation of National VI emissions started in May 2015, with the release at the end of 2016 and implementation beginning in 2020. The previous pattern and logic were that emission standards would be adjusted towards stricter levels every three years or so.

According to previous official announcements, the National VII emission standards will be released in 2025-2026, but the implementation date remains to be determined, potentially allowing automakers more time to adapt.

This is due to two significant impacts. First, the introduction of Euro 7 emissions was not successful, with most European automakers resisting it, and even Germany's Minister of Transport, Volker Wissing, leading protests. Second, China's automobile industry is currently unprecedented globally, with new energy vehicles developing rapidly and gasoline vehicles gradually becoming niche.

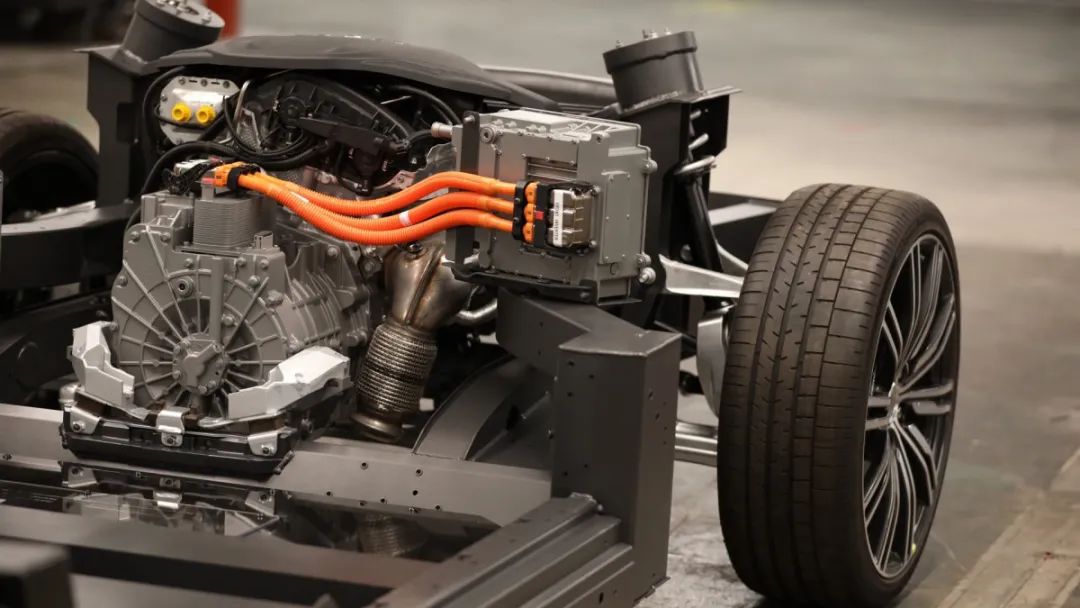

In the first half of 2024, 4.397 million new energy vehicles were registered, with annual sales expected to exceed 10 million. However, with a monthly penetration rate exceeding 50%, new energy vehicles are dominant, yet still deeply intertwined with gasoline and engines. Netizens' insightful summary goes, "The best-selling new energy vehicles still require 92 gasoline." Therefore, the introduction of National VII emissions will still have a core impact on the industry.

In the first half of 2024, BYD sold 881,000 plug-in hybrids, a year-on-year increase of 39.54%; Li Auto delivered 189,000 vehicles, most of which were extended-range; Huawei HarmonyOS Smart Behavior sold 194,200 vehicles, most of which were also extended-range. Additionally, new energy vehicle sales of Great Wall Motors, Geely Automobile, and Changan Automobile all exceeded 100,000 units, with plug-in hybrids accounting for the majority.

In other words, in the first half of 2024, automakers at the forefront of new energy sales had a demand for at least 1.5 million internal combustion engines, exceeding Dongfeng Nissan's peak sales in China during its best years.

As for the growth of pure electric vehicles, it is proceeding as scheduled, even dragging down market growth. For example, in June's China Passenger Car Association data, overall new energy vehicle wholesale sales increased by 28.6% year-on-year, while pure electric vehicles only increased by 5.6%.

Therefore, the most popular new energy vehicles still require engines, which directly validates the fact that Chinese people's cognition and understanding of new energy vehicles are far from the advanced level portrayed online. Everyone wants to minimize anxiety while experiencing new things.

Under National VII emissions, the development directions of gasoline vehicles and internal combustion engines are also clear, with three main points: first, price increase followed by decrease; second, reduced power; third, lower fuel consumption.

These three points are easy to understand. The continuous tightening of emission standards forces automakers to develop technologies for energy conservation and emission reduction, resulting in lower emissions and fuel consumption. However, given the different development routes and technical reserves of internal combustion engines among automakers, most can only achieve reduced fuel consumption by sacrificing performance. But, based on the timeline around the implementation of National VI emissions, the addition of PN limits and the RDE test that will closely resemble real-world driving conditions mean that automakers can no longer solely rely on sacrificing performance to meet emissions standards.

