Tax increase becomes a devastating blow! Chinese brands all fell out of the top 10 electric vehicle sales in Europe in September, with MG sales halved

![]() 10/15 2024

10/15 2024

![]() 444

444

In September, the automotive markets in various European countries experienced both rises and falls, and the same was true for the electric vehicle market. Electric vehicle shares declined in Germany and France, while they increased in the UK, Norway, and Sweden. For Chinese electric vehicle companies aiming to make a name for themselves in Europe, September marked the third month of temporary tariffs, and the situation was not optimistic.

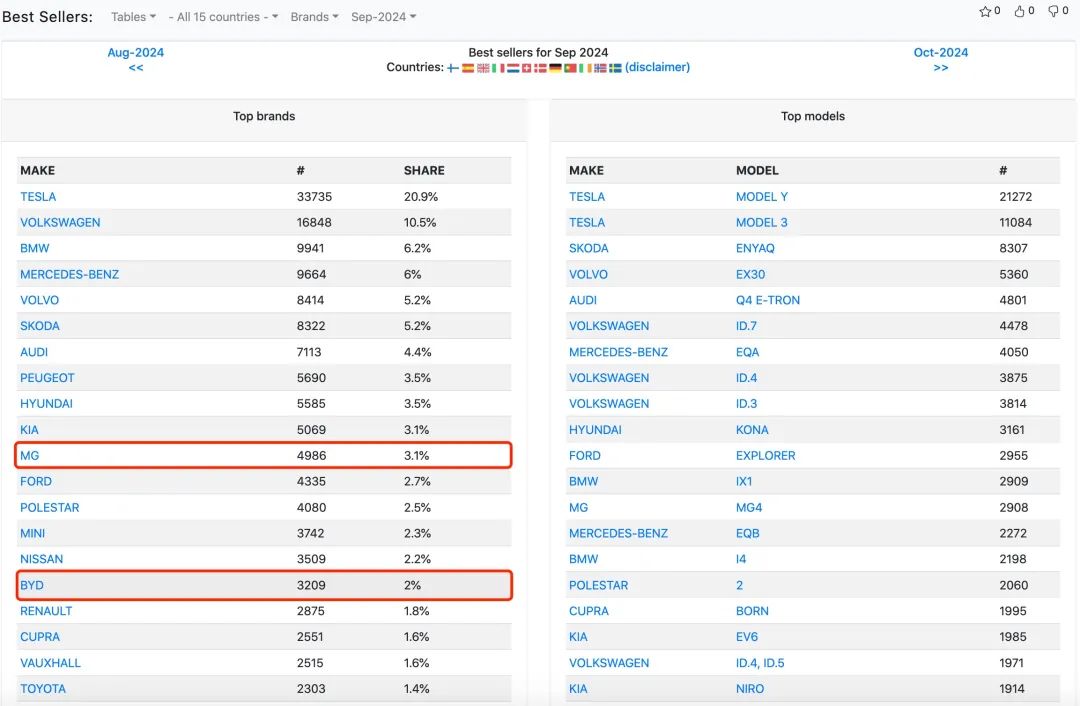

According to overseas agency statistics, in the September sales ranking of pure electric vehicles in 15 European countries, Tesla remained at the top with monthly sales of 33,785 units; Volkswagen ranked second with 16,848 units sold; BMW and Mercedes-Benz ranked third and fourth with 9,941 and 9,664 units sold, respectively; while Volvo, acquired by Geely, ranked fifth with 8,414 units sold per month. (Note: The 15 European countries include the UK, Norway, the Netherlands, Spain, Sweden, Denmark, Germany, Italy, Switzerland, Ireland, Finland, Austria, Portugal, France, and Belgium)

Among Chinese brands (excluding Volvo, etc.), MG, which previously sold the best, has now fallen out of the top 10 sales ranking for two consecutive months. In September, MG sold 4,986 units in the 15 European countries, ranking 11th; BYD ranked 16th with 3,209 units sold; while other brands such as XPeng, NIO, and Zeekr ranked outside the top 25 with sales of less than 1,000 units each.

If we look at the sales by country, among the 15 European countries mentioned above, only the UK, Spain, Sweden, Denmark, Ireland, and Portugal had Chinese brands in the top 10 electric vehicle sales in September. In the UK, MG sold 3,588 units in September, ranking fourth; in Sweden, MG sold 306 units, ranking 10th. In June of this year, MG ranked second in Germany with 4,699 units sold, accounting for 10.8% of the electric vehicle market share. By September, MG's sales in Germany had declined to 434 units, ranking 16th, with a sharp decline in market share to 1.3%.

Among the many Chinese brands entering the European market, MG has been the most affected by the tariff increases. On the one hand, MG faces a maximum tariff of 37.6%, significantly higher than other Chinese electric vehicle brands; on the other hand, MG is the Chinese electric vehicle brand with the largest sales volume in Europe. Since March 2023, MG's electric vehicles have consistently ranked in the top 10 in terms of monthly sales across the 15 European countries. For example, in June 2023, MG sold over 10,000 units, ranking third for the first time. And in June of this year, before the temporary tariffs were imposed, MG once again ranked fifth with 10,265 units sold.

