["In-depth Financial Report Analysis" - Can Musk's Inflated Cybercab Dream Catch Up with Baidu's Humble Success?

![]() 10/16 2024

10/16 2024

![]() 509

509

Author | Meng Xiao For more financial information, visit BT Finance Data Hub This article contains 4,499 words and is estimated to take 12 minutes to read

"

Musk successfully landed the Starship, but botched the autonomous driving launch event." On October 11, Tesla held a Cybercab (which Musk refers to as Robotaxi) launch event at Warner Bros. Studios in Los Angeles, California, USA. During the event, Musk rode in the driverless taxi Cybercab, which lacked a steering wheel and pedals, for just 200 meters. Musk announced at the event that the Cybercab is expected to enter production in 2026 and be available for purchase in 2027, with an estimated price tag of $30,000. However, the latest supply chain investigations indicate that mass production of the Cybercab is not expected to begin until the first quarter of 2027. Musk also unveiled the Robovan (driverless van) at the event, which is said to be capable of carrying up to 20 people at a time.

The market is skeptical of Musk's promises, with foreign media commenting that "while the pricing of the Cybercab seems attractive, it must be noted that Musk has a history of overpromising and underdelivering on vehicle pricing. For example, the Cybertruck was initially expected to cost less than $50,000, but now costs around $80,000." This significantly undermines Musk's credibility. Investors have also criticized Musk for delaying the originally scheduled August 18th launch event by two months, arriving an hour late to the event, and only staying for 20 minutes. The vehicles Musk discussed were described by the media as "still in the PPT stage," lacking technical details.

After the event, Tesla's stock price plummeted by 8.78%. By the close on October 11, 2024 (EDT), Tesla's share price was $217.8, with a total market value of $695.8 billion, representing a loss of $67 billion (approximately RMB 474.397 billion) in a single day. The total decline for the week exceeded 12.9%, with the share price down 47.5% from its peak of $414.497, wiping out nearly half of its value and evaporating $628.4 billion (approximately RMB 4.449 trillion) in market capitalization. Musk's personal wealth also shrank by $15 billion (RMB 106 billion).

Musk's performance at the launch event disappointed many investors and analysts. Garrett Nelson, an analyst at CFRA Research, publicly expressed disappointment with the lack of clarity in Tesla's recent product roadmap. "We believe this event did little to change the opaque intermediate-term earnings outlook," he said.

The implication is clear: Musk spoke at length about lofty ideas during the event, but they are still in the conceptual stage and have yet to be fully realized. In this field, there are already established commercial applications, while Tesla is only expected to launch its products in three years, raising doubts among investors about whether it can actually deliver. Meanwhile, the mature and established autonomous taxi service Apollo Go by Baidu has driven up the company's stock price, which has surged 26% in the past month, far outpacing the average gain in U.S. stocks. Fortunately, on October 13, Musk successfully landed the Starship for the first time, winning significant praise for Tesla and himself.

1

Poor Sales Performance in the First Half of the Year

In fact, Musk attached great importance to the launch event, even promoting it on social media as a "historic" occasion. However, investors are more concerned with Tesla's sales and performance than the event itself.

Affected by the strong rise of new energy vehicles in China, Tesla's performance in the Chinese market fell significantly short of expectations. In the first half of 2024, Tesla's overall sales in China fluctuated significantly, with cumulative sales of 278,000 vehicles, a year-on-year decrease of 5%. This marked the first time that Tesla's sales in China had declined year-on-year in a half-year period since entering the market. Specifically, January saw the highest year-on-year sales growth for Tesla in the first half of the year, with 41,000 vehicles sold, an increase of 48.8% over the same period last year. In contrast, BYD's sales growth was only 33.9% during the same period. However, Tesla's sales declined significantly in February, with 31,000 vehicles sold, a year-on-year decrease of 8.4%. For comparison, BYD's sales grew by 116% during the same period.

In March, Tesla's sales rebounded to 61,000 vehicles, but this was still a year-on-year decrease of 19.4%, while BYD's sales grew by 46.3% during the same period. April saw a significant decline in Tesla's sales, both month-on-month and year-on-year, with sales dropping to 32,000 vehicles (a 19.4% year-on-year decrease). In contrast, BYD's sales grew by 48.96% during the same period. Tesla's sales briefly rebounded to 55,000 vehicles in May, a year-on-year increase of 27.6%, but this growth rate still lagged behind BYD's 38.13%. In June, Tesla's sales declined again by 20%, to 58,000 vehicles, while BYD's sales grew by 30.02% year-on-year.

