EU votes to impose ultra-high tariffs on electric vehicles from China, auto companies may enter a "joint venture era" in overseas markets

![]() 10/17 2024

10/17 2024

![]() 537

537

At the beginning of October, representatives of EU member states voted to approve the final ruling draft of the EU electric vehicle countervailing case, proposing to impose final countervailing duties on electric vehicles originating in China. Accordingly, with this resolution, the EU is expected to start imposing import tariffs of up to 45% on Chinese electric vehicles next month.

The European Commission announced that this decision aims to protect the EU's automotive industry and prevent Chinese companies from gaining unfair price advantages in the market due to government subsidies. This tariff measure affects multiple auto companies and various electric vehicle models and is expected to have a significant impact on China's electric vehicle exports to the EU market.

▍Divisions Remain: "For and Against"

The European Commission initiated a countervailing investigation into Chinese electric vehicles at the end of 2023 and introduced provisional tariffs in July 2024. According to the voting results disclosed by the European Commission on October 4, out of the 27 EU member states, 10 voted in favor of imposing tariffs, 5 voted against, and 12 abstained.

In terms of specific tax rates, the EU will impose tariffs of 7.8% on Tesla, 17% on BYD, 18.8% on Geely, and 35.3% on SAIC, while other electric vehicle manufacturers that participated in the investigation but were not individually sampled will face a 20.7% tariff. The current automotive import tariff in Europe is 10%, meaning that Chinese electric vehicle manufacturers entering the European market will face ultra-high tariffs of up to 45%.

Notably, the proponents of the tariffs are led by France and Italy, both of which do not have significant automotive joint ventures in China. Alfa Romeo, from Italy, has almost no sales, and Fiat withdrew from China as early as 2018. Although French automakers have joint ventures in China through the Dongfeng Peugeot Citroen Automobile Company (DPCA), their market share has shrunk significantly.

On the other hand, opponents occupy a significant share of the domestic market. Major European automakers such as Volkswagen, Mercedes-Benz, and BMW have stated that imposing tariffs on Chinese electric vehicles is a "wrong approach." In 2023, the sales of these three automakers in China reached 4.762 million vehicles, far exceeding their sales of 2.8 million in Germany.

Volkswagen Group publicly called on the German government to oppose EU tariffs, emphasizing that punitive tariffs are detrimental to competition. German Chancellor Olaf Scholz also made it clear that Germany opposes EU tariffs and that Europe must continue negotiations with China.

▍"Reverse Joint Ventures" May Lead to Technology Transfer

It is worth mentioning that despite the impending EU countervailing tariffs, Chinese automakers including BYD, Hongqi, GAC Group, SAIC MAXUS, Dongfeng Fengxing, Wenjie, Xpeng, Leapmotor, and Skyworth appeared at the 90th Paris Motor Show held from October 14 to 20, showcasing their new products and technologies to enter the European market.

However, industry insiders indicate that the EU's countervailing investigation and proposed tariffs on Chinese electric vehicles are not simply acts of trade protectionism but reflect Europe's attempt to dominate the electric vehicle supply chain.

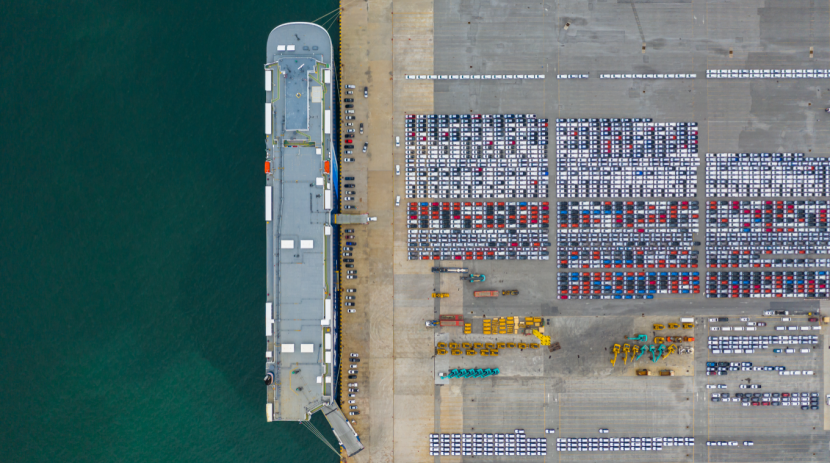

Traditional European automakers have lagged behind in the transition to electrification. Facing the strong rise of Chinese electric vehicles, the EU has chosen to impose tariffs to buy time for local companies to develop. Since electric vehicles produced in Europe will not be subject to mandatory tariffs, many EU member states support imposing tariffs on Chinese electric vehicles as a way to "force" Chinese companies to invest and establish factories in Europe.

A responsible person for the overseas business of an automaker told the Auto Insight that they had considered producing electric vehicles in Southeast Asia or other third-party countries for export to the EU. However, according to their research, even after the countervailing tariffs take effect, the EU still has the right to conduct more targeted investigations into automakers. Therefore, to truly enter the EU market under countervailing tariffs, establishing factories in the EU would be the optimal choice.

Currently, multiple Chinese automakers such as Chery, BYD, Great Wall, SAIC, Xpeng, and Geely plan to establish factories in Europe to address challenges such as EU electric vehicle tariffs.

However, establishing factories is not without challenges, as automakers must comply with the EU's stringent environmental and labor standards. According to insiders, the EU has proposed sharing or even transferring electric vehicle technology to increase the competitiveness of local automakers, similar to the joint venture model adopted by foreign automakers entering China in the past.

Just two days before the official opening of the Paris Motor Show, after eight rounds of negotiations between China and Europe, there was still no substantial change in the situation, and high tariffs have become a significant barrier for Chinese electric vehicles trying to enter the European market. Nevertheless, in the new energy sector, Chinese companies have the strength to compete with international giants, with the latest generation of technology, globally priced vehicles, and a focus on intelligence. Judging from this year's Paris Motor Show alone, Chinese companies are determined to enter the European market. Despite numerous challenges, the popularity of Chinese automotive brands in Europe remains unabated. Facing the irreversible transformation of the automotive industry, continued and in-depth global exploration is imperative.

Typesetting: Yang Shuo