"EU's Plot: Kill a Thousand Enemies, Lose Eight Hundred of Their Own"

![]() 10/14 2024

10/14 2024

![]() 672

672

"China's new energy vehicles can't be stopped by the EU's barriers"

Content

"After the National Day holiday, a major event occurred in China's automotive industry.

On October 7th, the EU officially passed a proposal to impose punitive tariffs on Chinese electric vehicles, raising tariffs on electric vehicles made in China from 10% to 45%.

Of course, this tariff increase was not entirely unexpected.

Earlier in July, there had already been a preview, when the EU temporarily increased tariffs on Chinese electric vehicles from the original 10% to 17%-38%.

However, this vote marks the finalization of the measure, signaling the arrival of a high trade barrier era for Chinese automakers seeking to expand overseas.

Electrek noticed that while the EU was considering imposing tariffs on Chinese electric vehicles, some prominent European automakers like Mercedes-Benz, BMW, and Volkswagen played the role of “rebellious children” by publicly opposing the tax increase, claiming that imposing countervailing tariffs was a “mistake” and even calling for a reduction in tariffs on Chinese automakers.

Surprising, isn't it? But why? Today, we'll try to clear things up for you in one article.

Why is the EU imposing tariffs?

First, why is the EU imposing tariffs on Chinese new energy vehicles?

You might immediately think of one reason: to protect European automakers.

Globally, China's new energy vehicles are leading the way in terms of cost-effectiveness, which is hard to resist.

This argument makes sense when looking at sales figures.

Take the sales data from August as an example.

Sales of pure electric vehicles in Europe plunged by 43.9% year-on-year, marking the fourth consecutive month of decline. Even though sales increased slightly by 6% in September, the momentum remained weak in the broader electric vehicle market.

Furthermore, it's difficult to say that any European automaker has achieved significant success in the transition to electric vehicles. This has directly led to layoffs and production cuts in Europe's electric vehicle industry.

For example, Audi suspended production at its Brussels plant, which specializes in electric vehicles, in September this year, sparking conflicts between automakers and employees. This pressure ultimately trickles down to governments.

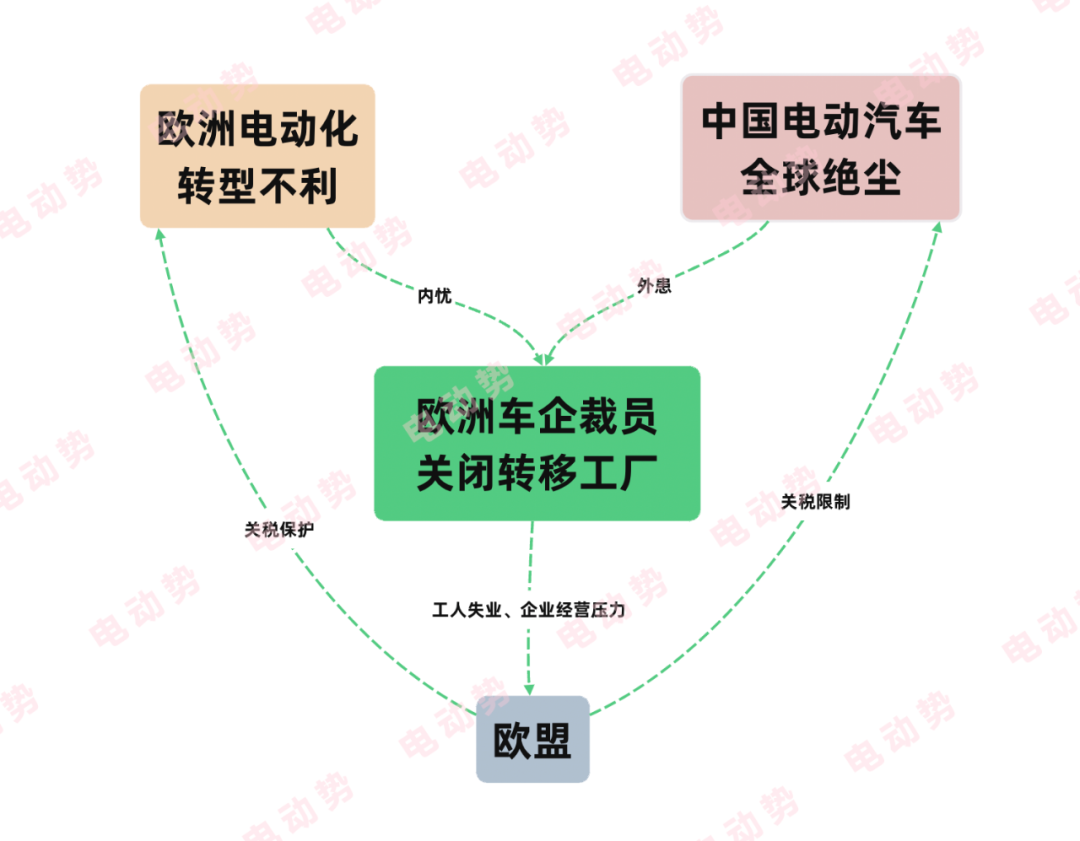

Gradually, a cycle emerges like this:

Moreover, some European automakers are eagerly awaiting EU intervention.

If the transition to electric vehicles fails, many automakers will fail to meet their 2025 emission reduction targets, potentially facing fines of over RMB 7 billion.

Therefore, the European Automobile Manufacturers Association has urged the EU to take urgent measures to support the development of electric vehicles.

