Bull market for 30 days, how much joy and sorrow?

![]() 10/28 2024

10/28 2024

![]() 463

463

Comment on auto stocks of the week and observe the various situations in the auto market.

From the package of policies announced on September 24 to the present, this wave of bull market in A-shares fueled by sentiment has passed a full month. Some say it's a monetary bull market, a debt-resolution bull market, an anti-deflation bull market, and even a national fortune bull market.

During the 18 trading days from September 24 to October 24, the cumulative turnover of Shanghai, Shenzhen, and Beijing stock markets exceeded RMB 30 trillion, with daily turnover exceeding RMB 1 trillion for 17 consecutive trading days. On October 8, the turnover of Shanghai and Shenzhen stock markets reached a record high of RMB 3.45 trillion.

Within one month, the share prices of 146 stocks increased by more than 100% cumulatively, with 20 stocks increasing by more than 200% and 7 stocks increasing by more than 300%. The Beijing Stock Exchange's "New Putin" index doubled overall within one month, from 600 points to the current 1360 points.

In this round of market, Ye Guofu, who accurately bought Yonghui Superstores with RMB 6.27 billion, achieved a maximum paper profit of 70%. There is also Cheng Lei, deputy general manager of Eastmoney.com, who significantly reduced his holdings by 1.2 million shares before this round of market started, missing out on over RMB 20 million in a week.

There is also a fitness blogger turned financial blogger "Da Lan," who was banned from a short video platform after shouting "Charge!" for more than a week, losing over 10 million followers.

At the intersection of Shanghai's Guangdong Road and Xizang Middle Road, "Love in Late Autumn" has transformed into Huangpu's Warren Buffett in this round of market. "It's dizzying to see it rise!" "The big bull market is here, it's definitely going to hit 14,000 points!" In the short video, the Shanghai uncle with few teeth has a distinct personality and a confident tone, gesticulating wildly while passionately expressing his opinions.

Many retail investors have experienced rollercoaster emotions during this month, impulsively chasing highs out of fear of missing out, then shouting "scammed" after getting stuck, and now once again "choosing to believe.""The memory of a fish lasts only 7 seconds, and the memory of retail investors isn't much better, lasting only about a day. When T+0 trading is introduced in A-shares, memory function is expected to continue to decline.

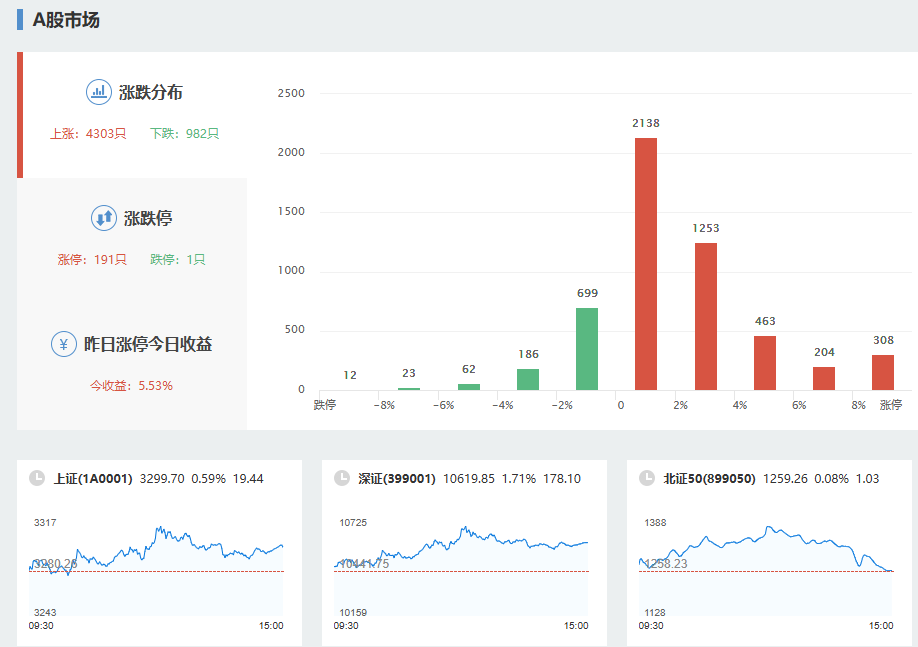

Judging from the overall market performance this week, the broad market showed a similar trend for 4 out of 5 days – rising in the morning, falling after lunch due to disagreements, and slightly pulling up towards the close. This is a typical K-line pattern after the trading volume increases, with funds continuously relaying.