GPF particulate filters clogging was a social hot topic a few years ago. They further filter exhaust emissions but correspondingly significantly increase powertrain costs. For example, during the transition from National V to National VI emissions in late 2019, the first National VI models to enter the market saw price increases of RMB 2,000-5,000. In the European market, many automakers facing the new Euro 7 emissions regulations have directly cut many small cars. Because small cars cannot sell at high prices and spread costs, it is more profitable to use these platforms to make more expensive and better-selling SUVs.

Few Chinese brands have full in-house research and development capabilities for engines, so the answer is on paper. Pure gasoline vehicles, to meet National VII emission standards, can only have two development directions: First, use technological advancements to achieve compliance, as demonstrated by BMW, Mercedes-Benz, Toyota, Honda, and other engine manufacturers. BMW's choice is to increase fuel injection pressure, such as 500bar high-pressure direct injection, while the most advanced on the market is currently 350bar. Other methods to enhance fuel combustion include secondary combustion chambers, such as more integration on the cylinder head, and placing the intercooler on the side to further strengthen cooling capacity.

The second direction is to add more filters and exhaust absorption devices, 48V motors, use three-cylinder engines or others. While technically feasible, the market environment does not allow it. Three-cylinder engines have no chance in China, 48V motors have high failure rates and are not recognized by the market, and adding more filtration devices has already been experienced during the National VI era. The Honda Civic, once renowned for its blazing acceleration, could reach 100 km/h in under 7 seconds in its tenth generation, but after National VI and the eleventh generation, it now takes over 8.5 seconds, making it feel like an entirely different car.

In summary, gasoline vehicles aren't going away, but they have entered a bottleneck phase and can only be patched up.

New Energy Vehicles Rest Easy? Traditional Plug-in Hybrids Aren't Smiling Either

Therefore, whether National VII emissions learn from the failure of Euro VII and choose a more moderate approach, or given the rapid development of new energy vehicles in China, pressuring gasoline vehicles, the restriction on internal combustion engine emissions is not particularly significant. There are two unavoidable first principles in the future: one is which markets' gasoline vehicles will be completely phased out, and the other is how extended-range and plug-in hybrid vehicles with engines will change. Especially the latter is crucial to consumer impact.

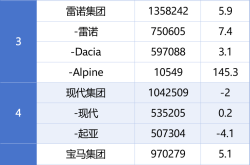

"Judging from the experience of the European market, it's questionable how many gasoline vehicles priced under RMB 100,000 will survive." Comparing European market sales in 2022 and 2023, as new energy penetration increases, the higher-priced Model Y has successfully displaced many previously top-10 small cars. For example, in 2023, when consumption rebounded post-pandemic, sales of over 95% of models increased, but Peugeot 208's annual sales declined by 12,000 units.

To comply with new regulations, costs must increase. Plug-in hybrids and extended-range vehicles have batteries, making them relatively easier to adapt. Moreover, gasoline vehicles priced under RMB 100,000 have already seen sales plummet, so almost all automakers have abandoned their corresponding product lines.

Low-priced gasoline vehicles have no way out, which is a deep concern for joint venture brands.

Even if National VII emissions perfectly learn from the failed experience of Euro VII emissions, the situation won't change because as one declines, the other grows—gasoline vehicles decline while new energy vehicles grow. Euro VII's development trajectory was ambitious, aiming for the strictest standards in history, which would have spurred technologies like dual three-way catalysts and larger GPF exhaust pipes. However, it ultimately fell short, with targets only slightly higher than Euro VI, and did not set an overly stringent goal.

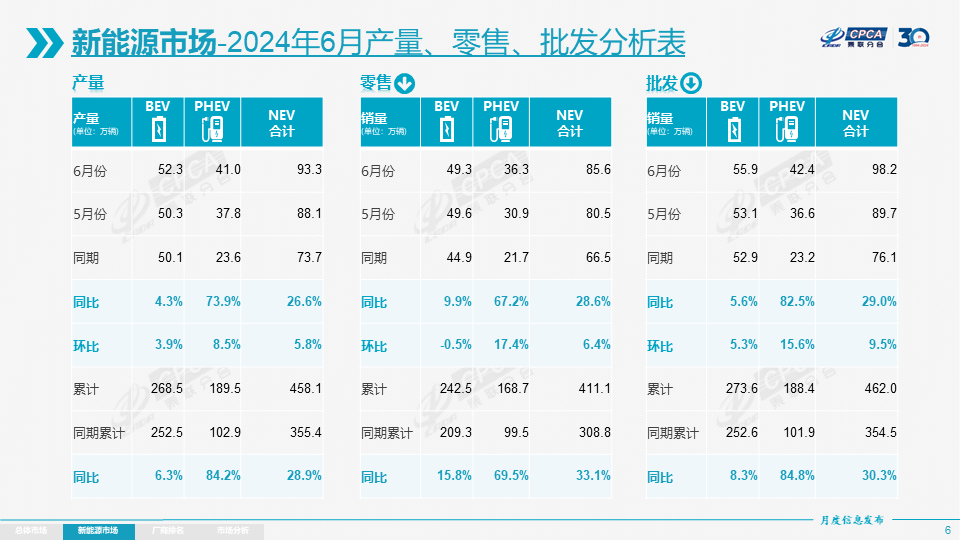

The next technical direction for plug-in hybrids and extended-range vehicles is basically the same as that of European and American internal combustion engines, but the biggest difference will be that most automakers with extended-range vehicles relying solely on engine capabilities will struggle to withstand new regulatory changes.