These factors represent the immediate impetus for the EU's actions. Europe's automotive industry needs assistance.

However, if we zoom out and consider the broader industrial perspective, we see a more profound impact: could Europe's new energy vehicle industry be at risk of becoming second-tier?

Currently, aside from Tesla in North America, Chinese electric vehicles are globally leading in terms of product competitiveness.

Take cost-effectiveness as an example.

MG4 EV, a compact electric vehicle from SAIC Motor, sells well in Europe with a starting price of €32,000. In comparison, the slightly inferior Audi Q4 e-tron starts at around €42,000. Even if domestic automakers double their domestic prices and sell their models in Europe, they still offer exceptional value. How can European automakers compete?

In terms of the industrial chain,

Six Chinese companies rank among the top ten global battery manufacturers in terms of installed capacity, accounting for over 60% of the global market share. European companies are virtually absent in this field.

Simply put, European automakers are struggling to compete.

What can they do? Protect themselves.

For instance, by raising tariffs, increasing product prices, and reducing cost-effectiveness, they can leave more market space for local companies.

However, one thing remains difficult to explain: although Chinese new energy vehicles are competitive, they are not widely sold in Europe, and their sales volumes are far from posing a significant threat to European automakers.

For instance, last year, SAIC Motor, the top-selling Chinese automaker in the EU, sold only 300,000 pure electric vehicles. Geely, ranking second, sold 22,400 units, while BYD, in third place, sold even fewer at 15,900 units.

Such sales volumes have a limited impact on the European market.

So why is the EU still raising tariffs? Even at the risk of Chinese retaliation?

Ultimately, the EU hopes that Chinese automakers will establish factories in Europe. If you want to expand your European market share, build a factory there. Local production will exempt you from high tariffs. Building factories will also involve various industrial chain links, thereby boosting Europe's new energy vehicle industry and employment.

Got it.

By imposing tariffs, the EU aims to protect European automakers while encouraging Chinese automakers to build factories in Europe.

But why are Mercedes-Benz, BMW, and Volkswagen opposing the tariff increase?

A crucial reason is that European automakers will also suffer from the measure.

Take BMW as an example.

Due to earlier industrial chain layouts, some of BMW's manufacturing plants are located in China.

In 2018, BMW invested in a factory in Zhangjiagang to produce BMW MINI electric vehicles, and it has revealed plans to transfer some European production lines to China for global exports.

Guess what? Even BMW, a European automaker, has to pay high tariffs when exporting vehicles made in its Chinese factories to Europe.

With the added tariffs, BMW's products will undoubtedly suffer significant impacts.

Similar situations exist for Mercedes-Benz and Volkswagen.

Moreover, China remains the largest single market for these automakers globally, and they are highly dependent on the Chinese market.

Last year, China accounted for 30% of Mercedes-Benz's global sales, 31% for BMW, and 35% for Volkswagen. China also contributed the most profit to these companies.

If the Chinese government retaliates by raising tariffs, the impact will be significant.

Indeed, following the vote, the Ministry of Commerce indicated that it was considering raising tariffs on imported high-displacement fuel vehicles.

Under these constraints, automakers within the EU have no choice but to publicly oppose the tariff increase.

Ultimately, European automakers seem to be the ones losing more.

Strategies for Chinese Automakers in the Future

However, this tariff increase serves as a wake-up call for Chinese automakers.

An era of high tariffs targeting Chinese automakers may be dawning.

Expanding overseas has been a top priority for Chinese companies in recent years, and Chinese automakers must seriously consider this strategic direction.

Yet, Chinese automakers still lack sufficient experience in overseas market operations.

Facing tariff protection, Chinese companies have no choice but to forge ahead. Withdrawal from the market would inflict irreparable damage to their brands. Chinese automakers must adopt new survival strategies and respond from a global perspective.

They can learn from the experience of Japanese automakers.

Japanese automakers once posed significant pressure on the automotive industry in Europe and the US, leading to the imposition of high tariffs as a trade barrier.

Toyota, a representative Japanese automaker, was heavily impacted.

Unlike China, Japan lacked a large domestic market, and no European or American automakers stood up for them at the time.

Nevertheless, Toyota not only survived but thrived, consistently ranking as the world's top automaker.

How did Toyota achieve this?

In essence, through local factory construction and localized operations.

Toyota first chose to jointly establish factories with General Motors to produce vehicles locally in the US to counter tariff policies. After familiarizing themselves with the local market, they established wholly-owned subsidiaries, truly becoming a “US” Toyota capable of independently developing strategies for the American market. Subsequently, Toyota replicated its successful model in the US, integrating the entire R&D-production-marketing-sales-aftersales chain. From initially exporting single products and technologies, they evolved into exporting entire industrial chains, forming a comprehensive global development system.

This could be a crucial path for Chinese automakers, and even Chinese companies in general, to expand overseas in the coming years.

Indeed, some Chinese automakers are already on this path.

SAIC Motor and BYD are planning to build car factories in Europe to achieve local production, demonstrating forward-thinking strategies.

Next, how to establish a strong local presence, further export corporate operations systems, and promote product brands will be the focus for Chinese automakers in the coming period.

In the long run, any non-market factors cannot hinder the development of advanced productivity. Just like the current tariff barriers, they only stimulate more creativity among automakers.

Alas.

It seems this day has finally arrived.

May every Chinese automaker smoothly expand overseas, propelling the Chinese automotive industry into a new era.