By comparing Tesla's sales performance in the first half of the year, it is evident that Tesla only experienced sales growth in two months. While Tesla's sales growth in January was higher than BYD's, it declined in the other four months. In contrast, BYD achieved growth of over 30% in all six months of the first half of the year, with only the first month's growth rate falling below Tesla's. In the first half of the year, BYD's market share of new energy vehicles further increased to 32.6%, with cumulative sales reaching 1.613 million vehicles, making it the domestic and global sales champion for new energy vehicles.

This means that three out of every ten consumers who purchase new energy vehicles choose BYD. In the first half of last year, BYD sold 1.256 million vehicles, a year-on-year increase of 28.4%. According to public data, Tesla sold approximately 546,000 vehicles globally in the first half of this year, trailing BYD and the gap is widening. The only consolation for Tesla is that the Model Y sold 209,082 vehicles in the first half of 2024, making it the top-selling new energy SUV.

Automotive journalist Zhang Zhiyong believes that Tesla's launch event was a failure. Since Tesla lost its position as the top-selling new energy vehicle globally, it has struggled to surpass BYD in sales. "BYD has passed on the benefits of cost reductions to consumers and made significant strides in its own research and development, making it difficult for Tesla to compete," Zhang said. "Judging from the growth in sales of both companies, the sales gap between them is likely to widen further."

Like Zhang Zhiyong, KC Boyce, Vice President of data analysis and consulting firm Escalent, expressed disappointment with the launch event. "Given Tesla's history of overpromising and underdelivering, I had low expectations for this event from the start. It was a typical Tesla advertisement full of hype," he said. Following the decline in sales, many investors and analysts expressed disappointment with Tesla's launch event.

2

Revenue and Net Profit Both Decline for the First Time

Tesla's declining sales have created difficulties for the company, which are directly reflected in its revenue. In the first half of this year, Tesla's revenue was $46.8 billion, a year-on-year decrease of 3.02%. Its net profit was $2.607 billion, a significant decrease of 50.02% from the same period last year, almost halving. In the first quarter of this year, Tesla's revenue was $21.3 billion, a year-on-year decrease of 8.69%, while its net profit was $1.129 billion, a year-on-year decrease of 55.07%. In comparison, BYD's revenue was RMB 301.1 billion (approximately $42.6 billion), a year-on-year increase of 15.76%, and its net profit was RMB 13.63 billion (approximately $1.93 billion), a year-on-year increase of 24.44%.

In terms of revenue and net profit, Tesla still leads BYD, but its previous significant advantages have gradually been eroded by BYD. Considering BYD's rapid development, it seems only a matter of time before it surpasses Tesla in both metrics. Tesla's poor performance in the first half of the year contributed to the decline in its share price during the year. At the beginning of the year, Tesla's opening share price was $250.08 per share. By the close on October 11, its share price had fallen by 13% year-to-date. In contrast, BYD's share price increased by 56% during the same period.

The significant declines in Tesla's revenue and net profit are directly related to declines in its gross margin and net margin. In the first half of this year, Tesla's gross margin was 17.68%, a decrease of 1.06 percentage points from the same period last year (18.74%). Its net margin was 5.64%, a significant decrease of 5.02 percentage points from 10.68% in the same period last year. Tesla has previously been known for its high gross and net margins, but this reputation may no longer hold. In the first half of this year, BYD's gross margin of 20.01% exceeded Tesla's, and its net margin of 4.69% was only 0.95 percentage points lower than Tesla's.

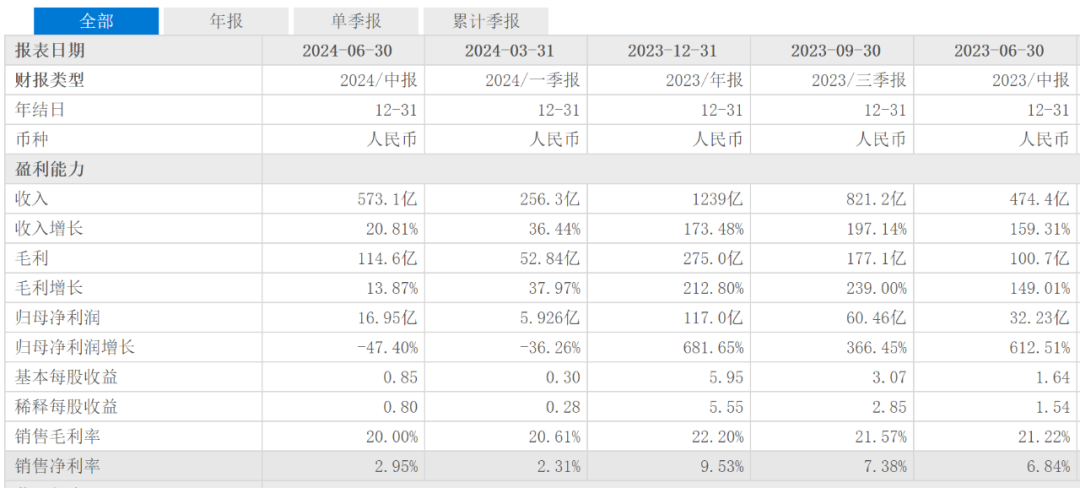

If not for the drag from Li Xiang's MAGE model, Li Xiang would have surpassed Tesla in both gross and net margins in the first half of the year. Despite a high gross margin of 20.00% in the first half of the year, Li Xiang's net margin declined to 2.95% due to lower-than-expected sales of the MAGE model. In comparison, Li Xiang's gross and net margins were as high as 21.22% and 6.84%, respectively, in the first half of last year. If compared to the first half of last year, Li Xiang has already achieved a leading position.

