Consumption has really downgraded, and even the Paris Motor Show has started to be down-to-earth

![]() 10/15 2024

10/15 2024

![]() 596

596

Cost-effectiveness is king

Author | Wang Lei, Liu Yajie

Editor | Qin Zhangyong

In my memory, the Paris Motor Show was an international large-scale exhibition filled with concept cars. The romantic and imaginative French tried to make the Paris Motor Show as dazzling as possible.

Furthermore, the Paris Motor Show began in 1898, making it the world's first international auto show. In its early days, it mainly showcased luxury and high-end cars, so participating companies also tried to showcase their concept cars and the most advanced technologies.

Especially in the field of new energy in recent years, there is even more room for imagination.

However, this year's Paris Motor Show seems to be compromising with the market, with new cars starting to focus on cost-effectiveness.

For example, French brands Renault and Citroen both unexpectedly showcased entry-level vehicles, with some microcars priced even below 20,000 euros, equivalent to around 150,000 Chinese yuan.

Even the prices of some models are less than half the average selling price of European cars, and even for Chinese brands exhibiting, their new cars are also advantageous for their high cost-effectiveness.

01 Increase in low-priced pure electric vehicles

It should be noted that new energy vehicles are generally more expensive than gasoline vehicles in the European market.

For example, in 2022, the average selling price of new energy vehicles in Europe was around 54,000 euros, more than double the price of traditional gasoline vehicles.

Jato Dynamics conducted a study in the first half of this year, revealing that the average selling price of electric vehicles in Europe reached 65,000 euros, approximately twice that of gasoline vehicles.

In comparison, the prices of the new cars released by automakers this time are generally lower than this figure, sometimes even half as much.

For instance, Renault Group brought seven global premiere models and two concept cars, including the Renault 4 E-Tech pure electric vehicle, Renault 5, and the upcoming new generation Twingo.

Most of Renault's models are priced below 40,000 euros, and the starting price of the pure electric five-door Twingo E-Tech model, set to be launched in 2026, is less than 20,000 euros.

Stellantis Group's French brand Citroen showcased three global premiere models, including the electric versions of the C3 and C3 Aircross, which were unveiled and opened to the public for the first time.

The C3 Aircross is produced based on the Smart Car platform of the Stellantis Group, offering a seven-seater version for consumers to choose from. It will also provide low-cost electric and internal combustion engine versions, with the entry-level version priced below 20,000 euros to be launched in the first half of next year.

Domestic exhibitors have also maximized cost-effectiveness.

Leapmotor's B10 made its global debut in Paris. Positioned as a compact SUV, it is built on Leapmotor's LEAP3.5 architecture B platform and is expected to offer both extended-range and pure electric power options. The roof is also equipped with a lookout tower-style LiDAR and will carry a high-level intelligent driving system.

Leapmotor has always been adept at cost control, and with its positioning as a "small ideal," sales have also started to surge. As the first model in the B series, the B10 will obviously replicate the previous product strategy of "hitting low with high."

The vehicle will focus on the 100,000-150,000 yuan market segment. With reference to Leapmotor's C10, a mid-sized SUV priced at 128,800-168,800 yuan in China, the lower-priced B10 is expected to be priced below 120,000 yuan.

Xpeng Motors' "world's first AI car," the Xpeng P7+, announced a pre-sale price of 209,800 yuan at the Paris Motor Show.

Prior to this, the slogan of the Xpeng P7+ was to reshape the 300,000 yuan pure electric sedan market, and the pre-sale price of less than 210,000 yuan directly shattered people's expectations.

This car combines the advantages of coupes, SUVs, and MPVs, and comes standard with Xpeng's AI Hawkeye Vision Intelligent Driving Solution across all trim levels. It is the first to carry the Dimensity 5.4.0 system and can accommodate up to 33 20-inch suitcases.

The feedback from the domestic market has also been positive, with orders for the Xpeng P7+ exceeding 30,000 within 1 hour and 48 minutes of pre-sale.

In addition, European automotive giants are also focusing on low-cost products.

For example, BMW brought over 15 pure electric vehicles, with a focus on showcasing its small luxury brand MINI electric models. Of course, many electric MINIs are produced by Bright Mobility Limited.

Skoda, a subsidiary of Volkswagen, also unveiled its plug-in hybrid SUV Elroq earlier this month at a price of 33,000 euros (approximately 256,000 Chinese yuan), significantly lower than the local average selling price. Meanwhile, Volkswagen's compact car ID.2all is expected to be launched before the end of next year at a price below 25,000 euros.

In summary, a prominent label of this year's Paris Motor Show is cost-effectiveness, even for century-old luxury brands, which have also adapted to the cost and price competition from domestic automakers.