October 25 marked a watershed moment in the bull market, with the market surging in the morning but falling back throughout the day, led by the ChiNext Index. The Beijing Stock Exchange 50 Index saw significant volatility, once surging over 10% to set a new record high before falling back slightly at the close. The total turnover of Shanghai and Shenzhen stock markets reached RMB 1.77 trillion, an increase of RMB 251.6 billion from the previous trading day, with over 4,300 stocks rising across the market.

In terms of sector performance, new energy stocks rallied collectively, with the photovoltaic sector leading the way. Over 20 stocks, including Longi Green Energy, Tongwei Co., Ltd., Ai Xu Co., Ltd., JA Solar, and Junda Corporation, hit their daily limits. The lithium battery sector also rose, with Tianli Lithium, Tianji Lithium, and Tinci Materials among the stocks hitting their daily limits.

Although the auto sector did not lead the market in this round, the new energy sector soared again under favorable policies. The Silicon Branch of the China Nonferrous Metals Industry Association stated on its official account that recently, favorable news related to the photovoltaic industry has been frequently released, driving the crystalline silicon photovoltaic industry back to normal through supply-side structural reforms.

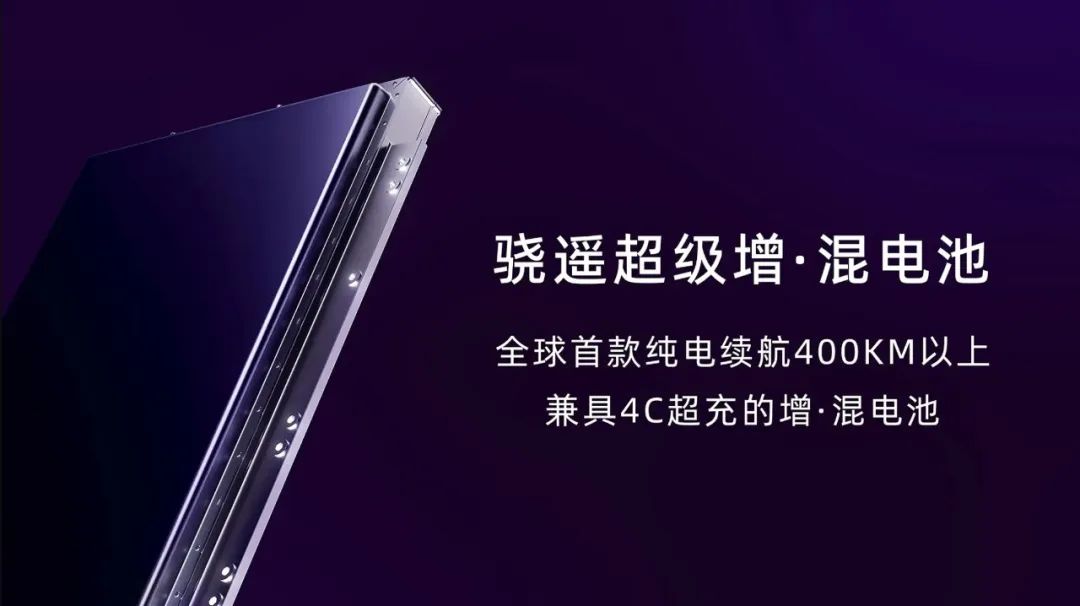

In addition, there have been continuous favorable news in the battery sector. It is reported that China's first mass production line for all-solid-state lithium-ion batteries has officially commenced operations. Moreover, yesterday, CATL launched its new Super Hybrid Battery, the Xiao Yao, which is the world's first hybrid battery with a pure electric range of over 400 kilometers and 4C fast charging capabilities, ushering in the era of "large battery capacity" for hybrid vehicles.

