The most anticipated IPO of Chinese hard tech is finally coming

![]() 10/15 2024

10/15 2024

![]() 486

486

In 2004, the Defense Advanced Research Projects Agency (DARPA) of the United States Department of Defense began organizing the first Driverless Car Challenge. After the conclusion of the third Urban Challenge in 2007, the director of DARPA stated, "There will be no more competitions in the future. DARPA's mission has been accomplished, and now it's up to capital to take over." At this point, it was time for tech billionaire and Google co-founder Larry Page to enter the stage.

Larry Page, leveraging his financial resources and persuasive skills, successfully convinced Sebastian Thrun, known as the "Father of Autonomous Driving in Silicon Valley," to officially initiate autonomous driving research under the "Google X" project in January 2009. Later, Elon Musk, equally fueled by a spirit of challenge and curiosity, approached Google with plans to jointly develop and integrate Autopilot into Tesla. However, the collaboration was terminated due to numerous safety concerns that emerged during further testing of Google's system. Tesla, on the other hand, emerged as a leader, continuing to independently develop Autopilot technology, which was officially launched in 2014 and first implemented in the Model S in October 2015, thereby igniting the wave of modern autonomous driving. Coincidentally, it was during this year that Horizon Robotics, a Chinese provider of autonomous driving computing power solutions, was founded. In December 2023, Horizon completed its final round of funding prior to its IPO, with a valuation of up to US$8.71 billion (approximately RMB 62 billion). By October 2024, Horizon had officially passed the listing hearing of the Hong Kong Stock Exchange, ushering in the era of "China's first autonomous driving stock."

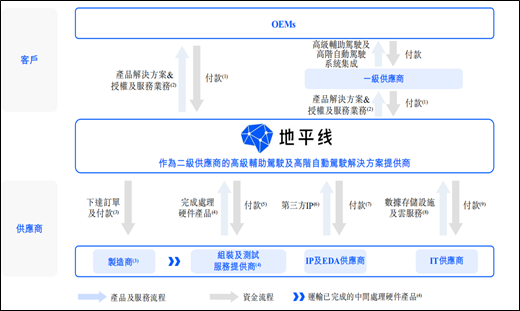

01 Teaching to fish and also teaching how to fish

After its establishment in 2015, Horizon released its first-generation BPU (Brain Processing Unit) in 2016 and its first-generation processing hardware, Journey, in 2017, a chip designed for automotive applications. Since then, it has continuously optimized, iterated, and integrated its products. Starting in 2021, Horizon Mono (an advanced driver assistance system solution) equipped with "Journey 3" achieved its first mass production in the Lixiang ONE, making Horizon the first domestic supplier of pre-installed, mass-produced advanced driver assistance systems (ADAS) and advanced autonomous driving (AD) solutions. Since its significant volume increase in 2021, Horizon has consistently led the domestic market in terms of installation volume each year – ranking fourth globally among domestic and international players from 2021 to the first half of 2024, with market shares of 9.3% and 15.4%, respectively. Positioned as a tier-two supplier, Horizon serves both tier-one suppliers and OEMs (original equipment manufacturers), providing intelligent driving solutions while also allowing customers to choose any solution or combination from its full-stack products, ranging from algorithms to software, development tools, and processing hardware, within its open ecosystem. In short, Horizon offers both the fish and the fishing skills. This strategy forms the basis of Horizon's two primary revenue streams: product solutions and licensing and services.

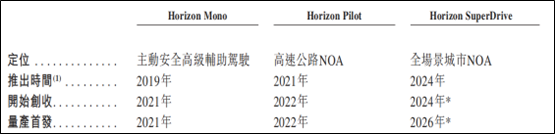

1. Product Solutions: Horizon offers three solutions – HorizonMono (Advanced Driver Assistance System), Horizon Pilot (Advanced Autonomous Driving), and HorizonSuperDrive (even more advanced autonomous driving) – covering functional combinations from L2 to L2+ levels.

For end customers, Horizon's solutions are equivalent to "standard products" that can be directly integrated into vehicles.

2. Licensing and Services: Leveraging its full-stack capabilities spanning from basic algorithms to end-user applications, Horizon generates revenue through "knowledge-based payments" by licensing algorithms, software, and development toolchains to customers. For Horizon, an open ecosystem enables intellectual property to generate greater economic benefits, strengthens its capabilities through customer collaboration, and creates incremental opportunities for its hardware/solutions through synergetic development. For downstream customers, utilizing Horizon's "sunk costs" and "experience reserves" significantly reduces development risks and capital investments while aligning with their product development strategies to achieve differentiation.

02 Starting with Lixiang Auto, intelligent driving solutions increase revenue but reduce profit margins

According to the prospectus, Horizon's performance surged significantly from 2021 to 2023, with operating revenue growing continuously from RMB 467 million to RMB 1.552 billion in 2023, representing a compound annual growth rate of 82.3%. This growth was primarily driven by the rapid expansion of its partner Lixiang Auto. In 2019, Horizon collaborated with Lixiang Auto, leveraging resource sharing and open cooperation to achieve mass production of Horizon Mono equipped with "Journey 3" in the Lixiang ONE within eight months (typically requiring 1-2 years). Through in-depth cooperation, mass production of Horizon Pilot equipped with "Journey 5" was achieved in the Lixiang L series within seven months in 2022.