02 The choice of the market

The once-grand Paris Motor Show has now evolved into its current state, partly due to the innate preference of European citizens for small cars, but the root cause lies in the dramatic changes that have taken place in the local market.

In simple terms, not only are high-priced cars struggling to sell in Europe, but even cheap cars are starting to have trouble finding buyers.

Not long ago, according to data released by the European Automobile Manufacturers' Association (ACEA), new car sales in the EU fell 18.3% year-on-year in August to approximately 643,600 units, the lowest level in three years. Sales in major markets such as Germany, France, and Italy all declined by double digits, with drops of 27.8%, 24.3%, and 13.4%, respectively.

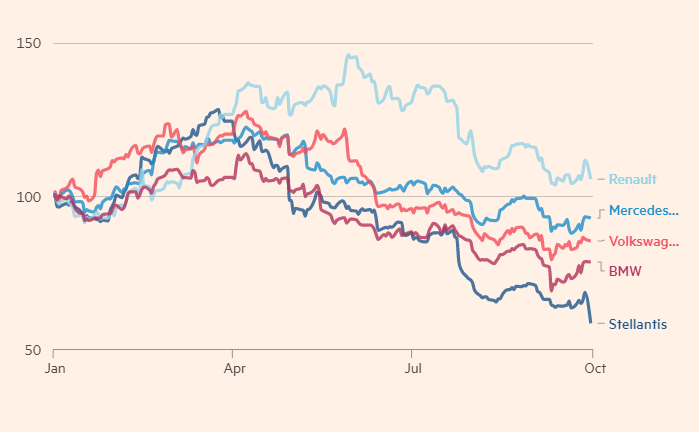

From the perspective of manufacturers, the number of car registrations for Europe's top three automakers – Volkswagen, Stellantis, and Renault – decreased by 14.8%, 29.5%, and 13.9%, respectively, compared to the same period last year.

Due to weak demand, many European automakers issued profit warnings and revised their profit forecasts within just one month.

Sales of pure electric vehicles have also taken a hit, with registrations plunging 44% in August to around 92,600 units. Market share fell from 21% in 2023 to 14%, with steeper declines in Germany (-68.8%) and France (-33.1%). Even Tesla, the top-selling brand, saw sales drop by more than 40%.

Interestingly, in the just-concluded month of September, demand for electric vehicles in the UK hit a new high, with registrations surging 24.4% year-on-year to 56,387 units, accounting for 20.5% of the UK car market, up from 16.6% in the same period last year.

The reason for this uptick can be attributed to the government's bailout policies, which offered at least £2 billion (approximately $2.6 billion) in electric vehicle discounts, resulting in a temporary surge in demand. In other words, substantial price cuts at the retail level sparked people's buying appetite.

Similarly, the decline in sales in most parts of Europe is due to the withdrawal of subsidy policies. For instance, the German government abruptly abolished electric vehicle subsidies of up to 6,000 euros at the end of 2023, leading to a nearly 70% year-on-year decline this year.

It is evident from this that a significant fact in the European electric vehicle market is that people will only buy cars with significant subsidies. Moreover, purchasing behavior driven by price cuts is inherently a manifestation of consumption downgrade.

As a major consumer good, car purchases are often directly influenced by economic conditions. During economic downturns, many families choose to postpone or cancel their car-buying plans.

Looking back at China, the same trend is emerging, with an increasing number of consumers seeking high cost-effectiveness, aiming to minimize car-buying costs without sacrificing product quality and performance. Consumer preferences have shifted from a "brand-only" mindset to an "experience-first" approach.

In other words, they want to accomplish big things with little money.

Of course, the market below 200,000 yuan remains the mainstream. According to data from the National Bureau of Statistics, as of 2024, among households with cars, 39% had vehicles priced below 100,000 yuan, 42.6% had vehicles priced between 100,000 and 200,000 yuan, 16% had vehicles priced between 200,000 and 500,000 yuan, and 2.8% had vehicles priced above 500,000 yuan. This means that models priced below 200,000 yuan constitute the foundation of China's automotive market.

An obvious example is BYD, which aims to sell 4 million vehicles this year. Although its high-end models are also doing well, the bulk of its sales still come from its Dynasty and Ocean series products.

Of course, models priced below 200,000 yuan cannot be defined as low-end. From a product performance perspective, models priced around 200,000 yuan can already rival those priced at 400,000 yuan in the past.

Behind the chain of car buying and selling lies a concentrated reflection of the economy. As the economy changes, so do consumer demands, forcing automakers to sell cars based on these demands. After all, only by surviving can they have a future, regardless of the type of vehicle they produce.