The development direction of plug-in hybrids is now clear, with BYD and Mercedes representing the civilian and luxury routes, respectively. BYD's fifth-generation DM significantly enhances engine combustion efficiency and power generation capabilities, while upgrading the intelligent management distribution system (deciding when to use electricity or gasoline based on different road conditions).

Mercedes, on the other hand, has significantly increased investment in ICE (internal combustion engine) research and development this year. In an interview at this year's Beijing Auto Show, Christoph Starzynski, Vice President of Vehicle Engineering and Vehicle Functions at Mercedes-Benz Group AG, confirmed to us that more new engines would soon be launched, particularly for plug-in hybrid models, which would see noticeable improvements.

Similar to the path of civilian models, plug-in hybrids will have stronger power generation capabilities and higher engine combustion efficiency, resulting in higher power generation efficiency. However, given Mercedes' engineering team's 140-year tradition of always aiming for the mainstream data and striving to exceed it with new technologies.

The next step is to develop higher horsepower and RPM motors, rewrite the ECU and MAP charts of internal combustion engines (changing intake and exhaust, fuel injection, and ignition) to improve power generation efficiency while reducing emissions and fuel consumption. The path is not difficult to predict, as it involves compatible deep Miller cycles. As for how to operate large motors, Mercedes-AMG has already removed the P2 motor from some models' transmissions, making the transmission clutch-based.

Technical details may be challenging for laypeople to understand, but the technical path for extended-range vehicles is straightforward.

"Significant short-term improvements in range extenders are unrealistic. As far as I know, many companies focusing on extended-range vehicles are now considering hiding battery capacity to comply with upcoming National VII regulations."

Currently, there are not many companies in China producing range extenders. Harbin Dongan has been applying for new technology patents since 2023, covering only two areas. The first area is simplifying the internal structure of the range extender, such as in the publication number CN117578772A, which changes the rotor structure by omitting the two front and rear bearings that connect to the engine, thereby reducing the size and slightly improving combustion efficiency. The second area focuses on enhancing the accuracy of experimental simulations, meaning that the data from bench tests can be as accurately presented on the computer as possible. This approach is inspired by Huawei's DriveOne model.

For companies with the longest-standing range extender solutions, those that started later are following suit. For example, companies like Changan and Geely are adopting both plug-in hybrids and range extenders. Great Wall, Geely, and Chery are more inclined to use plug-in hybrids to directly cover the range extender segment. As for BYD, the Qin PLUS DM-i equipped with the fifth-generation DM system is already on the way, boasting a true WLTC fuel consumption rate of just over 2 liters per 100 kilometers, a figure that range extenders cannot achieve.

Therefore, the strategy of "hiding battery capacity to meet China National 7 emission standards" is indeed feasible. Specifically, this strategy means that in the National 7 emission tests, where the emissions of the internal combustion engine are tested after the battery of a plug-in hybrid or range extender is depleted, the actual electric range of the battery can be understated by dozens of kilometers or more. For instance, the mainstream range extender models currently have a battery capacity of 40 kWh and a WLTC pure electric range of 200 kilometers. By labeling it as 180 kilometers and hiding 20 kilometers of range, the internal combustion engine's emissions values can be reduced during testing.

Of course, hiding battery capacity is a way to address the rules, similar to the often-mentioned reverse overstatement in the current pure electric vehicle market, as well as slightly more in-depth aspects like the Depth of Discharge (DOD).

In fact, there are many visible clues and outlines regarding the China National 7 emission standards. At the 2024 Electric Vehicle 100 Forum, Ouyang Minggao and Wang Chuanfu expressed similar views. Ouyang Minggao, an academician of the Chinese Academy of Sciences and vice chairman of the China EV 100, predicted that by 2026 at the latest, the penetration rate of new energy vehicles will exceed 50%, and PHEV (plug-in hybrid electric vehicles) will rise rapidly to share the market equally with pure electric vehicles in the short term. The technological route for automakers is hybrid (both series and parallel), because everything that series hybrid technology (range extenders) can achieve, plug-in hybrids can as well, but not vice versa.

Wang Chuanfu's view is that with the rise of new energy, market elimination and fierce competition will be inevitable. The underlying implication is that relatively outdated products will gradually disappear. If we consider the forthcoming Qin PLUS DM-i, which will be equipped with the fifth-generation DM system and might continue to be priced at around 79,800 yuan, the impact on gasoline vehicles will be evident.

However, the good news is that gasoline vehicles will not truly disappear in the short term; their technology will continue to advance at least until 2030. On one hand, there is global demand for such vehicles; on the other hand, before significant breakthroughs in power batteries and charging infrastructure occur, new energy vehicles will still need to rely on internal combustion engines to succeed.