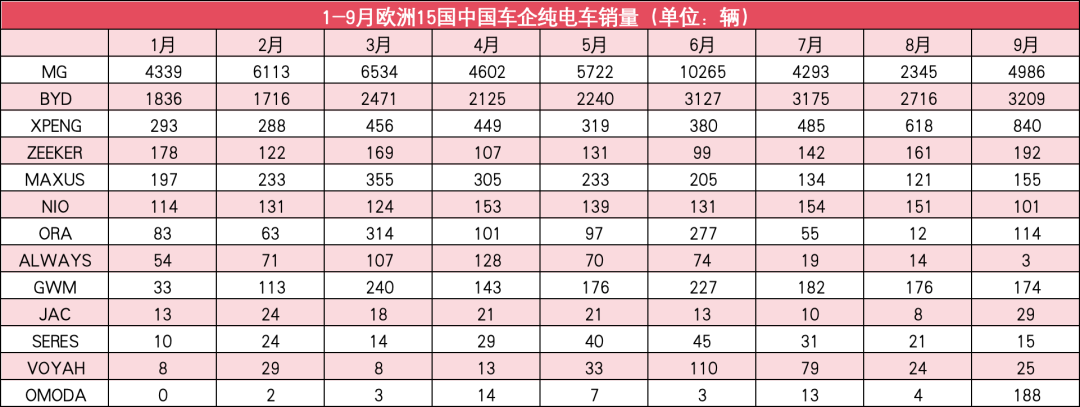

Starting in July, MG's sales plummeted to 4,293 units; in August, they fell further to 2,345 units, the second-lowest monthly sales figure for MG in the 15 European countries in nearly two years (sales in August 2022 were 2,150 units). In terms of development trends, MG was gaining momentum in the European market when it was dealt a severe blow by the temporary tariff increases.

The key factor behind MG's month-on-month sales growth in September was the UK market. Its sales in the UK increased from 949 units in August to 3,588 units in September. In addition to the MG 4, MG ZS, and MG 5, MG also officially delivered the coupe model MG Cyberster to UK customers in September, with sales of 70 units that month. Other brands like BYD, Chery's OMODA, and Great Wall's Ora have also identified the UK as a key market in Europe, with a relatively high proportion of their sales coming from the UK.

For other Chinese brands with smaller sales volumes in Europe, the negative impact was less significant than for MG. From January to September of this year, despite the imposition of temporary tariffs from early July, monthly sales of many brands have continued to rise. For example, BYD's monthly sales increased from 1,836 units in January to 3,209 units in September; XPeng's monthly sales increased from 293 units in January to 840 units in September. Other brands like NIO, Zeekr, and SAIC MAXUS have also experienced fluctuations in monthly sales, but these fluctuations are not significant due to their relatively small sales volumes.

For marginal automakers like AIWAYS, the increase in tariffs is undoubtedly a devastating blow. Struggling to survive in the domestic market, AIWAYS chose to abandon the Chinese market and focus on Europe this year. Unfortunately, it encountered the imposition of temporary tariffs soon after. In terms of sales, AIWAYS was able to maintain monthly sales of around 100 units in March and April, but by September, monthly sales had plummeted to just 3 units.

On October 4, the European Union voted to impose ultra-high tariffs on electric vehicles imported from China. In addition to the base tariff of 10%, additional tariffs of varying rates will be imposed on domestically produced electric vehicles for a period of five years. Among them, SAIC Motor faces the highest additional tariff rate of 35.3%; Geely and BYD face tariff rates of 18.8% and 17%, respectively; Tesla is the least affected, with an additional tariff of 7.8%; other electric vehicle manufacturers that participated in the investigation but were not individually sampled face an additional tariff of 20.7%.

Although the temporary tariffs imposed over the past three months have had a limited impact on the sales of Chinese electric vehicles with relatively small sales volumes, from a more strategic perspective, the passage of ultra-high tariffs on electric vehicles imported from China for five years will have a significant impact on the European expansion plans of domestic brands.

Another interesting phenomenon is that as European countries gradually phased out subsidies for new energy vehicles earlier this year, a large number of private customers quickly returned to gasoline and hybrid vehicles. Based on this, many automakers such as Volkswagen, BMW, Audi, Jaguar Land Rover, and Volvo have expressed optimism about the prospects of the hybrid vehicle market (including both mild hybrids and plug-in hybrids).

This also presents an opportunity for domestic electric vehicle companies – on the one hand, there is growing demand for hybrid vehicles, and on the other hand, the additional tariffs imposed on Chinese electric vehicles do not apply to hybrid models. With the introduction of technologies such as BYD's DM hybrid technology, Great Wall's Lemon Hybrid DHT, Changan's Bluecore iDD hybrid system, Chery's Kunpeng powertrain, Geely's Leishen Zhiqing Hi·X, Dongfeng's Max powertrain, and GAC's Julang hybrid system, the export of hybrid vehicles may become a new trend in the future.