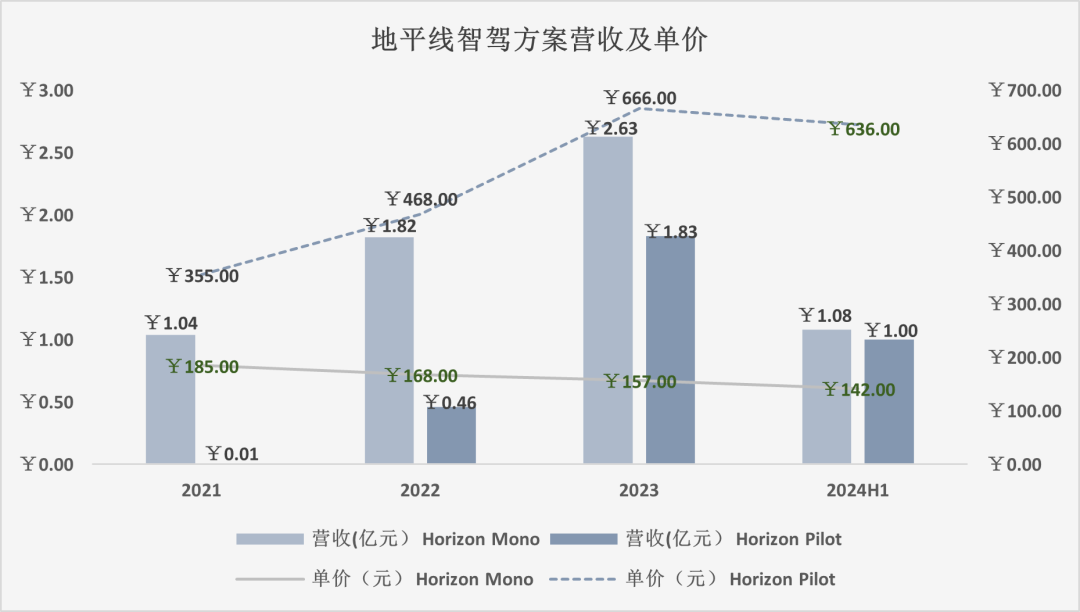

Following the implementation of this product solution, domestic automotive brands, particularly new energy vehicles, began to gain momentum. The downstream competition for feature stacking significantly increased the demand for intelligent driving, leading to large-scale volume increases for Horizon: (1) From 2021 to the first half of 2024, the number of designated models was 44, 101, 210, and 275, respectively; (2) Solution shipments were 569,000, 1.179 million, 1.947 million, and 920,000 units, respectively; (3) Operating revenue from "Product Solutions" grew continuously from RMB 208 million in 2021 to RMB 506 million in 2023 (CAGR of 55.97%). However, despite the volume increases, unit prices continued to decline, resulting in a sustained decline in overall gross margins:

From 2021 to H1 2024, the unit price of Horizon Mono continued to decline, and even the higher-end Horizon Pilot entered the phase of trading volume for price in H1 2024. Although increased downstream sales supported upstream suppliers, Horizon failed to create a buyer's market. The overall strategy of trading volume for price not only reflects downstream OEMs' cost control in price wars but also indicates significant competitive pressure on Horizon's intelligent driving solutions. In H1 2024, operating revenue from "Product Solutions" increased by 15.62% year-on-year to RMB 222 million, but gross margins further declined by 8.8 percentage points year-on-year to 41.7%. The significant slowdown in growth combined with the sharp decline in gross margins resulted in increased revenue but reduced profits in H1 2024.

Horizon Product Solutions Revenue, Gross Profit (Margin)Operating Revenue (RMB million)Gross Profit (RMB million)Gross Margin2021¥208¥14268.50%2022¥319¥19862.10%2023¥506¥22644.70%2024H1¥222¥7341.70%2023H1¥192¥9750.50%Change¥30¥-24↓8.8 pptsYoY15.63%-24.74%

03 Volkswagen eyes Horizon's "shovel"

In addition to providing intelligent driving solutions, Horizon generates revenue through its "knowledge-based payment" business by licensing its full-stack capabilities. This involves licensing algorithms and software to customers, providing relevant code and design manuals, and charging licensing fees and royalties. Horizon also offers design and technical services, generating service fees.