Some analysts believe that this is CATL's heavy technical blow in the hybrid vehicle sector (including plug-in hybrids and range extenders) after earning over RMB 36 billion in the first three quarters. CATL's share price rose accordingly amidst days of volatility, closing at RMB 258.88 on Friday, up 5.17% significantly.

Since its listing, CATL's median P/E ratio has been around 50 times. Amidst extreme pessimism last year and earlier this year, its valuation once dropped to around 15 times. If the bull market sentiment further intensifies, the optimistic P/E ratio valuation is expected to reach 30 times, potentially pushing CATL's market value above RMB 1.5 trillion again.

The electrification of the automotive industry has driven up the prices of energy concepts such as lithium batteries. As we enter the second half of the smart era, related component industries are also entering the securities market.

On October 24, Horizon Robotics, a leading autonomous driving technology company, officially went public on the Hong Kong Stock Exchange. After nine years of growth, this influential Chinese provider of intelligent driving solutions has finally reached the vast horizon of the capital market.

According to the Hong Kong Stock Exchange, Horizon Robotics' final offering price was HKD 3.99, making it the largest technology IPO in Hong Kong this year. On October 24, its share price peaked at HKD 5.5 during the first day of trading on the Hong Kong Stock Exchange's main board, with its market value once surging by over 37.8% to reach HKD 71.66 billion.

However, on the second day of trading, Horizon Robotics' share price broke below its offering price intraday. Although shareholders intervened in a timely manner to arrest some of the declines, the downward trend was stabilized.

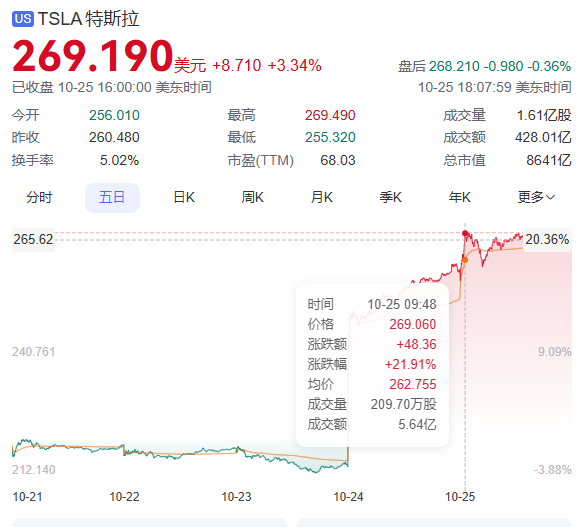

Regardless of how hot the A-share market gets, the star of the week is undoubtedly Tesla across the ocean. After the 7 millionth vehicle rolled off the production line on October 22, Tesla announced its third-quarter results for 2024. In Q3 of this year, Tesla delivered approximately 463,000 electric vehicles globally, setting a new quarterly delivery record for 2024.

More impressive than sales figures are Tesla's financial results. Revenue reached USD 25.182 billion, up 8% year-on-year; net income was USD 2.167 billion, up 17% year-on-year; gross margin increased to 19.8%, up about 2 percentage points year-on-year; excluding profits from other businesses and carbon credits, automotive gross margin was also as high as 17.1%.

During this earnings announcement, Musk finally revealed the news that he had not disclosed at the Tesla AI Day about the upcoming production of an affordable electric vehicle.

Tesla's share price surged 21.92% at the close on October 24, its largest single-day gain since May 2013, closing at USD 260.48 per share. Its total market value reached USD 832.1 billion, a one-day increase of approximately USD 150 billion, exceeding the combined market value of General Motors, Ford, and Stellantis. Musk's net worth increased by USD 33.5 billion overnight.

In comparison, the USD 1 million per day spent campaigning for Trump seems like a drop in the ocean. Two weeks ago at the Tesla AI Day, the company was criticized for not meeting expectations on various fronts. Now it seems that Musk had been holding back big news, devastating short-sellers on Wall Street.

From this perspective, it might be more comfortable to be a retail investor in the greenhouse of the A-share market.

Note: Some images are sourced from the internet. In case of infringement, please contact us for removal.