"Tesla faces intensifying challenges," Zhang Zhiyong said, explaining the decline in profits. "In the face of fierce competition from domestic new energy vehicles, Tesla's gross and net margins have declined. If it does not reduce prices, sales will be significantly affected. However, reducing prices to maintain sales will impact profits." Zhang believes that this decline in profits reflects the strong rise of domestic new energy vehicle companies.

3

Tesla's PPT Vision Versus Baidu Apollo Go's Grounded Reality

Investors are skeptical because Tesla currently only has a concept for its autonomous taxi service, which is not expected to be fully realized until at least 2027, meaning at least three more years. In contrast, Baidu's Apollo Go service has already been operational for three years. In August 2021, Apollo Go launched its first driverless mobility service.

According to Baidu, Apollo Go is currently operational in 12 cities, including Beijing, Shanghai, Chongqing, Shenzhen, Wuhan, Changsha, Guangzhou, and Wuxi. On June 19, Apollo Go began offering 100% driverless ride-hailing services across Wuhan, marking a significant milestone in the development of driverless technology. Since its launch in August 2021, Apollo Go has experienced rapid growth. In the second quarter of 2024, it recorded approximately 899,000 orders, a year-on-year increase of 26%. As of July 28, 2024, Apollo Go had completed over 7 million ride-hailing orders since its inception. It took just three years for Apollo Go to reach this milestone.

Apollo Go's updates are not limited to software; it has also excelled in hardware, introducing the fifth-generation ApolloMoon, which costs 480,000 RMB. Compared to the previous model, the cost has been reduced by 60%, while performance has improved tenfold. According to Baidu, costs are expected to continue to decline in the future. The rapid growth of Apollo Go demonstrates the market's acceptance and demand for driverless taxis. After his first ride in Apollo Go, 50-year-old Wang Jinxian was so impressed that he immediately shared his experience with his friends and strongly recommended the service. "At first, I was hesitant to try it, but after my first ride, I found it to be smooth, safe, and affordable compared to traditional taxis and ride-hailing services," he said. Since then, Wang and his family have chosen Apollo Go for almost all their travels.

The acceptance and popularity of Apollo Go are spreading beyond just middle-aged individuals like Wang. In addition to significant research and development investments by Baidu, the success of Apollo Go is also supported by Baidu's powerful intelligent transportation system, which integrates vehicles, roads, and clouds, benefiting many cities. This is a key factor in Apollo Go's rapid expansion to over a dozen cities, making it a leading player in the smart mobility industry.

Tesla invested $2.225 billion in research and development in the first half of the year, a year-on-year increase of 29.81%. During the same period, BYD invested RMB 19.62 billion (approximately $2.77 billion) in research and development, a year-on-year increase of 41.82%. Meanwhile, Baidu invested RMB 11.25 billion in research and development. While all three companies have invested heavily in research and development, Tesla is no longer the most willing to spend on research and development.

Zhang Zhiyong believes that autonomous taxis have broad market prospects and significant development potential in the long run, and the rapid growth of Apollo Go is the best proof of this. "With the continuous development and improvement of autonomous driving technology, autonomous taxis will become an important part of future transportation. As one of the leading companies in autonomous driving technology, Tesla has lagged behind Baidu, another leader in autonomous driving, in terms of commercialization. If Tesla wants to catch up with Baidu, it will need to overcome many challenges, including technical maturity, legal and regulatory improvements, market acceptance, and competitive pressure. It may need to humble itself and learn from Baidu in terms of commercialization paths, product pricing, and user experience, given that Apollo Go has already established a mature business model after years of exploration."

After Tesla's conference, an analyst from Jefferies said, "Tesla has ambitious goals, but there is little evidence of feasibility. Tesla has not provided a plan for how to achieve a higher level of autonomous driving." Compared to the fully operational Robotaxi service, Tesla's plan seems more like a "PPT" floating in the air. Especially in the current fiercely competitive market for Tesla's main new energy vehicle business, the autonomous taxi service is given higher expectations. Therefore, once these expectations are not met, the market may exhibit stronger pessimism.