From 2021 to 2023, revenue from "Licensing and Services" surged from RMB 202 million to RMB 964 million. The rapid growth in 2022 was driven by numerous OEMs and tier-one suppliers leveraging Horizon's capabilities, while the growth in 2023 was fueled by Volkswagen. In 2023, Horizon and Volkswagen jointly established Horizon CoreTech (with Horizon owning 40%). By providing comprehensive technical support to CoreTech, Horizon facilitated the development of CoreTech's autonomous driving solutions, which will directly benefit from Volkswagen's domestic sales. In this business model, Horizon earns licensing fees during the "shovel selling" process and will become CoreTech's primary hardware supplier upon successful development. According to the prospectus, revenue from CoreTech accounted for RMB 627 million and RMB 352 million in 2023 and H1 2024, respectively, representing 65.04% and 50.94% of "Licensing and Services" revenue and 40.4% and 37.69% of total revenue for the respective periods, making CoreTech Horizon's largest customer. Notably, "knowledge-based payments" are highly profitable, as evidenced by the 93% gross margin recorded for "Licensing and Services" in H1 2024.

Horizon Licensing and Services Revenue, Gross Profit (Margin)Licensing and Services (RMB million)Gross Profit (RMB million)Gross Margin2021¥202¥18692%2022¥482¥42387.80%2023¥964¥85789%2024H1¥691¥64293%2023H1¥153¥12582.20%Change¥538¥517↑9.8 pptsYoY351.63%413.60%

04 First principle: Computing power, but not limited to it

Despite explosive revenue growth, Horizon continues to incur losses, with cumulative losses of approximately RMB 5.5 billion from 2021 to H1 2024. Overall, losses have narrowed slightly, with H1 2024 losses decreasing by 19.28% year-on-year to RMB 804 million. The primary reason for these losses is sustained high R&D expenditure: From 2021 to 2024, Horizon's cumulative R&D expenditure reached RMB 6.8 billion, increasing annually, with H1 2024 expenditure growing by 35.37% year-on-year to RMB 1.42 billion. Amid the trend towards intelligent driving, as advanced and full autonomous driving gradually become a reality, requirements for computing power, FPS, power consumption, process technology, and compatibility are increasingly stringent. High R&D investment is essential not only for optimizing existing products and solutions but also for preparing for future full autonomous driving. Horizon's rapid rise over the years and its capture of market share from foreign giants like NVIDIA underscores a multifaceted first principle behind "domestic substitution":

In the long run, as autonomous driving levels advance, the demand for chip computing power will continue to grow (each level typically requiring a tenfold increase, with basic computing requirements of 2-2.5 TOPS for L2, 20-30 TOPS for L3, over 200 TOPS for L4, and over 2000 TOPS for L5). Therefore, computing power remains a core competitive factor for autonomous driving chips in the long term.

However, in the short term, given the objective restrictions on higher autonomous driving levels (L3 is not yet permitted in China), competition in the "computing power-saturated" environment focuses on non-computing power aspects and cost-effectiveness. A comparison between Horizon's "Journey 5" and NVIDIA's "Orin X" reveals that Horizon still lags behind NVIDIA in terms of computing power and process technology. Horizon's FPS (frames per second) performance, however, significantly surpasses NVIDIA's, which is crucial for visual perception-based autonomous driving scenarios. Higher FPS means smoother preservation, transmission, and display of dynamic information (with faster response times given sufficient computing power), a key factor in Horizon's current success. For downstream customers, in a non-computing power-focused competitive environment, achieving "standardized" features and cost-effectiveness are top priorities. While some manufacturers and models opt for high-cost solutions for long-term planning, focusing on cost-effectiveness in the current stage is also crucial.

Comparison between Horizon and NVIDIA ChipsSingle-chip Computing PowerProcess TechnologyFPSApplicable ScenariosPower ConsumptionJourney 5128 TOPS16nm1531L2-L430WOrin X254 TOPS7nm1001L2-L580W

05 Final Thoughts: This is Just the Beginning

Examining the details of Horizon's rapid growth, it becomes clear that the premise of "domestic substitution" is sufficient computing power. Basic autonomous driving solutions have already entered the era of trading volume for price, with some detailed advantages potentially enabling latecomers to compete for market share but without generating premiums (as evidenced by declining prices for autonomous driving solutions). In the long run, major manufacturers possess open collaboration platforms, and downstream customers seek differentiation amidst fierce competition, ultimately striving for autonomy. In other words, suppliers like Horizon will likely see their long-term competitiveness return to integrated "hardware + software" offerings (combining computing power and algorithms), though manufacturing challenges remain. This sets them apart from internet-era companies. As an enterprise in the AI technology cycle, Horizon's core competitiveness ultimately rests on its integrated "hardware + software" technology and product capabilities, marking a significant divergence from traditional centralized computing power players. Understanding this distinction, NVIDIA serves as a prime example – evolving from early game cards to mid-stage mining cards and now to intelligent supercomputing cards, with its computing power architecture continuously advancing through programmability to adapt to more advanced algorithms, ultimately becoming encapsulated "superhuman brains" that transcend computational tool limitations to serve as the intellectual hubs of all intelligent entities.

In a sense, Horizon possesses the potential to generalize from the autonomous driving sector to all intelligent entity products and industries (we will cover Horizon's technology and product logic in future special reports). This underscores its core value as one of China's leading intelligent computing power unicorns. In our observation, Horizon's IPO is likely to be one of the most anticipated Chinese hard tech IPOs in recent years. For Horizon itself and China's AI computing power industry, this IPO marks just the beginning of a new era.